Thesis

Hims & Hers Health (NYSE:HIMS) reported a stellar Q2 and raised guidance. Despite a triple beat the stock has sold off sharply in the days since their earnings release. The company is taking steps to expand into new categories. We believe that the risk/reward has materially improved since the last time we covered the company, and are upgrading from a hold to a strong buy.

What’s Changed

Our last writeup on Hims focused mainly on the risks surrounding the business model. At the time we felt like the risk/reward profile could be better and had a neutral opinion on the stock. Since then the company has reported yet another triple beat quarter, yet the stock has sold off dramatically. The company has made steps to expand into new product categories and diversify their business. Andrew Dudum has spoken about their hesitance to add weight management drugs to the platform due to the uncertainty surrounding them. This shows that Hims is taking a conservative approach to what drugs they allow on their platform, which could earn them some favorability in the eyes of the regulators.

We have reevaluated our growth and risk estimates for the company. The gap between price and value is now too wide to ignore and we see a great opportunity to take a long position.

Stellar Q2

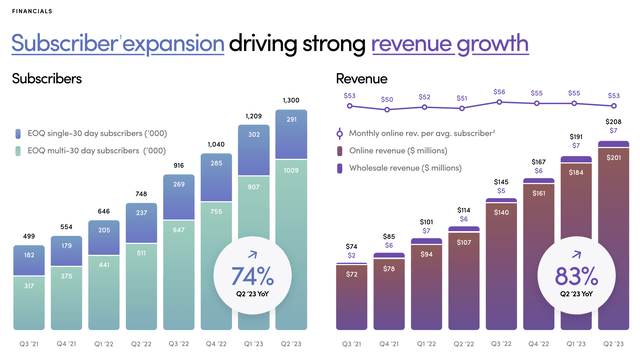

Hims demonstrated continued growth in revenue and profitability in the quarter. Revenue grew 83% year over year, continuing their pace of blistering top-line growth. Adjusted EBITDA margins swung to being positive after being negative in the prior year quarter. This shows that Hims has been able to push towards profitability without sacrificing growth, something that many growth companies have struggled with over the past two years. This significantly de-risks the business and is an example of effective operational management. A dilution event in the future seems unlikely, as does debt financing.

Hims and Hers Q2 2023 Financial Results Presentation

Hims has consistently grown subscriber and revenue numbers across economic cycles. This shows that the business has stickiness and consumer appeal, as no matter what has been going on with the economy customers are still choosing to use Hims’ platform instead of a competing solution. A breakdown in this trend of growth would be a warning sign to investors, but for now the company is executing well.

Hims and Hers Q2 2023 Financial Results Presentation

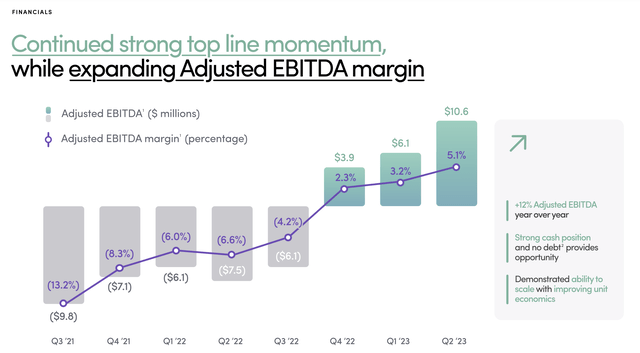

Hims has rapidly improved profitability over the past couple of quarters. This is the mark of a mature company and shows management’s willingness to exercise financial discipline. While we generally disregard non-GAAP numbers, Hims doesn’t grant obscene amounts of stock based compensation so we are willing to take these non-GAAP numbers into consideration (albeit with a grain of salt). The company appears to be on track for GAAP profitability sometime next year. This could lead to some investors who had been waiting on the sidelines to feel more comfortable with owning the stock.

Hims and Hers Q2 2023 Financial Results Presentation

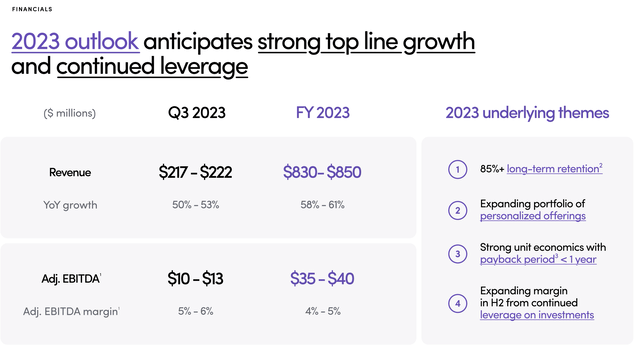

Hims has continued to raise their guidance nearly every quarter. Management is either sandbagging or is seeing growing momentum within the business that makes it difficult to forecast. It’s likely a mix of both. In this economic environment FY 2023 YoY revenue growth of between 58-61% is nothing to sneeze at. The actual revenue number for FY 2023 will be closer to $875 million if trends continue.

Hims and Hers Q2 2023 Financial Results Presentation

New Categories

Heart Health

The company’s press release on this topic can be found here. Stepping into cardiovascular health helps the company differentiate their product offerings and works towards their goal of creating a wellness platform. Since this is preventative medicine, it fits in nicely with their subscription focused business model and ensures that customers will have some innate stickiness. This is crucial for a company that operates in the realm of keeping CAC < LTV.

Weight Management

While many analysts and investors are eager for Hims to jump into this category, in our opinion a conservative approach is best. An interview regarding this topic can be found here. They plan to launch this business by the end of 2023. Their patience gives the company an opportunity to observe what works and what doesn’t, and ensure that the launch of this product category goes as planned. Expanding into this category will further diversify their revenue and could end up being a significant growth driver going forward.

Price Action

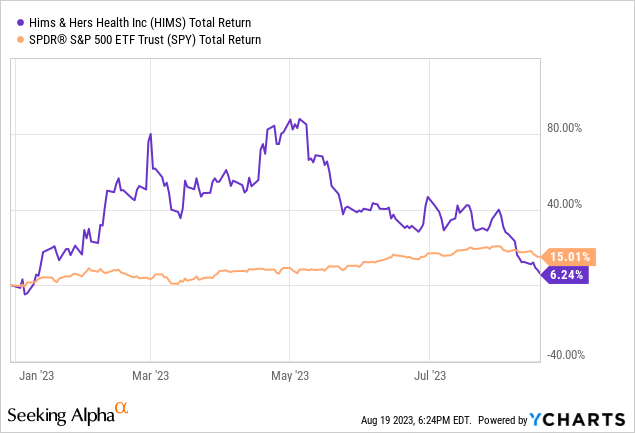

After a massive rally at the beginning of the year Hims’ stock has taken a nosedive. The stock is now underperforming the S&P 500 (SPY) YTD. This has happened despite the company continuing to crush earnings and raise guidance quarter after quarter. The lower the price goes the larger the gap between price and value becomes. After being neutral on the company we now firmly side with the bulls and believe the company will outperform the S&P 500 over the next several years (unless regulators target their business).

Valuation

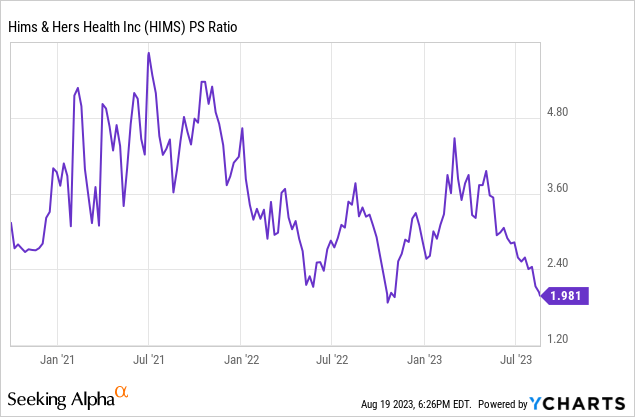

Given the fundamentals of the business, Hims appears to be tremendously undervalued. For a company growing revenue over 80% a PS ratio of 1.98 seems absurdly cheap. While the company remains unprofitable on a GAAP basis they aren’t losing massive amounts of money, with net losses in their Q2 being just $7.2 million. The market appears to be applying a massive discount to Hims’ stock due to perceived competitive and regulatory concerns. We believe the gap between price and value is far too large given the consistent execution of the business.

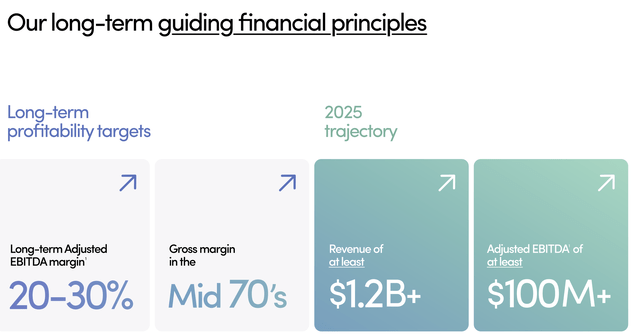

Hims’ long-term revenue guidance could end up being heavily sandbagged and the company has ample potential to outperform their public target. Their adjusted EBITDA margin target seems aggressive and true GAAP net margins will probably be around 10-15%. Fortunately for investors, this level of profitability is still materially higher than their currently negative net margins. If management can beat profit guidance it would be icing on the cake.

Hims and Hers Q2 2023 Financial Results Presentation

Operating cash flow was $9,483,000 in Q1 and $16,826,000 in Q2. It would be aggressive to assume that this high level of sequential growth will continue. We arrive at our 2024 cash flow estimates by conservatively assuming that Hims can sequentially grow their operating cash flow at 1/4 the rate they did between Q1 and Q2 over the next couple of quarters. This causes us to arrive at a 2024 operating cash flow estimate of $100,347,500. Given the margin profile and growth projections of the business, we believe that a 30x multiple on operating cash flow is fair. Assigning a 30x multiple on operating cash flow gives us a share price of $14.44. Should shares reach this level, we believe that investors can continue to hold if the business is materially outperforming expectations. Our estimates for operating cash flows and future growth would be inaccurate in this scenario.

Risks

Our previous article outlined many of the risks surrounding Hims. These risks still remain, but the risk/reward has improved substantially due to the selloff in the stock as well as the continued fundamental execution.

The risks are great, but at this moment the reward appears to be greater.

Key Takeaway

Hims is getting no respect from the market. The company continues to outperform expectations and is showing massive improvement in their fundamentals. The company is taking steps to diversify their revenue without being too aggressive in adding new drugs to the platform. We believe the gap between price and value has widened substantially and that current prices represent a buying opportunity.

Read the full article here