Research Brief

Recently, my focus on the “innovation” & “managed services” sector turned towards a specific niche: federal contractors specializing in aerospace, homeland security, & cybersecurity.

After my coverage of General Dynamics (GD), L3Harris Technologies (LHX), Leidos (LDOS), and Booz Allen Hamilton (BAH), today I will deep dive into the next one in this series and a well-known name in this space:

Northrop Grumman (NYSE:NOC), who recently had its 2023Q2 results on July 27th, will be today’s feature stock.

My personal experience with this sector started in 2001 as a Drew University student during my leadership semester in Washington DC, passing by facilities of Northrop & Lockheed on the train ride there, a memory I vividly recall. Then, the endless policy discussions and panels during that semester, and research papers, and visits to Capitol Hill and lobbyist offices. All of this is part of the “ecosystem” in which this firm operates, and a lot of federal public monies are at stake in this process.

For readers new to this stock, here are quick notable points I think should be relevant about this company, from its website: 95K employees, facilities in all 50 states & 25+ countries worldwide, based in Virginia US, majority of its business comes from US federal government: defense & intelligence sector. 2022 sales were $36.6B. Trades on NYSE.

Rating Methodology

To get a “holistic” rating score of buy, sell, or hold, I break down my analysis into 5 categories: dividends, share price, valuation, earnings growth, & capital strength.

If I recommend the stock on at least 3 of these categories it gets a hold rating, and at least 4 will give it a buy rating. A score of less than 3 is a sell rating.

Dividends: Recommend

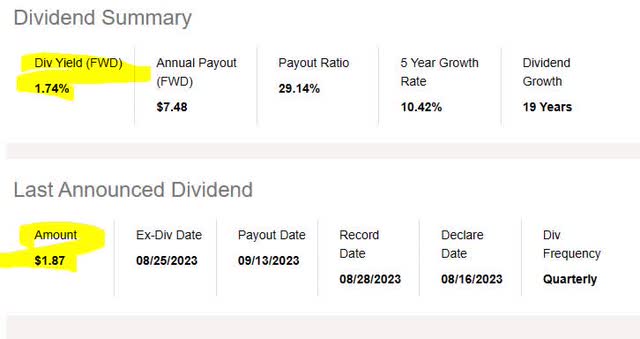

The first category I will look at is dividends, and compare to the overall sector. As of Aug. 19th, according to dividend data from Seeking Alpha, Northrop has a dividend yield of 1.74%, not terrible or attention-grabbing either.

Worthy of mention is its dividend of $1.87 per share is quarterly and has an upcoming ex date this week on the 25th, which could be worth taking advantage of.

Northrop Grumman – dividend yield (Seeking Alpha)

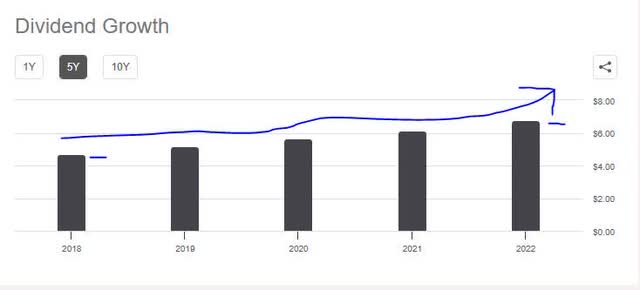

Another key data point is a 5-year proven dividend growth rate, shown in the chart below. The stock went from an annual dividend of $4.70 in 2018 to $6.76 in 2022, an almost 44% gain in 5 years, which is impressive.

Though not a guarantor of future dividends, this does show evidence of past & current financial strength to return capital back to shareholders.

Northrop – dividend 5 year growth (Seeking Alpha)

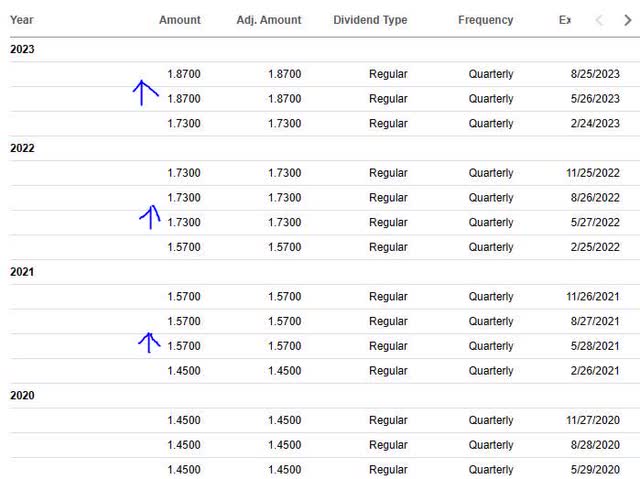

If you look at the dividend payout history, it also shows a reliable quarterly payout every quarter since 2020, and has been increasing, another good sign and it should provide confidence to the dividend-income portfolio investor in this sector.

Northrop – dividend history (Seeking Alpha)

In comparing Northrop’s dividend yield to some the peers I mentioned, if you consider that Booz Allen’s dividend yield is just 1.64%, and Leidos has a yield of 1.50%, Northrop beats them both slightly on dividend yield, an important metric because a higher yield means a better return on capital invested.

Based on the evidence, I can safely recommend this stock in the category of dividends.

Share Price: Recommend

In this category, I am taking a very simplified approach to determining whether the current share price is a buy opportunity or not.

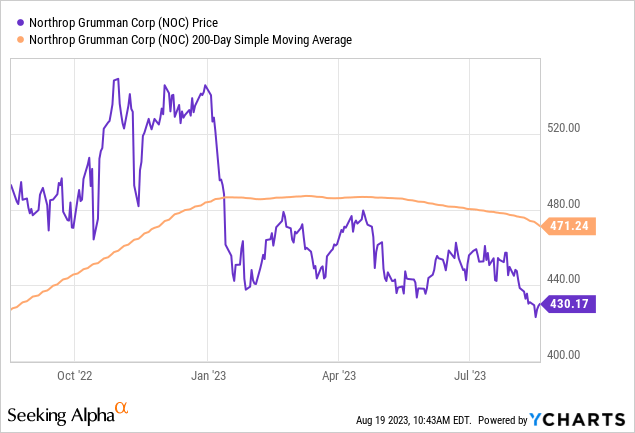

First, I pull the current chart as of Aug. 19th after yesterday’s market close, showing the closing price of $430.17 (blue line) vs the 200-day simple moving average of $471.24 (orange line). Now, don’t get startled in seeing a share price as gigantic as this, as it is not the price itself that should decide a buy decision.

Second, I establish a goal for how long I want to hold the stock, my goal for return on capital, and my maximum risk tolerance for capital loss.

In my fictitious trade, I will buy 10 shares and hold for 1 year to earn the full year dividend income, my goal is at least 10% return on capital after a year, and my loss tolerance is negative -10% return in a year.

Assumptions: the moving average I am tracking will move up by 10% in a year, and that will be my sell price, or it will drop by 10% and that will be my sell price. This establishes a “range” to think about long term.

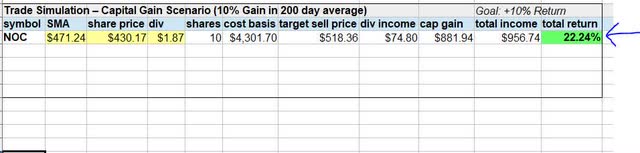

In the following simulation, I just plug in the current share price, current 200-day SMA, and dividend amount. My target sell price of $518.36 is 10% above the current moving average. In this simulation, I exceed my profit goal and achieve 22.24% return on capital invested. Income is from capital gains and dividends.

Northrop – trade simulation 1 – gain scenario (author analysis)

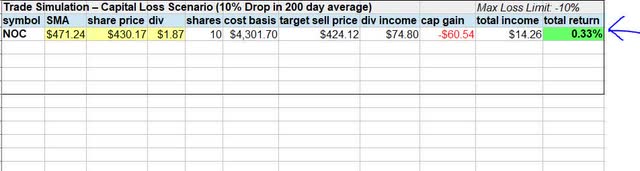

In the 2nd simulation, testing a loss scenario, I plug in the same data and my sell price now is 10% below the current SMA. However, my capital loss is offset by dividend income, so I am actually getting a positive return of +0.33%, hence it is within my max loss limit of negative -10%.

Northrop – trade simulation 2 – loss scenario (author analysis)

Because the current share price works out in both simulations, I would recommend it as a buying price.

Valuation: Recommend

In this category, I will look at valuation from the point of view of the price to earnings and price to book value, using valuation data from Seeking Alpha.

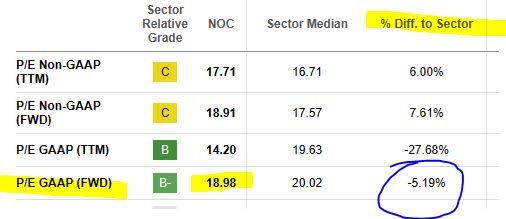

First, as of Aug. 19th the forward P/E of 18.98 is impressively over 5% below the sector average which is hovering closer to 20x earnings, as seen below. This earned it a “B-” grade from Seeking Alpha, and this is a key metric to follow, showing that the market is willing to pay almost 19x earnings for this stock.

Northrop – P/E ratio (Seeking Alpha)

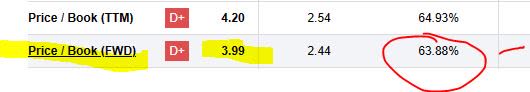

In terms of price-to-book, the market is paying 4x book value when the sector average is closer to 2.4x book, making this stock almost 64% higher than its sector.

Northrop – P/B ratio (Seeking Alpha)

In weighing the two metrics, although its price to book seems overvalued, the price to earnings is still very attractive.

Incidentally, in comparing to one of its peers, Northrop’s price to book is still far better than that of Booz Allen, whose trailing P/B ratio is over 486% above the sector average, earning an “F” grade. Also, another peer I have not covered yet, Lockheed Martin (LMT), has a forward P/B ratio that is 439% above the sector average. If you know this sector, you know that Lockheed is also a major competitor of Northrop Grumman, as is Boeing (BA).

So, my outlook is that the valuation can be recommended based on the evidence shown.

Earnings Growth: Not Recommended

At first glance, the top line figures YoY look great, with a jump in total revenues as well as gross profit, as the table shows:

Northrop – top line revenue YoY (Seeking Alpha)

However, the bottom line not so good, with net income showing a YoY drop:

Northrop – net income YoY (Seeking Alpha)

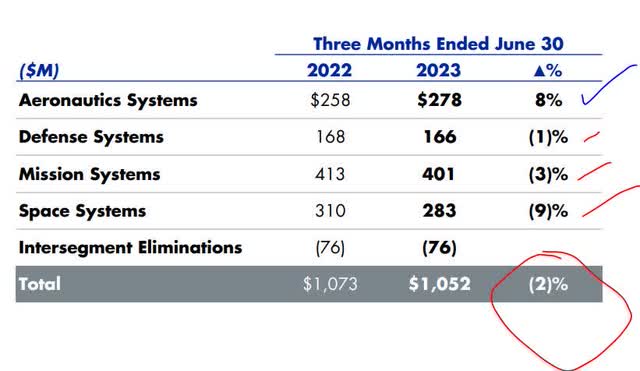

On closer look, their operating income YoY fell across multiple business segments:

Northrop – operating income YoY (company q2 presentation)

According to the company earnings release commentary:

Second quarter 2023 net earnings decreased $134 million, or 14 percent, primarily due to a $244 million reduction in the non-operating FAS pension benefit.

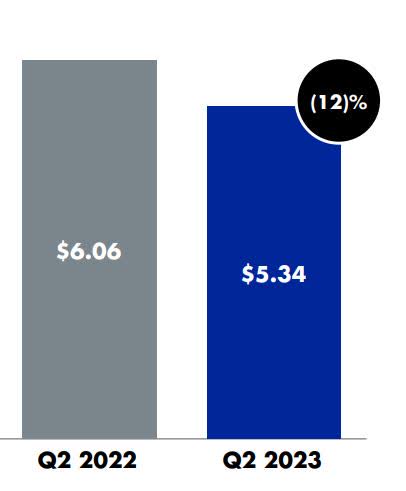

This impact can be seen in the earnings per share YoY comparison too:

Northrop – diluted EPS YoY (company Q2 presentation)

In this case, I have to ding the company in this category and not recommend on earnings growth, despite strong top line numbers. I do expect an improvement in Q3.

Capital Strength: Recommend

I would recommend this company in the category of capital strength and here some key data points to strengthen that thesis:

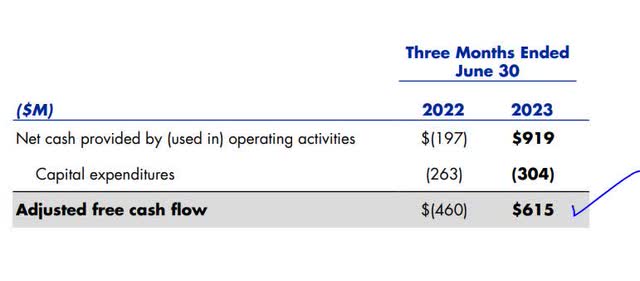

According to the Q2 presentation, the company will “continue to expect to return over 100% of adjusted free cash flow this year to shareholders, including ~$1.5 billion in share repurchases.”

This is a positive sign, I think.

Further, I like the positive cash flow they achieved in the last quarter as well of around $0.6B

Northrop – free cash flow (company Q2 presentation)

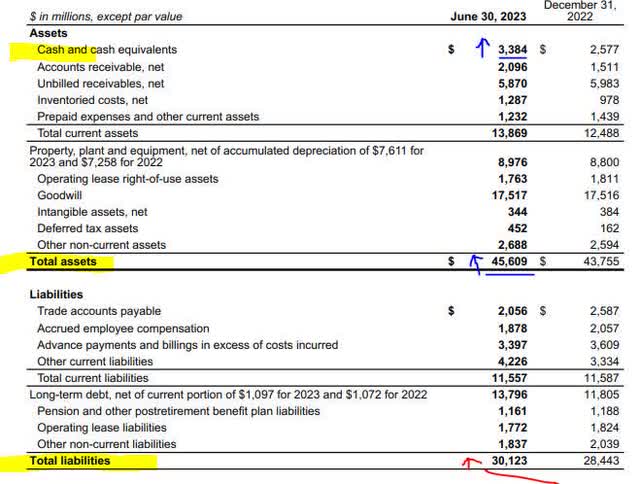

In taking a look at the company balance sheet, it has greatly expanded both on the asset and liability side, since the end of 2022, with a cash & cash equivalent position of $3.3B, total assets of $45.6B, total liabilities of $30B.

Northrop – balance sheet (company q2 earnings release)

The one thing I would mention, though, is that we are in a very high interest rate environment since last year, after Fed rate hikes, so the question would be what is the impact of rates on this company’s long-term debt, and interest expense.

The following table gives some insight into this topic, showing a YoY increase in the interest expense, with interest expense at $147MM. In Q3 commentary I would like to see more about how they are reducing their long-term debt load effectively.

Northrop – interest expense (Seeking Alpha)

Rating Score: Buy

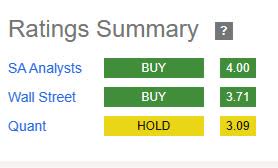

Today, this stock won 4 of my 5 rating categories, earning a “buy” rating from me, which is actually in line with the consensus from analysts and Wall Street who I agree with this time, but it is more bullish than the SA quant system, as shown below.

Northrop – rating consensus (Seeking Alpha)

Again, what prevented it from being a “strong buy” was the poor showing on YoY net income growth.

Risk to my Outlook: Sector Competition

A risk to my modestly bullish outlook is the fact that Northrop has to compete for contracts with some big players in this space like Lockheed and Boeing, among others. A few big contract losses to those competitors, especially media publicized ones, may cause investors to be bearish on this stock, making my outlook too rosy.

However, the benchmark I look at is the current pipeline of contracts or programs already awarded and in progress. Consider all the work coming this company’s way, according to their Q2 earnings release:

Q2 and YTD 2023 net awards totaled $10.9B and $18.9B, respectively, and backlog totaled $78.8B. Significant Q2 new awards include $5.4B for restricted programs (primarily at Space Systems, Aeronautics Systems and Mission Systems), $0.6B for F-35 (primarily at Aeronautics Systems and Mission Systems), $0.3B for the Missile Defense Agency’s Ballistic Missile Defense System Overhead Persistent Infrared Architecture (BOA) and $0.3B for Virginia-Class submarines.

I am of the opinion that these awards and other will more than keep them busy and the revenue coming, despite competition from big players, and thereby lessening the risk of a bearish Wall Street, though not eliminating that risk entirely. After all, federal contracts can get cancelled, delayed, renewed or not renewed, and so on.

Analysis Wrap-up

Here are the points we went over today.

This stock got a buy rating today, in line with the consensus from Wall Street analysts, but more bullish than the quant system.

Positives: dividends, share price, valuation, capital strength.

Headwinds: earnings growth YoY.

Concluding thoughts:

This wraps up this month’s series on the innovation sector when it comes to federal contractors, with a focus on aerospace & homeland security.

The sector will remain on my watchlist, and this stock in particular, due to its seemingly never-ending pipeline of projects & work, and federal dollars flowing its way. Hence, my forward-looking sentiment on both this stock and sector is generally positive, expecting continued strong financial fundamentals in the next several years.

Read the full article here