Friday came within 10 points of last year’s high give or take, then turned upward

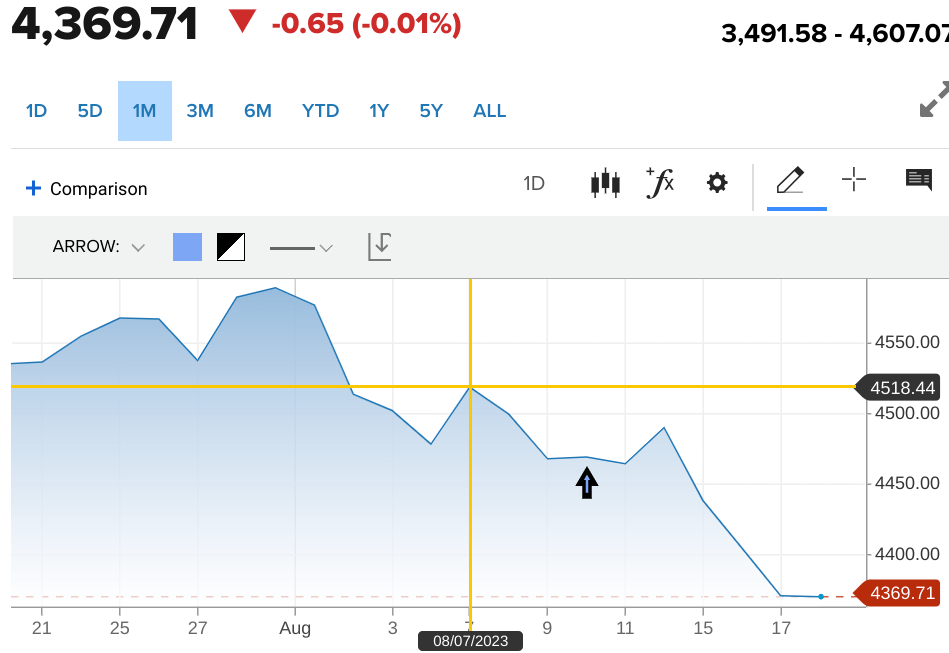

My expectation was that the reversal would have after the FOMC minutes were released. This would conform to selling on the “rumor” and buying on the “fact”. The fact is there was nothing new in the minutes, they were based on old data. According to the latest survey, we now have future Inflation expectations in the 3% range. There was a bunch of data that shows that inflation especially core inflation is moving down. Instead, the selling intensified and continued lower Thursday and into Friday morning. In the morning the S&P500 fell to about 4335 which is +10 above last year’s high of 4325. Soon after buyers came in and pushed above yesterday’s close at 4381 before it closed flat at 4369.71 -0.01%. This is a strong reversal to the week’s downward slide. It should portend a buoyant start to next week. Let’s look at the 1-month chart of the S&P 500.

CNBC

This is courtesy of CNBC, it is the easiest way to find the actual S&P 500. I put an arrow where I believe the first level of real resistance might be, and where I think this week’s rally might stall. Where that is 4468 about 100 points from Friday’s close. The yellow line is where we might reach if Powell claims victory at Jackson Hole, and that the Fed will no longer need to raise rates.

Let’s be realistic Powell is not going to be giving us soothing words

Everyone expects harsh rhetoric from Powell since that is what happened last year, he “read the riot act” to the bulls and the market promptly cratered. He will at least hint at one more raise likely for November, and say that he will continue to be data-dependent. The key is he will in no uncertain terms state that he doesn’t see a need to lower rates until 2025. Will that sell off the market? I am not sure, frankly, if the market moves up 10-20 S&P points per day, then by Thursday, we’d be up 60 points tops. That isn’t overextended, and at this point hasn’t everyone accepted that interest rates aren’t falling anytime soon? The convexity is “dis-inverting” by having the 10-Y rate moving upward with alacrity and the 2-Y staying under 5%. This is happening because the economy is strong, not because the Fed is raising rates. This is a good thing and the market will eventually acclimate to the current rise which could talk the 10-Y Treasury to 5.50%, which means mortgage rates will be at or over 8%. I know this sounds radical coming from ZIRP – Zero Interest Rate Policy we had for so long. Guess what, plenty of homes sold at that rate years ago. There will be an upstart coming along that will find a way to lower the cost of a single-family home. That is another topic for another time. The question is, is the market ready to hear that? It all depends upon the 10-Y moving up in smaller increments. If it stays under 4.30% for all of this week, I think the market can handle it. If the 10-Y blasts up another 10 basis points Monday morning you can kiss any rally goodbye. I just took a peek at the futures both the Nasdaq and the S&P500 are green. It’s only 8:45 pm Eastern on a Sunday night but I’ll take it.

So if the 10-Year behaves what else could go wrong? Big tech like Apple (AAPL) needs to stabilize

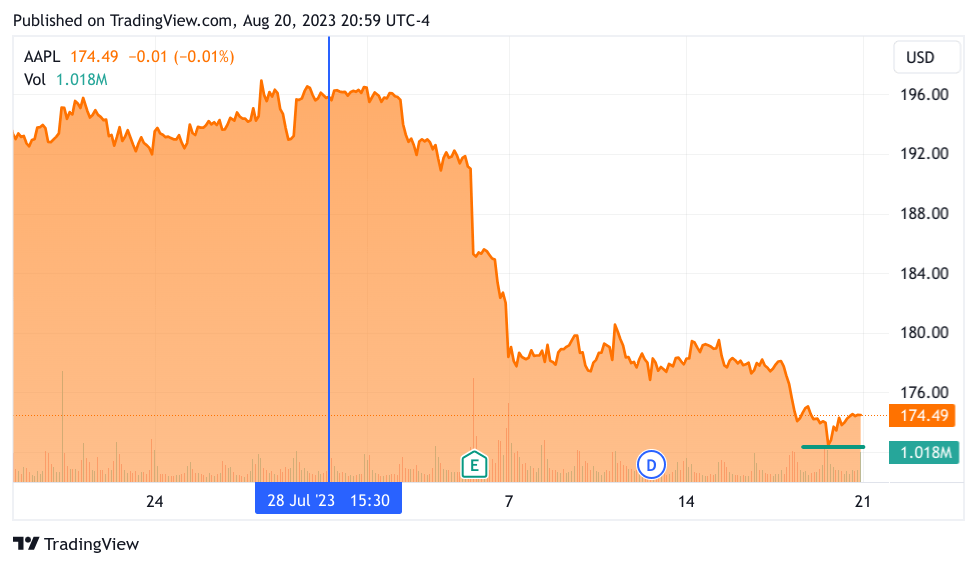

I mention AAPL but all the Great 8 including Netflix (NFLX), have been decidedly weak. Back on July 30, the title was “Trees Don’t Grow to the Sky, and Neither Does Apple”. I got hate mail for that but take a look at this chart now. I wrote the article on Sunday, July 30, the vertical line is the 31 of July. So there was no trendline showing the downside. I was guided by the previous trendline which went up and up without respite and giving AAPL a huge PE ratio.

TradingView

This is a one-month chart and I am not sure that AAPL is over its selling jag yet. It might continue to weigh on the market or only move up grudgingly because it is part of so many ETFs.

I got some hate in the comment section, pretty much saying that AAPL will never go down, or that they were up 33% so why should they sell? The worst reaction was when they heard that I had the temerity not to own AAPL. Anyway, I digress, personally I still wouldn’t own AAPL. Let’s see if they can actually grow their overall revenue this quarter. I favor growth stocks that actually grow. Yes, they make all kinds of money because of the Apps Store, services are growing and they add more and more services. Great. AAPL has demonstrated time and again that it can sell off for a sustained period of time. If it gets low enough I might trade it. I might invest if they actually come out with that Apple iCar or whatever they will call it. So this is my concern, AAPL, Netflix, Nvidia (NVDA), and Tesla (TSLA) all have terrible charts. Here are a few:

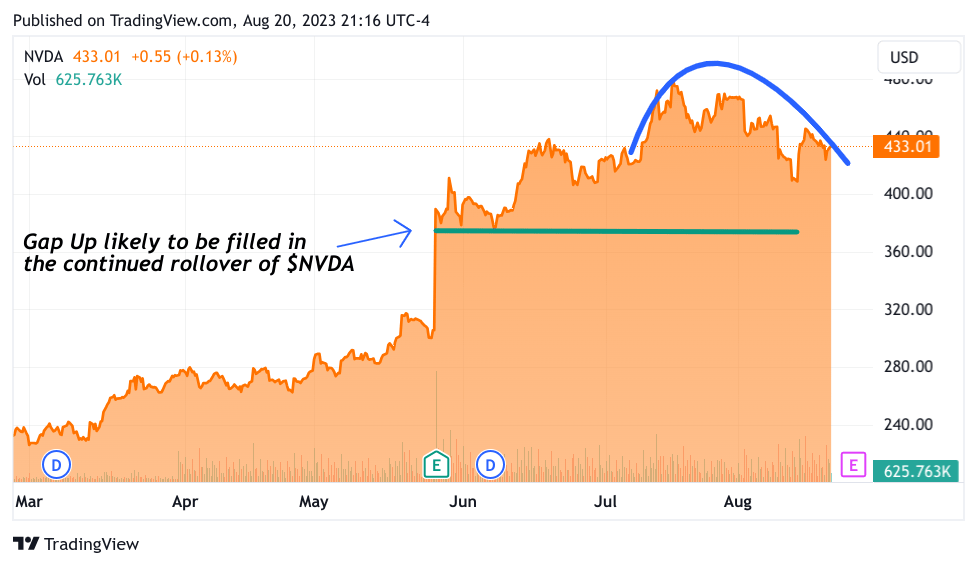

TradingView

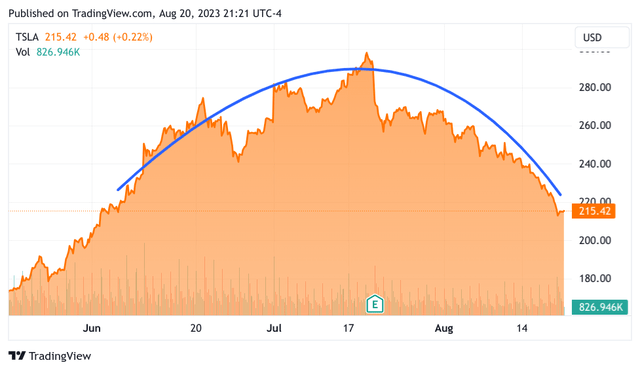

NVDA is rolling over and could fall past that green line which is poor support and fill the “gap down” to the left. TSLA is particularly bad, you know how I say that I like rounding bottoms? Another way to put it is that it’s a “bearish to bullish” reversal. For TSLA it is the opposite, a rounding top.

TradingView

This is the hugest “bullish to bearish” I’ve seen I think, ever. Ok enough with the bearish conjecture. What do we do?

This is my plan

I believe that the market starts out positive. I could even see the market have a nice rally going into Wednesday. I am going to close out my long options positions slowly. By the end of Tuesday, I am going to start hedging again, probably these first call options will not generate a lot of alpha if my premise is correct and the market continues to rise on Wednesday. He speaks on August 25, and 10.05 am Eastern. Who knows maybe the market opens up in the positive on Thursday the 24 and keeps going! All the while I will keep adding hedges through call options or put options whichever looks cheaper. Jerome Powell will HAVE to say that rate rises are on offer, and that there will be no rate cuts not even in 2024. All this has been made plain many times. Now let me put together that narrative with the biggest capitalized stocks in the history of stock markets, with nearly universal crummy charts. Unfortunately, that adds up to another sell-off and another test of 4320. I think it holds, there is just too much other positive stuff going on like the Atlanta Fed predicting that Q3 will show 5.8% GDP. Yes, it’s the first release and they always overshoot, so cut it to 3%. 3% is huge! It shows an economy that is accelerating while at the same time lowering inflation. How is that possible? Productivity. Also, we have more workers than can be counted by conventional means. This is not the tight labor market that economists are claiming. I believe I’ve said this before, there are a lot of willing workers who are finding a way to work in the US.

So I am not a bear, in the medium and long term

I left out the VIX in this discussion. I expect it to fall all week, that will be my confirmation that the market will be complacent before the Powell speech. Once it gets into the low 15s it will be part of my hedging regimen. I expect that by the week after the stock market will reverse again and the rally continues. At least to some point in September, when the market gets really heavy. It’s the strongest seasonal pattern on the calendar and we have to respect that. After September is over, maybe we can get more positive, as we close out the year breaking old highs.

Last week I mentioned that I have 3 biotechs that I am currently buying here they are:

I just scanned the article and I promised 5, I am going to keep it to the 3 best. They are Apellis (APLS), Axsome (AXSM) and the 3rd is Sage Therapeutics (SAGE). I have them in equity but I am also trading in Call options. Each one had strong selling by market participants but in my opinion, they are not good reasons. Do your own research and see if you agree.

Let me summarize

The week will start off bullish and in fact, I am expecting upward momentum to build as the week progresses, We may even see Thursday moving higher. All the while I will be trimming positions, especially my Call options, and instead will put that cash into hedges. I think the VIX will reverse and that will be part of my hedging process as well. August 25 Powell uses Jackson Hole to be hawkish once again, there will be one more hike in the future, and there won’t be any interest rate cuts for the foreseeable future. The market sells back down to test 4320 one more time and it holds. The week after at some point the market reverses again as more economic news dribbles out. We might get some heartening news from what is left of the earnings reports this week.

Good luck everyone!

Read the full article here