This doesn’t happen often. A company trading below book value. Sorry, that was not right. What is rare is finding quality companies that trade below book value. I believe WestRock Company (NYSE:WRK) is one such company that has attractive characteristics but has been penalized by the market for several reasons. Two primary reasons that stand out to me are the industry it operates in and the narrative-driven AI hype cycle we are in (If you are at a dinner with your friends does it sound hip when you say you have bought Palantir and Nvidia for your portfolio or when you say have invested in a paper packaging company?) Other reasons could be their debt levels which can be quite concerning at first glance. The company also overpaid for its acquisitions, had to write down a significant chunk of its goodwill, and is in a turnaround of its operations. But what can be expected from this company if we put all of these in the rearview mirror? If we say that the stock price more than reflects the company’s current situation, can this be a good investment in the current market conditions?

Playing Defense

I believe in the current market the best offense is a good defense. That means investing in industries that have stable demand, reliable cash flow, and exhibit less sensitivity to economic cycles. This also means they are usually not popular and are more focused on value.

WestRock Company is a multinational packaging solutions provider. They specialize in creating innovative packaging solutions for various industries, such as consumer goods, food, and healthcare. With a focus on sustainability, WestRock offers an array of packaging materials, corrugated containers, folding cartons, displays, and packaging machinery. They cover the entire packaging supply chain, from design to manufacturing and distribution, making them a significant player in the packaging industry. One of their recent big wins is partnering with Costco to replace single-use plastic “dog bone” clips with a Paperboard solution that is available in curbside recyclable formats

Investor Presentation

So this is not an industry that would feature in any “hot” investing list. But this does not mean it would not provide you with above-average market returns. This stock has suffered recently but there have been periods where it has provided even above benchmark returns. While I understand timing the entry is difficult, I believe we are again around one such entry point where the business is trading for less than what it’s worth, and it has possibly put the worst behind it.

The company’s equity is at $10B and with a market cap of $8.23B, its book multiple is 0.8x. While a P/B ratio lesser than one is already an indicator of value, since this is an unloved industry we have to check if this is common across the industry or if the company is actually undervalued. Across the industry, the median is 2x and the average is 3x.

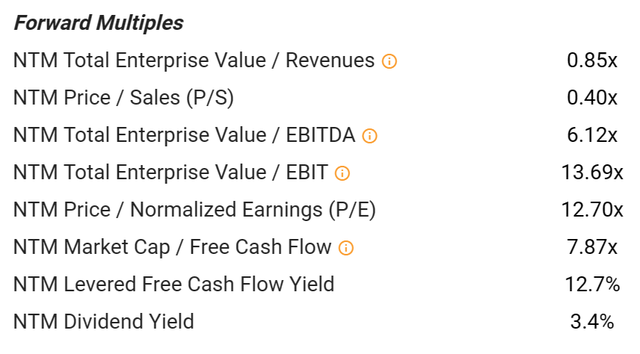

Additionally, their cash flow ratios are also very attractive. For LTM, their OCF came in close to $1.8B which puts their P/CF at 4.6 which again ranks quite favorably within the industry (and also within their sector). LTM PE multiple does not accurately reflect their business mainly due to one-time expenses. But this starts normalizing when you look at their forward multiples.

Tikr

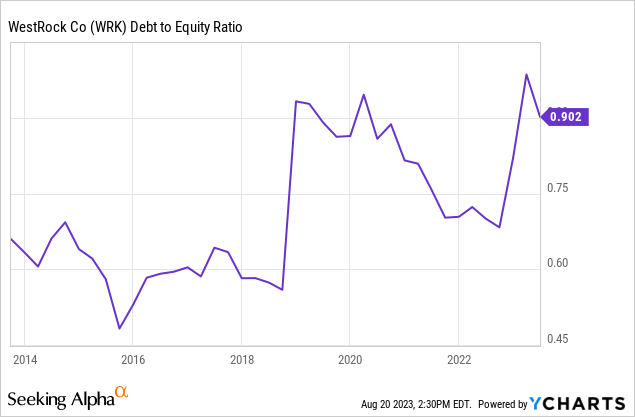

Debt Levels

The other concern expressed about this company is its debt level. Debt to equity is close it its highest levels in the last ten years.

But peeling back the layers we realize that it is not as much of a concern.

1. Its debt is well covered by its operating cash flow. OCF as a percentage of its long-term debt is over 20%

2. Its EBIT for LTM is at $1.45B and it is quite sufficient to cover its current payments on its debt. Its current ratio of 1.5 suggests there are no liquidity problems faced by the company.

Looking forward

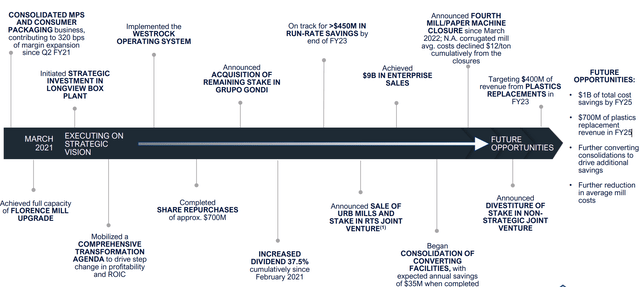

Past, Present and Future (Investor Presentation)

The company has made significant efforts to put its worst behind it and look ahead. QoQ they have shown a revenue decline of 7% for Q3 coming in at $5.1B. While they do not expect any bump in revenues, they are targeting $400M of revenue from plastics replacements in FY23. On a longer timeframe, they expect $700M of plastics replacement revenue in FY25. They are also making significant improvements in improving their operations and bottom line.

They expect to exit FY23 with more than $450M in run-rate savings by closing and consolidating their facilities. They also expect their consolidated EBITDA to be in the range of $675 to $725M and adjusted EPS to be in the range of $0.66 to $0.83 per share. On a longer timeframe, they expect further converting consolidations and more reductions in average mill costs to drive additional savings. In total, by 2025 they expect their cost savings to be around $1B.

In conclusion, the steps undertaken by the company bode well and will lead to a much brighter future ahead for them.

Risks to this thesis

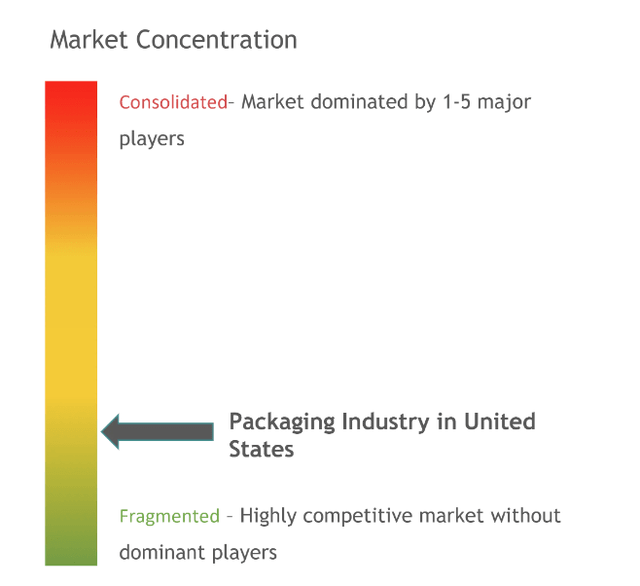

The biggest risks I see to this company are from its competitors. The industry has low barriers to entry with little to no differentiation between peers outside of price.

Mordor Intelligence

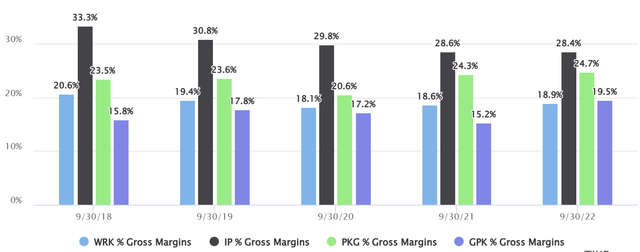

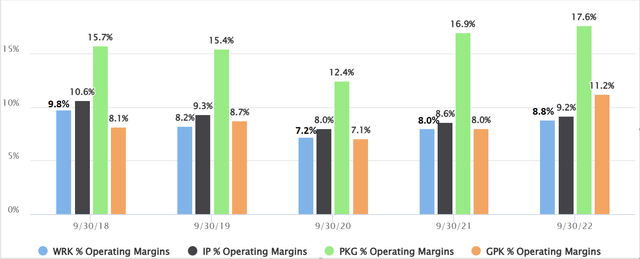

Now to check if a company could efficiently compete on price, the first thing to look for is margins. If we compare the margins of Westrock against some of the key players in the industry we see that it does not fare well.

Gross Margins Comparison (Tikr) Operating Margins (Tikr)

The good news is that as we saw, the company is working to improve its efficiency and making cost savings a big part of its future plan. But this will definitely take some time to pan out and will be important metrics to watch out for.

Final Call

Presently, I rate this company as a buy. I do recognize the company is coming out of a turnaround and also fares less favorably than its competitors. But I do believe that it has put the worst behind it and the market is giving an opportunity for the investors to buy into this business at a discount. Previously, in these situations, the company has always been able to expand its multiples and get above the benchmark returns, and in my opinion, we are at a similar juncture this time around as well. Over the immediate term, we may see more pain while the turnaround is in its final stages but over the medium term, this could be a great entry point. But I don’t expect to hold this stock past its expiry date. Competition is high and sooner or later the company could find itself back in another bad situation. My strategy for this company is to get into this company at the right price (I believe we are near one right now), keep a close eye on their progress, and revisit my thesis every six months to see how we have progressed. I would not hold this investment for the long term and would look to get out whenever the price is right. I will aim to keep the readers informed here on Seeking Alpha through my journey.

Read the full article here