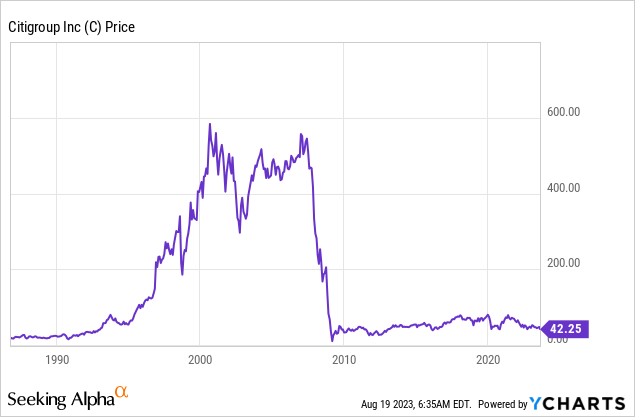

Citigroup’s (NYSE:C) stock price has dropped 20% since my May 2022 sell recommendation article and I think it is still overpriced. Most other Seeking Alpha contributors have written buy recommendation articles – I strongly disagree. Besides having stagnant results for years and poor management, the new proposals for capital/risk requirements could have a significant negative impact on Citi. I am maintaining my sell recommendation on C stock.

Citigroup=Stagnation=Sell

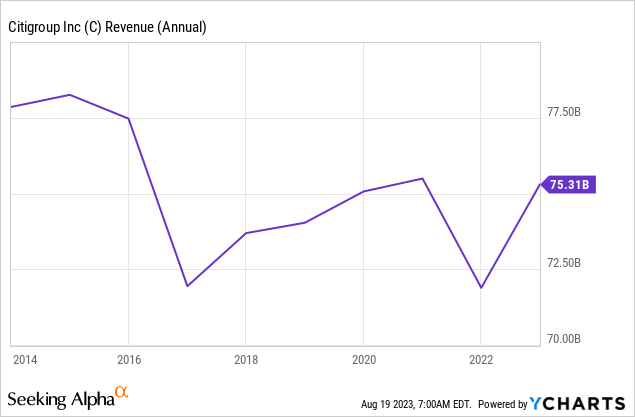

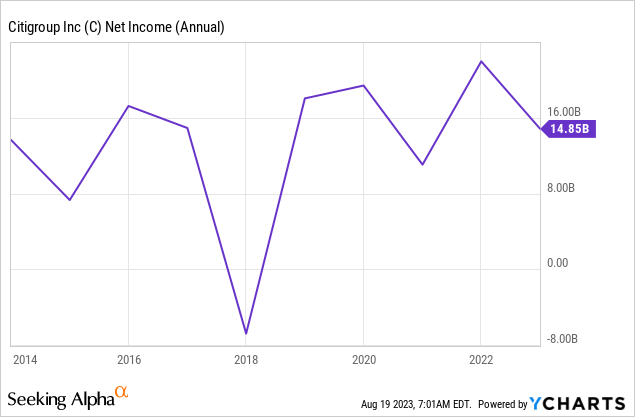

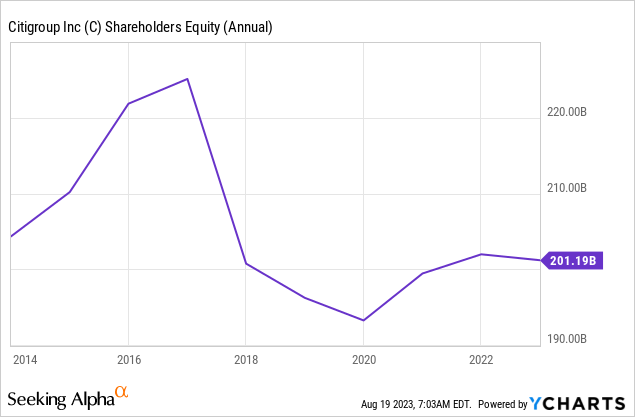

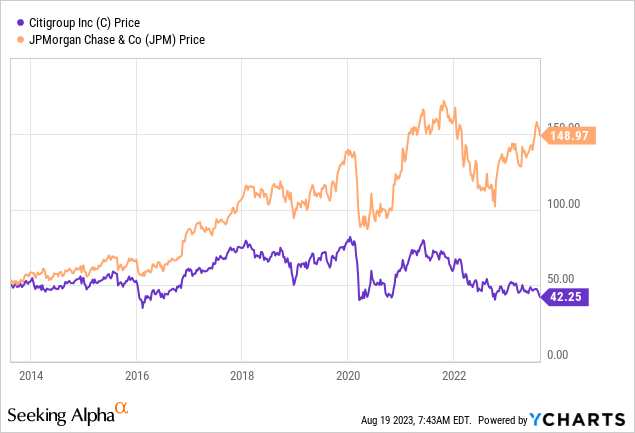

This, in theory, could be a very, very short article because the three charts below are prime facie evidence that Citigroup remains a sell. It has been stagnant for years.

Citigroup’s stock price performance has been pathetic over the last ten years compared to JPMorgan Chase (JPM), the “gold standard of major banks”. Why the huge difference? Brains (or lack of brains).

Most manufacturers’ major asset is what they actually produce. For REITs it is their buildings/land/location. For banks it is their brain power. Bank services are actually fairly generic. Making the right decisions at the right time differentiates banks. If you look at the board of directors of JPM (latest proxy) you see all sharp bright successful businesspeople. Contrast that with Citigroup’s board (latest proxy). Many on Citi’s board come from governmental bureaucratic backgrounds where maximizing profits is not even a consideration. Jamie Dimon has been outstanding whereas Citi’s CEOs have been “less than dynamic”. I consider board members to be a critical part of any investment analysis and Citi completely fails, in my opinion, on this point. (I wrote my opinion on many Citi board members and pinned it to the top of my May 2022 article.)

Recent Results – Still Large Unrealized Securities Losses

A fairly recent article by IP Banking Research covered Citi’s 2Q results. I want to add what I consider an important item and that is unrealized losses in their securities portfolios. I covered this issue by giving the latest massive unrealized losses for the 2Q for a list of major banks in an August 7 article. Citigroup’s 2Q available for sale – AFS securities had an unrealized loss of $4,691 million ($242,025 million cost – $237,334 million fair value), which is a modest improvement from a loss of $4,853 million at the end of 1Q. Hold to maturity – HTM securities had $24,045 million loss ($262,066 million cost – $238,021 million fair value), which is somewhat worse than $22,491 million loss at the end of 1Q. The total unrealized loss per share at the end of 2Q was $14.92.

Many readers assert that these unrealized losses are not that big of a deal and that I am making this issue to be more important than it actually is for investors. I disagree. An important research study was published by the Kansas City Federal Reserve bank a few months ago. The study concluded:

First, higher unrealized losses threaten the solvency of the bank.

Second, the inability or reluctance of banks to sell securities in loss positions can increase debt usage.

Third, as funding costs increase, banks may raise the cost of lending or tighten lending standards because they are reluctant to sell securities to generate loanable funds.

Fourth, banks with large unrealized losses may be reluctant to market themselves for acquisition if they believe underwater securities have temporarily depressed offer prices.

There are numerous statements in the new bank regulation proposals that I cover below that contain references to large unrealized securities losses. There are even changes for category III and category IV banks regarding accumulated other comprehensive income (AOCI) and regulatory capital based on these unrealized losses.

Remember HTM losses are not reflected via AOCI in shareholder equity on the balance sheet. These federal agencies also think these unrealized losses are important. It is interesting to note a statement in the document asserting: “More recently, the agencies have observed generally higher levels of securities classified as held-to-maturity (HTM) among banking organizations that recognize AOCI in regulatory capital”. There is footnote to this statement further asserting: “GAAP set forth restrictions on the classification of a debt security as HTM, circumstances not consistent with the HTM classification, and situations that call into question or taint a banking organization’s intent to hold securities in the HTM category”.

Citi has much larger HTM unrealized losses than AFS losses and these large HTM losses are not reflected on their balance sheet via AOCI. I have to wonder if Citi is included in the banking organizations footnote statement regarding actual intent to hold securities in the HTM category.

Proposed Rulemaking – Impact on Citi

An important factor impacting my sell recommendation of Citigroup is new proposed rules announced July 27. While Citi may not be impacted as much as some other banks, I think that even prior to this new regulation, after some modifications, becoming effective on July 1, 2025, and is completely phased in by July 1, 2028, it will have a negative impact on C’s stock price. Currently, the proposal is in the public comment time period.

This is a 1087-page document, but unfortunately the table of contents does not show the page number for each section. Oddly enough, “Section 722 of the Gramm-Leach Bliley Act requires the Federal banking agencies to use plain language in all proposed and final rules published after January 1, 2000”. (Post in the comment section below after you read the entire 1087 pages if you think it uses “plain language”.)

The proposals will apply to bank entities with assets $100 billion or more. For those banks under $100 billion the revised requirements for market risk would also apply to those with $5 billion or more in trading assets plus trading liabilities or for which trading assets plus trading liabilities exceed 10 percent of total assets.

Citi is in category II. It seems that the biggest impact could be on category III ($250 billion – $700 billion in total assets) and category IV ($100 billion – $250 billion) banks, but it will vary greatly from bank to bank. The primary purpose for these proposals is to “strengthen the calculation of risk-based capital requirements to better reflect the risks of these banking organizations’ exposures”.

A major change is the proposal would “eliminate the use of banking organizations’ internal models to set regulatory capital requirements and in their place apply a simpler and more consistent standardized framework”. Banks could still use them internally, but not to set regulatory capital requirement. At this point it is unclear if this new standardized model is stricter than the internal model Citi currently uses. If it is stricter, how much will it impact Citi directly? I consider this a yellow flag for Citi because of the uncertainty. There is an exception – “for market risk, the proposal would retain banking organizations’ ability to use internal models”, but these internal models are still subject to regulatory oversight and may not be automatically approved and if not approved, would be required to use a standardize measure for risk.

During the 2007-2009 financial crisis OTC derivative contracts, including interest rate swaps and default swaps, were major factors that caused the collapse of our banking system. Some counterparties defaulted on these contracts. Credit valuation adjustment (CVA), which measures the risk of counterparty default, is a major focus of the new regulatory proposal. I wonder if stricter CVA regulations will shrink the OTC derivative market to only the strongest counterparties because to justify doing a swap with a relatively weak counterparty that would have a negative impact on a bank’s risk-weighted assets, the bank would have to expect a larger “profit” to justify the trade. This would force Citi and other banks to make sure that their financial position is always strong enough to be included in that “strongest counterparty” group. That actually seems to be the intent of this CVA regulation change.

There are also some other proposed changes to risk-weighted assets (RWA). A statement on page 500 that stood out about these changes was: “Consequently, the increase in RWA associated with trading activity would raise required capital ratios by as much as roughly 67 basis points across large holding companies subject to Category I, II, III, or IV capital standards”. That is a significant increase. (Sorry, I am not able to estimate the increased amount specifically for Citi.)

As expected, there are proposed changes regarding a bank’s real estate loans. I am going to be rather simplistic in explaining these changes. It does not seem that high quality loans that are collateralized by real estate are impacted by these changes, but lower quality real estate loans are impacted. (See page 61 for a diagram illustrating the complexity of the real estate risk exposures.) An important factor is if the loan repayment is dependent upon the cash flow generated by the real estate or not. While, in my opinion, these changes are needed to improve a bank’s risk exposure to real estate, the changes could have a negative impact on the real estate industry, such as the already weak office building market. The result of these changes could force banks to charge more via higher interest rates and/or fees for certain types of real estate loans, which could be a negative impact on many REITs. Citi’s real estate loan portfolio is approximately 17% of their total loans.

Collectively the proposed changes, including those not covered in this article, could force Citi to significantly improve their balance sheet. While some shareholders may not like this, but hopefully the board will not authorize future share repurchases in order to improve their equity capital position and keep dividend payouts very modest.

Conclusion

Citigroup has been unimpressive for years and I think their future looks less than robust. Stronger banks, both financially and managerially, might be able to adjust to the new proposed bank capital and risk regulations better than Citi. There is significant risk for C shareholders because of the uncertainties associated with the proposed changes and any final amendments made to them.

Because I don’t like the current management/board of directors, they have massive unrealized securities losses, Citigroup has had stagnant results, and the new bank proposals could have a negative impact, I rate C stock a sell.

Read the full article here