The PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund ETF (NYSEARCA:HYS) is a simple short-term high-yield corporate bond index ETF.

Although the fund sports a reasonably strong, growing 6.1% dividend yield, it is quite expensive for an index ETF, with a 0.55% expense ratio. Most of HYS’s peers are cheaper, with the SPDR Portfolio High Yield Bond ETF (SPHY) sporting a particularly low 0.05% expense ratio, half a percentage point lower. I see no reason to overpay for a simple index ETF, so I would not invest in HYS.

HYS – Overview and Analysis

HYS is a simple short-term high-yield corporate bond index ETF, with all the characteristics and implications that entails.

High Credit Risk

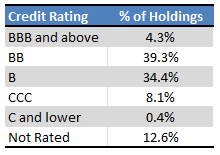

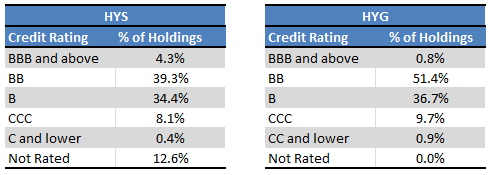

Credit quality is low, with the fund focusing corporate bonds rated BB-B:

HYS – Chart by Author

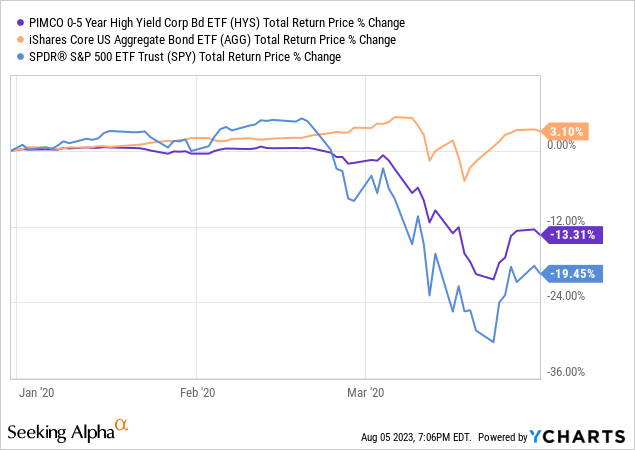

The credit ratings above are indicative of relatively risky issuers, with weak financials and balance sheets. Said issuers can almost always meet their current financial obligations right now, but might have difficulties doing so if economic or financial conditions deteriorate. Default rates are higher than those of investment-grade issuers, and these would almost certainly spike during any downturn or recession. Expect sizable losses during these, higher than average for a bond fund, but lower than those of most equity indexes. This was the case during 1Q2020, the onset of the coronavirus pandemic, as expected:

Data by YCharts

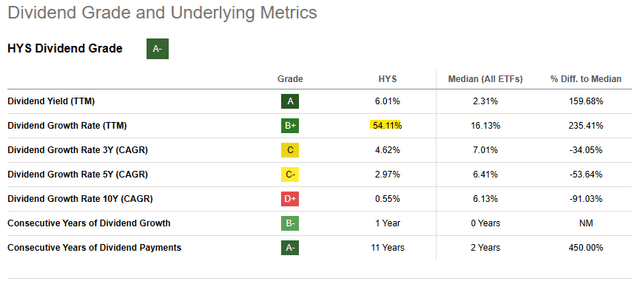

Strong Dividends

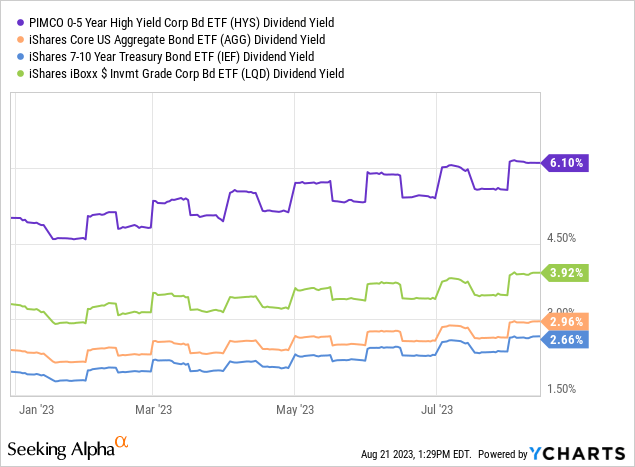

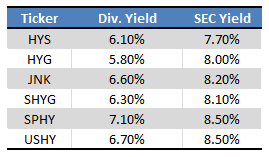

Securities with high credit risk tend to sport strong yields, and HYS is no exception. The fund currently yields 6.1%, quite a bit higher than most bonds and bond sub-asset classes:

Although the fund’s yield might look low relative to where interest rates are right now, remember those are trailing twelve month, or TTM, dividend yields, and yields were much lower twelve months ago. HYS’s SEC yield, which measures a fund’s underlying generation of income, is somewhat higher at 7.7%. Annualizing the fund’s latest monthly dividend payment nets me a 6.1% yield, equivalent to its annual dividend.

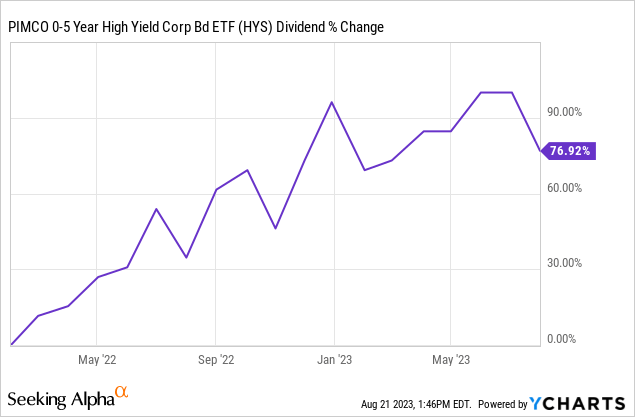

Strong Dividend Growth

HYS has seen strong dividend growth these past few years, courtesy of Federal Reserve hikes. Dividends have increased over 76.92% since early 2022…

…and over 54.1% these past twelve months:

Seeking Alpha

HYS’s dividends should continue to see growth in the coming months, as the fund replaces its older, lower-yielding bonds from before Federal Reserve hikes, with newer, higher-yielding alternatives issued after the hikes. Much will depend on future fed policy, which is highly uncertain, however.

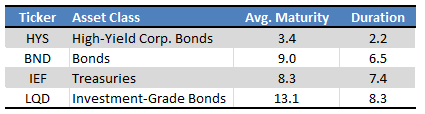

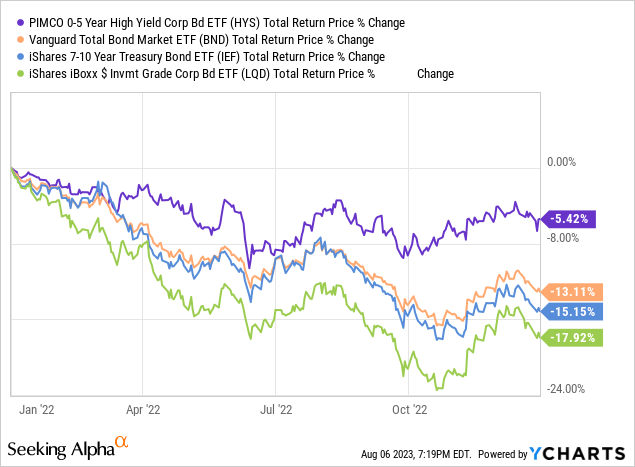

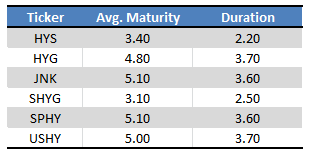

Below-Average Interest Rate Risk

Investors are generally reluctant to extend long-term credit to risky issuers, so riskier bonds and loans tend to have shorter maturities than safer, investment-grade issues. HYS focuses on high-yield corporate bonds, and so its portfolio is of below-average maturity and duration.

Fund Filings – Chart by Author

Due to the above, the fund should see below-average losses when interest rates increase, as was the case in 2022:

Data by YCharts

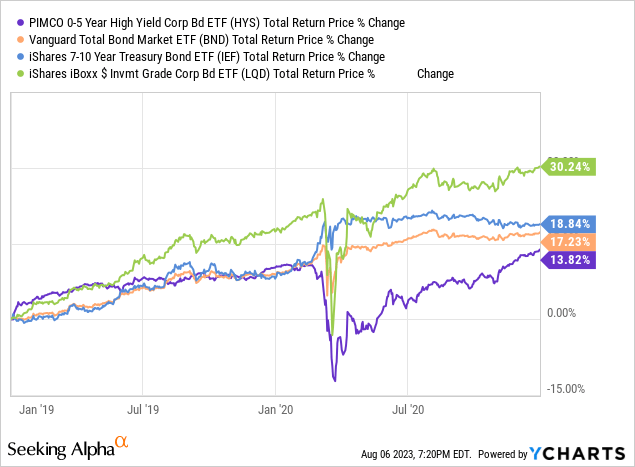

HYS should see comparatively weak gains when interest rates decrease, but this is complicated by the fact that the Fed tends to cut during recessions, which impacts high-yield bonds quite heavily. The fund did perform quite badly from early 2019 to mid-2020, during which the Fed cut rates quite significantly. The pandemic was responsible for a lot of the underperformance, however.

Data by YCharts

HYS – Peer Comparison

Similar Characteristics and Investment Thesis

HYS is quite similar to most other high-yield corporate bond ETFs in the market, including the benchmark iShares iBoxx $ High Yield Corporate Bond ETF (HYG).

Credit quality is quite similar, if perhaps a tiny bit weaker for HYS. Compare said fund’s credit quality with that of HYG.

Fund Filings – Chart by Author

As can be seen above, both HYS and HYG focus on non-investment grade bonds, with an average rating of BB. HYS holds a few more investment-grade bonds, however, as well as unrated bonds. The net effect seems to be a decrease in credit quality, but this remains broadly similar between the funds, and between most other high-yield corporate bond funds as well.

Dividends are quite similar as well, with most high-yield corporate bond ETFs sporting comparatively strong TTM and SEC yields. HYS’s dividends seem a bit lower than those of its peers, however.

Fund Filings – Chart by Author

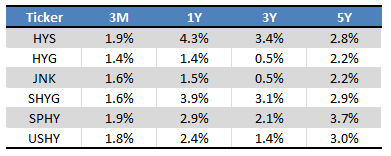

Performance is quite similar across the board as well, with HYS performing somewhat better than average across the 1Y and 3Y mark.

Seeking Alpha – Chart by Author

HYS does differ from most of its peers in two key ways.

First, the fund focuses on somewhat shorter-term high-yield corporate bonds, which reduces the fund’s average maturity, duration, and interest rate risk. The fund iShares 0-5 Year High Yield Corporate Bond ETF (SHYG) is quite similar to the in this regard, however.

Seeking Alpha – Chart by Author

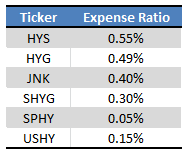

Second, the fund’s 0.55% expense ratio is quite a bit higher than average:

Seeking Alpha – Chart by Author

In my opinion, HYS does not provide sufficient advantages relative to its peers to warrant or merit a 0.55% expense ratio. An expensive actively-managed fund might generate more in alpha than it charges in fees. A niche, targeted index fund might provide exposure to a best-performing investment niche. A simple, broad-based index fund, however, will rarely significantly differ from the market, so expenses are rarely worth it. HYS is no exception, in my opinion at least.

Of the funds above, the SPDR Portfolio High Yield Bond ETF (SPHY) sports the lowest 0.05% expense ratio, 0.50% lower than HYS. SPHY’s lower expenses directly increase the fund’s dividends and long-term total shareholder returns vis a vis HYS, as can be seen in the graphs above. In my opinion, SPHY is a broadly superior investment to HYS.

For investors looking for short-term high-yield corporate bonds, the SHYG seems like a better choice as well. SHYG is pricier than SPHY, but still cheaper than HYS, with a 0.30% expense ratio. Lower expenses mean (marginally) higher dividends and long-term total returns as well.

Conclusion

HYS is a simple short-term high-yield corporate bond index ETF. Although the fund offers investors a good, growing 6.1% dividend yield, it is more expensive than almost all of its peers, and does not offer investors any compelling advantages or benefits relative to peers. I see no reason to overpay for a simple index ETF, so I would not invest in HYS.

Read the full article here