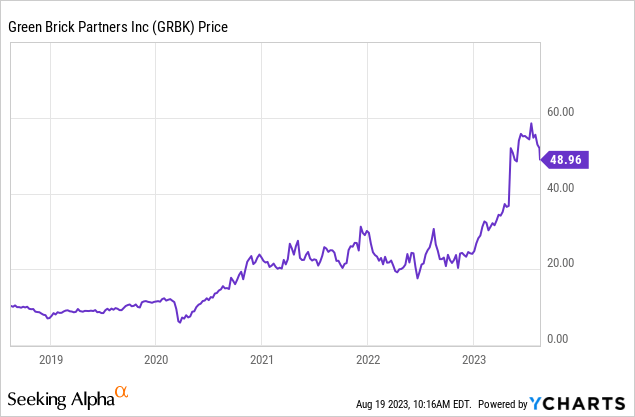

I mentioned Green Brick Partners (NYSE:GRBK) as a Buy idea in July of last year here with the share quote around $22. Since then, its ultra-low valuation and still strong home construction markets in Texas, Florida, and Georgia have caught the fancy of Wall Street. Price today is hovering around $50.

YCharts – Green Brick Partners, 5 Years of Weekly Price Change

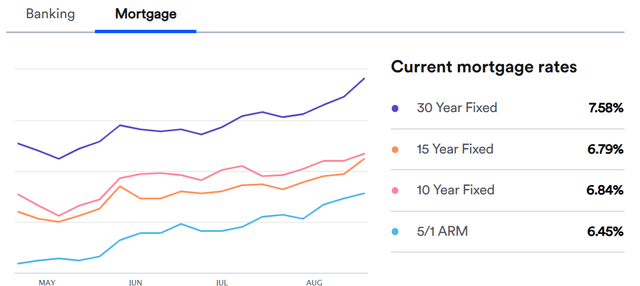

However, the combination of another bump in mortgage rates during July-August, alongside reasonable odds of a recession in America later this year into 2024 (better than 50/50 in my estimation), argue for caution in Green Brick.

On August 16th, Bankrate.com reported the “average rate on all 30-year mortgages climbed to 7.31 percent this week, up from 7.12 percent last week, according to Bankrate’s weekly national survey of large lenders.” Today, August 19th, the typical 30-year fixed rate is up to 7.58%, a 22-year high.

Bankrate.com – Mortgage Rates, August 19th, 2023

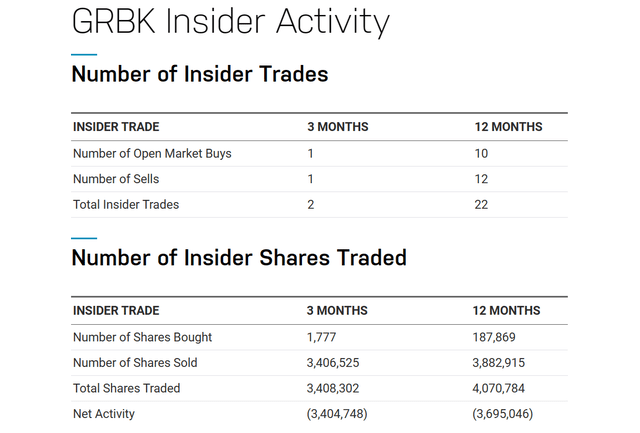

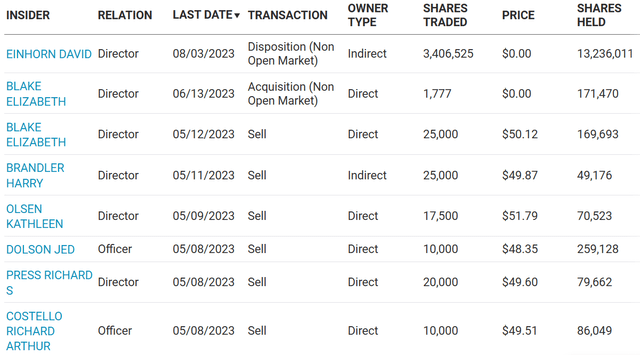

Equally worrisome, aggressive insider selling has hit the stock since May, as outsized gains are captured in the notoriously cyclical housing market. Putting together the investment puzzle, I think traders/investors may be wise to look elsewhere for new purchases and avoid Green Brick for the time being.

Insider Selling

Major investor David Einhorn, through his hedge fund Greenlight Capital, sold about 20% of his stake in the company weeks ago in the low-$50s. Plus, other knowledgeable owners including company management have decided since late spring to cash in a portion of their chips on the GRBK spike in price during 2023.

I don’t know if insiders are seeing a reduction in new home orders, or are they just prudently locking in gains for themselves, but the slight net buying trend of shares a year ago has turned into a flood of stock selling this summer. On the tables below, you can review the net 3.695 million shares liquidated over the last year by insiders required to report trading to the SEC. 3.4 million are directly tied to Einhorn wanting to get a portion of his money out.

Nasdaq.com – Green Brick Partners, Insider Trading, 12 Months Nasdaq.com – Green Brick Partners, Insider Trading Since May 2023

Technical Chart Topping?

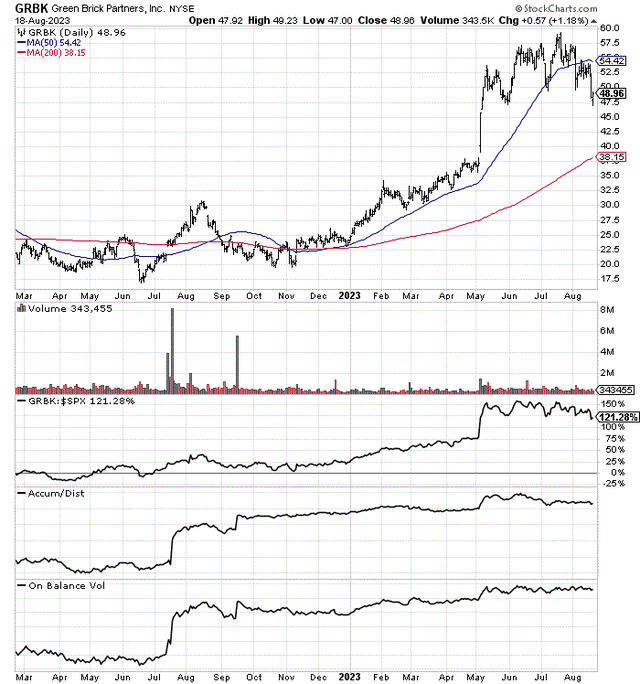

The early May spike in price on much better-than-expected operating results was followed by a drift higher, at first. But since July’s quote peak, momentum has turned lower. At the $59 price high, relative strength to the S&P 500, the Accumulation/Distribution Line, and On Balance Volume were already headed lower (a divergence in buying patterns from early June). Below I have drawn an 18-month chart of daily price and volume changes to review.

StockCharts.com – Green Brick Partners, 18 Months Of Daily Price & Volume Changes

Price dipped below its 50-day moving average several weeks ago for the first time since November, and selling pressure has only intensified with the weakness on Wall Street generally in August.

It is entirely possible, further market declines overall into October could pull Green Brick’s price all the way back to $38-$40, where the 200-day moving average is located and a large price “gap” exists from early May.

Final Thoughts

I get that home construction is a very profitable endeavor again in 2023, just like 2020-22. Warren Buffett‘s Berkshire Hathaway (BRK.A) (BRK.B) added to his home builder sector ownership in the June quarter, about the same time as insiders began selling Green Brick. On top of numerous fully-owned builders across the nation, Berkshire started new stakes in D.R. Horton (DHI), NVR Inc. (NVR), and Lennar (LEN.B) this spring.

I understand the pull of low P/Es and hopes for a soft landing in the economy. Yet, to me, the risk of a hard landing is increasing with rising long-term borrowing rates this summer and the quickly approaching resumption of student loan payments into October. Both are going to be hard on consumers already stretched by rampant inflation, while discouraging spend on a new home, in my view.

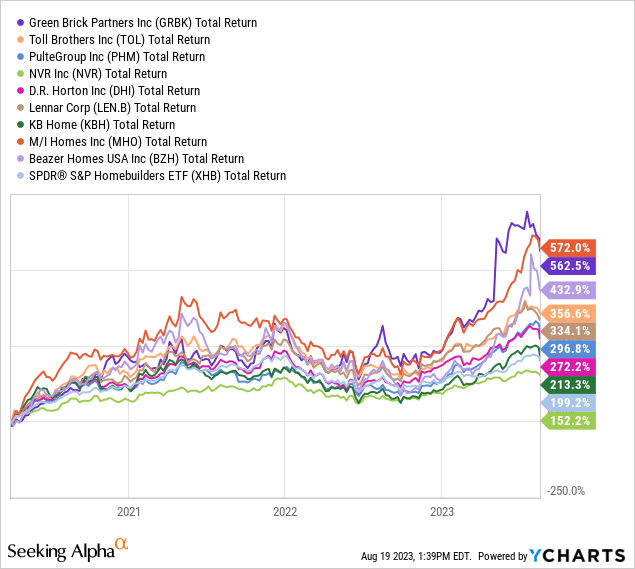

In terms of cyclical reversal potential, measured from the pandemic lows in late March and early April 2020, Green Brick has been one of the top total return performers in the sector, streaking to a +562% gain in value for investors. Calling for a 6 to 12-month breather and price retracement is not rocket science, just common sense.

YCharts – Home Builders, Total Returns, Since April 2020

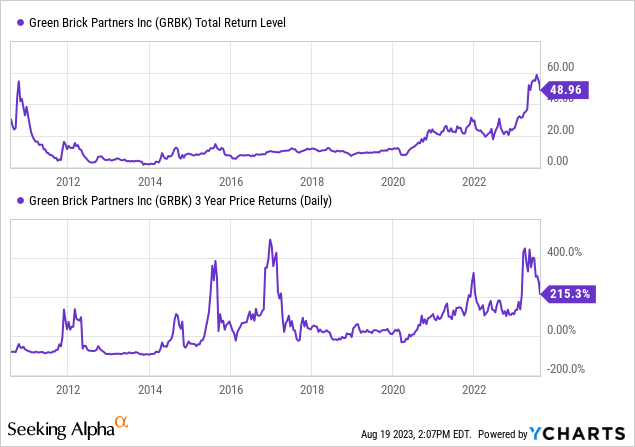

Another data point revolving around an “overbought” position for shares is to look at trailing 3-year price action. When gains of +300% or greater have appeared like early summer 2023, it has proven prudent to step aside for a spell. 2015, 2017, and late 2021, are all examples of price rising too fast over intermediate time scales, then retracing each advance over the following 6-12 months (if not longer). Will history repeat?

YCharts – Green Brick Partners, 3-Year Rolling Performance vs. Share Price, Since 2011

What circumstances would change my mind? I think a robust economy combined with far lower interest rates would keep home construction trends in high gear. Another 20% or 30% of price upside may remain under this scenario, pushing GRBK’s valuation to a fully-valued cycle peak area. Nevertheless, this rosy/bullish scenario appears rather unlikely.

At this stage, I feel the chances for Green Brick “underperformance” of the S&P 500 over the next 12 months are now better than the average equity. Despite valuation metrics that seem to retain clear appeal (P/E of 8x), I am downgrading my rating to Hold. Housing stocks always look cheapest near a cycle peak, with monster write-offs and operating losses near a major industry bottom. That’s what makes investing difficult for rearview mirror thinkers.

If a cyclical downturn in housing construction is approaching, liquidating some to all of your position around a price peak may be the best way to play this name. In addition, if you are considering purchasing a new position, I would hold off for lower quotes this autumn.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Read the full article here