Deal Overview

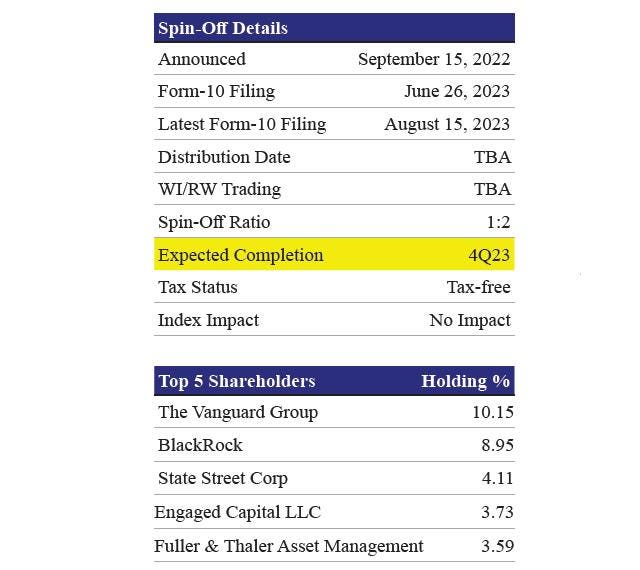

On August 16, 2023, NCR Corporation (NYSE: NCR, $29.84, Market Capitalisation: $4.2 billion), a leading enterprise technology provider for retail stores, restaurants, and self-directed banking, announced that the U.S. Securities and Exchange Commission (SEC) has declared effective the registration statement on form 10 filed by NCR Atleos (Spin-Off). Post-spin-off, NCR RemainCo will be named NCR Voyix, focused on digital commerce business, and NCR Atleos (Spin-Off) will focus on ATM business. As per the amended Form 10, each NCR shareholder would receive one share of NCR Atleos common stock for every two shares of NCR common stock held at the close of business on the record date, and NCR Atleos is expected to list its common stock on NYSE under the symbol “NATL”. The Company continues to expect the spin-off to be completed by the end of 4Q23, while information regarding the record date and distribution date will be provided in due course. After completing the proposed spin-off, NCR Voyix (RemainCo) will focus on the digital commerce business, continuing to operate its Retail, Hospitality, and Digital Banking businesses. NCR Atleos (Spin-Off) will include ATMfocused businesses, including Self-Service Banking, Payments & Network, and Telecommunications & Technology businesses. Moreover, NCR has announced to host Investor Days for NCR Atleos (Spin-Off) and NCR Voyix (RemainCo) on September 5, 2023.

Valuation

We value NCR Corporation (NCR) using the 2024e EV/EBITDA methodology by valuing NCR Voyix (Stub) and NCR Atleos (Spin-Off) separately. Our intrinsic value of $24.00 for NCR (Stub) is based on a 2024e EV/EBITDA multiple of 9.2x (Previously: 9.5x) for the digital commerce business (~4% discount to its peer multiple of 9.6x). Our fair value estimate for NCR Atleos (Spin-Off) stands at $22.00 per share based on the 2024e EV/EBITDA multiple of 5.1x (Previously: 5.3x) to ATM business (~13% discount to multiple of Euronet). We arrive at a consolidated target price of $35.00 per share (Previously: $37.00) for NCR Corporation, which implies a potential upside of 17.3% from the current market price of $29.84 as of 8/18. We, thereby, retain our ‘Buy’ rating on the stock. Risks to our valuation include a slowdown in sales growth due to rising competition, weakness in the economy, slower momentum in key markets, and failure to achieve the cost saving targets.

2Q23 and 1H23 Results Review

2Q23

In 2Q23, NCR recorded revenues of $2.0 billion, down 0.3% YoY (flat on a constant currency basis), as the decline in ATM, SCO and POS revenues was partially offset by an increase in software license and Bitcoin

BTC

1H23

In 1H23, the Company’s revenues grew 0.4% YoY to $3.9 billion, as the service revenue increased 2% due to growth in recurring banking services revenue, payments processing, software maintenance and software-related services, partially offset by a decline in hardware maintenance revenue. Foreign currency fluctuations had an unfavorable impact of 2% on the revenue comparison, primarily in hardware maintenance, hardware product sales and payments processing. In 1H23, adjusted operating income increased to $503 million, up 39.3% YoY, from $361 million in 1H22. Notably, the Company reported Adjusted EBITDA of $691 million in 1H23, up 13.3% YoY (+18% YoY on a constant currency basis), despite the unfavorable impact of foreign currency fluctuations. Adjusted EBITDA margin improved to 17.8% in 1H23, compared to 15.8% in the prior-year period, driven by cost mitigation actions and a higher margin revenue mix. In 1H23, NCR reported a net income of $151 million, up 46.6% YoY, compared to $103 million in 1H22.

Segmental Information

NCR currently operates in 5 operating segments. Post-spin-off, NCR Voyix (RemainCo) will include Retail, Hospitality, and Digital Banking segments. NCR Atleos (Spin-Off) will include Self-Service Banking, Payments & Network segments.

Retail Segment

2Q23

For 2Q23, the Retail segment recorded a revenue of $576 million, up 2.5% YoY, compared to the prior year period. This was primarily due to higher revenue from services and point-of-sale solutions partially offset by decreased self-checkout related revenue. Adjusted EBITDA for the period was $123 million, up 18.3% YoY, with a margin of 21.4%, up by 290 bps. This was primarily due to improvements in component, labor and freight costs and other cost mitigation and pricing actions partially offset by increased employee benefit-related costs.

1H23

In 1H23, the Retail segment recorded a revenue of $1.1 billion, up 1.8% YoY, primarily due to higher revenue from services and point-of-sale solutions partially offset by decreased self-checkout related revenue. Adjusted EBITDA for the period was increased to $220 million, up 28.7% YoY, with a margin of 19.5%, up by 410 bps. This was primarily driven by favorable software and services revenue mix and due to improvements in component, labor and freight costs and other cost mitigation and pricing actions partially offset by increased employee benefit-related costs.

Hospitality Segment 2Q23

The Hospitality segment recorded a revenue of $235 million in 2Q23, down 1.3% compared to the prior year period. This was primarily due to a decrease in POS hardware partially offset by an increase in point-of-sale solutions revenue and increases in services and payments processing revenues. However, Adjusted EBITDA for the period was $60 million, up 30.4% YoY, with a margin of 25.5%, up by 620 bps primarily due to improvements in component, labor and freight costs and other cost mitigation and pricing actions partially offset by increased employee benefit-related costs.

1H23

In 1H23, the Hospitality segment recorded a revenue of $458 million, up 2.0% YoY, compared to the prior-year period. This was primarily due to increased services and software revenues, including growth in cloud services and payment processing, partially offset by a decrease in POS hardware. Adjusted EBITDA for the period was $113 million, up 29.9% YoY, with a margin of 24.7%, up by 530 bps primarily due to improvements in component, labor and freight costs and other cost mitigation and pricing actions partially offset by increased employee benefit-related costs.

Digital Banking Segment

2Q23

For 2Q23, the Digital Banking segment recorded a revenue of $140 million, up 6.9% YoY, compared to the prior-year period. This was due to increased recurring cloud services and software maintenance revenues. Adjusted EBITDA for the period was $53 million, down 5.4% YoY, with a margin of 37.9%, down by 480 bps driven by investment in selling expenses and research and development expenses, and an increase in employee benefit-related costs.

1H23

The Digital Banking segment recorded a revenue of $276 million in 1H23, up 3.4% YoY, due to increased recurring cloud services and software maintenance revenues. Adjusted EBITDA for the period was $102 million, down 8.9% YoY, with a margin of 37.0%, down by 490 bps driven by investment in selling expenses and research and development expenses, and an increase in employee benefit-related costs.

Self-Service Banking 2Q23

For 2Q23, Self-Service Banking Segment recorded a revenue of $661 million, down 2.7% YoY, compared to the prior-year period. This was due to the shift from one-time ATM hardware and hardware maintenance revenues to recurring ATM as-a-Service arrangements and a decline in one-time software license revenues. The declines in ATM hardware, hardware maintenance and software license revenues were partially offset by increased recurring software and services revenue. Software and services revenue as a percent of total Self-Service Banking segment revenue was 69% for 2Q23. Adjusted EBITDA for the period was $169 million, up 19.0% YoY, with a margin of 25.6%, up by 470 bps. This is due to the reduction in direct costs, particularly in expenses related to fuel and components, particularly in ATM hardware, and increases in higher margin recurring revenue streams. These improvements were partially offset by an increase in employee benefit-related costs.

1H23

For 1H23, Self-Service Banking Segment recorded a revenue of $1.3 billion, down 1.2% YoY, due to the shift from one-time ATM hardware and hardware maintenance revenues to recurring ATM as-a- Service arrangements in addition to a decline in one-time software license revenues partially offset by an increase in recurring software and services revenue. Software and services revenue as a percent of total Self-Service Banking segment revenue was 67% for 1H23. Adjusted EBITDA for the period was $307 million, up 20.9% YoY, with a margin of 24.1%, up by 440 bps driven by the reduction in direct costs, particularly in expenses related to fuel and components, particularly in ATM hardware, as well as increases in higher margin recurring revenue streams. These improvements were partially offset by an increase in employee benefit-related costs.

Payments & Networks 2Q23

In 2Q23, the Payments Segment recorded a revenue of $333 million, up 0.3% YoY, compared to the prior-year period due to increased payment processing and higher Bitcoin-related revenue. Adjusted EBITDA for the period was $99 million, up 2.1% YoY, with a margin of 29.7%, up 50 bps. This is due to increased higher-margin transaction revenue and cost optimization initiatives, partially offset by an increase in interest rates affecting the cost of vault cash rental obligations and employee benefit-related costs.

1H23

In 1H23, the Payments Segment recorded a revenue of $656 million, up 4.0% YoY, compared to the prior-year period due to increased payment processing and Bitcoin related revenue driven by higher margin ATM transactions and merchant acquiring services. Adjusted EBITDA for the period was $182 million, down 6.7% YoY, with a margin of 27.7%, down by 320 bps. This is due to significantly higher interest rates on vault cash agreements, higher cash-in-transit costs driven by the higher volume of cash dispensed in the period, and an increase in employee benefit-related costs.

Corporate & Other Segment

For 2Q23, the Corporate & Other Segment recorded a revenue of $54 million, down 11.5% YoY, compared to the prior-year period. Adjusted EBITDA for the period was -$106 million. In 1H23, Corporate & Other Segment reported revenue of $108 million, down 16.3% YoY, compared to the prior-year period. Adjusted EBITDA came in at -$106 million in 1H23 compared to -$195 million in 1H23.

Valuation

We value NCR Corporation by sum-of-the-parts valuation by assessing NCR Voyix (Stub) and NCR Atleos (Spin-Off) separately using the EV/EBITDA valuation methodology.

A] NCR Voyix (Stub):

EV/EBITDA Valuation: Post-spin-off, NCR Voyix (Stub) will focus on digital commerce business, continuing to operate its Retail, Hospitality, and Digital Banking businesses. We assign a 2024e EV/ EBITDA multiple of 9.2x (Previously: 9.5x) to NCR’s digital commerce business. The ~4% discount to its peer multiple of 9.6x (Previously: 10.2x) factors in NCR’s relatively slower top-line growth and higher debt level. We have estimated FY24e adjusted EBITDA of $705 million, with Net Debt of $2.4 billion. We have also considered a conglomerate discount of 20%. Consequently, we arrive at an intrinsic value of $24.00 for NCR Voyix (Stub).

B]NCR Atleos (Spin-Off):

EV/EBITDA Valuation: Post-spin-off, NCR Atleos (Spin-Off) will include the ATM business and continue shifting to a highly recurring revenue model to drive stable cash flow and shareholder capital returns. Our fair value estimate for NCR Atleos (Spin-Off) stands at $22.00 per share (Previously: $24.00) ($12.00 per NCR share) based on the 2024e EV/EBITDA multiple of 5.1x (Previously: 5.3x) to ATM business (~13% discount to multiple of Euronet). We have assumed a Net Debt of $2.6 billion.

C] Consolidated Valuation:

We arrive at a consolidated target price of $35.00 per share (Previously: $37.00) for NCR Corporation, which implies a potential upside of 17.3% from the current market price of $29.84 as of 8/18. We, thereby, retain our ‘Buy’ rating on the stock.

Company Description

NCR Corporation (Parent)

NCR Corporation (NYSE: NCR) is a leader in transforming, connecting, and running technology platforms for self-directed banking, stores, and restaurants. Headquartered in Atlanta with 35,000 employees globally, NCR operates through five segments: Payments & Network, Digital Banking, Self Service Banking, Retail, and Hospitality. The Payments & Network segment offers credit unions, banks, digital banks, fintech, stored-value debit card issuers, and other consumer financial services providers access to its retail-based automated teller machines (ATM) network. Digital Banking solution helps financial institutions implement their digital platform for various transactions. Its Self-Service Banking segment offers a line of ATM hardware and software, related installation, maintenance, and managed professional services. The Retail segment offers software-defined solutions to customers in the retail industry. The hospitality segment offers technology solutions, such as table-service, quick-service, and fast-casual restaurants of all sizes to the hospitality sector. The Company reported total revenue of $7.8 billion in FY22. Post spin-off, NCR (RemainCo) will be named NCR Voyix and will focus on digital commerce business, continuing to operate its Retail, Hospitality, and Digital Banking businesses. NCR is expected to be a growth business positioned to leverage NCR’s software-led model to continue transforming, connecting, and running global retail, hospitality, and digital banking businesses.

NCR Atleos (Spin-Off)

The NCR Atleos (Spin-off) will be a cash-generative business positioned to deliver ATM as a Service to a large, installed customer base across banks and retailers. The Company’s major ATM network customers include Capital One, Citi Group, Walgreens, Kroger, CVC Pharmacy, Varo, etc. While in the Self- Service Banking business, major customers include HSBC, Bank of America, AIB, Wells Fargo, CIBC, ATB, ANZ, Lloyds, Liberty Bank, PNC Bank, Credit Agricole, National Bank of Egypt, Santander, etc. Moreover, NCR Atleos is expected to build on NCR’s leadership in self-service banking and ATM networks to meet global demand for ATM access and leverage new ATM transaction types, including digital currency solutions, to drive market growth. Furthermore, the Company will continue shifting to a highly recurring revenue model to drive stable cash flow and shareholder capital returns. In FY22, the business generated total revenue of $4.1 billion.

Read the full article here