About two months ago I wrote an article on City Office REIT (NYSE:CIO) giving a recommendation to avoid equity but instead consider investing in CIO’s preferred shares – City Office REIT (CIO.PA).

There were three reasons outlined backing my thinking on why not equity.

- Debt saturated balance sheet. CIO has a net debt to EBITDA of 6.5x, which could considered relatively aggressive in the context of the prevailing market interest rates and the risks linked to the below A-class office building. Usually, a net debt to EBITDA of 5x is viewed as a long-term sweet-spot for REITs. So 1.5x above that looks optically a manageable amount of debt. However, as I will elaborate below, this is certainly not the right time for CIO to carry a debt load, which is on the aggressive-end of the spectrum.

- Negative outlook on the interest cost component. Currently, CIO has a weighted average cost of debt at 4.6%, which is by ~ 200 basis points below the cost of recently attracted financing via a term note. This means that there is still a notable room for interest cost component to increase and render an unfavourable impact on the underlying FFO.

- Unfavorable lease maturities. During times like these when the bargaining power has clearly shifted in favor of the tenants, it is extremely important to have back-ended loaded lease maturities. Otherwise, with each expiring lease, there is a rather high probability of suffering from incremental uptick in the vacancy rate and / or being exposed to negative lease spreads just to keep the tenants in place. In CIO’s case more than 20% of the leases fall due over the next 3 years.

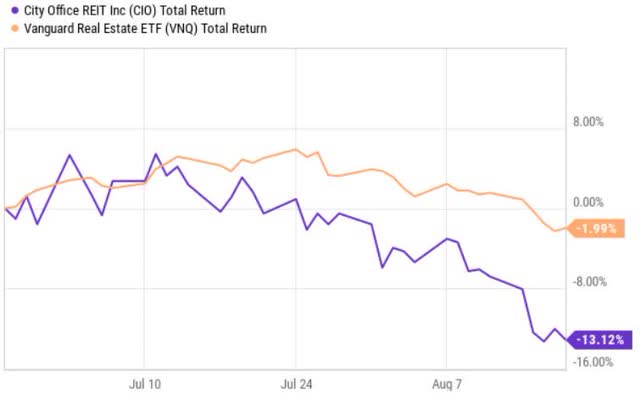

So far the thesis of avoiding equity exposure to CIO has played out correctly.

Ycharts

The share price has dropped by ~ 13% in just less than two month period, implying a negative alpha performance of ~ 11% (compared to the broader REIT market).

At the same time I made a case for CIO’s preferred shares because of the presence of several important elements, which could put a floor on negative returns and over a longer period also award preferred shareholders with some decent return. Moreover, I had a comfort in such position because of the resilient Q1 results (in the context of preferred shareholders), where like-for-like NOI grew and total portfolio occupancy improved.

So far the preferred share position has increased in value by ~2% (on a total return basis) assuming a completely different trajectory than CIO’s equity.

Let’s now revisit the key assumptions of the preferred share play and contextualize these with the recently published Q2 results.

Synthesis of Q2 results and thesis review

One of the main reasons why the Share price dropped once the Q2 results were circulated was the negative rate of change in the NOI figure, which previously was characterized by a high degree of resiliency and even minor growth.

The NOI decreased by $0.8 million mostly due to the deconsolidation of 190 Office Center during the second quarter, where the CIO decided to hand back the property to the lender, thus benefiting from reduced debt and interest cost. Another factor, which impacted the NOI result was the increase in operating expenses (uptick of 7% on a year-over-year same-store basis).

As a result the AFFO plummeted by ~ 10% compared to Q1, 2023.

Yet, on the positive side CIO managed to register positive lease spreads and most importantly maintained the occupancy ratio in a solid territory.

According to James Farrar – CEO & Director (Q2, 2023 earnings call):

During the second quarter, we completed 224,000 square feet of total leasing activity with a healthy 7.2% improvement in renewal cash rents versus the expiring rents. Quarter-over-quarter, we achieved an increase in occupancy at 9 of our properties, maintained occupancy at 11 and experienced a decline at only 4 assets.

A critical component for the preferred shareholders is the same store growth, which if positive indicates that the underlying assets are still in demand and carry a value. CIO’s same store cash NOI change was positive 7.5% as compared to second quarter of 2022. Overall, for 2023, CIO seems to be capturing a 3% to 4% increase in same store cash NOI.

The key reasons for such performance are the embedded rent escalators, positive leasing spreads and strong occupancy ratio, which in Q2, 2023 increased by 80 basis points relative to the prior quarter.

In a nutshell, if we exclude the one-off related to the deconsolidation of 190 Office Center, the underlying results seem strong indicating a positive outlook for the preferred shareholders.

Now, let’s take a look at the structure of debt, liquidity and coverage of preferred distributions to determine whether a position in the preferred shares is sound.

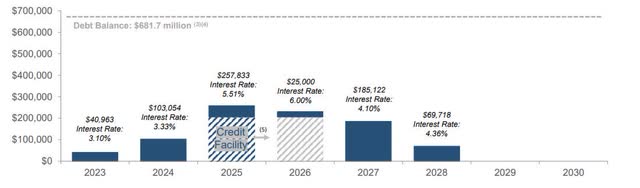

The debt maturity profile of CIO seems very strong.

City Office REIT

In 2023 and 2024 there are immaterial debt maturities for CIO to refinance. In 2025 we see the first major debt maturity stemming from the credit facility. Looking at the details of the credit facility, we can see that CIO has the option to extend the maturity date by 1 year until 2026.

In addition to a well-staggered debt maturities, the interest rate risk is also mitigated by having over 90% of debt based on fixed rates.

If we annualize the Q2, 2023 AFFO result, we land at $29 million, which in conjunction with the cash at hand of $38 million is more than enough to pay down the 2023 debt and later provide a nice buffer for the upcoming debt maturity in 2024.

As of Q2, 2023, CIO also held $90 million of undrawn revolving line of credit. Putting together the internal cash generation, existing liquidity and the undrawn revolving line of credit, it seems that CIO comes close to the actual refinancing need at 2025 (or 2026 if extended by 1 year).

Relatively recently the Management of CIO decided to cut the dividend by 50% bringing down the AFFO payout to 56%.

This is positive for the preferred shareholders as this way the Company is able to accumulate more of an internally generated cash to reduce the leverage and secure a stronger base of liquidity to refinance the debt maturities in 2025 and 2026.

Finally, based on the Q2, 2023 results, the AFFO coverage of preferred shares lands at ~ 4x.

The bottom line

All in all, Q2 results confirm the resiliency of CIO’s business operations and send positive signals for the preferred shareholders that the key risk (i.e., debt refinancing in 2025 or 2026 if the credit facility is extended) is well-managed.

The refinancing risk is, in my opinion, relatively low due to the growing same store NOI and decent prospects of further internal cash accumulation due to the decreased dividend and locked in financing costs.

At the same time, I would still stay away from CIO’s equity considering the fact that the Management is consumed with the efforts to reduce leverage and successfully roll over the debt maturities. We should not be surprised that CIO opts for additional dividend cut and / or divests additional assets just to reduce the dependency on external liquidity once the debt maturities kick in.

Plus, the fact that WeWork (NYSE:WE) – CIO’s second largest tenant accounting for ~3% of leases – is clearly in a very difficult position does not necessarily bode well for solid improvement on the AFFO front. This coupled with the volatile office segment and higher for longer interest rate scenario make the equity story not that appealing.

Read the full article here