Investment Thesis

Century Communities (NYSE:CCS) has been on a stellar ride with shares spiking 35% over the past year as a result of growth within home building sector driven by lack of resale inventory. Its attractive positioning within entry level ready to move-in homes has been the key catalyst in the firm’s growth prospects. Housing market has witnessed some sequential improvement with total housing starts improving over the past few months driven by single family homes. It reported a strong quarter topping analyst consensus expectations while also increasing the guidance on the back of improvement in cycle times. However, the optimism and growth seems to be already priced in the stock which is currently trading at 11x Forward P/E. Initiate at Neutral.

Company Background

CCS is a leading home builder offering new homes under the Century Communities and Century Complete brands with operations across 18 states in the US. It primarily focuses on entry level home segment providing affordable move in ready housing options (~93% of homes delivered are entry level for Q2 2023). It also offers title, insurance and lending services through its brands Parkway, IHL and Inspire respectively within select markets.

Housing Market

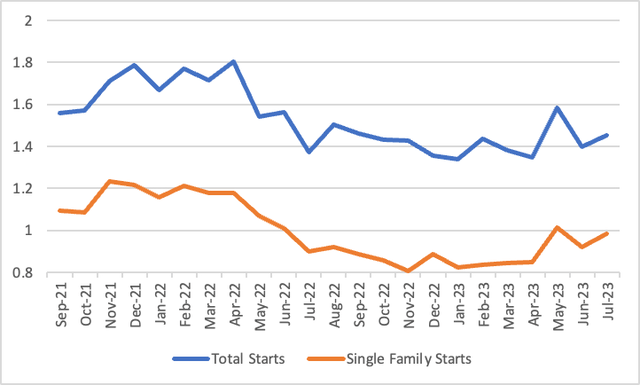

Housing market has been on a sticky wicket since last year when Federal Reserve started jacking up the rates to unprecedented levels never seen in decades to curb inflation. Post the slump witnessed over the past few quarters, housing activity has sequentially improved and stabilized with July total housing starts increasing by 3.9% sequentially and 5.9% growth YoY, ahead of street estimates. The growth was led by single family starts which grew 6.7% sequentially and 9.5% YoY as a result of uptick in demand for smaller houses while multi-family starts continue to decline.

US Census Bureau

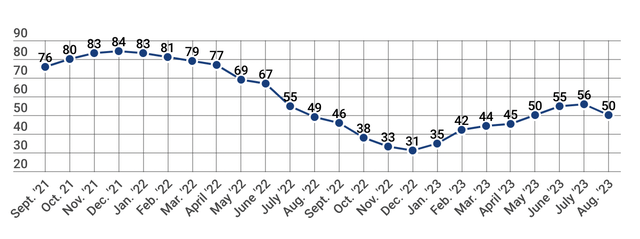

Builders’ confidence dropped 6 points sequentially, while increasing 1 point YoY, as rising mortgage rates makes housing affordability a challenge squeezing consumer demand while the construction costs continue to spiral upwards.

NAHB

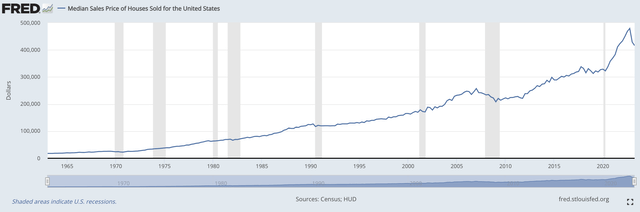

However, we believe given the dearth of supply of resale units as homeowners are not opting for a sale who have locked in at lower rates, the homebuilding sector has been on a run with stocks like Green Brick Partners (GRBK) and M/I Homes (MHO) are up 80 – 100% for the year while LGI Homes (LGIH) is up 15%. June single family Home Sales declined 3% sequentially following the April Sales jumping to 0.7 mn home sales, a 15 month high. Median Sales prices have shot up recently as a result of ongoing demand supply mismatch. We believe the sharp uptick in the home prices witnessed recently could further moderate as the demand and supply dynamics irons out as supply looks to catch up with housing affordability, while there could be a short term volatility.

Federal Reserve Bank of St. Louis

Earnings Beat and Raise

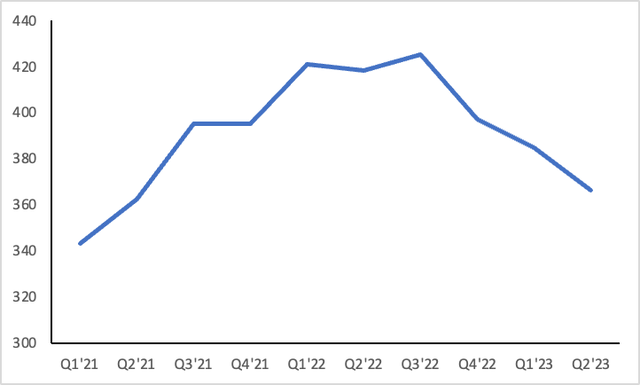

CCS reported strong Q2 with revenues declining 28% YoY while improving 12% sequentially at $844 mn topping consensus estimates pegged at $715 mn. The sequential revenue growth was driven by 17% jump in home deliveries at 2,235 for the quarter. Adjusted Homebuilding gross margins declined 840 bps YoY as a result of increased cost of construction while average home rates declined over the year but it improved 140 bps sequentially on the back of improvements in construction costs as well as cycle times. However, average selling price per home kept decreasing over the quarters which can come under further pressure.

Average Home Sale Price

Company filings

Adj. EBITDA margins came in at 9.8% for the quarter down by over 10 percentage points YoY but improved 260 bps sequentially on the back of strong gross margins and tighter cost controls. Adj. EPS came in at $1.60 beating consensus estimates which was pegged at ~$1.00.

Balance sheet position remained stable with total liquidity of $1.2 bn including $370 mn in cash, in line with previous quarter while net homebuilding debt to equity increased marginally sequentially from 21.5% to 22.3%. Homebuilding debt to LTM EBITDA stands at 2.3x with no near term maturities.

It reported 3,041 home starts for the quarter with a backlog of $750 mn which will lead to an improvement in deliveries for H2 compared to H1 (which in essence is typical for a homebuilding company due to seasonality) as a result of which the company revised its guidance upwards. It increased its guidance for home deliveries for the year to 8,300 – 9,000 (from 7,250 – 8,250 previously), a jump of 12% at midpoint with revenues expected to be about $3.1 – $3.4 bn (from $2.7 – $3.2 bn), an increase of 10% at midpoint driven by improvement in cycle times which is reasonable given the momentum in Q2.

Valuation

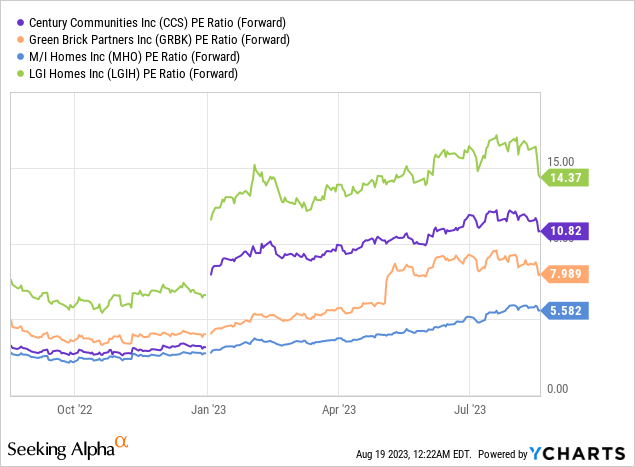

CCS trades at 11x Fwd P/E which is at a premium to its average set of peers and at a significant premium to its peers (ex-LGIH) as street anticipates better growth prospects. We believe the current valuation provides limited upside as any further increase in rate hikes which had sent markets tumbling down along with the continued overhang of slowing economy entering in H2 2023 and 2024 would likely lead to PE derating. Even factoring a normalizing demand environment, with the shares currently trading near the 52 week highs at 11x Forward P/E, downside risks to home selling prices and the lack of valuation comfort, we initiate with a Neutral rating.

Risks to Rating

Risks to rating include

1) Significant supply crunch that will lead to a substantial growth in order book and drive home sales

2) Prolonged slowdown of economy amidst higher mortgage rates could significantly pressure housing affordability and squeeze gross margins with increasing construction costs

Final Thoughts

CCS has a strong moat within entry home segment amidst a turbulent housing market and significantly challenging macro environment. While it has delivered strong results topping estimates and raising guidance, its operations are quite cyclical and H2 is generally always better than H1 as more people look to get their new homes starting summer. We believe while the home starts have improved, average home prices have kept falling and we believe there are downside risks to it as a result of ongoing macro challenges. We initiate with neutral primarily due to limited margin of safety in a challenged housing market.

Read the full article here