I last mentioned Advanced Micro Devices (NASDAQ:AMD) as a hold to avoid idea back in January 2022 here. Since then, the stock has fluctuated wildly, ending up -12% lower over the last 18 months. The year-to-date 2023 number has been far more bullish, achieving a price gain of +65% with the return of excitement in Big Tech and enthusiasm for AI semiconductor picks specifically.

AMD is set to release the first major competition for NVIDIA (NVDA) AI chips later in the year, but this follows a familiar pattern at the company of trying to catch up to rivals inventing novel semiconductor designs. Seeking Alpha analyst Sustainable Investment Holdings wrote a bullish article last week here, which captures the prevailing market sentiment about AMD’s AI-chip prospects for 2024, likely filling the void for customer demand from NVIDIA’s capacity problem.

What is bothering me again at the current lofty price level is underlying valuations are incredibly stretched, not too far off the late 2021 bubble peak. If a global recession hits soon, the highly-cyclical semiconductor industry could easily experience a large drop in demand for all chips vs. current super-charged forecasts, including the AI kind.

If such plays out, what does AMD have in terms of assets and valuations to back the now $170 billion equity market capitalization? Not much is the answer. So, hang with me as I play devil’s advocate, and explain the real downside risk inherent in AMD at $105 a share in August.

High Interest Rates Are A Risk

Honestly, the overall valuation setup has not changed much from late 2021. The most obvious red flag is AMD and many other semiconductors do not pay cash dividends. When interest rates are rising aggressively, with relatively risk-free Treasury or bank CD or money market funds guaranteeing the 100% return of principal plus 5% and greater for yield, equity “growth” names with no dividend investment component are not very desirable in my view.

And, even if you believe monster earnings are coming in 2024-25 similar to Wall Street analyst forecasts, earnings yields of 3% to 5% at $105 per share are still a good distance below the immediate and easy 5%+ cash-equivalent yield available to investors. This has been my gripe against a swath of growth-focused stocks since late 2021, after inflation and interest rates bottomed. Today, the underwater spreads between Big Tech earnings and free cash flow yields vs. short-term interest rates have become quite absurd.

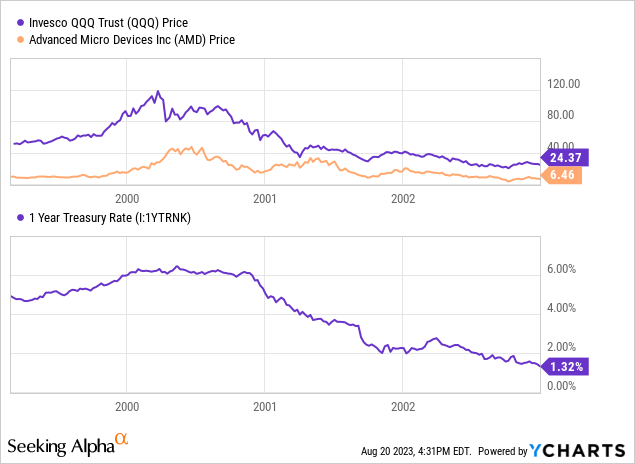

Really, you have to go back to the 1999-2001 original Dotcom Tech Boom/Bust period to find a major disconnect, like the summer of 2023. Below, you can see how the 2000 instance worked out for equities over the next few years into late 2002. I have graphed price changes for the Invesco NASDAQ 100 ETF (QQQ) and AMD vs. 12-month Treasury yields. Simplified – high interest rates are very bad news for expensive technology growth companies.

YCharts – Big Tech QQQ and AMD Price vs. 1-Year Treasury Rates, March 1999 to Dec 2002

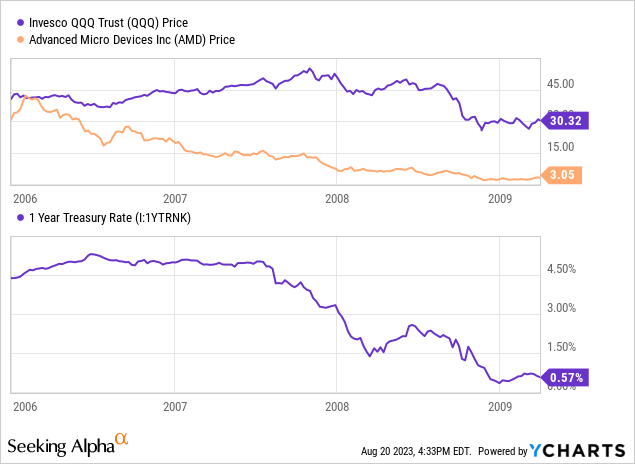

A similar stock market trainwreck appeared after the 2006-07 experience of high short-term interest rates, hit just before the Great Recession. AMD in fact peaked in early 2006, and slid -95% in price into early 2009!

YCharts – Big Tech QQQ and AMD Price vs. 1-Year Treasury Rates, Jan 2006 – March 2009

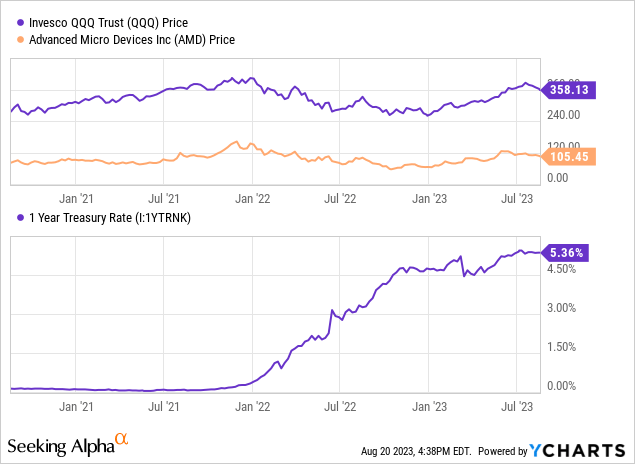

Here is today’s picture, with Big Tech including AMD sitting at a very high price/valuation level at the same time as interest rates are reaching for 22-year records on the upside.

YCharts – Big Tech QQQ and AMD Price vs. 1-Year Treasury Rates, Since August 2020

Extreme Valuation Persists

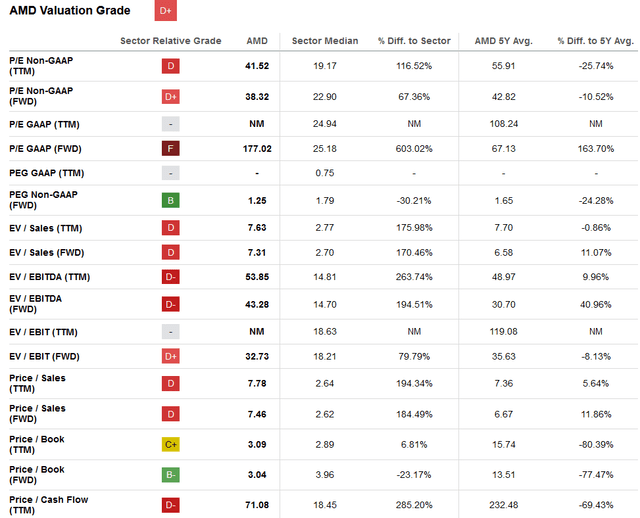

First off, Seeking Alpha’s Quant-ranking system puts a “D+” valuation grade on AMD. When you compare the current price and enterprise valuation on common fundamental metrics vs. others in the semiconductor industry, few are realistically more expensive, bottom line (NVIDIA is one of them).

Seeking Alpha Table – AMD Valuation Grade, August 20th, 2023

If the economy hits the skids, sales and profit growth will likely move sharply into reverse. And, if history is a guide, large operating losses are something to worry about. You can forget the AI-hype advance, as everyone will start to focus on slashed pricing trends for processors and memory chips across the board, with negative repercussions for all manufacturers and sellers in the semiconductor space. That’s the down part of an economic cycle, which AMD and peers have not experienced in at least four years to any serious degree.

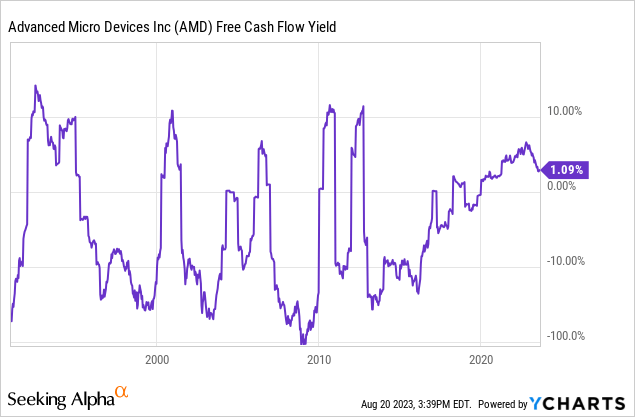

Already, on a free cash flow basis, AMD is not a huge winner for shareholders. It never has been in my view. Keeping chip prices low in an effort to chase down competitors like Intel (INTC) or Qualcomm (QCOM) or NVIDIA, while growing customer sales, means profits and free cash flow have been a secondary goal.

Outside of the mid-1990s, the last four years centered around the pandemic-caused chip shortage situation have provided the longest stretch of good times for the company. Yet, the prevailing free cash flow yield fluctuating between breakeven and 6% since late 2019 looks less impressive, with 5%+ cash yields available at no risk to investors today.

YCharts – AMD, Trailing Free Cash Flow Yield, Since 1991

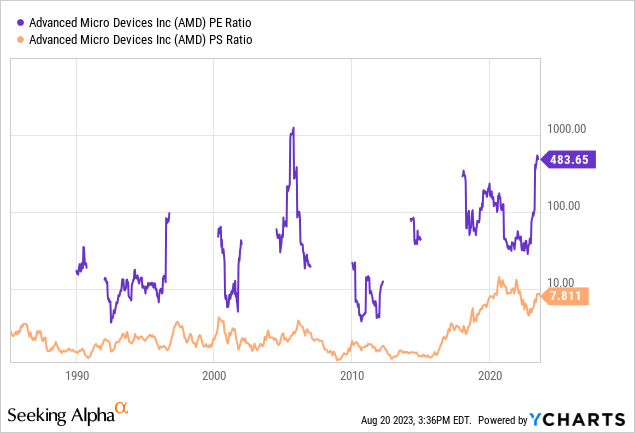

Reviewing price to trailing GAAP earnings and sales since 1986, I can argue AMD is almost as expensive today as the record highs of 2021. So, if operations start to miss estimates, where is the downside support going to come from for investors at $105?

YCharts – AMD, Price to Trailing Earnings and Sales, Since 1986

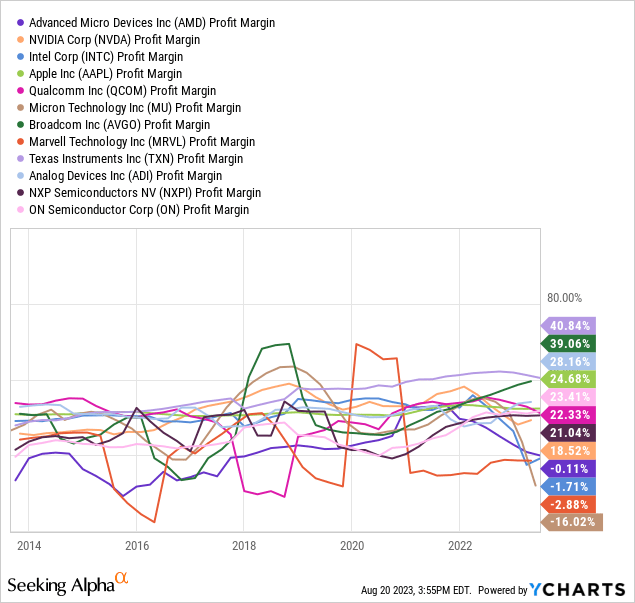

In terms of profitability, AMD has always had a spotty history of generating regular operating income. Below is a 10-year graph of final profit margins on sales vs. large-cap semiconductor competitors and peers. Only Marvell (MRVL) has had an equally difficult time earning money for owners. Shockingly, after more than four decades in business, the June quarter AMD balance sheet reports a net loss of ($243) million for “retained earnings” over its entire cyclical, rapid technology-change history!

YCharts – AMD vs. Big Tech Semiconductors, Profit Margins, 10 Years

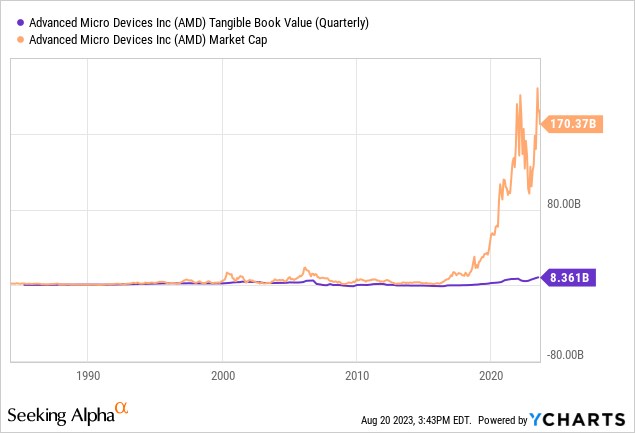

Another monster negative is the company holds very little in the way of tangible book value. Net hard assets minus all liabilities are around $8 billion vs. the current company value of $170 billion. Including the Xilinx merger last year, today’s spread in worth vs. net hard assets (think cash, plant & equipment, inventory) is just as large as 2021’s peak. Nobody cares about accounting book value near the peak of a tech boom, but everyone might if operating earnings morph into losses a year down the road in my view.

YCharts – AMD, Tangible Book Value vs. Equity Market Cap, Since 1986

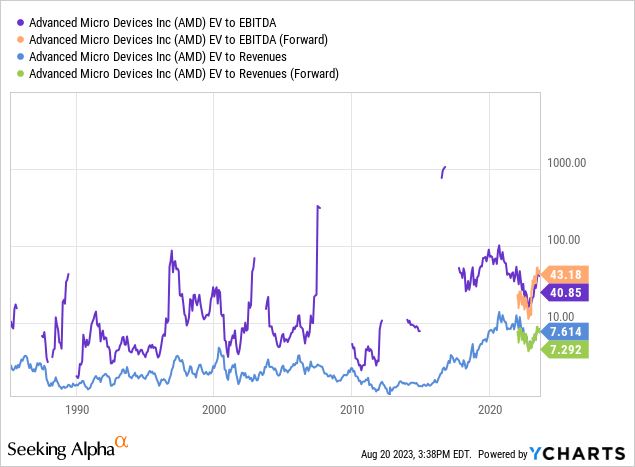

Lastly, enterprise valuations of 40x EBITDA and 7.5x sales remain close to the all-time highs of 2021. As an example of how much downside may exist, at the 1990, 2002 and 2009 recession lows EV to sales traded under 2x sliding results!

YCharts – AMD, Enterprise Valuations, Since 1986

Technical Trading Chart

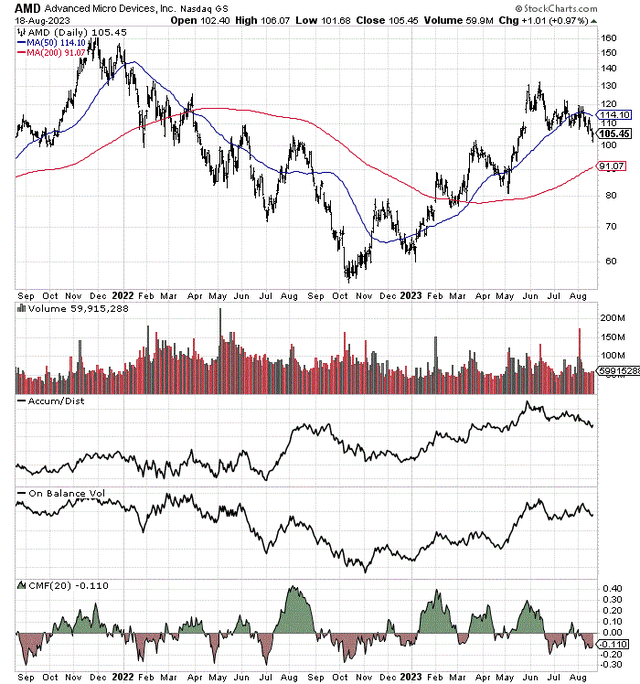

The trading chart highlights a peak in buying during late May and early June. Price is already down -20% and below the important 50-day moving average.

The Accumulation/Distribution Line and On Balance Volume have been trending lower for months. Plus, the 20-day Chaikin Money Flow reading has been in negative territory for months.

While the chart read using my momentum formulas does not give any definitive signal on long-term direction, they are in worse shape now than witnessed during the 2022 decline in price. So, at best, I can only rate the company in a neutral zone for chart strength. At worst, a substantial price decline may have already begun.

StockCharts.com – AMD, 24 Months of Daily Price & Volume Changes

Final Thoughts

I believe most analysts and investors caught up in the AI mania of 2023 are viewing AMD’s investment glass as nearly full. However, a recession next year may translate into something of a glass half empty situation to one needing a refill.

The “risk” part of the equation is now being completely ignored by overly bullish Big Tech investors (much like the late 2021 setup). The AMD valuation remains hard to justify with math. And, rising interest rates mean short-term cash-equivalent investments are offering just as much yield (actually greater) on your capital (including considerably more cash in your dividend pocket) without taking on any equity security downside risk.

In essence, investments not paying a dividend better have serious undervaluation and growth characteristics for you to pull the trigger and buy a position. If they don’t (like AMD), investors may by purchasing/holding a mountain of risk, with little to no future reward potential. That’s backwards to me.

Remember, the smartest time to sell a semiconductor stock is when it appears nothing can wrong after years of positive business developments. Conversely, the best time to buy is after a recession or industry bust, years after a price peak in shares. Think about it. Which setup describes today’s location in the economic cycle?

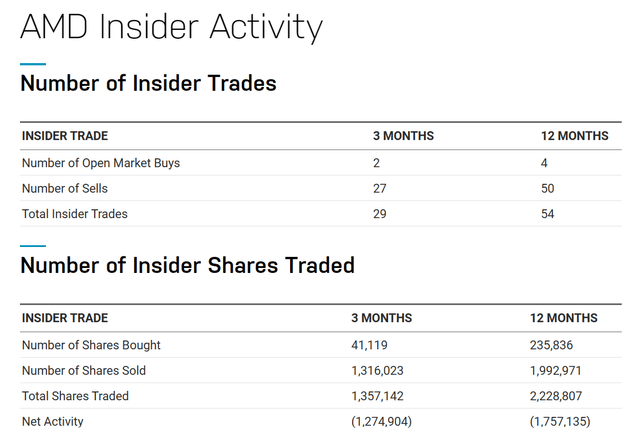

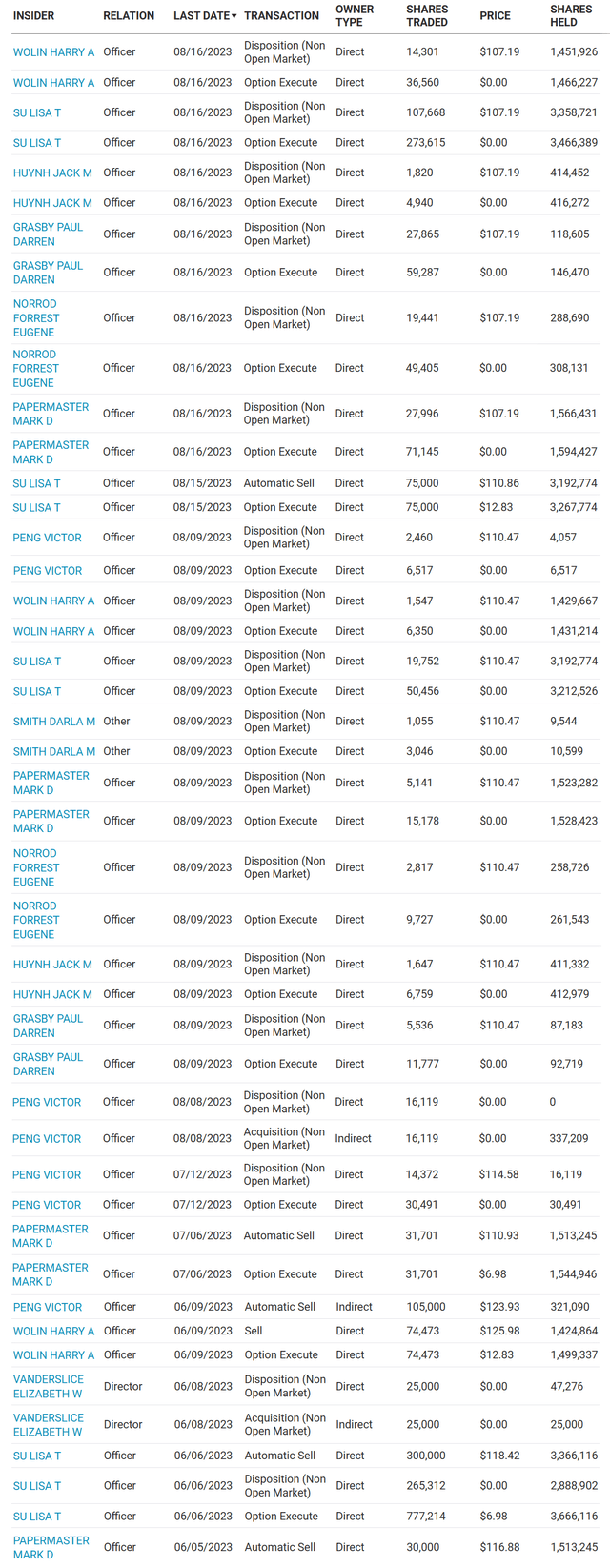

Further complicating the bullish argument, company management and insiders (including the CEO) have been aggressively selling stock this summer, especially in August. They appear to be very willing to lock-in prices above $100.

Nasdaq.com – AMD, All Insider Trades Reported to SEC, 12 Months Nasdaq.com – AMD, All Insider Trades Reported to SEC, Since June 2023

I am modeling upside that is very limited for the share price, perhaps to just +15% to +20% for potential gains over the next 12 months. And, this assumes a soft-landing economy crossed with strong AI demand for its new chips coming to market. What’s the downside? You can call me crazy if you wish, but a deep recession probably tanks AMD -50% to -70% over the next 12–18 months. Historically, major semiconductor cycle declines have decimated AMD’s share quote by similar amounts.

I now rate AMD shares a Sell. Please don’t be bashful or ashamed looking at alternative ideas for your investment dollars. They may not be as exciting or sexy as a variety of AI growth, “sure winners” in the news daily, but numerous equities outside of Big Tech have far better odds of delivering a profit on your investment over the next 12–24 months in my opinion.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Read the full article here