Investing in a high quality consumer staple business is a medium to long-term endeavour that requires patience and the ability to avoid any emotional biases.

This is the case of Mondelez (NASDAQ:MDLZ), which is among the best-positioned Packaged Food companies and one of my favourite picks within the broader consumer staples sector. As such, it was one of the first high conviction ideas I presented to my subscribers late last year.

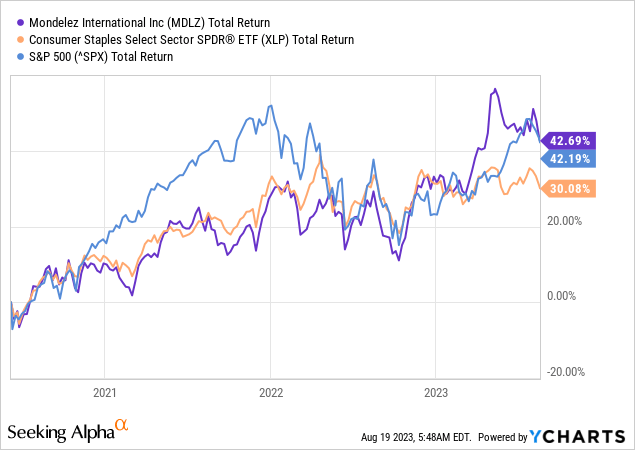

Back when I first covered the stock in the summer of 2020, MDLZ was not a very popular choice among retail investors. The stock had a very low expected topline growth and a premium multiple. In spite of these largely irrelevant characteristics for long-term investors, MDLZ has now outperformed both the consumer staples sector and the S&P 500.

*Adjusted for its low beta and low standard deviation of returns, MDLZ has done even better when compared to the broader market.

As we see above, however, for most of the time since the summer of 2020, MDLZ was actually performing in-line with the Consumer Staples Select Sector SPDR ETF (XLP). It wasn’t until earlier this year, when the market re-priced the stock on the back of the strong Q1 2023 results and the elevated guidance for the rest of the year.

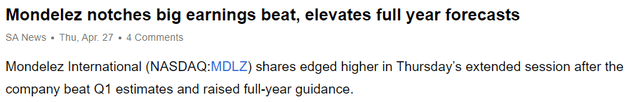

Seeking Alpha

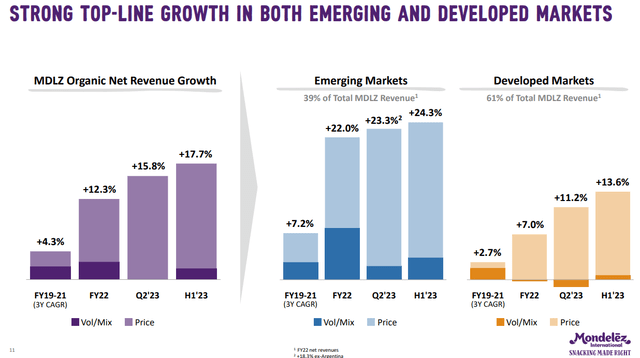

The 10% expected growth in both revenue and adjusted earnings per share for 2023 was indeed impressive, but it is hardly a result of something that happened over a 3-month period. Quite the contrary, this is a reflection of the company’s long-term strategy, competitive positioning and strong brand portfolio that I have been covering over the past few years.

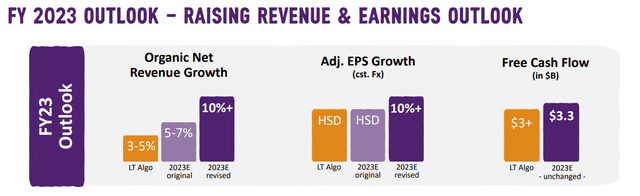

Mondelez Investor Presentation

Following the Q1 results for this year, the guidance was then once again revised in the second half of the year to 12% growth in both revenue and EPS.

Mondelez Investor Presentation

As Mondelez continues to deliver on its strategy, investors could once again follow for the misconception that a premium valuation equates low expected returns.

Strategy Implications

One of the main pillars of my investment thesis for MDLZ has been the opportunity for margin improvement over time as the company reorganizes and fully capitalizes on its strong brand portfolio.

Seeking Alpha

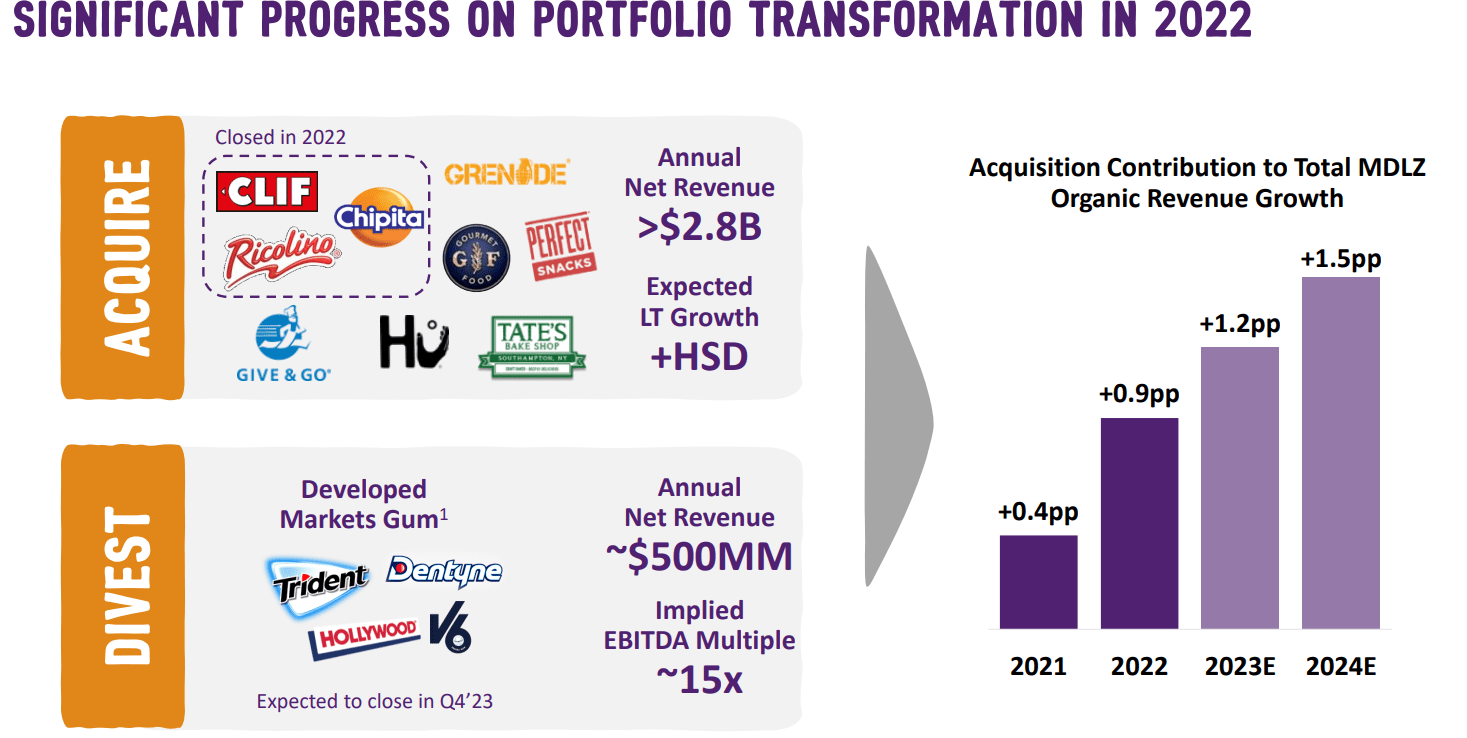

In that regard, management has done a very good job by divesting some non-core assets and focusing on expanding the business into adjacent product categories.

By doing so, MDLZ is not only benefiting from synergies, but is also optimizing its sales channels and fully leveraging its iconic brands. The deals for Chipita and Ricolino were also strategically important from improving the company’s geographical reach in Eastern Europe and Mexico.

Mondelez Investor Presentation

By positioning itself in the right product categories and reshaping its brand portfolio, Mondelez could still improve margins over the coming years, but the recent jump in commodity prices has postponed this opportunity (more on that later).

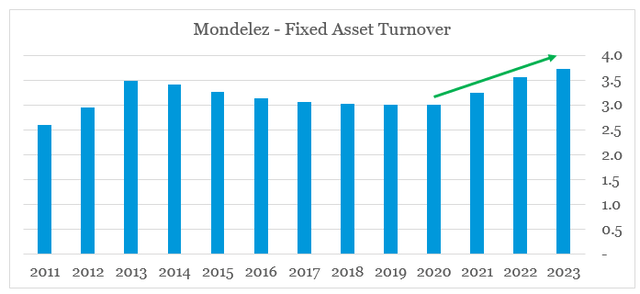

Instead, by optimizing its portfolio and growing the business, management succeeded at improving the company’s fixed asset turnover to its highest levels in more than a decade.

prepared by the author, using data from SEC Filings

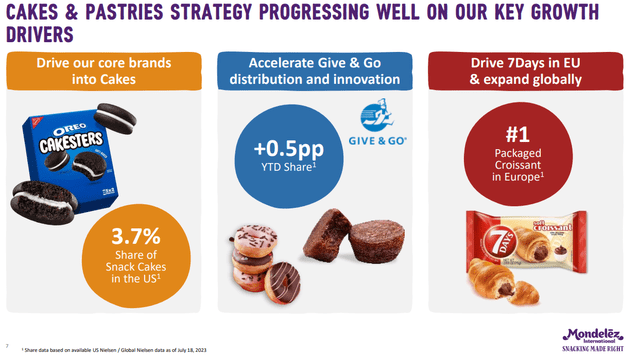

The commentary below is a very good example of the results that the current strategy provides in terms of expansion into new product areas, which has a positive impact on MDLZ capacity utilization.

(…) in China we launched Oreo Airy Cake in March driven by the strength of the Oreo name as the world’s favourite cookie this new packaged cake already has achieved a 3.5% market share and 80% of the velocity of its leading competitor in large stores. (…)

Similarly, in developed markets, we are making solid progress in expanding our successful cookie and chocolate franchises into choco-bakery, cakes and pastries. For instance, in the United States, Oreo Cakesters are continuing to perform well. Since the recent launch of this fan favorite, it already has earned a 3.7 share of packaged snacks cakes.

Source: Mondelez Q2 2023 Earnings Transcript

As I mentioned earlier, recent acquisitions were also well-thought-out with the intention to not only use the company’s existing brands in new product areas, but also by scaling up strong local brands in new geographies (see the 7 Days example below).

Mondelez Investor Presentation

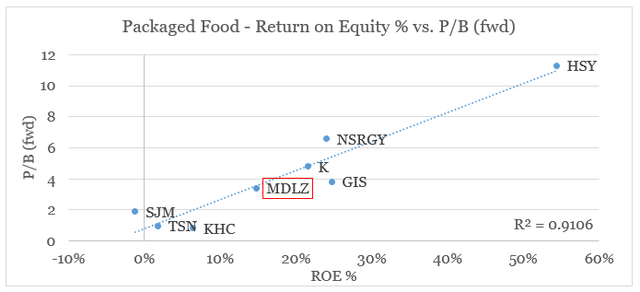

Through the higher asset turnover and the leaner business model, Mondelez management was able to retain the company’s industry-leading Return on Equity and thus to support the stock’s premium valuation, in spite of the falling margins.

prepared by the author, using data from Seeking Alpha

The Margin Opportunity

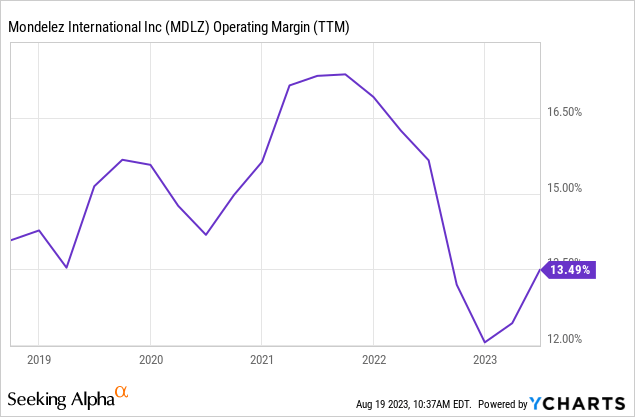

Contrary to the improving asset turnover in recent years, MDLZ’s operating margin fell dramatically since 2021 and now sits near multi-year lows.

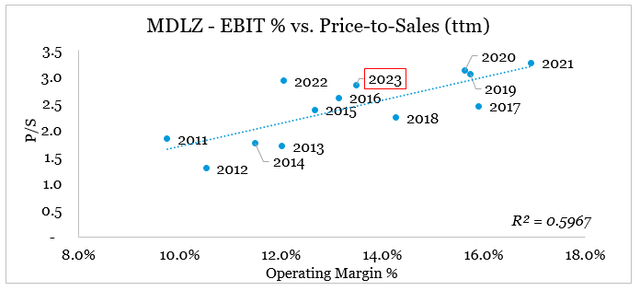

The market, however, does not expect this drop to last long, as the company’s current price-to-sales multiple of 2.9 implies an EBIT margin of around 15% (see the graph below).

prepared by the author, using data from Seeking Alpha and SEC Filings

This expectation is largely based on the strong topline growth in recent quarters that is due to Mondelez’ strong brand portfolio and its ability to sustain impressive price increases, without sacrificing volume growth.

Mondelez Investor Presentation

The impact of pricing on Mondelez’ topline was even more impressive once we compare it to that of its major peer in the chocolate segment – The Hershey Company (HSY).

Net price realization of 7.7% in the second quarter was in line with expectations. We now expect slightly higher price realization in the second half of the year as our previously announced confection price increase begins to take effect. We continue to expect the majority of this pricing impact to hit in 2024 and help offset anticipated cocoa and sugar inflation. Volume was a 2.7% headwind, driven by the lapping of inventory replenishment in North America Confectionery in Q2 of 2022, as well as the timing of promotional shipments into Q1 of 2023. Both were in line with expectations.

Source: The Hershey Company Second Quarter 2023 Earnings Release

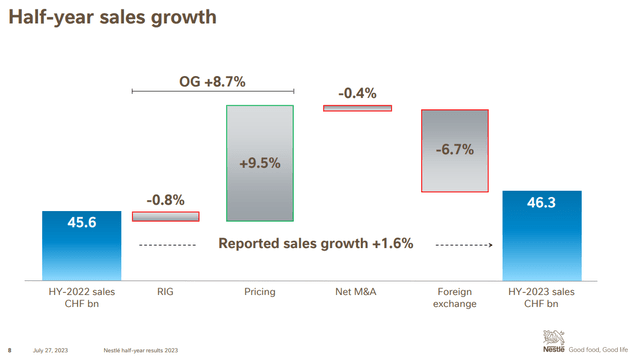

Even Nestle’s (OTCPK:NSRGY) brand portfolio wasn’t able to sustain such high price increases for the first half of 2023.

Nestle Investor Presentation

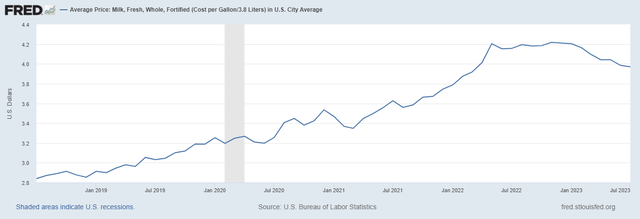

Having said all that, the impact of pricing on Mondelez’ bottom line should cool down over the coming quarters, but in the meantime the margins will be given a boost by the falling prices of key raw materials, such as wheat and dairy.

We purchase and use large quantities of commodities, including cocoa, dairy, wheat, edible oils, sugar and other sweeteners, flavoring agents and nuts.

Source: Mondelez 2022 10-K SEC Filing

FRED FRED

It should be noted, however, that prices of cocoa and sugar are still making new highs and that could continue to put pressure on margins during the second half of the current fiscal year.

FRED FRED

In spite of this cost headwind, Mondelez is still in a very good position to continue to improve its margins for the foreseeable future as other cost items normalize, asset efficiency improves and higher product prices continue to flow through the bottom line.

Conclusion

Mondelez’ strategy to focus on core product segments and expand into adjacent product areas is already delivering results. Although margins remain depressed due to the unprecedented price increase in all major raw materials, MDLZ has retained its industry-leading return on capital. Looking ahead, the company is in a very good position to improve its margins more than the market currently expects. This creates the opportunity for an upward multiple repricing at a time when MDLZ’s topline is growing at double-digit rates.

Read the full article here