Investment thesis

A year-to-date selloff in regional banks provides attractive investment opportunities. Despite being the largest U.S. bank outside the “Big Four”, U.S. Bancorp (NYSE:USB) also suffered a massive stock price decline in 2023 after several adverse events for the regional banking industry. The current harsh environment also weighs on the bank’s profitability, and the undermined investor sentiment also can be explained by narrowing EPS. But headwinds are temporary, while USB is a wide-moat bank with a diversified revenue mix and strong capital allocation. After a year-to-date sell-off, the stock currently trades with about a 33% discount and offers an attractive 5.2% forward dividend yield. To sum up, USB is a “Strong Buy”

Company information

USB provides a full range of financial services, including lending and depository services, cash management, capital markets, and trust and investment management services. It also engages in credit card services, merchant and ATM processing, mortgage banking, insurance, brokerage, and leasing.

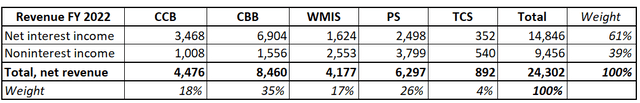

The bank’s fiscal year ends on December 31. USB’s major lines of business are Corporate and Commercial Banking [CCB], Consumer and Business Banking [CBB], Wealth Management and Investment Services [WMIS], Payment Services [PS], and Treasury and Corporate Support [TCS].

Compiled by the author based on the latest 10-K report

Financials

I like the bank’s broad diversification of revenue streams, where the largest one represents slightly above a third of the total. As a bank, USB generates a substantial part of net interest income [NII], but the noninterest income represents almost 40% which is solid. Having a large portion of noninterest income makes the bank less vulnerable to shifts in interest-rate cycles and more resilient. A broad portfolio of service offerings makes USB a solid financial service “one-stop shop” for customers. That said, the bank has many opportunities to cross-sell, which enables it to drive down customer acquisition costs.

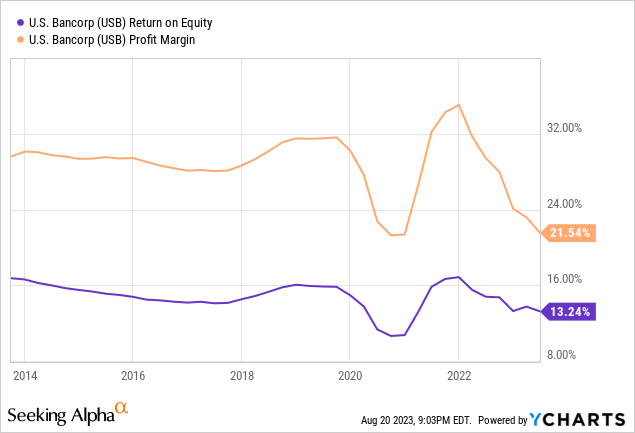

The bank has a stellar “A+” profitability grade from Seeking Alpha Quant. But, if we dig deeper, we see that the current net income margin is lower than the sector median and is substantially lower than USB’s five-year average. The same with ROE and ROA. This is due to the current weak macro environment with high-interest rates, which weighs both the loan portfolio quality and the economic activity. While the current challenges for profitability are obvious, they are temporary and not secular. Pre-covid key profitability metrics were stable and there was an impressive rebound after the short-term recession in 2020. That said, USB has a solid track record of maintaining solid profitability metrics. I expect them to start bouncing back once the Fed pivots its monetary policy, which is expected next year.

Solid long-term profitability enabled USB’s balance sheet to be in good shape, with a standard equity Tier 1 capital ratio at 9.1% as of June 30, 2023. This aligns with the management’s targeted common equity Tier 1 ratio. USB pays dividends and has a consistent track record of payouts and growth. Currently, the stock offers a solid 5.2% forward dividend yield. I think the dividend is safe as the management’s capital allocation has proven sound over the long term.

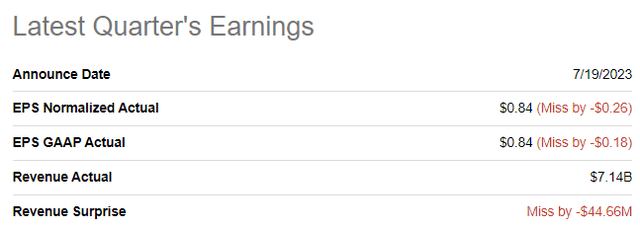

The latest quarterly earnings were released on July 19, when the bank missed consensus estimates on revenue and the bottom line. While revenue demonstrated a solid 19% YoY growth, the adjusted EPS narrowed from $0.99 to $0.84.

Seeking Alpha

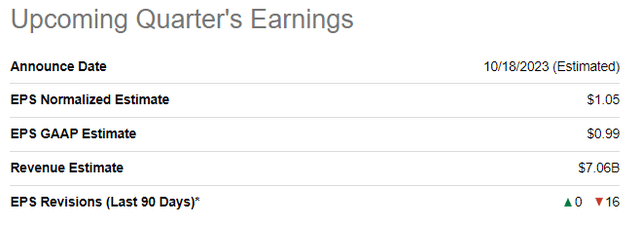

The upcoming quarter’s earnings release is scheduled on October 18. Consensus expects revenue to maintain double-digit growth with a 12% YoY increase. The adjusted EPS is projected to shrink again with a YoY change from $1.16 to $1.05.

Seeking Alpha

While USB’s earnings demonstrate temporary weakness amid the challenging environment, I think the bank is poised to return to a strong profitability path once macro factors start easing. The bank’s large-scale and very broad revenue mix, where non-interest income represents a solid 40%, means USB is in a pole position to capture the broader economy’s recovery tailwinds.

Valuation

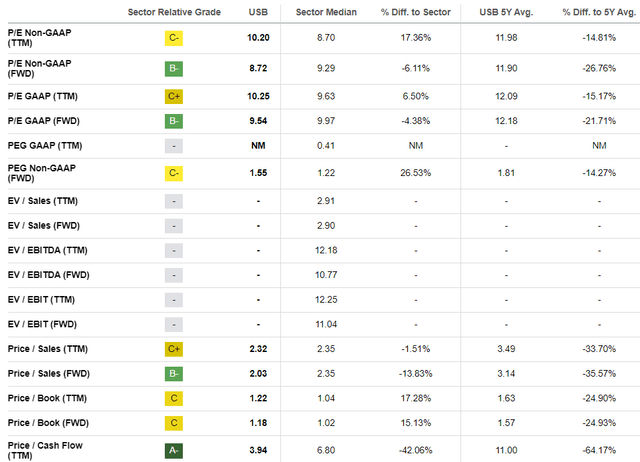

The stock price declined 17% year-to-date, significantly underperforming the broad U.S. market and the Financial sector (XLF). Seeking Alpha Quant assigns the stock a “B” valuation grade. While comparing USB’s multiples with the sector median provides mixed outcomes, current valuation ratios are substantially lower than the bank’s historical averages. This might indicate undervaluation.

Seeking Alpha

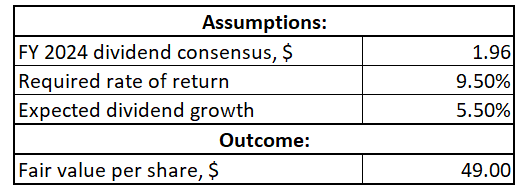

I use a dividend discount model [DDM] to proceed with this. A 9.5% WACC looks fair to me to use as a required rate of return. USB’s long-term dividend CAGR is stellar, though it decelerated notably in the last three years. That said, I use a more conservative 5.5% divided CAGR to be on the safe side. Consensus dividend estimates project a $1.96 payout in FY 2024.

Author’s calculations

According to my DDM calculations, the stock’s fair price is $49. This means about 33% upside potential from the current level. To conclude this part, both valuation approaches indicate that USB stock is attractively valued.

Risks to consider

While I look positive at the bank’s prospects and valuation, I must acknowledge the potential risks of investing in USB.

As a large bank at a national scale, represented in 25 states, USB is significantly exposed to macroeconomic risks. Shifts in the macroeconomic environment, like inflation and unemployment rates, affect the bank’s performance. Economic downturns impede borrowers’ ability to repay debt, weighing on USB’s loan portfolio quality. The bank’s profitability also significantly depends on the interest rates cycle, which is what we have seen in recent quarters.

The current sentiment regarding the U.S. Financial sector is also weak, and it might take multiple quarters to regain investors’ confidence. News is primarily bad for the banking industry this year, which started from several regional banks’ failures in Spring 2023. While this summer was calm primarily for the banking industry, the recent credit ratings downgrade for multiple regional financial institutions from Moody’s did not add optimism for investors. Last but not least, the downgrade of the U.S. country credit rating was also harmful to the stock market as a whole and the Financial sector in particular.

That said, it might take multiple quarters before the sentiment regarding regional banks and the Financial sector shifts to positive, catalyzing USB’s stock price to move toward its fair value.

Bottom line

To conclude, USB is a “Strong Buy”. I like the bank’s diversified portfolio of product offerings which makes it a solid financial services one-stop shop for customers. Having a wide financial services mix also gives the bank ability to drive down client acquisition costs by being able to cross-sell its offerings to existing customers. The bank has a robust track record of success and a strong balance sheet makes it ready to weather the storm. The valuation looks very attractive with about 33% upside potential and a 5.2% forward dividend yield.

Read the full article here