China is in trouble, and it seems that Beijing is running out of options on how to fix the structural problems of its economy which is already on the brink of a deflation. Add to all of this the fact that the foreign capital continues to leave the country en masse and it becomes obvious that now is likely not the time to invest in China.

We already see how Alibaba’s (NYSE:BABA) stock struggles to breach major technical resistance levels and reach its fair value as political and economic issues continue to limit its upside to this day, and this is likely to remain the case in the foreseeable future. As such, it’s hard to justify a long-term long position in the company at this stage, especially when the businesses of Alibaba’s direct Western peers are growing at a greater rate while their shares offer a more attractive risk/return ratio without the political risks.

Is The Crackdown Truly Over?

Earlier this month, Alibaba reported mixed Q1 earnings results. Due to the depreciation of the yuan, the company’s revenues in Q1 increased only by 5.2% Y/Y in dollar terms to $32.29 billion, against $30.69 billion a year ago when China imposed strict lockdowns. What’s worse is that during the recent quarter, Alibaba’s cloud revenues increased only by 4% Y/Y. For comparison, the cloud businesses of its Western competitors such as Google (GOOG)(GOOGL), Microsoft (MSFT), and Amazon (AMZN) continued to grow at an aggressive double-digit rate and greatly expanded their user base. Such a mixed performance shows that despite all the chatter about how Alibaba is finally about to take off, the reality is that it still struggles to catch up with the American Big Tech despite having a much lower comparable base, while the risks seem to continue to mount with each passing quarter.

In addition to this, the market seems to take Beijing’s reconciliation efforts to attract new investors with a grain of salt. Even though the Chinese authorities slapped a final fine of around $1 billion on Alibaba’s Ant Group and held a major meeting with global investors last month, the market is not convinced that now is the time to return to China as capital outflows continue to outweigh the inflows.

What’s more is that to this day, there’s still an indication that the crackdown against the private sector, which started in late 2020 and destroyed over $1 trillion of shareholder value is not truly over yet. Just last week, news came out that the Chinese authorities started their crusade against the country’s private medical sector in an effort to increase the state presence in the healthcare industry under the disguise of achieving Xi Jinping’s common prosperity goal.

Such news would undoubtedly make it harder for investors to become excited about investing in China once again. We already see how Alibaba investors missed the latest AI-fueled stock market rally, which pushed stocks of Western Big Tech firms to record levels. Despite several positive developments in recent months, Alibaba’s shares are still unable to breach the $80 to $100 levels at which they have been trading for most of the last year and stay there for a while mostly due to political risks that limit the upside.

Economic And Geopolitical Risks Are Not Going Anywhere

What’s worse is that the current weak state of the Chinese economy could make it even harder for Alibaba to greatly improve its performance and push the shares to 52-week highs in the foreseeable future. The latest data shows that consumer confidence in China continues to wane as the country is on the brink of deflation, while authorities begin to hide important statistics to ease the blow and not make its structural problems known to the public. Just a week after President Biden called the Chinese economy a ‘ticking time bomb’, the Chinese authorities were prompted to intervene in the markets to stop the depreciation of the country’s stocks and currency in response to the shadow banking crisis that has shaken the control of the state.

In addition to this, the geopolitical risks are unlikely to disappear anytime soon. Just last month, when U.S. Treasury Secretary Janet Yellen stated that it’s premature to lift tariffs, Chinese officials admitted that geopolitics is to blame for the weak foreign trade activity that’s hurting its economy. In addition to this, the disappearance and later the ousting of the former Chinese ambassador to the U.S. Qin Gang, who was appointed as foreign minister of China at the beginning of this year to repair ties with the U.S., could signal a return to the ‘wolf warrior’ diplomacy that could hurt the Sino-American relations even more.

Considering that the U.S. Administration recently restricted additional American investment into the Chinese tech sector, it becomes obvious that it’s no longer worth it to invest in Chinese equities given all the geopolitical risks that come with it.

What’s Next?

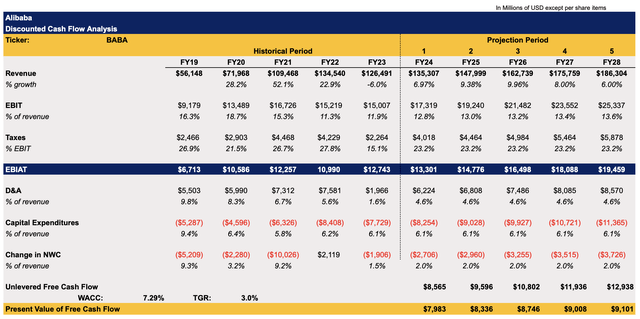

All of these developments are more than likely to have a negative effect on Alibaba’s performance in the following quarters. In May, I made a DCF model which showed that Alibaba’s fair value is $123.26 per share, above the current price by ~40%. However, back then I assumed that the company’s revenues will grow at 10% Y/Y in the next couple of years. After the mixed performance in Q1, the street expects that Alibaba’s revenues will be growing at below 10% in the next couple of years.

This has been reflected in the updated model below, which assumes that the top-line growth rate would be weaker than previously anticipated. At the same time, even though the revenue growth rate would be lower, the potential improvement of Alibaba’s earnings is likely to mitigate some of the downside caused by the revision of the top-line growth rate. The assumptions for the tax rate and the D&A rate for the following years are mostly averages of the previous few years, while the CapEx rate as a percentage of revenue is expected to remain at the same levels in the model as in FY23. The change in net working capital stands at 2% of revenues, while the TGR of 3% and the WACC rate of 7.29% remained the same as before mostly due to the lower cost of capital in China which Alibaba could access if needed.

Alibaba’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

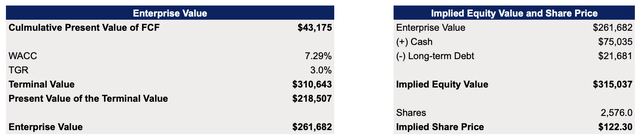

The updated model shows that Alibaba’s fair value is $122.30 per share, greatly above the current market price.

Alibaba’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

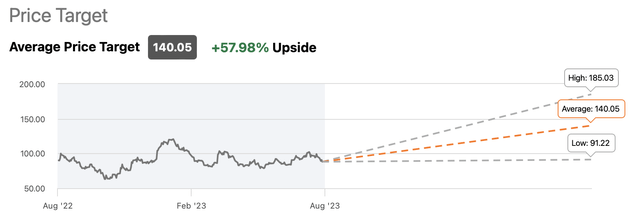

This updated price target is also close to the consensus that’s currently on the street.

Alibaba’s Consensus Price Target (Seeking Alpha)

Despite this, I’m still not convinced that Alibaba is a solid buy. We shouldn’t forget that the company has been trading below its fair value for years and yet it didn’t stop its shares from falling further down due to political risks that have undermined most of the growth catalysts so far.

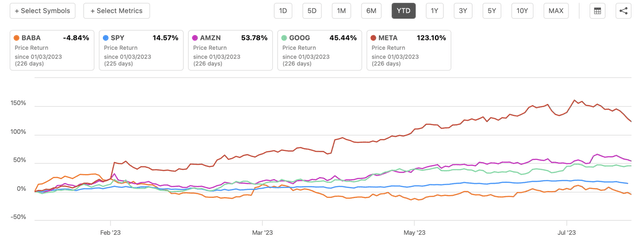

We once again see this happening in real-time as Alibaba’s shares are unable to breach major technical resistance levels even though the management bought back over $3 billion worth of shares in Q1. While the shares of American Big Tech firms managed to appreciate by double or even triple-digit rates since the start of the year, Alibaba’s shares depreciated by nearly 5% in the same period. This shows that China-related risks are likely to continue to hurt Alibaba’s performance and limit its upside in the foreseeable future.

YTD Performance of Alibaba’s Shares Against Its Western Peers (Seeking Alpha)

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here