Investment Thesis

Opera Limited (NASDAQ:OPRA) is heading into its Q2 results this Thursday premarket. Opera will spend some time explaining to investors not to be overly concerned about the mixed shelf filing from earlier in July. But Opera won’t dwell on this point and will look to push the narrative on to the progress it’s done with stabilizing its user base.

Since the stock is down nearly 50% from its recent highs, investors’ expectations are already damped, therefore this stock is primed to move higher together with its Q2 results.

Rapid Recap

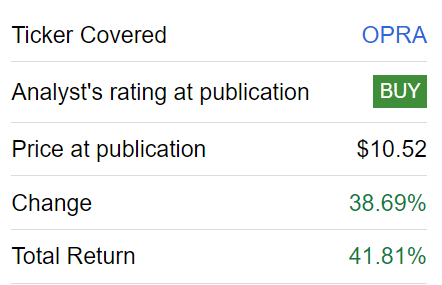

There’s no denying that Opera has been a volatile stock. Since I first highlighted OPRA earlier this year, the stock has rapidly moved higher.

OPRA stock performance

The stock has since taken a breather. Some aspects are of its own doing, while some are due to a proliferated risk-off sentiment that permeated the market since the start of August.

How should investors think of Opera now?

Short-Term Traders Become Long-Term Investors

In my previous analysis, I said,

[…] Opera had been in the past owned by a Chinese company. But since October 2022, Kunlun Tech and its founder are the only significant Chinese holders.

I went on to note that,

[…] the key concern to the investment thesis is that Opera has simply a tiny sliver of market share compared with the other top browsers.

Those few lines get to the crux of the matter. Investors are worried.

When a stock is going up, investors throw caution to the wind. Invest first and ask questions later, becomes the motto. Let’s be honest, we’ve all done it.

But when a stock starts to move in the opposite direction, we turn skeptical. Particularly when a stock moves rapidly in the opposite direction. At that junction, investors start to ask questions. Ever more challenging questions. And not only do investors actively ask more pressing questions, they demand certainty. As a corollary, investors decidedly ask for ever larger margins of safety before sending good money after bad money. Investors want to know that the water is safe.

Why Opera?

Opera is a web browser. Opera is known for its speed and focus on user privacy and performance.

Opera aims to provide a fast, privacy-focused browsing experience while offering additional features that enhance users’ online activities. Furthermore, it’s committed to innovation making it an attractive option for a small cohort of users seeking an alternative web browser.

Many of Opera’s features, including the VPN, ad blocker, and cryptocurrency wallet, are available for free to all users, without users needing to get hold of third-party extensions, which for many web users can be quite challenging to download and install.

Q2 2023 Preview, the Driver for This Stock

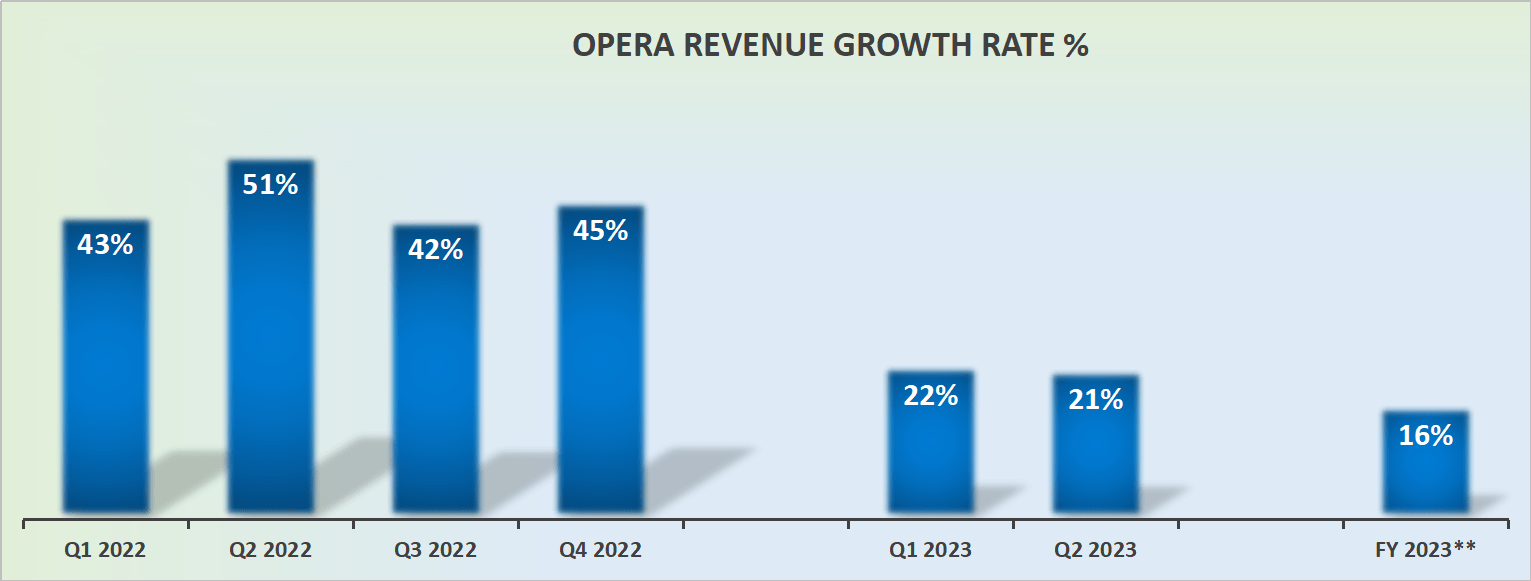

OPRA revenue growth rates

Opera has a challenging endeavor on Thursday. Can Opera’s earnings results sufficiently raise its full-year 2023 guidance to appease investors? As I’ve stated already, Opera has attempted to assuage investors about its mixed shelf filing, going to great lengths in its press release to explain that there’s nothing untoward in its mixed shelf filing, and if Kunlun Tech Limited (“Kunlun”) seeks to divest of Opera, it will do so while following appropriate decorum.

That being said, I argue that since this stock is already down close to 50% from the highs set in July, investors’ expectations have already been significantly re-rated lower.

For my part, I argue that investors shouldn’t be overly dismissive of Opera’s rapid progress. Indeed, I believe that the real driver for this stock will be whether Opera has been to stabilize its monthly active user base. Opera has allowed a natural churn of its user base from lower ARPU (average revenue per user) markets, to more actively chase higher ARPU Western users.

If Opera is able to convincingly demonstrate that its efforts to increase Western users continue to gather momentum, I believe investors will be more than willing to put aside the mixed shelf concerns. Investors will move on.

Next, let’s discuss Opera’s valuation.

OPRA Stock – Priced at 13x 2024 Free Cash Flow

According to my estimates, Opera could reach around $80 million of free cash flow in 2023. What’s more, given that 2023 is now mostly in the rearview mirror, a useful endeavor is to form a view of Opera’s 2024 free cash flows.

Accordingly, I believe that Opera’s free cash flows could reach $100 million in 2024. A figure that Opera should reach with ease, given that Opera’s free cash flows in Q2 2023 are likely to be close to $25 million. This puts the stock priced at approximately 13x next year’s free cash flows.

Furthermore, Opera has no debt on its balance sheet. Also, Opera has a 9.5% stake in OPay, valued on the balance sheet at around $220 million.

The Bottom Line

The recent mixed shelf filing in July has left some uncertainty, but the company aims to reassure investors.

Despite a nearly 50% drop from recent highs, there’s potential for a rebound alongside Q2 results.

However, Opera’s volatile history and its small market share in comparison to other browsers have investors concerned. When stocks decline rapidly, skepticism sets in, and certainty becomes paramount.

Stabilizing its user base, especially in higher ARPU markets, could sway investor sentiment. Additionally, its valuation at 13x 2024 free cash flow and lack of debt provide meaningful upside potential. Even though for now, uncertainty seems to be the prevailing sentiment, I argue that there’s a lot to be bullish about Opera.

Read the full article here