Introduction

Viking Therapeutics (NASDAQ:VKTX) is a clinical-stage biotech firm working on treatments for metabolic and endocrine issues. Their main drug, VK2809, is a thyroid hormone receptor beta agonist for non-alcoholic steatohepatitis (NASH), showing good tolerability in Phase 2b trials. Viking is also testing VK0214 for X-ALD, a rare neurological condition, and starting Phase 1 trials of VK2735 for metabolic problems. Additionally, positive outcomes were reported from a Phase 2 trial of VK5211 for hip fracture recovery.

The following article highlights the company’s key drug candidates, recent earnings report, financial position, and stock analysis.

Q2 2023 Earnings

Viking’s latest earnings report revealed a Q2 2023 R&D expense of $13.9M, a rise from $13.5M in 2022, attributed to higher pre-clinical study and manufacturing costs. General and administrative expenses jumped to $9.8M from $4.1M, largely driven by increased legal and patent costs. The Q2 net loss grew to $19.2M from $17.4M in 2022. Over the first half of 2023, the net loss totaled $38.8M, mainly due to elevated general and administrative expenses. Viking’s cash and short-term investments as of June 30 stood at $392.9M, up from $155.5M at 2022’s end.

Liquidity & Cash Runway

Turning to Viking Therapeutics’ balance sheet, the company had cash and cash equivalents of $69.5M, and short-term investments – available-for-sale of $323.4M. The total of these assets is $392.9M. Over the past six months, the company reported a net loss of $38.8M and used $36.1M in net cash for its operating activities. The average monthly net cash used in operating activities amounts to $6.0M. The cash runway, calculated by dividing total cash + marketable securities ($392.9M) by average monthly cash burn ($6.0M), is approximately 65 months (>5 years). However, these estimates are my own and may differ from other analyses. Viking Therapeutics has shown strong liquidity, with current assets far outweighing current liabilities ($399.4M to $13.5M). The company also has minimal long-term liabilities and total liabilities of $14.6M. Despite the net loss and cash burn, the company seems to have sufficient resources for the foreseeable future. Still, it is crucial for the company to closely monitor its spending and explore avenues for additional revenue or financing if its development and research activities increase the cash burn rate.

Valuation, Growth, & Momentum

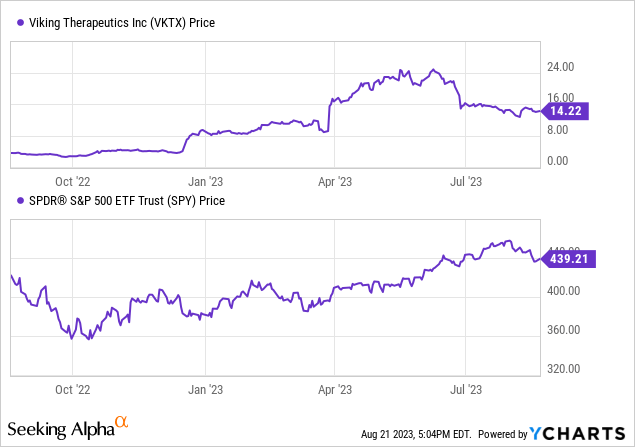

Seeking Alpha data indicates that Viking has a financial structure characterized by low debt relative to its market cap and a significant cash position. The company’s enterprise value stands at $1.01 billion. Yet, Viking is facing declining earnings projections, as their drug candidates mature, with a drop in EPS anticipated for the next three fiscal years. Despite these projections, the stock has experienced substantial growth over the past year.

With these negative earnings forecasts, the company is currently unprofitable and profitability may be some years off. Viking’s valuation metrics are not meaningful as positive earnings have not been achieved.

Viking Therapeutics Sets Sights on NASH, Obesity, and X-ALD

In their recent earnings call, Viking Therapeutics’ management outlined their growth initiatives and shared exciting progress on three main drug candidates – VK2809, VK2735, and VK0214. Each of these drugs seems to hold promise in their respective fields and could potentially revolutionize treatment options for patients.

For instance, VK2809 is a drug that targets patients with NASH and fibrosis. Results from the Phase 2b VOYAGE study are particularly impressive. The drug significantly reduced liver fat content, and up to 85% of patients receiving the drug experienced at least a 30% relative reduction in liver fat content. This level of efficacy could translate into a real histologic benefit in NASH, a notoriously challenging disease to treat. Additionally, the drug demonstrates reductions in LDL cholesterol, triglycerides, and atherogenic lipoproteins, which are all associated with cardiovascular risk. These findings make VK2809 not just a potential NASH therapy, but also a cardiovascular protective agent. The company noted that while other NASH development programs have shown increases in these lipids following treatment, VK2809 seems to offer a unique advantage in this regard. The company is scheduled to report data from secondary and exploratory objectives from the VOYAGE study in the first half of 2024. This will be a crucial milestone, and if the positive trend continues, VK2809 could become a frontrunner in the NASH treatment landscape.

The company’s VK2735 is a dual agonist targeting obesity that has shown promise in weight loss, glucose control, and insulin sensitivity. In the Phase 1 study, single doses of VK2735 were safe and well-tolerated, with a half-life of approximately 170 to 250 hours. In a portion of the study, VK2735 showed reductions in body weight up to 7.8% and improvements in plasma glucose levels. The potential to have both a subcutaneous and oral formulation could make VK2735 a versatile and attractive option for patients. However, while the preliminary results are encouraging, it is important to recognize that the Phase 1 study was conducted in a small number of healthy volunteers. Further large-scale studies in patients with obesity are needed to fully understand the efficacy and safety profile of VK2735.

Lastly, VK0214 is targeting X-ALD, a rare and debilitating metabolic disorder. In the ongoing Phase 1b study, the company is evaluating the safety, tolerability, and pharmacokinetics of VK0214 in patients with the AMN form of X-ALD. The decision to advance the program is based on positive results from a prior Phase 1 study. However, it’s worth noting that the company is currently still enrolling patients and the study is expected to complete enrollment later this year. The final data will provide a better understanding of the drug’s potential.

My Analysis & Recommendation

To sum up, Viking Therapeutics has made notable progress with their drug candidates, especially VK2809, which has demonstrated strong potential in NASH treatment. Investors should watch for secondary and exploratory data from the VOYAGE study expected in early 2024. Positive outcomes could establish VK2809 as a leading candidate in NASH treatment, possibly enhancing Viking’s stock value. VK2735 and VK0214 are both in initial development stages, and their success will depend on larger trials and more data. These drug candidates present interesting market opportunities if they continue to exhibit encouraging results in future trials.

Drug development is generally risky and uncertain. Phase 1 drugs have about a 10% success rate, increasing to approximately 30% in Phase 2, and approximately 70% in Phase 3. VK2809, in Phase 2b, has an estimated 30% chance of market success. VK2735 and VK0214, both in Phase 1, have around a 10% chance. It is important to remember that these estimates can change based on factors like mechanism of action, target patient group, and indication (e.g. psychiatric drugs have higher failure rates than endocrine drugs).

Financially, Viking seems well-positioned with strong liquidity. The latest earnings report indicates increased R&D and administrative expenses, resulting in a net loss of $38.8M over the past six months. However, with $392.9M in cash and short-term investments, the company has a cash runway of about five years, allowing sufficient time to progress its drug candidates. Minimal debt and substantial cash holdings further support Viking’s financial stability.

In light of this analysis and Viking’s rich $1 billion valuation, I recommend a “Hold” position for Viking Therapeutics. VK2809 shows promise, and the financials are robust, but the risks of drug development and ongoing losses call for caution. Viking remains years away from profitability and its path is uncertain. Existing investors should consider retaining their shares and watch for data from the VOYAGE study. For potential investors, waiting for more conclusive results from the company’s drugs and a clearer route to profitability is advisable before investing.

Read the full article here