Investment Thesis

Palo Alto Networks (NASDAQ:PANW) reported results on Friday, after the close. The oddest time for a large mega-cap company to report. This kept many investors on the sidelines for fear that something odd would surface.

Investors needn’t be concerned as the underlying thesis continues to unfold. Recall, I’ve consistently made the declaration that PANW is a strong buy for two reasons.

Firstly, I’ve stated that Palo Alto is highly profitable. And second, what some investors see as its weakness, I see as its strength. Namely, that it’s not only contingent on the fast-growing Next Generation Security portfolio but that its legacy operations continue to contribute substantial free cash flows, that Palo Alto Networks is able to reinvest back into its growth operations.

We have much to go through, so let’s get to it.

Why Palo Alto Networks?

As noted in the introduction, Palo Alto Networks has its Next-Generation Security platform. It competes with CrowdStrike (CRWD) and SentinelOne (S) on this aspect of its business.

As AI continues to grow and see broader adoption, this will lead to increased demand for cybersecurity products.

What makes PANW different from its peers, is that Palo Alto Networks also has its hardware business. This is where Palo Alto Networks sells firewall products and it competes with the likes of Fortinet (FTNT).

Furthermore, many investors have been quick to latch onto the fact that Fortinet’s sold off earlier this month, consequently, there had been fears that Palo Alto would suffer a similar fate.

However, I should make clear the advantage that PANW has relative to Fortinet is that PANW’s hardware is more integrated and easier to cross-sell into its software offering.

Whereas, Fortinet’s business is more specialized and works better for more demanding tasks. Certainly, that’s part of the problem. Fortinet is too specialized for its total addressable market to meaningfully increase.

PANW Q4 2023

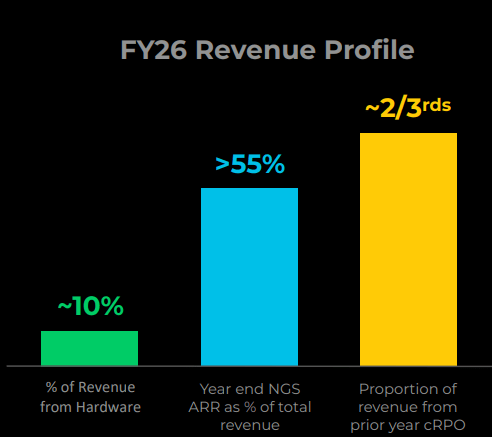

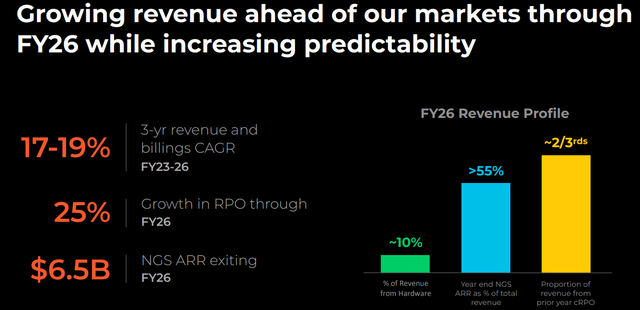

But the message that came out of this earnings report is that PANW wants to move forward over the next 3 years and shed its narrative away from being a hardware cybersecurity business with an exciting, albeit small, software business, towards a well-positioned software business, with a small legacy highly cash-generative hardware business.

Revenue Growth Rates Still Strong

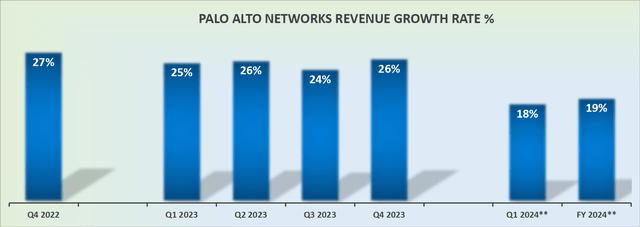

PANW revenue growth rates

As we look ahead, there’s no question that fiscal 2024 will be no match to fiscal 2023.

I don’t believe that anyone was expecting yet another sizzling period in the next twelve months. The message that comes out of SentinelOne, and others indirectly related to cybersecurity, for instance, Datadog (DDOG) reinforce my argument.

IT departments are being forced to cut costs and operate in a leaner environment.

Again, I’ve made this argument on countless occasions in the past, the reason why Palo Alto Networks has a competitive advantage relative to others is that right now, enterprises are more cost-sensitive.

This is a period that is being marketed by platformization and vendor consolidation. And only those cybersecurity platforms that can offer clear and high ROIs are being adopted, while the others are being discarded. In essence, customers will pay, but more so than before, customers demand value. If you provide value, customers will stick around with your platform for a prolonged period of time.

And this takes me to discuss the next section.

PANW Stock Valuation — Why PANW Deserves a Premium?

PANW Q4 2023

I’ve made the argument many times, PANW should trade at a premium because it’s going to be added to many S&P500 indexes.

What investors want to see is three things:

- Steady growth;

- Predictability;

- High-profit margins.

And that’s precisely want Palo Alto Networks delivers. The graphic above reflects those two, with PANW pointing to around 18% midpoint CAGR into fiscal 2026.

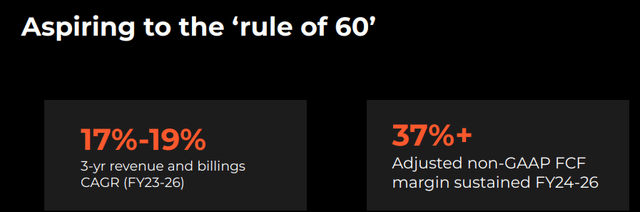

Meanwhile, the third criterion is noted in the graphic below, with Palo Alto Networks performing very strongly on a +Rule of 40.

PANW Q4 2023

Recall, the Rule of 40, is a company’s growth rates plus profit margins. Typically, companies that reach a Rule of 40 are recognized by investors as being high-quality companies.

And as you can see above, PANW is on target to be above a Rule of 50.

To put this all together, I believe that paying 44x this year’s non-GAAP EPS is a very attractive valuation for PANW.

The Bottom Line

In my analysis of Palo Alto Networks’ earnings, I find it to be an attractive investment choice.

Despite an unconventional earnings release time, its underlying strength stands out. PANW’s profitability, diverse business model, and focus on Next-Generation Security make it a strong cybersecurity company.

The earnings report indicates PANW’s strategic shift towards becoming more software-centric over the next three years, moving away from its hardware-centric image.

While fiscal 2024 might not match the previous year’s performance, PANW’s competitive advantage in a cost-sensitive market, offering high ROI and value, makes it an attractive prospect.

With steady growth, predictability, and robust profit margins, PANW appears to be attractively valued, trading at 44 times this year’s non-GAAP EPS.

Read the full article here