Thesis

The shareholder lawsuit against AMC Entertainment Holdings, Inc. (NYSE:AMC) has delayed its plans to raise capital before the historically slow end of August and September. Additionally, the company will have to pay $129 million in shares, which could double if APE shareholders win the latest lawsuit filed against AMC. I also think that it will fail to raise enough capital to tackle the 2026 debt maturities, let alone the rest of the debt. The movie theater chain will also be affected by the writers’ strike, as fewer movies will be released for the next couple of years if the writers decide to continue their strike. All of that will make it hard for it to continue operating, let alone pay its massive debt, which is why I’m giving AMC a strong sell rating.

One Lawsuit Out, Another Lawsuit In

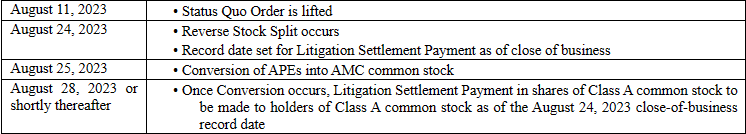

The shareholders’ lawsuit that was preventing AMC from executing its capital raising plan has been resolved, with Judge Zurn approving the $129 million settlement paid in stocks to the common stockholders.

Now, AMC is supposed to move forward with its plan to execute a 1 to 10 reverse split on its common stock. The company would then issue one additional share for owners of AMC common stock as part of the settlement, and then convert every 10 APE shares into 1 AMC share.

Latest 8K

By August 28, AMC should have around 155 million shares outstanding, which would leave it with the option to issue around 369 million shares to raise capital since its authorized shares are just a little over 524 million.

What poses a problem for AMC is the recent lawsuit from APE holders that demand to receive the same compensation that common stockholders received or increase the conversion ratio from 1:1 to 1:1.3. The lawsuit is mainly based on the anti-dilution adjustments of the COD, which could mean that the lawsuit will probably not be dismissed and could delay AMC’s plans even further.

If the plaintiff wins the case, AMC will have to either pay $129 million or issue an additional AMC share for every 100 APE shares, which would increase its shares outstanding to around 165 million after performing the reverse split, APE conversion, and issuing settlement shares.

Looming Debt

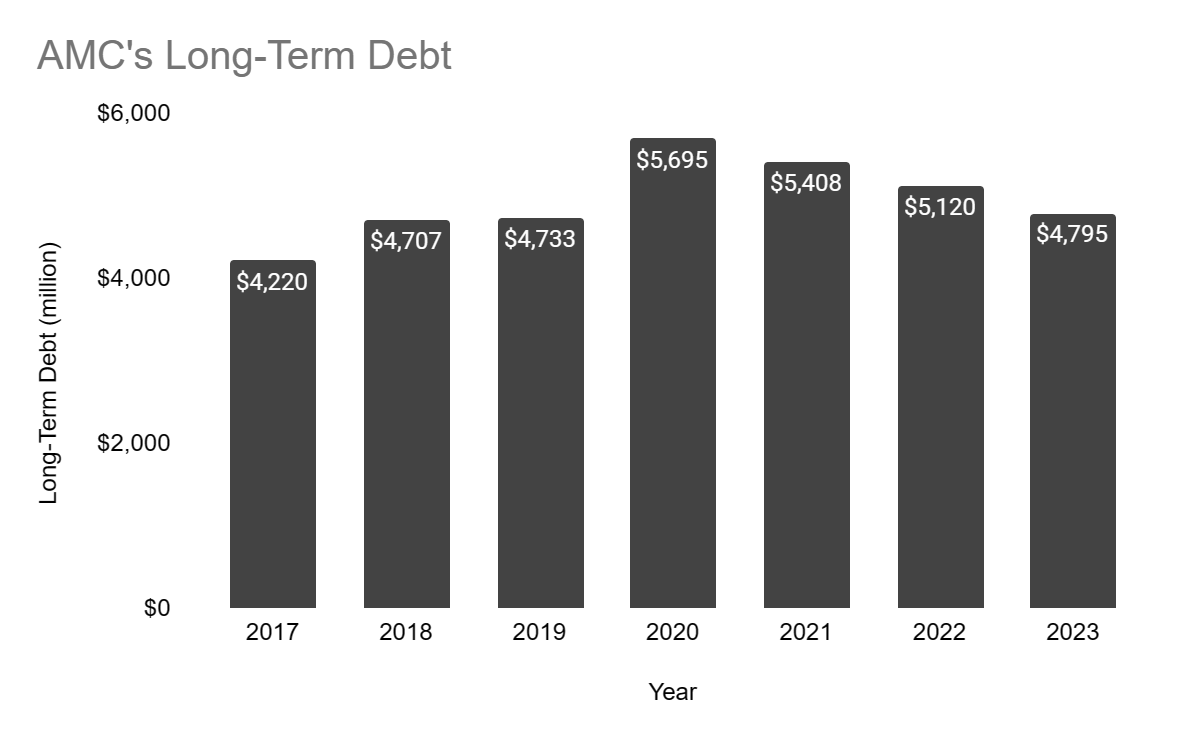

The reason AMC needs to raise capital and decrease cash burn is to try and save as much capital as possible to pay its existing debt, which was made worse during the pandemic since barely any new movies got released and theaters were closed. As of June 30, 2023, AMC had $4.8 billion in debt. While this number is comparable to its pre-pandemic debt levels, it still does not have enough liquidity to pay off its debt maturities.

AMC Earnings Report

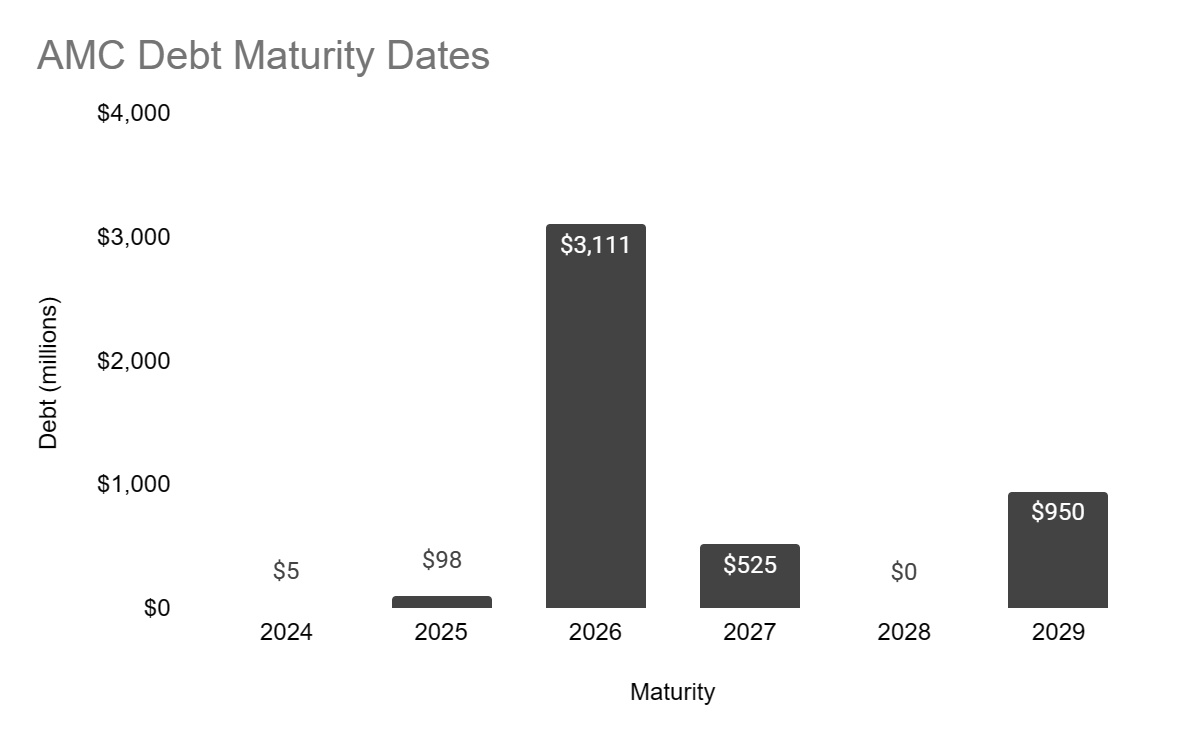

AMC’s current cash balance of $450 million can handle its debt maturities for the next two years, since they combine for a total of $103 million. The first debt wall AMC will face is the $3.1 billion maturity in 2026.

Q2 earnings

Looking at AMC’s plan to raise capital and tackle the debt, I find it hard to see how it would be able to pay its debt since the movie theater chain can issue 369 million shares in the best-case scenario after the split and the conversion, which represents 70% of its authorized shares. Assuming that its $4.4 billion market cap stays roughly the same, it would be able to raise around $3 billion.

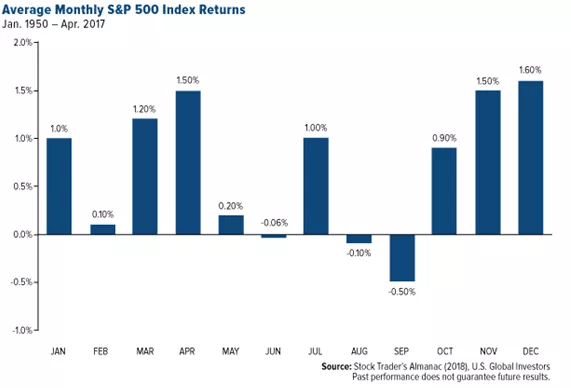

I believe that the argument that AMC can raise $15 billion given its expected post-split PPS of $40 isn’t really realistic. Why would a company that is suffering from extreme cash burn and is expected to have a rough year next year due to the writers’ strike have its market cap triple? If every company that is trying to raise capital to pay off its debt through diluting its shareholders had its market cap triple, then most companies that went bankrupt due to their debt would’ve been fine. Furthermore, due to the delay in the company’s plan, AMC may have difficulty raising capital since capital markets are historically slow in late August and September.

S&P 500 index returns by month.

While refinancing could still be an option, the fact that the movie theater chain included its liabilities in the document it submitted to the court as one of the reasons it needs to raise capital makes me believe that it will not be able to refinance its debt.

A Decent Q2 Is Not Enough

AMC had a decent Q2, beating analyst estimates for both revenue and EPS by $61 million and $0.03 respectively. The cinema operator achieved $1.347 billion in revenue and reached profitability by achieving $9 million in net income. It also repurchased $42 million of debt at an average discount of 34% and repaid $27 million of its deferred rent. That said, AMC still suffered $60 million in cash outflow in the quarter, which can be attributed to both the debt repurchase and the deferred rent payment, in addition to its capital expenditures, which amounted to $50 million.

All in all, AMC had a decent quarter, especially when compared to Q1, which saw the company suffer from more than double the current cash outflow.

Writers Strike and Future Revenues

AMC’s revenues are at risk of declining due to the current writers’ strike that started in May, which means that movies that were expected to be released in the next couple of years may suffer delays. In this way, fewer people will go to movie theaters due to the lack of new movies. With no big blockbuster movies expected to be released for the rest of the year, Q4 may be the start of AMC’s revenue decline since Q3 saw the release of several big movies like Oppenheimer, Mission Impossible, and Barbie, with the latter breaking the $1 billion mark recently.

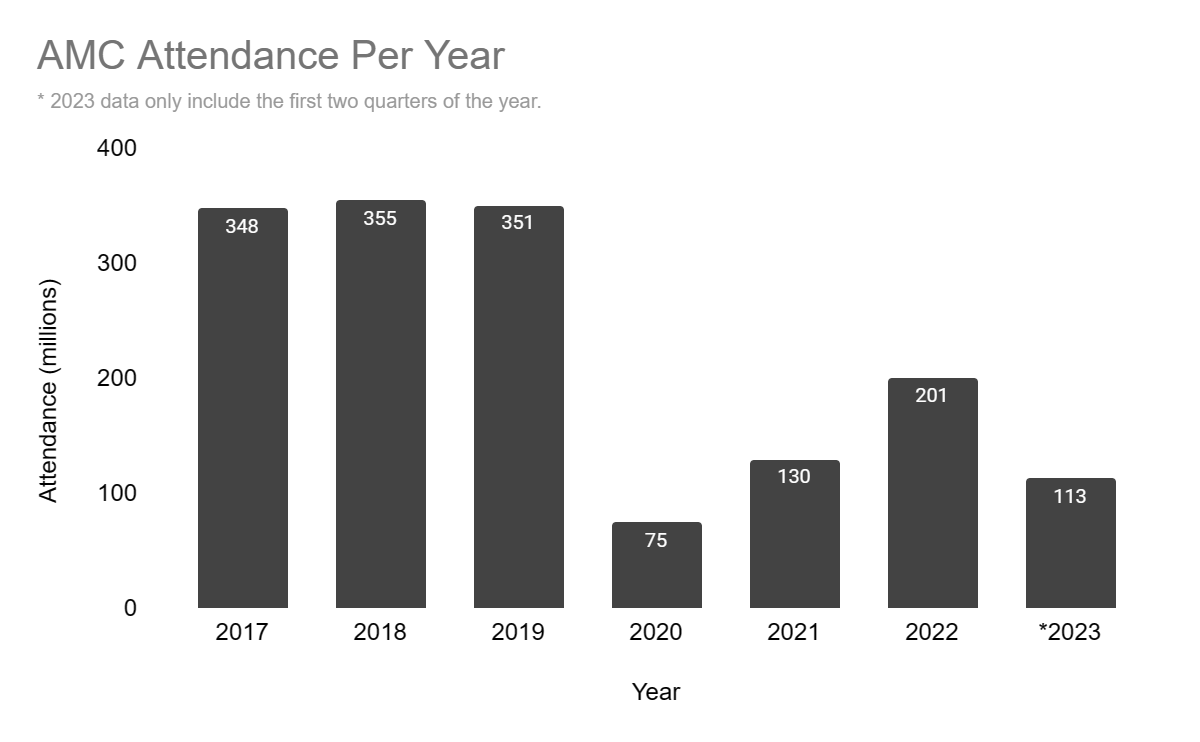

Also, some movies being released on streaming platforms instead of theaters, like Tetris, which was released on Apple TV+ (NASDAQ: AAPL), or being available shortly after, like Disney’s (DIS) Ant-Man and the Wasp: Quantumania, puts cinema operators in a bad position. The decline in attendance after the pandemic is apparent, with only 113 million so far in 2023, and while Q3 will provide a boost to these numbers, it will still be far off from pre-pandemic attendance numbers.

AMC earnings

Even if we assumed that AMC could raise enough capital to pay the debt, it would still be in a bad position due to the decline in moviegoer numbers.

Upside Risks

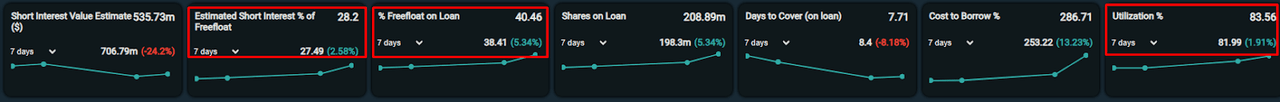

The biggest risk to my thesis is AMC’s status as a popular meme stock. That could see the stock run on relatively positive Q3 earnings and trigger a short squeeze since it is highly shorted with 28% short interest, 40% freefloat on loan, and an 83% utilization rate.

Ortex

In that case, AMC could use this opportunity to dilute its shareholders and raise capital, which would provide it with more capital than it would’ve gained in normal circumstances, putting it in a better position to pay off its debt.

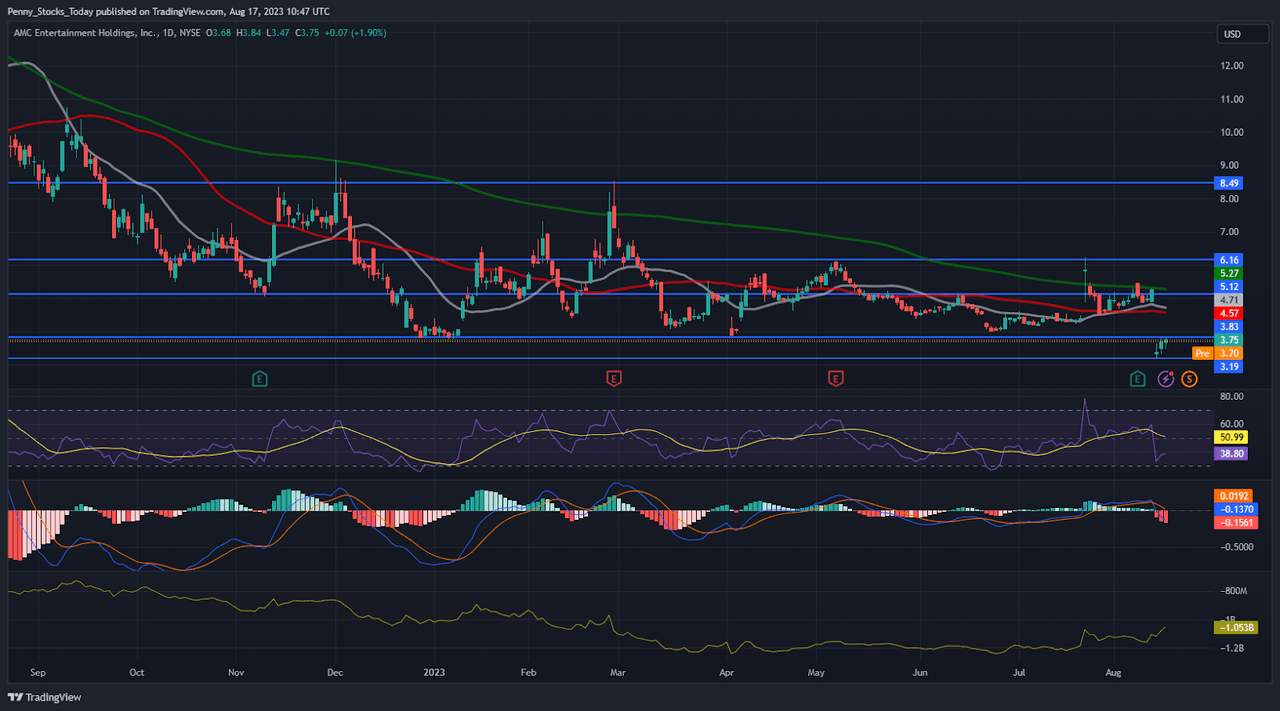

Technical Analysis

Tradingview Chart

Looking at the daily chart, AMC just broke its neutral trend after it slid almost 40% after the conversion settlement was approved on August 11. As for the indicators, the stock is trading below the 21, 50, and 200 MAs which is a bearish indication. Meanwhile, the RSI is approaching oversold territory at 38 and the MACD is bearish.

In my opinion, AMC will continue its downward trend and will continue to close the gap with APE, so I believe the current PPS is a suitable price to short it, especially since it is trading near the $3.83 resistance.

Conclusion

While AMC had decent Q2 earnings, it is still far from enough to pull it out of the danger zone. While it is currently in the middle of executing its plan to raise capital, I don’t believe its efforts will be enough. AMC is going to be forced to raise capital at an unfavorable time with the quiet nature of the capital market in late August and September. Furthermore, I think AMC won’t be able to raise enough capital to tackle the 2026 debt maturities.

Leaving the debt and need to raise capital aside, its future and present revenues are also at risk due to the ongoing writers’ strike that may delay future movie releases and the rise of streaming platforms that may impact the number of people going to cinemas even further. I don’t really see any upside in investing in AMC at the moment, which is why I’m giving it a strong sell rating.

Read the full article here