A few days ago, in one of my “lessons learned” articles I explained that when I was a real estate developer, and “one of my trophy assets was a shopping center known as Blackstock Center that was anchored by PetSmart, Party City, and Red Lobster.

What made this property a “trophy” – in my definition – is the fact that it is located on a terrific site alongside a well-traveled Interstate and near other retailers such as Home Depot, Lowe’s and Wal-Mart.

Selecting sites is an important part of the value creation process and having developed sites for a long list of retailers, I feel as though I have a PhD in value creation “from the ground up”. Consider these companies that I have developed stores for:

- Walmart (WMT)

- PetSmart

- Goodyear Tire (GT)

- Advance Auto Parts (AAP)

- O’Reilly Auto Parts (ORLY)

- Walgreens (WBA)

- CVS (CVS)

- Aaron Rents (AAN)

- Buddy’s

- Barnes & Noble

- McDonald’s (MCD)

- Wendy’s (WEN)

- Papa John’s (PZZA)

- Eckerd Drug

- Blockbuster Video

- Hollywood Video

- Food Lion

- Bi-Lo

- Dollar Tree (Dollar Tree, Inc. (DLTR)

- Dollar General (DG)

- Family Dollar (DLTR)

- Lowe’s Food (LOW)

- Alltel

- Verizon (VZ)

- Subway

- Hibbett Sports (HIBB)

- Red Lobster

- IHOP

- Waffle House

- Sherwin Williams (SHW)

- Rent-A-Center

- Domino’s Pizza (DPZ)

- Outback (BLMN)

- Applebee’s

- Dunkin Donuts

The list goes on and on…

Prior to writing on Seeking Alpha, I was a real estate dealmaker and over the decades I was involved in over $1 Billion in deals.

Most of these deals were located on fee-simple real estate, which simply means that I owned the land underneath the buildings that I invested in.

However, Blackstock Center (that I referenced earlier) is on a ground lease which means that someone else owns the dirt.

Although it may seem unusual for a developer to construct a building on land owned by someone else, there are good reasons that a ground lease is advantageous to all parties involved.

The biggest advantage for a tenant (i.e. developer like me) is that a ground lease provides access to well-located land that otherwise couldn’t be purchased (that’s exactly why I leased the land at Blackstock Center).

Also, this is why ground leases are popular with big retail tenants such as McDonald’s, Chick-fil-a, and Starbucks.

A second advantage of a ground lease is that the tenant (i.e. developer like me) does not have to come up with the upfront cash to purchase the land. So, this lowers the upfront equity requirement, freeing up cash and enhancing the yield on cost.

In the case of Blackstock Center, the construction costs were around $6 million, and the ground rent was around $150,000 per year. The gross cash flow that the property generated was in excess of $1 million per year (now you know why I called it a trophy).

For the landowner, a ground lease provides a stable income stream while still allowing the landlord to retain ownership of the land.

Usually, ground leases have built-in rent escalation clauses and eviction rights, which provides the landowner sufficient rent increases over the term of the lease as well as further downside protection in the event of a default.

One of the most overlooked benefits of a ground lease, for the landowner, is the reversion rights, which transfers the ownership of the improvements to the landowner at the end of the lease term.

In my view, being a landowner in a ground lease transaction is the ultimate “sleep well at night” investment because it combines the best of both worlds: predictable income and reversion rights.

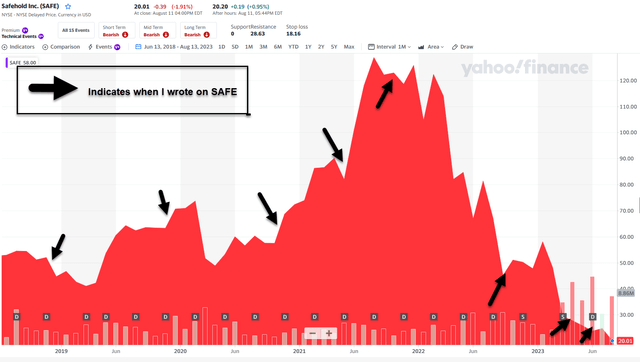

Today I want to highlight a pure-play ground lease REIT known as Safehold (Safehold Inc. (NYSE:SAFE) Stock Price Today, Quote & News). I’ve written on the company in the past:

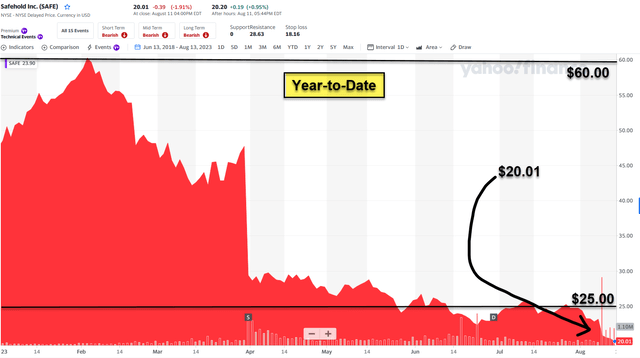

Yahoo Finance

A few weeks ago, I wrote an article explaining my three biggest losers in 2023 and SAFE was on the list. I explained that “I’ve eaten my fair share of crow here on Seeking Alpha” and while SAFE has been a tough pill to swallow, I’m not backing down.

For the record, I’m still long SAFE (2 accounts: -37.5% in one and -28% in the other one). Combined (both portfolios), I hold around 2.5% of SAFE in these combined investment accounts.

SAFE: The Basics

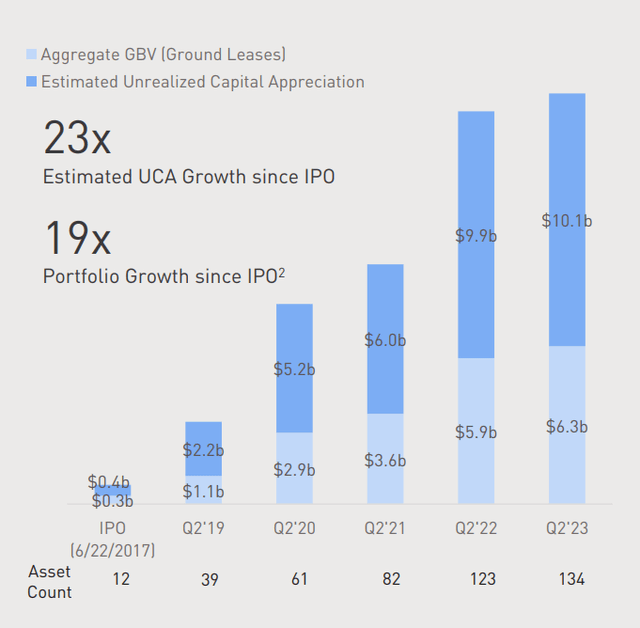

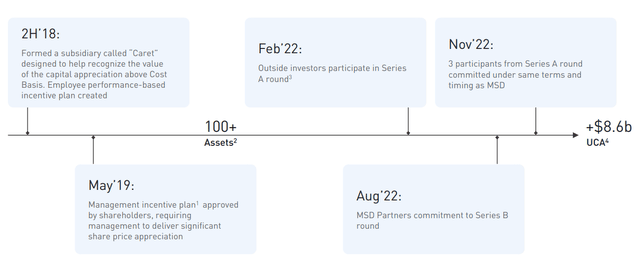

Since going public in an IPO in 2017 SAFE has grown the lease portfolio from around $300 million to over $6.3 billion (over 19x). The reversion value of the ground lease portfolio, or what’s referred to as “unrealized capital appreciation” has grown from around $400 million to over $10.1 billion.

SAFE Investor Presentation

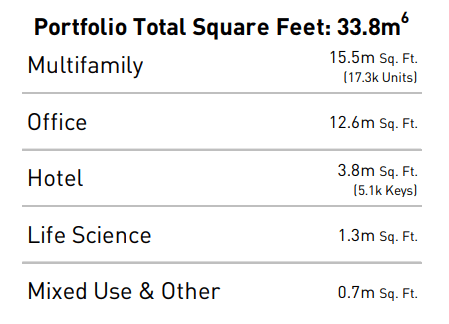

This is amazing growth for any REIT, and SAFE has continued to scale its business during and after the global pandemic. As seen below, SAFE has also assembled a diversified portfolio of ground leases in multifamily, office, hotel, life science, and other.

SAFE Investor Presentation

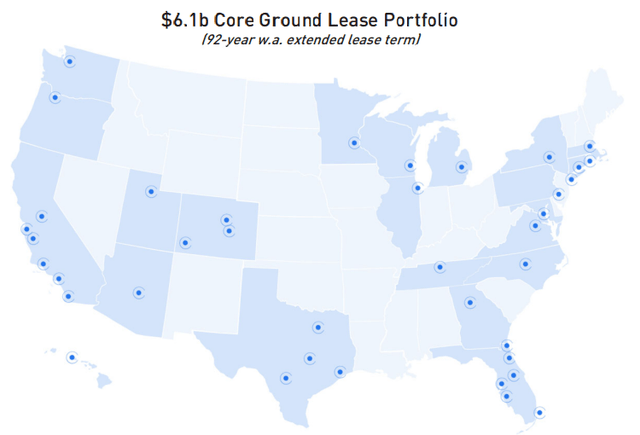

SAFE has also expanded the portfolio geographically and as seen below, the company owns sites in markets such as Manhattan (23%), Washington, DC (11%), Boston (7%), Los Angeles (7%), San Francisco (4%), Denver (4%), Honolulu (4%), Nashville (4%), Miami (3%), and Atlanta (3%).

SAFE Investor Presentation

One thing worth pointing out here is that the ground leases are long duration, SAFE’s WALT is ~90 years, and while these long-term leases may not seem attractive (in the eyes of Mr. Market), SAFE’s leases have CPI-linked escalators (capped 3% to 3.5%) on 83% of its leases.

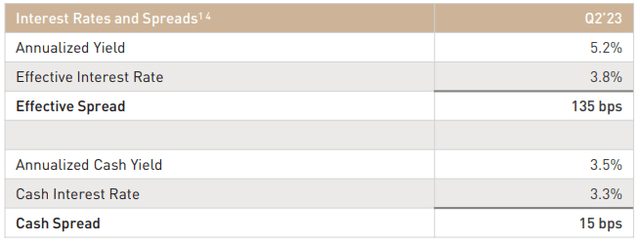

On a GAAP basis (as seen below), SAFE’s portfolio generates a cash yield of 3.5% and an annualized yield of 5.2%, presuming a 0% inflationary environment for the length of the ground leases.

Note the disconnect between economic returns and what SAFE recognizes for GAAP. Once again, the majority of SAFE’s portfolio consists of ground leases with contractual compounding cash flows and periodic CPI lookbacks.

SAFE Investor Presentation

In a recent article I explained,

“…there’s a good chance that the moves that the Fed has made to reduce inflation (rapidly raising interest rates) will eventually lead to a recession. When this occurs their most likely course of action will be to cut rates to help spur economic growth.

And when that happens the yields on short-term bonds (and therefore, money market funds) will fall. The way I see it, your guess is as good as mine when it comes to the timing of major macro shifts like that.”

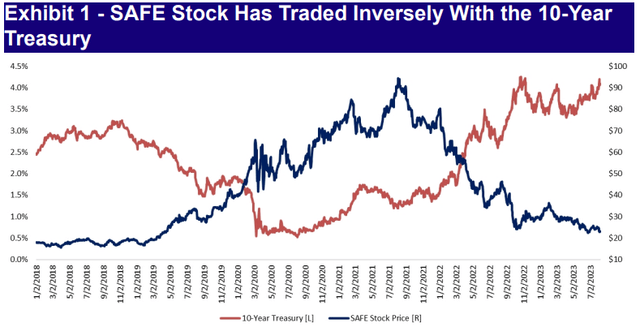

However, it appears that rates have “peaked”, which has noticeably been a headwind for SAFE and longer-duration REITs (i.e. O, NNN, VICI, ADC, etc…) since last March, and that “higher-for-longer” rationale is likely to continue into 2H23 before a possible rate cut in 2024.

Mizuho Securities

A SAFE Balance Sheet

At the end of Q2-23 SAFE had approximately $4.3 billion of debt comprised of $1.5 billion of unsecured notes, $1.5 billion of non-recourse secured debt, $1 billion drawn on the unsecured revolver, and $272 million of (pro rata share of) debt on ground leases owned in JVs.

SAFE’s weighted average debt maturity is approximately 23 years, with no corporate maturities due until 2026 (just the revolver). SAFE had approximately $816 million of cash and credit facility availability.

At the end of Q2-23 SAFE was levered 1.9x on a total debt-to-book equity basis and the effective interest rate on permanent debt was 3.8% (135 bps spread to the 5.2% GAAP annualized yield I mentioned earlier).

Notably, SAFE is on a positive outlook at both Moody’s and Fitch which means the company is on track for a potential credit rating upgrade from BBB+ to A- (over the next 12 to 18 months).

Also, days ago SAFE commenced an underwritten public offering to sell 6.5M shares to certain affiliates of MSD Partners, L.P. in a private placement, a number of shares equal to ~8.5% of the total number of shares ($173 million), subject to a cap of 639,656 shares.

These proceeds will be used towards debt repayment and reinforcing the balance sheet (again, credit upgrade on the horizon) and to help fund an upcoming $500 million JV that was previously announced.

SAFE owned 55% of the venture with a leading sovereign wealth fund, and in addition to SAFE’s share of the ground lease economics it will earn a management fee with the potential for additional promote upside. According to Haendel St. Juste with Mizuho Research,

“SAFE issued capital at what management believed to be ~4% implied cap rate, with ~$150M of proceeds allocated towards paying down SAFE’s revolver (~6.5%), which stood at ~$1B at 2Q23-end. We estimate the net accretion (interest expense savings net of new equity costs) to SAFE to be ~5c / year.”

He added,

“SAFE issued now because it didn’t want to risk getting shut out of the equity capital markets until mid-September (or longer) and face the potential risk of other REITs stepping in ahead of them…and potentially delay / risk its expected credit upgrade.”

SAFE Investor Presentation

Latest Earnings

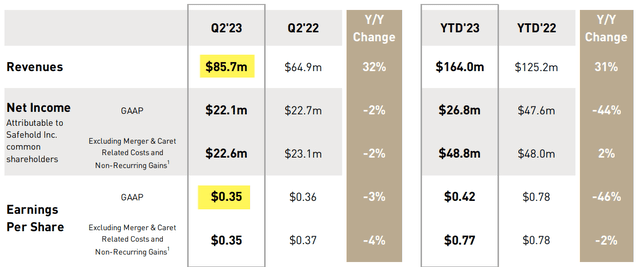

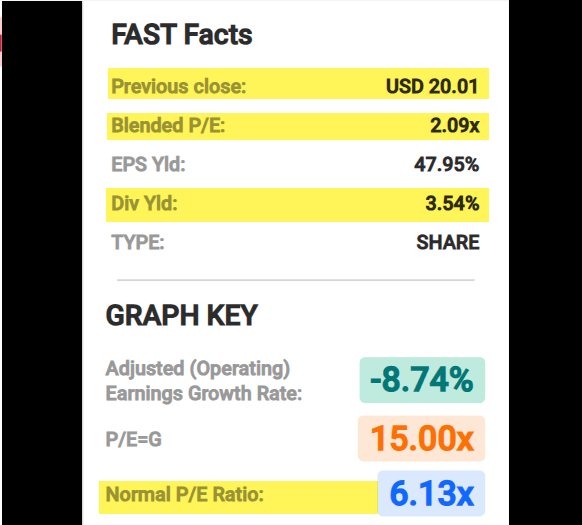

In Q2-23 SAFE generated revenue of $85.7 million, and net income of $22.1 million. EPS (earnings per share) was $0.35, which includes one-time merger costs with the external manager.

SAFE Investor Presentation

Mizuho trimmed its FY23e EPS estimate to $1.45 (from $1.48) and the FY24e EPS estimate to $1.60 (from $1.65) based upon “prevailing multiples and view on interest rates”.

SAFE’s current dividend payout is $.71 per share, which translates into a payout ratio of 49% (using Mizuho’s 2023 EPS estimate). Mizuho also lowered its PT to $25 from $31.

(Mizuho’s price target of $25 applies a 1x expansion to the 2023 P/E multiple to its 2024 EPS estimate, which “conservatively reflects the strength of its external growth pipeline and the overall platform”.)

Yahoo Finance

One catalyst worth noting here is that SAFE is well-positioned to grow its portfolio in this rising rate environment. As I have argued in the past, net lease REITs like Realty Income (O), Agree Realty (ADC) and VICI Properties (VICI) should all benefit because of the increased demand for sale-leaseback capital.

Corporate customers owning real estate are looking for ways to monetize buildings because rent costs are cheaper than debt costs. Similarly, SAFE should see more transaction activity as sellers rely on ground leases as a source of capital.

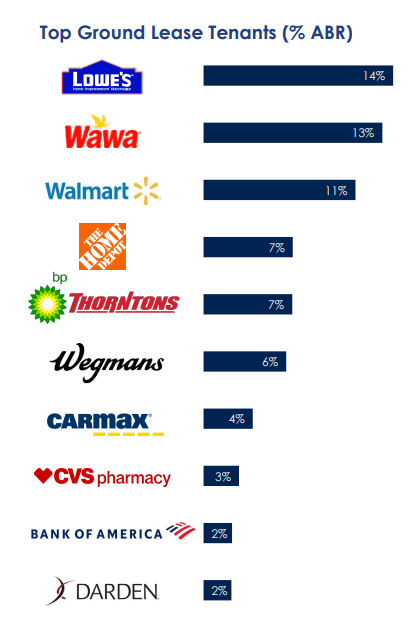

Other Equity REITs have entered the race, such as Agree Realty that owns 210 ground leases (87% investment grade rated customers) that account for 11.9% of ADC’s ABR (weighted lease term of 10.9 years).

ADC Investor Presentation

Our Buy target is price target is $30 which assumes SAFE generates excess returns and achieves its unrealized capital gain potential (also known as the Carat program).

SAFE Investor Presentation

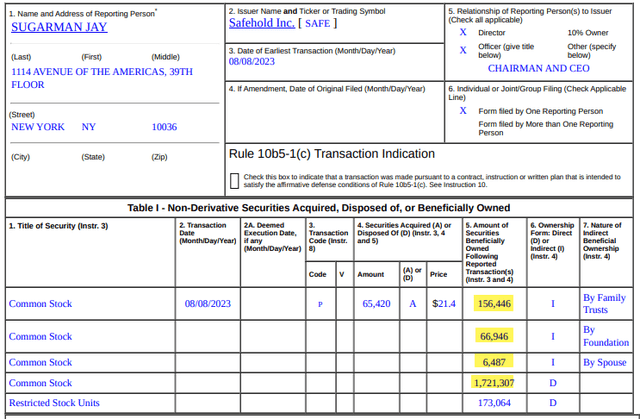

I also want to highlight the fact that Jay Sugarman, CEO, has been an active buyer of SAFE. A few days ago, he purchased 65,420 shares for his family trust ($1.4 million) and he holds over 1.95 million shares (worth ~$35 million) indirectly and directly.

SEC – Form 4

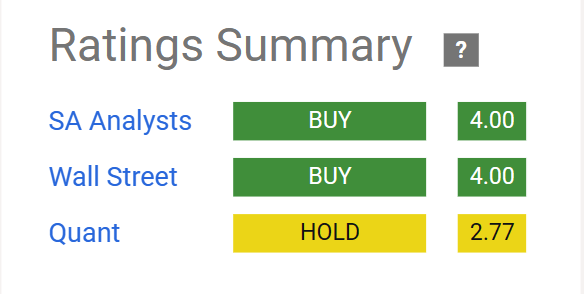

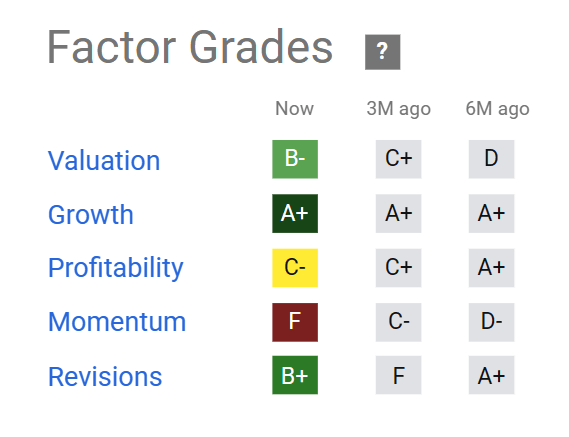

I plan to reach out to Sugarman this week in hopes of scheduling an interview, at which time I will make a decision as to whether I will Buy or Hold. We maintain a Strong Buy.

FAST Graphs

Seeking Alpha

Seeking Alpha

Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Read the full article here