Editor’s note: Seeking Alpha is proud to welcome Mihail Stoyanov as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Thesis

Gerdau (NYSE:GGB) is well-positioned to benefit from trade rivalry between US and China. It is among the most prominent steel makers in the Western Hemisphere and has notable exposure to US markets. On top of that has a robust balance sheet, good management with skin in the game, and pays generous dividends.

The largest steel producers in the world are India in first place and China in second. The largest steel consumer is China, and the USA comes second. China and the US are in deteriorating diplomatic and economic relations.

This has implications on many levels, and one of them is trade. Soon, it is very likely that the US will look for alternative steel sources. In addition, the US infrastructure renewal needs raw materials, including steel.

Potential supply problems with China and steadily increasing demand will lead to a deficit. Gerdau might greatly benefit from that.

Company Overview

Gerdau is a vertically integrated steel producer that incorporates all processes – from iron ore extraction through the production and forming of steel to customer sales. The company’s operations are based in the USA and Latin America.

In Brazil, Gerdau has fully integrated steel production from iron ore extraction through the production and processing of steel billets to the end sales. This segment includes the iron ore mines in Minas Gerais, seven steel mills with blast furnaces, and four primary and secondary steel production plants with electric arc furnaces. This segment accounts for 40% of 2022 sales.

South America’s operation is focused on producing and distributing steel in the following South American countries – Argentina, Peru, Venezuela, Uruguay, and Colombia. This segment accounts for 8.7% of 2022 sales.

North American operation includes U.S. production and distribution spread among ten steel mills, recycling plants, and sales centers. This segment accounts for 37.7% of 2022 sales. Specialty steel operation produces steel for the automotive industry. Production is split between the US and Brazil. This segment accounts for 16.5% of 2022 sales.

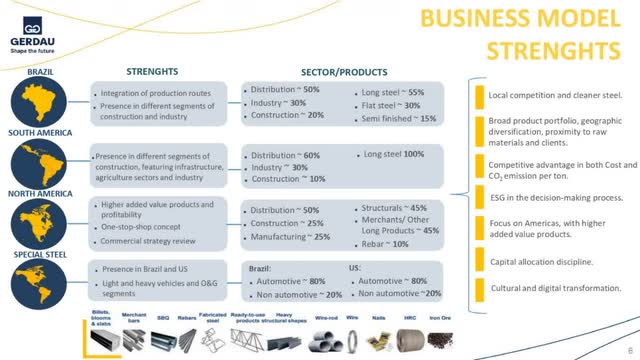

The following graph from the last investor’s presentation shows all company segments:

Gerdau investors presentation

Gerdau has exposure to two of the top steel-consuming markets – the US (number 2) and Brazil (number 12). There is a clear trend of increasing demand in these two countries.

The United States has the strongest demographics of any developed economy and needs everything from infrastructure upgrades to new housing to more cars. Steel has a significant role in all three.

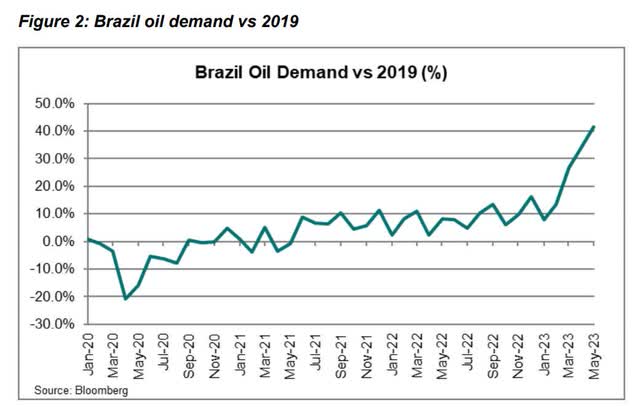

In Brazil, the situation is similar – strong demographics with a steady increase in GDP per capita equals more consumption. In recent years, this has been evident with the sharp rise in crude oil consumption. The demand for steel shows a strong correlation with the need for oil.

Bloomberg

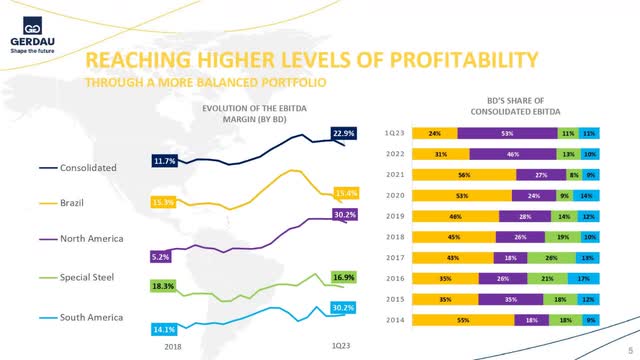

In each region where Gerdau operates, it has consistently achieved success. Measured in EBITDA margin, all operations have record growth over the previous years.

Gerdau investors presentation

Over the past seven years, the price of steel has risen significantly. From a low of $1,665 per ton in 2015, it is now $3,657.

This sustained trend has positively impacted all companies in the industry. Even high energy prices, which account for around 50% of costs, have yet to impact realized profit margins negatively.

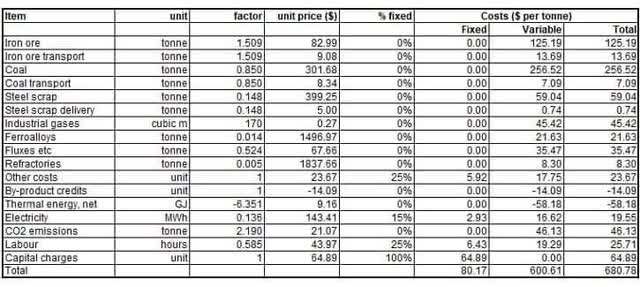

The following table shows the cost structure of producing one ton of steel. The data from Steelonthenet.com represents the Basic oxygen furnace steelmaking costs for 2023. The average production cost per ton is $680. It is close to the industry average, which is $585.

Steelonthenet.com

Gerdau’s price per ton is lower because of cheaper access to iron ore. Unlike steelmakers without cheap access to iron ore, which must import the ore (sometimes from Brazil), Gerdau owns its iron ore mines several hundred miles away from the furnaces and foundries.

Logistics costs drop significantly and directly affect the final price per ton. Another advantage of Gerdau is cheaper access to energy commodities.

Unlike Japan, China, and India, which are net importers, Brazil is rich in fossil fuels, significantly reducing the need for imports and hence the final production cost.

Company Financials

Steelmaking is a capital-intensive business and requires constant access to liquidity. The reasons lie in the cost structure – high fixed costs for property, plant, and equipment (PPE) and high variable costs for energy and raw materials.

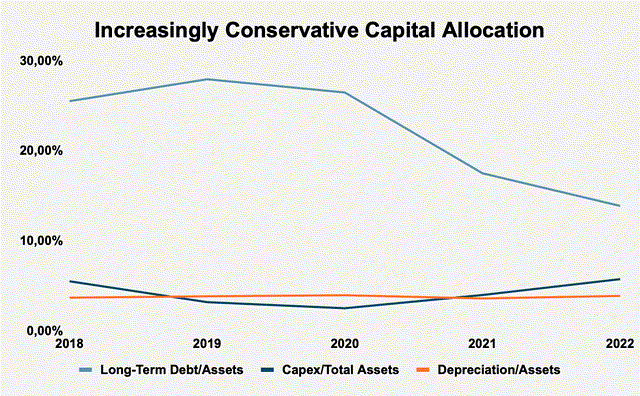

Despite these features, Gerdau is a positive example of a heavy industry company that has successfully reduced its liabilities over the last five years. The following graph shows it:

Gerdau investors presentation

The chart also shows two other critical parameters – capital investment vs. assets and depreciation vs. assets. Investments have increased steadily over the last two years, while depreciation has remained stable as a percentage of total assets. This means that Gerdau is investing enough in CAPEX to offset the impairment of its assets.

Successful debt reduction is not a one-off act but demonstrates a proactive management policy over the long term. The table below confirms that Gerdau’s management follows a conservative approach to liquidity and solvency.

|

EBITDA/Interest expense |

16.5 |

|

EBITDA-CAPEX/Interest expense |

14.5 |

|

Quick Ratio |

1.1 |

|

Current Ratio |

2.5 |

|

Net debt/EBITDA |

0.4 |

|

Net Debt/ EBITDA – CAPEX |

0.6 |

|

Long-term debt/Equity |

20.8 % |

|

Total debt/Equity |

27.4 % |

|

Total liabilities/Total assets |

36.0 % |

Sources of data: Seeking Alpha Gerdau company’s profile

Gerdau is competitive or even superior to its USA and European rivals on all these parameters. The only red dot is the cost of capital – borrowed and equity. Gerdau regularly pays dividends, which is an advantage for shareholders but comes at a price. Namely, foregone benefits such as investment in PPE and development would have accelerated the company’s long-term growth.

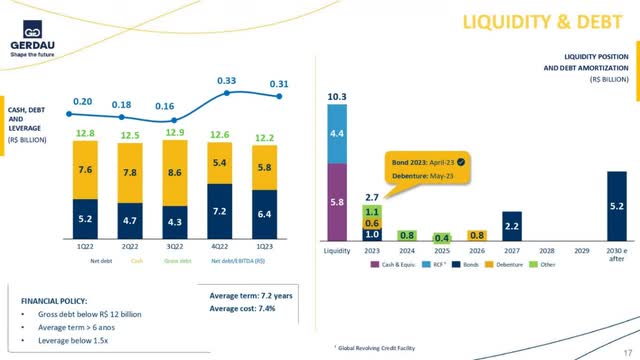

Interest rates are relatively high for borrowed capital (i.e., bonds and loans (10-13%). The following graph shows the maturities of the bonds issued by Gerdau:

Gerdau investors presentation

The chart’s right half shows liquidity, debt amortization, and the maturities of the different bond issues (the dark blue blocks). The currency is the Brazilian real. The credit rating by S&P is BBB- which stands for investment-grade bonds.

They have $200 million to repay in 2023. The following maturities are 2027 – $400 million and 2030 – $1.04 billion. I use a BRL/USD rate of $0.2 as of 12/08/2023. The wide distribution of maturities on Gerdau’s debt offsets its relatively high cost. In addition, the company has $509 million cash on hand and is generating $1.17 billion of free cash flow for 2022.

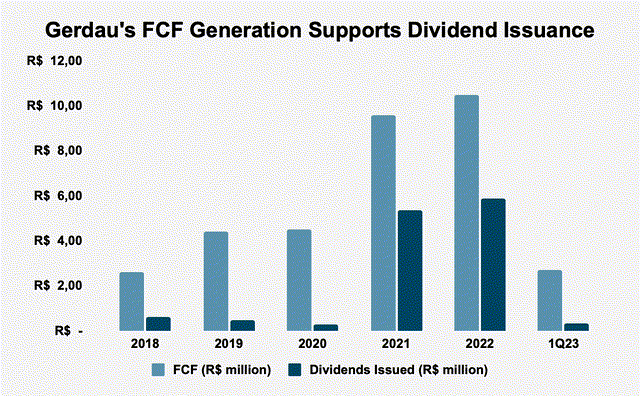

The beginning of a new super cycle in commodities has also positively impacted Gerdau. Free cash flow has been growing steadily for the last five years:

Gerdau investors presentation

As can be seen, this has a positive impact on the dividends distributed by the company. Gerdau also excels in other parameters measuring the company’s efficiency.

|

Free cash flow/EV |

11 % |

|

Sales/EV |

157 % |

|

Gross Margin |

21.2 % |

|

Operational Margin |

18.8 % |

|

ROI% |

16.1 % |

|

ROE% |

25.7 % |

|

Net income per employee |

77,000 $ |

Sources of data: Seeking Alpha Gerdau company’s profile

On all metrics, Gerdau outperforms its US competitors, Cleveland-Cliffs Inc. (CLF) and United States Steel Corporation (X).

Company Dividend Policy

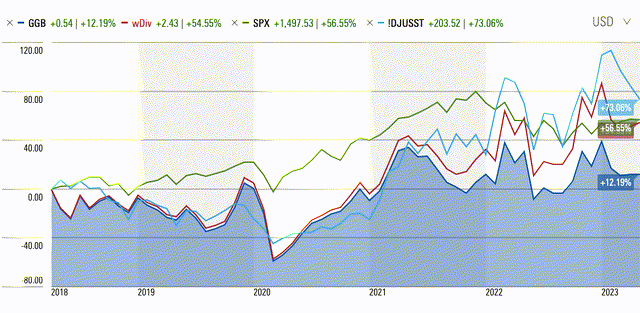

In the last five years, GGB underperformed S&P 500 and Dow Jones Steel. Considering total shareholder returns, the company closes the gap with the broad market. The reason behind that is generous dividend payments.

Morning Star

Gerdau has traditionally distributed dividends. The company’s articles of association stipulate that 30% of profits must be distributed yearly as dividends.

|

Dividend yield (TTM) |

6.46 % |

|

Payout ratio (TTM) |

51 % |

|

5Y dividend growth (CAGR) |

61.35 % |

|

Frequency |

annual |

Sources of data: Seeking Alpha Gerdau company’s profile

GGB is performing well financially. The company has a robust balance sheet providing liquidity. Last year the management notably reduced the company’s debt and maintained dividends.

People

When we buy a single share, we become business owners and delegate company management to its executives. That means one thing: we must know with whom we are dealing. That means who are the managers and who are the principal shareholders? The former tells us who will manage our funds, and the latter tells us about the other people who share our views.

Managers:

- CFO Rafael Japur – in that capacity since 2022, owns 0.45% of the company’s stock.

- CEO Gustavo Da Cunha – in office since 2018, owns 0.58% of the company’s stock.

- Director Andre Gerdau Johannpeter, who succeeded the company’s founder and has served on the board since 1979, owns 3.0% of the company’s shares.

- Chairman Guilherme Gerdau Johannpeter, who succeeded the company’s founder and has served on the board since 2020, owns 1.02% of the company’s shares.

Investors:

Significant funds own a large proportion of A-shares. They are as follows:

- GIC Pte Ltd. is the legal entity representing Singapore’s sovereign wealth fund. They own 5.17% of the company’s shares;

- Capital Research and Management Co., a US-based investment firm, owns 7.19% of the stock;

- Itau Unibanco S.A. – own 1.43% of the stock.

Eat your own cooking is a mandatory rule I follow when selecting potential investments. GGB is a positive example where managers have skin in the game. The presence of Singapore’s wealth fund among investors is attractive. Usually, sovereign funds allocate up to one percent per idea, but GIC invested more than 5%. That shows a high level of conviction in their thesis.

Valuation

Gerdau does not have pricing power, and its business is capital-intensive, focusing on tangible assets. These features make the use of cash flow-based valuation methods dangerously misleading. Gerdau has achieved strong results in recent years, which is expected to continue, but that is not guaranteed due to the lack of pricing power. I use Net Asset Value in cases like that. Apart from calculating the company’s net asset value, I compare it against its peers using EV/Sales and Price/book ratios.

The valuation of a company only tells me how much I am currently paying for each dollar of net assets.

I calculate NAV as follows:

NAV = NetPPE + cash + short term investments + inventories + total receivables – total liabilities

I use the following values from the last financial statement for Q3 2023:

- Net property, plant, and equipment $4.26 billion

- Cash – $509 million

- Short-term Investments – $640 million

- Total receivables – $1.7 billion

- Inventory – $3.39 billion

- Total liabilities – $5.31 billion

GGB business valuation:

Net Asset Value = 5,140,000,000 USD

Intrinsic value per share = 3.01 USD

Current market price = 5.18 USD (12/08/2023)

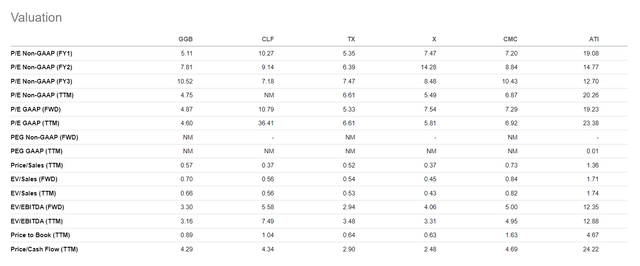

The relative valuation shows where the company stands against its peers. GGB is relatively pricey compared to other major steel players.

Gerdau profile in Seeking Alpha

As for business and relative valuation, I rely more on asset-based ratios than earnings-based ones. I use EV/Sales and Price/Book ratio in that case. Both indicate Gerdau is priced relatively high.

Based on business and relative valuation, GGB is expensive. In cases like GGB, I would divide the investment into three to four entries over a few months. Thus, I achieved two things: protect myself from trying to be right about the timing and the direction; get a better average price.

Risks

The Brazilian economy and stock market closely follow the commodity cycle. That’s why the charts of IBOVESPA companies resemble those of a mining company – sharp declines followed by epic highs followed by new lows. This feature is essential because even buying Brazilian banks’ shares, we are long bauxite, soya, iron ore, gold, and oil – principal Brazilian exports.

In addition, a considerable part of raw material exports is directed to China. This means that the Brazilian economy is a derivative of the Chinese economy. When China prospers, Brazil prospers, and vice versa.

Gerdau’s principal risks are based on iron ore and energy prices, Brazil’s economy, and potential macro headwinds. Energy is one of the significant expenses in steel production. Higher energy prices will squeeze the profit margins and vice versa. Iron ore is the primary input of steel production. Its price limits the profit margins. GGB has an advantage as the owner of iron mines which partially mitigates the effects of higher prices.

The Brazilian economy is stable, but its disadvantage is its dependency on China. If the latter has troubles, it will transmit among its trade partners. Steel demand is correlated with overall economic activity. The recession scenario is still on the table. It is unknown how deep and when it might happen.

Conclusion

Gerdau is well positioned to benefit from trade rivalry between US and China, Brazil’s great demography, and the global steel demand. It is among the most prominent steel makers in the Western Hemisphere and has notable exposure to US markets. On top of that has a robust balance sheet, good management with skin in the game, and pays generous dividends. Gerdau’s share price is relatively high based on NAV and relative valuation. The generous dividend partially compensates for that. Gerdau is an excellent investment for long-term investors with a horizon above 24 months.

Read the full article here