Investment action

I recommended a buy rating for Xometry (NASDAQ:XMTR) when I wrote about it the last time, as I expected the business to continue growing as guided given that the previous issues that plagued the business were largely resolved. Based on my current outlook and analysis of XMTR, I recommend a buy rating. Aside from the strong revenue growth, the key metric, active buyers, remains healthy with 44% y/y growth. This is a clear indication of XMTR’s long-term growth profile, in my opinion, regardless of what the market thinks about the near-term impact of the macro environment. EBITDA should also turn positive soon, thereby reducing the valuation gap between peers.

Basic Recap

XMTR is an online marketplace for custom-made products. XMTR’s innovative software has enabled the creation of a global marketplace for the sale and purchase of custom manufactured components and assemblies, allowing both buyers and sellers to benefit from the platform.

Review

XMTR’s 2Q23 results were impressive, with revenue growth of 16% and an increase to $111 million. In particular, the results highlighted the potential growth profile, especially in light of the vigor of the active buyer base. In my opinion, the strength of XMTR’s active buyer base is more indicative of the company’s long-term growth potential than its revenue growth. Refreshing readers’ memory, remember that XMTR is a platform that needs both buyers and sellers to support the flywheel effect. With more active buyers, it attracts more sellers, thereby enhancing the value of the platform for all users.

Q2 active buyers increased 44% year-over-year to 48,294 with 3,578 new active buyers. In Q2, the percentage of revenue from existing accounts was 96% underscoring the efficiency, and transparency of our business model that leads to increasing account stickiness and spend over time. 2Q23 call

Updates on product developments and partnerships were also provided by management. For instance, in early 3Q, XMTR started beta testing Teamcenter with some of their larger enterprise customers. This tool facilitates in-house collaboration and management of projects between engineers and procurement professionals. With Teamcenter shifting the XMTR marketplace’s emphasis from individual buyers and individual parts to teams managing supply chain projects, I think this will help XMTR further penetrate its larger customers. The fact that XMTR signed its largest ever multi-year production order in the second quarter, as well as other statements from upper management, lend credence to my expectation.

We expect marketplace growth of 30% to 33% in 2023. In addition to excellent order growth, we are seeing strength in large orders, including the largest multi-year production order in our history. 2Q23 call

As for partnerships, XMTR entered into a partnership with Alibaba (BABA) Group’s 1688.com in 2Q, with the integration recently expanding to the mobile app. I expect this to continue to support XMTR’s international growth (it saw 96% growth in 2Q23) as XMTR taps into BABA’s large network of mobile users.

Aside from strong revenue growth, XMTR should see further EBITDA margin expansion, continuing the momentum seen in 2Q23. XMTR reported adjusted EBITDA of -$8.7 million, near the high end of the guided range. Along with revenue growth, RIF efforts in 1H23 and consolidation of office space to lower lease expenses should push XMTR closer to breakeven status and the possibility of adj EBITDA positive in the coming quarters.

As such, looking over the near-term (2H23), I believe the narrative is solid with expectation for strong revenue growth and improved adj EBITDA trajectory. The ongoing debate in the short term is expected to revolve around how the macroeconomic conditions persist in restraining growth, which might cast a shadow on the enduring industry-wide long-term trend. In my opinion, investors ought to emphasize the long-term perspective, where I see XMTR as a frontrunner in the online B2B marketplace sector, facilitating connections between enterprises and industrial parts manufacturers, effectively tapping into the significant total addressable market.

Valuation

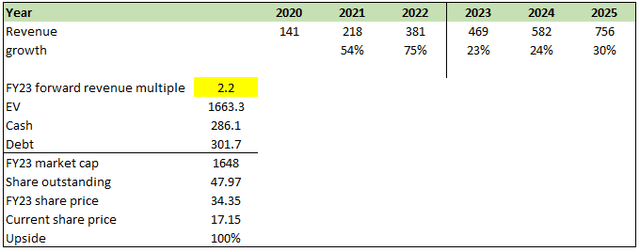

Author’s work

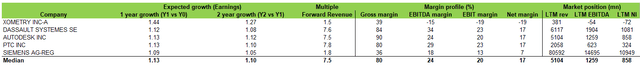

I continue to believe XMTR will meet management’s FY23 guidance given the growth momentum seen in 2Q23, in particular in active buyers and international growth. The 1688 partnership should also help accelerate growth as XMTR can now reach the millions of mobile users in China. Post FY23, I made the conservative assumption that growth would remain slow for 1 more year before reaccelerating to 30% in FY25. My opinion on XMTR is largely the same, in that I believe the multiple discount is too big relative to peers. The plausible reason that the market is unlikely to attach a premium is because XMTR remains loss-making. Historically, XMTR trades at a discount of ~30% vs peers, but it is trading at ~70% discount today, on a forward revenue multiple basis. Assuming the difference goes back to 30%, XMTR should trade at ~3.2x forward revenue today. With the growth and EBITDA trajectory, I expect this gap to gradually close over the coming quarters. I assumed XMTR would trade at a 50% discount (somewhere in between a 30 and 70% discount) in FY24.

Author’s work

Final thoughts

XMTR solid growth in active buyers supports its long-term expansion prospects. My recommendation to buy XMTR stands, as its recent 2Q23 results underscore a promising growth trajectory, especially evident in the robust active buyer base. This metric holds more significance for XMTR’s long-term potential than mere revenue growth. XMTR’s initiatives, like the Teamcenter collaboration tool and the partnership with Alibaba’s 1688.com, position it favorably for future growth. Additionally, I anticipate EBITDA margins to continue expanding, bolstering its financial outlook.

Read the full article here