There is a French expression marcher sur la tête which roughly translates to it’s as logical as walking on the head. It in many ways encapsulates the current period of the US capital markets with REITs currently selling off because of healthy employment figures, strong retail sales, and resilient GDP growth. AGNC’s (NASDAQ:AGNC) common shares have lost 25% of their value over the last 1 -year, a 13.6% loss on a total return basis on the back of a Fed funds rate being hiked to a 22-year high at 5.25% to 5.50%. However, good is now bad and a strong economy has pushed up rate hike concerns and reinvigorated the sell REIT trade that dominated much of 2022 and early 2023.

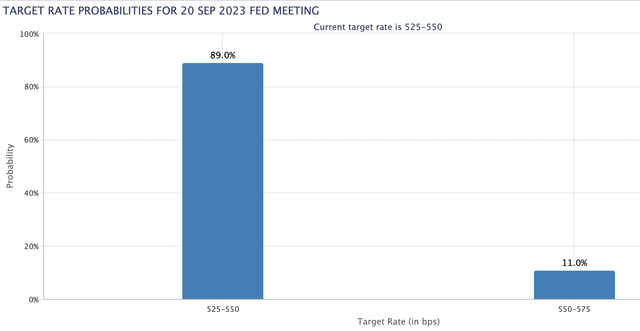

CME FedWatch Tool

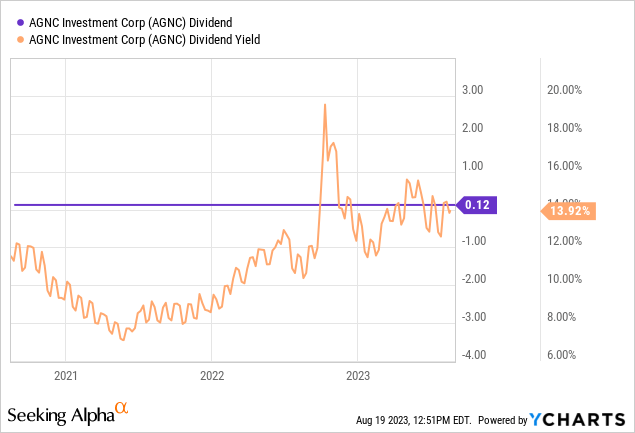

The Federal Open Market Committee is set to next meet on the 20th of September but the probability of a second rate hike after the June pause still sits quite low at 11%, but up from around a 10% chance a week ago. Critically, the income is the prize and AGNC has maintained its current monthly payout at $0.12 per share for the last 3 years since the pandemic forced a 25% cut. That was painful, but it was hard to foresee COVID, which sparked margin calls on AGNC’s heavily levered agency MBS portfolio. Critically, the current payout is safe and its hefty monthly paid yield should help form a source of salary-like income against the economic chaos that has defined much of the post-pandemic economic zeitgeist. AGNC’s management was open during the second quarter earnings call on macroeconomic factors forming the primary drivers of their portfolio performance.

Is The Yield Safe?

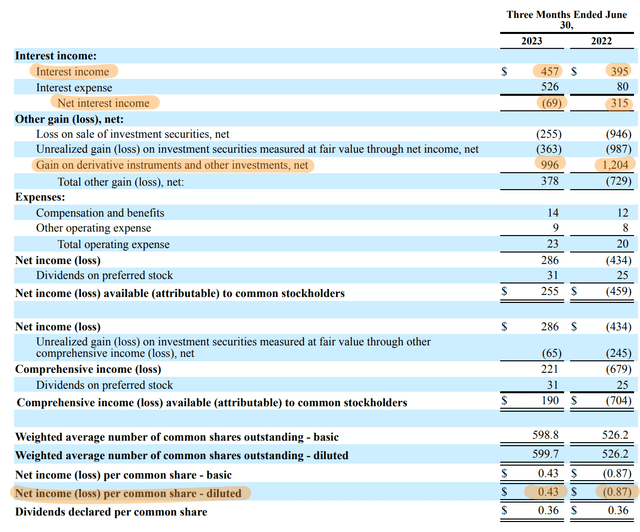

The second quarter was a period when debt ceiling uncertainty and the specter of a government default sparked agency MBS volatility and pushed spreads to their widest level since the 2008 great financial crisis. AGNC reported fiscal 2023 second-quarter earnings that saw a net interest loss of $69 million recorded versus a profit of $315 million in the year-ago quarter on the back of interest expenses that jumped around 6.5x over its year-ago comp to $526 million.

AGNC Investment Corp Fiscal 2023 Second Quarter Form 10-Q

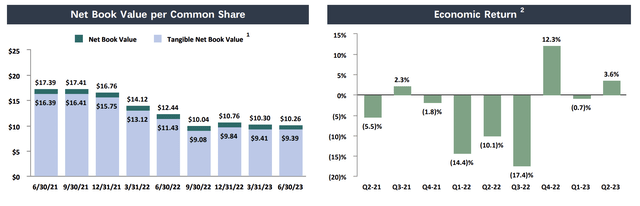

The mREIT recorded a comprehensive income of $0.32 per share on the back of leverage at the second quarter end of 7.2x tangible equity. AGNC’s economic return on tangible common equity was 3.6% during the quarter, driven by a dip in tangible net book value and $0.36 per share in dividends declared. Critically, the dividend was 186% covered by a $0.67 net spread and dollar roll income per share. However, this non-GAAP EPS measure was down from $0.83 per share in the year-ago period.

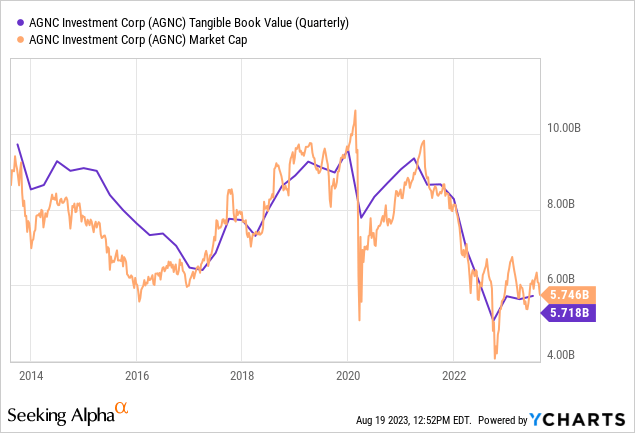

The Direction Of Tangible Book Value

Investors should pay close attention to tangible book value which in many ways dictates the direction of the stock price. To be clear, AGNC’s double-digit yield whilst far in excess of many competing income-focused tickers, has been set against the backdrop of tangible book value faced with pressure. The mREIT reported a second-quarter tangible net book value of $9.39 per share, a dip of around 2 cents sequentially from the first quarter. AGNC’s tangible book value over the last decade has been volatile and mostly trended downwards. 2022 formed the most material pullback of this on the back of ten consecutive Fed rate hikes in one of the fastest paces of monetary tightening in decades.

AGNC Investment Corp Fiscal 2023 Second Quarter Presentation

Four of AGNC’s preferreds are also still trading at discounts to their par value with the Series G fixed-rate reset preferreds (NASDAQ:AGNCL) now currently offering a yield on cost of 8.71%, around 630 basis points lower than the commons. The Series C (AGNCN) fixed-to-floating rate offers the highest yield as they floated first with their floating rate mechanism currently pushing through a 10% yield on cost. These continue to be a way to gain exposure to the ticker without the inherent volatility of tangible book value with the commons.

AGNC Investment Corp Fiscal 2023 Second Quarter Presentation

I’m positive that the common shares will perform better through the end of 2023 and next year. This comes as recession expectations for 2023 have also been scrapped with J.P. Morgan no longer forecasting a US recession this year. Next year might also see the US skirt a hard landing with Goldman Sachs cutting the probability of a recession in 2024 to 20% from a prior 25% stance. The dividend is currently covered and this coverage looks set to be repeated through the final two quarters of 2023. The question is which positioning to take from a risk perspective. AGNC has made progress with stabilizing net book value over the last three quarters with its per share tangible net book value for the second quarter up from three quarters ago. The ticker is a hold here.

Read the full article here