Introduction

The story for Ryan Specialty Holdings, Inc. (NYSE:RYAN) is one of growth right now as the topline increased 19% YoY and the bottom line by 16%. However, growth like this often comes to a higher multiple and valuation, and RYAN is no different right now as the p/e sits at over 30. That is quite the premium to pay right now for the company, and ultimately, it’s offputting enough for me not to rate the company a buy, unfortunately.

Without a dividend as well and margins that still need some work in some places, I don’t think RYAN necessarily justifies the current valuation it’s given. The business approach and asset base quality though for the company seem solid, however, and that is sufficient enough to not warrant a sell here but rather a hold in my opinion.

Company Structure

RYAN operates in the insurance brokers industry where it has gathered up a decent valuation sitting at over $11 billion. The company was founded just back in 2010 but has grown rather impressively over the years but still has some work to do in terms of bottom-line margins. As RYAN enters its growth phase the estimates for future EPS are very positive and within a few years, it would reach a p/e of 20 if the share price remains the same, which represents a yearly growth of around 20% at least.

As for the focus of the business, it comes down to being a service provider of specialty products and solutions for both insurance brokers and agents. The company is driving growth through securing coverage for complex specialty risks, which has been impressive and immense over the last few years.

In terms of services, the company also offers distribution, underwriting, and product development as well by acting as a wholesale broker and managing underwriter. The sectors the company serves are varied but some notable ones are commercial and industrial sectors.

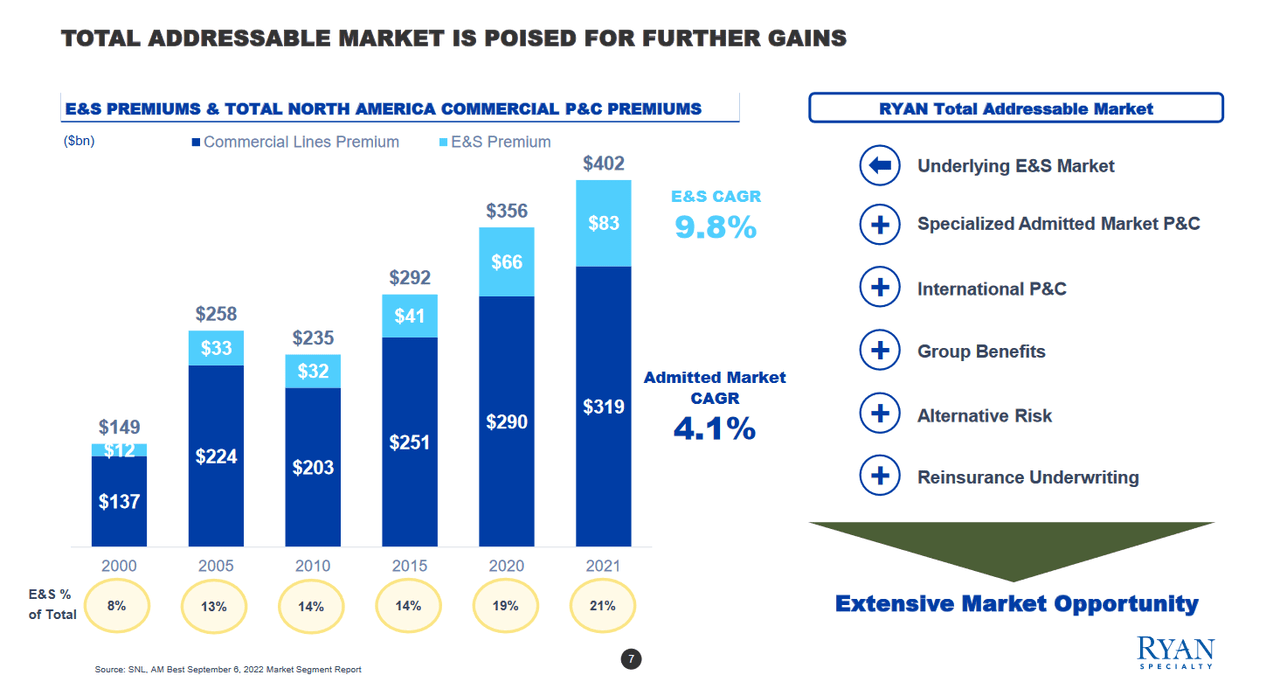

TAM (Investor Presentation)

The TAM that RYAN has is steadily growing and driving demand and growth for the business. The commercial lines premium remains the largest one for the company and has extruded a 4.1% CAGR between 2000 and 2021. This type of steady growth and reliability has been a major benefit to the company over the years.

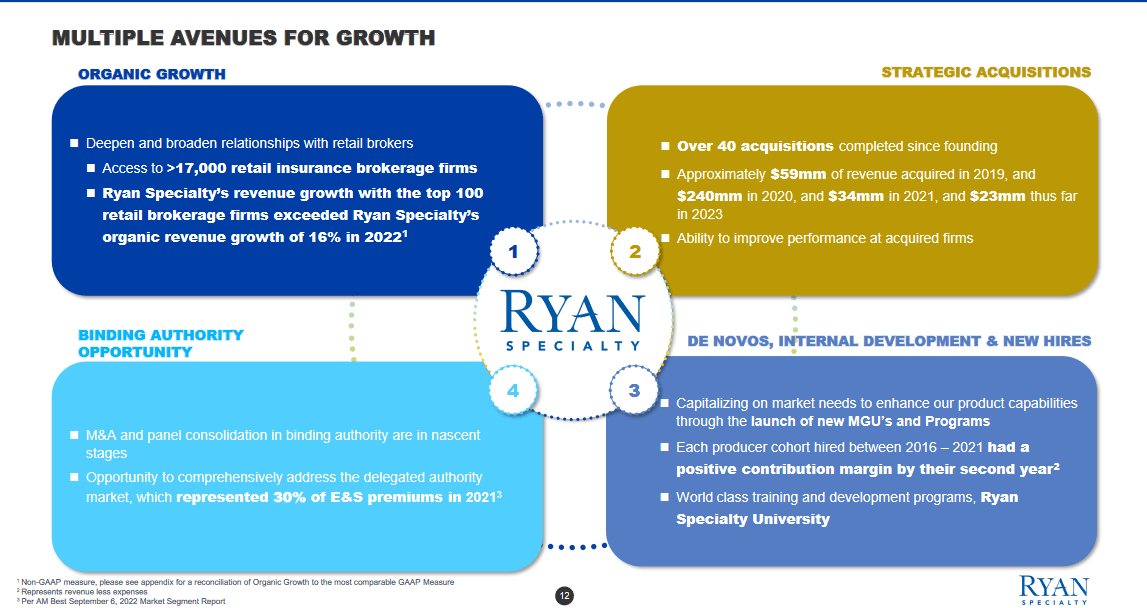

Growth (Investor Presentation)

What seems to have also made the market so positive towards the company is the many ways it’s able to grow revenues. RYAN can do it both through acquisitions and organic growth as they broaden their relationship with retail brokers. With access to over 17,000 retail insurance brokers, RYAN is left with a significant growth opportunity that can build up a solid revenue-generating base for them which they can build with acquisitions.

Fundamentals

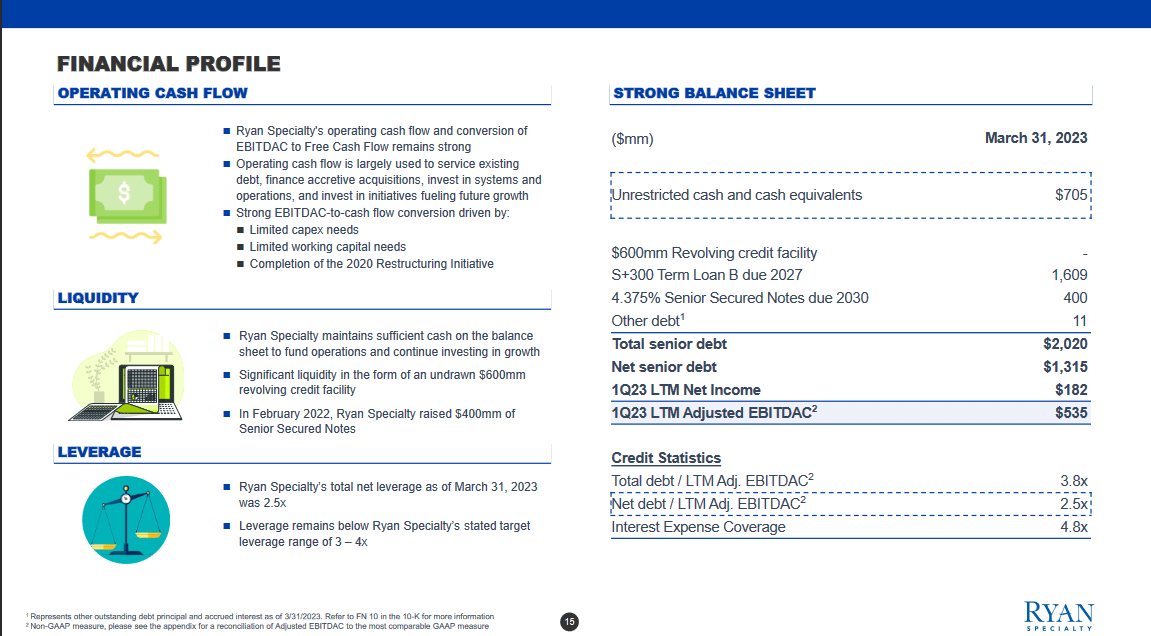

Fundamentals (Earnings Presentation)

The quality of the business is impressive in my opinion and as the management aims to grow margins and build value through acquisitions I think there is still a lot to gain here from holding. The net leverage sits at 2.5 which is not out of the norm and certainly not high enough to cause any alarm bells to go off I think. With limited working capital needs as well, the company is in a flexible position from which they can grow.

Earnings Transcript

From the last earnings call by RYAN, the CEO Patrick Ryan had some interesting thoughts to share and comments about the company’s recent quarterly performance.

“We saw broad-based strength across our specialties, particularly in property and in many individual lines of business. The specific headwinds we noted on our prior calls were in line with our expectations and partially offset some of the very strong tailwinds we experienced in property. Overall, I’m very pleased with our performance in the quarter and throughout the first half of 2023.

Noting broad-based demand is reassuring to the growth story about the company, but seeing the tailwinds being sufficient to push revenue and earnings to be barely impacted by headwinds like wage inflation and generally a slower broader economic activity is comforting, but not enough once again to make it a buy.

“Further on the M&A front, our pipeline remains robust. We remain disciplined in our pursuit of acquisitions, particularly in the current environment, as we will only move forward when all of our criteria are met. Each acquisition must be a strong cultural fit, strategic and accretive”.

Seeing that the company is still actively looking for M&A opportunities is further driving up the share price I think. Depending on the size of the acquisitions, I would expect the share price to fall somewhat. There has been solid progress in growing the cash position over the years, and right now RYAN has nearly $1 billion of it. This lends them the very ability to make significant acquisitions without endangering their financial state as a business.

Risk Associated

The operational prosperity of the entity hinges on the insurance carriers’ sustained capability to adeptly and adequately assess risks and extend coverage. This, in turn, pivots on the insurance companies’ capacity to secure reinsurance, a critical layer of protection that fortifies their ability to manage potential losses effectively. Without adequate growth prospects, the valuation will quickly tumble for RYAN as the price reaches something more in line with sector averages on both an earnings basis and a cash flow basis. But with a massive market opportunity still, it seems unlikely for the moment. Rather, challenges come in the shape of increased competition instead.

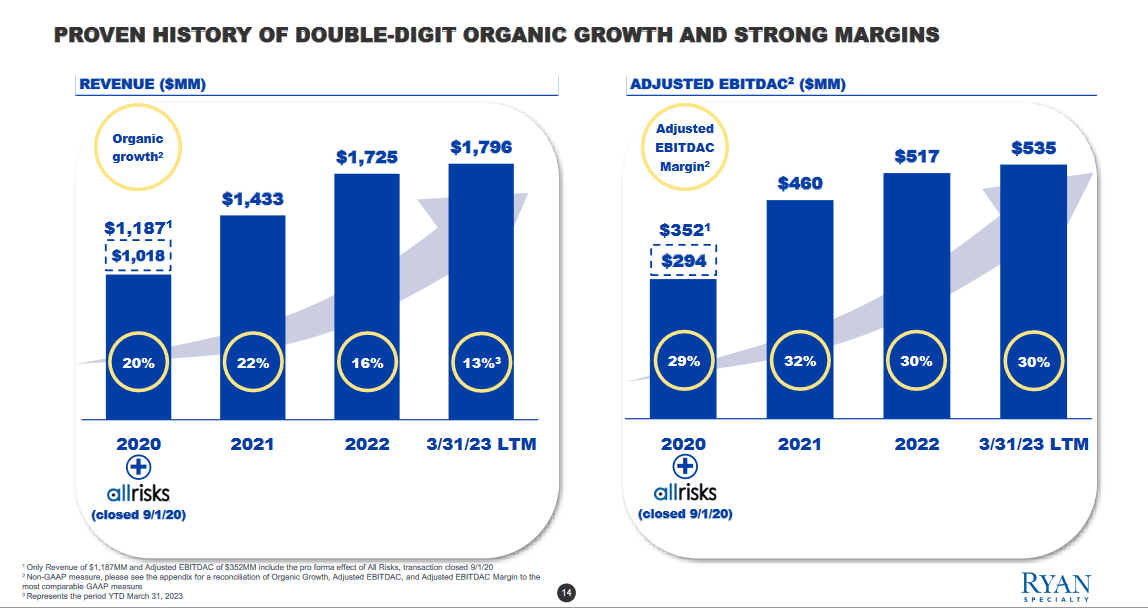

Historical Performance (Investor Presentation)

The potential challenges that insurance intermediaries might encounter extend beyond their traditional role of connecting clients with coverage options. These intermediaries, often brokers or agents, serve as the bridge between policyholders and insurers, facilitating the acquisition of suitable insurance solutions.

One critical consideration is the intermediaries’ capacity to secure the types and levels of coverage that precisely match their clients’ needs. Insurance is not a one-size-fits-all solution; each client’s risk profile, industry, and specific requirements necessitate tailored coverage. Growth is the story being told with RYAN right now, and it relies on their ability to keep up similar reports as the one we got recently.

Investor Takeaway

The investment case for RYAN seems to circle them being able to grow very quickly through their broad industry exposure and opportunity to still tap into organic growth potentials. This has been rewarded by the share price trading very high and far above where I would be comfortable starting a position. A p/e of very 30 doesn’t get me excited and offers no margin of safety either. Despite the bottom line being projected to grow nearly 20% YoY, it’s a premium I don’t want to pay. I seek undervalued plays, and RYAN isn’t one right now. However, there is still value to be derived from holding shares, and this results in me rating RYAN a hold rather than a buy right now.

Read the full article here