Asana, Inc. (NYSE:ASAN) is a software company operating in the crowded space of work management tools. Shares have been on a tear as of late, with their value climbing an impressive 52% YTD. Granted, the company’s market value is still a far cry from the level reached during the COVID market bubble, however the recent performance on the market was very much welcomed by old and new shareholders alike.

I recognize that Asana is targeting an interesting and probably growing Total Addressable Market, however after reviewing how the company has performed over the past 3 years I came to the conclusion that it is not the right investment for me. There’s some to like, such as sky-high gross margins and growing customer base, however the positives are outweighed in my opinion by consistent losses and huge shares dilution. I don’t like the risk-reward at this price and I will personally stay on the sidelines.

Asana targets an interesting niche of the IT market

As with many other software companies, Asana was founded when the co-founders experienced first-hand a problem and decided to fix it. While working at Facebook, they saw how productivity was impacted by employees wasting a lot of time simply thinking about work itself: who was working on what task, who was responsible for which project and so forth. We have all experienced the endless stream of emails, messages, spreadsheets that teams rely upon for organizing workflows. As per Asana’s most recent Anatomy of Work Index report, an estimated 58% of knowledge work is dedicated solely on trying to disentangle the interconnected web of collaborative work across many teams. By recognizing that work is mostly a result of cross interactions across different teams, Asana developed the Asana Work Graph, a technology that allows employees of a company to have an always-up-to-date record of every project, task, document that is currently under development in the company.

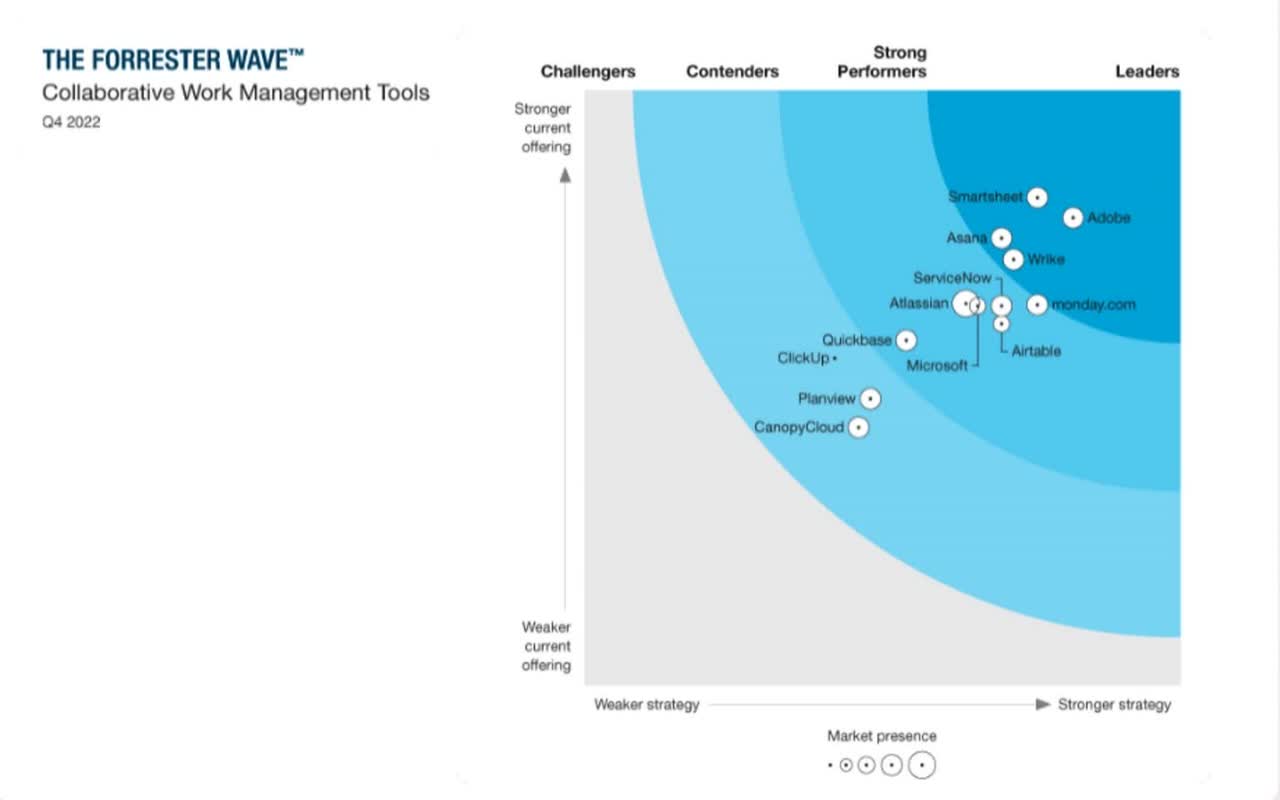

Asana is considered a Leader on collaborative work management tools (Asana Investor Presentation)

As simple as it might sound, Asana has clearly struck a chord among companies as the productivity benefits of adopting this technology quickly became evident. After being implemented, Asana’s products quickly became structurally important to its customers as evidenced by the company’s Dollar-Based Net Retention Rate: this metric is very popular among software companies and in practical terms it indicates how much existing customers are paying more compared to the prior year. ASANA’s overall DBNRR is over 110%, but it actually improves substantially if we consider customer cohorts spending more. As per the most recent filings, customers spending at least $5,000 per year had a DBNRR of over 115%, while customers spending at least $100,000 reached over 130%. The fact that Asana becomes more important the more customers spends bodes very well for the company’s land and expand model: many customers initially sign-up either for a completely free product or for a free version of a paid one; once they realize the value that the product provides however, they often end up purchasing more seats and rely more and more on Asana for driving productivity higher.

Asana Investor Presentation

Revenue growth was also much higher for buyers spending at least $100,000 per year compared with those spending only $5,000 (31% compared with 19%), again demonstrating the increasing value provided by Asana to big organization. In some way Asana exemplifies what is good of software companies on the financial side. The costs of providing the product are incredibly low, especially once the company reaches a certain scale. As a result, Asana has consistently reported Gross Margins of around 90%, best-in-class for any software company available in the market today.

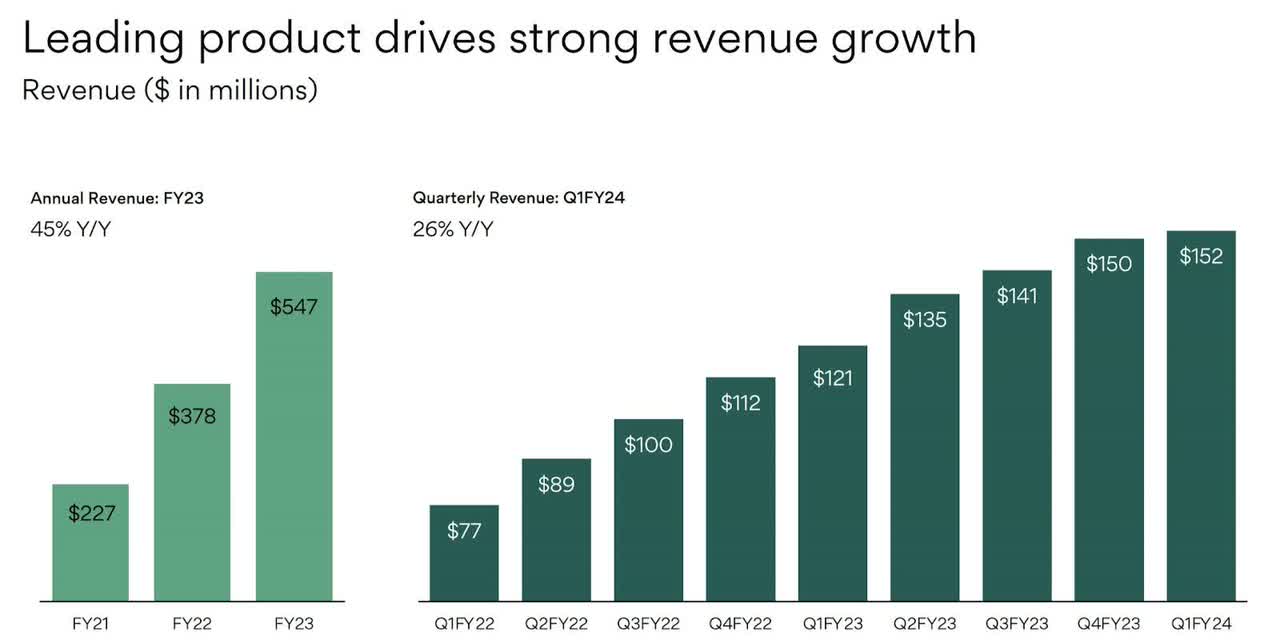

The company is still very far from profitability

As much as I appreciate the success in terms of the number of customers and the ROI that they enjoy from implementing Asana in their workflow, I must admit that I am not particularly in love with the company’s overall financial profile. Since its IPO in 2020, ASAN generally recorded very high annual top-line growth rates of around 60-80%, clearly aided by the lockdown orders issued by the governments around the world in an attempt to curb the spread of COVID19. As impressive as this performance was, it cannot be ignored that for the past 8 quarters or so the growth slowed consistently, until reaching 26% in the latest quarter and will probably be around 18% for the full year by considering management guidance. Still positive and all, just not as astounding as in the past. I get the feeling that we actually have no idea of what a normal environment means for a company like Asana, which adds uncertainty and clearly affects the market sentiment towards the stock.

Moreover, although the company took advantage of cheap money and lockdown orders to invest heavily into its growth and attract a lot of customers, I don’t particularly like seeing Cash from Operation still consistently negative quarter after quarter. I would expect ASAN to clearly show improvements in that sense considering the incredibly high Gross Margins, however that does not seem to be the case so far. I must say that there are other companies such as monday.com | A new way of working (MNDY), which are active in the same market and are of relatively similar size, operating at positive free cash flow and clearly showing initial signs of scale

On this note, the company’s latest quarter showed very early signs of operating cost rationalization. This quarter was indeed the first ever for the company in which operating costs did not grow YoY but remained actually flat, which coupled with a healthy revenue growth resulted in an improvement in operating loss from -$96 million to -$65 million. Baby steps.

While I don’t see ASAN showing meaningful signs of economy of scale, its balance sheet does not look extremely reassuring either. In FY2020 and FY2021 the company took on debt ($300 million and $180 million respectively) to bolster its position as cost of capital at the time was particularly low. In FY2023 ASAN has instead relied on stock issuance for $370 million to fund its operation, in a clear change of strategy due to the Federal Reserve hiking interest rates and making it much harder to get access to cash. As a result, in the latest TTM Asana has burned through $133 million just from operating and is now left with about $523 million of cash and cash equivalents. Again, nothing to particularly worry about but definitely not the strongest financial profile I’ve seen lately.

Stock-based Compensation and inside ownership

When analyzing software companies I always dedicate some time to review their policies around Stock Based Compensation (SBC). Growth companies have traditionally relied somewhat heavily on stock issuance to partially remunerate their employees in order to retain cash to invest into more growth. I have nothing against this strategy for growth companies because I actually think it often makes a lot of sense: these kinds of companies are often trying to turbocharge their growth in order to reap the benefits of economic scale sooner rather than later. SBC compensation allows management to attract top talents by offering compelling compensations, while also retaining more cash to be used for investments, supposedly at a good ROI being them high growth companies. The natural result is share dilution which directly impacts current shareholders.

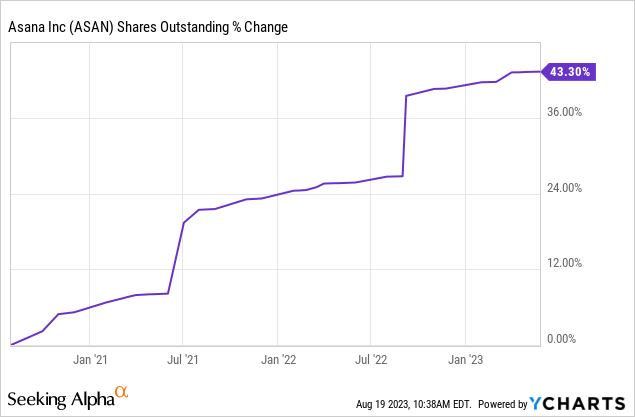

As it turns out, Asana’s SBC appears to be a bit out of control as in the latest 3 quarters Total Shares Outstanding increased YoY by around 14%. That is a clear negative in my book, because it means that current shareholders effectively own 14% less of the company compared to last year, a very meaningful number considering that a common benchmark to evaluate potential investments is about 10%-12% of yearly return.

YCharts – Seeking Alpha

On the flipside, it is worth mentioning that insiders own a large chunk of the company which is always good to see. CEO and co-founder Dustin Moskovitz has been a serial buyer of Asana’s stock since its IPO despite its share price continuing to plummet. As per most recent reports, Moskovitz personally holds about 51% of the outstanding stock. His frequent purchases of ASAN shares clearly show that the management is still very bullish on the long-term prospects of the company despite the dilution and the current losses.

Valuation and key takeaways

Since Asana’s IPO in late 2020 the company’s stock has experienced both exuberant and depressing times, like many of its peers. The share price is down an astonishing 85% from all-time highs, however despite this massive repricing shares are still very far from cheap. As ASAN is currently unprofitable both from a Free Cash Flow and a GAAP perspective, assigning a valuation to the stock is very complicated as it necessitates several assumptions.

On a Price to Sales ratio the stock is currently trading at multiple of 7x, expensive on its own but actually cheaper that peers such as Atlassian (TEAM, 13.4x) and monday.com, 12.2x), however understandingly so considering that both are currently already profitable.

If we consider an imaginary 20% FCF margin which is possible based on mature software companies of similar nature (TEAM’s TTM FCF margin is currently 27%), that would imply a current Price to potential FCF of 38x which is still very expensive, especially considering that we are assessing a purely fictitious profitability.

Overall I personally don’t think ASAN is the right fit for me at this price. I would never bet against it as anything can happen and customers seem to like the product, however the stock is relatively expensive, the company is very far from profitability and is currently diluting shareholders like crazy (around 14% YoY). I am happy to stay on the sidelines on this one. If I happen to miss out on a big one, so be it: that is, oftentimes, what investing is about after all.

Read the full article here