Business development companies have experienced phenomenal growth due to their floating-rate portfolios and growing demand for alternative financing. In particular, venture lending businesses such as Horizon Technology Finance (NASDAQ:HRZN) and TriplePoint Venture Growth (NYSE:TPVG) saw robust net income growth, enabling them to return significant amounts of cash to shareholders. However, the increasing risk of defaults on portfolio holdings has raised concerns about future performance, prompting analysts to issue sell ratings for both companies. In my opinion, the concerns are genuine to some extent, but there is no immediate risk of a sharp stock price selloff or a dividend cut. Therefore, it might be prudent to consider the share price volatility as a buying opportunity. Furthermore, I believe Horizon is better positioned to weather headwinds and deliver high returns than TriplePoint.

Compass Point Sell Rating

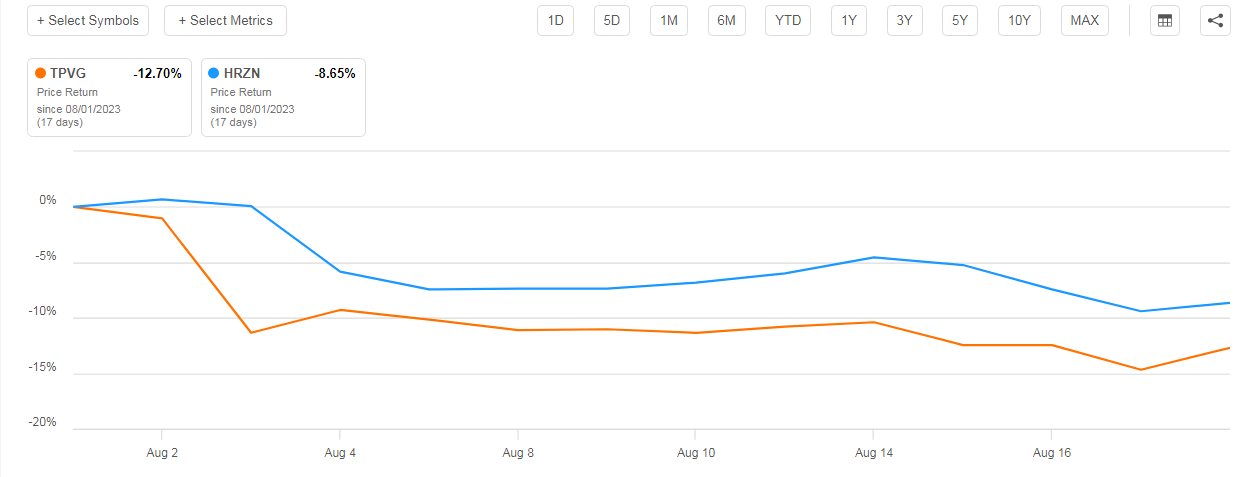

Horizon and TriplePoint’s Share Price Performance (Seeking Alpha)

Shares of TriplePoint have fallen roughly 12% since the beginning of August, while Horizon’s stock has plunged nearly 8%. Compass Point’s “Sell” ratings for both companies, combined with broader market volatility, contributed significantly to price volatility in the last two weeks. Horizon’s sell rating is based on the rating agency’s forecast that half of the portfolio companies in lower credit categories will default in the next four quarters. On the other hand, its analyst Alexander expressed concerns about the steep decline in TPBG’s net asset value and potential losses in the coming quarter. Let us look at the numbers for both companies to see if it is time to sell the stocks due to the risk of share price declines and dividend cuts.

Where Does Horizon Technology Stand?

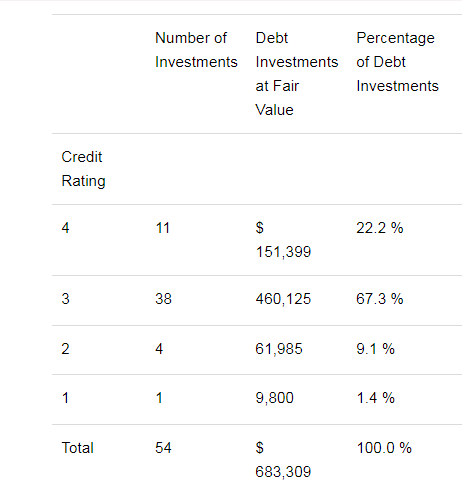

Horizon Portfolio Credit Rating (Earnings Release)

It’s true that Horizon Technology’s net asset value of $11.07 per share declined from $11.34 in the previous quarter because it wrote off three debt investments and reduced the fair value of other debt investments. It’s important to note that credit losses are a part of the lending business, and they have historically been higher during tight credit conditions and economic downturns. Right now, it appears that the worst is almost over for the venture lending company’s portfolio.

As of the end of June, around 22% of its debt investment was performing above expectations and ranked in the highest credit category 4, compared to 15% in the previous quarter. In addition, 67% of its investments were performing as expected. The number of risky debt investments in category 2 fell by 4% in the June quarter compared to the previous quarter. The company had only one debt investment rated highly risky with a portfolio weight of 1.4%, down from three in the previous quarter. Overall, Horizon’s loan portfolio had a weighted average credit rating of 3.1, up from 3.0 the previous quarter. A credit rating of 3 is considered a standard level of risk. Furthermore, the company’s strategy of funding existing portfolio holdings rather than new ones demonstrates its confidence in the growth prospects of its existing holdings. In the June quarter, it’s $50 million of 11 debt investments were mostly in existing holdings, with only two new companies.

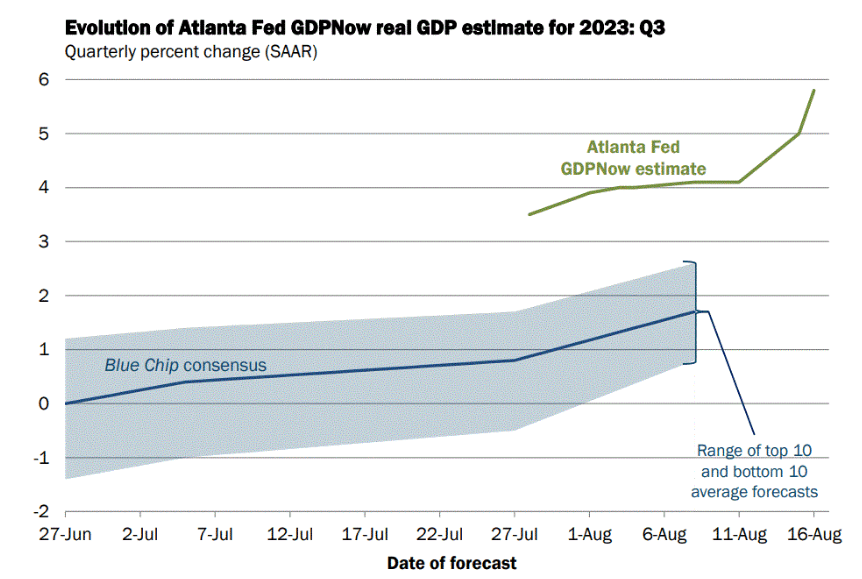

Q3 GDP Estimate (Fed Atlanta)

Another point to mention is that market fundamentals have improved significantly during the third quarter, with expectations for further growth in the fourth quarter. For instance, factors that created volatility in the VC market, such as the Fed’s rate hikes, have reached the terminal level, and a rate cut is highly anticipated in early 2024. Moreover, the US economy has been growing at a significantly faster pace than expected, with third-quarter GDP growth now anticipated to hit 5.8%. An improved economic environment would aid in increasing investor confidence in venture lending markets. PitchBook data also shows that headwinds began to weaken in the second quarter, with economic growth prospects and AI hype fueling investor optimism.

Net Investment Income Growth Negates The Risk of Lower Returns

Despite writing off three investments in the last quarter, Horizon’s portfolio generated a whopping 50% net investment income growth, thanks to floating rate investments and the Fed’s rate hike policy. Higher demand for alternative financing in venture lending has also contributed to the weighted average portfolio yield on debt investments reaching 16.7%. In fact, its net investment income per share of $0.54 for the June quarter compared to a quarterly distribution of $0.33 per share reflects the possibility of special dividends rather than a reduction.

Moreover, the earnings growth trend is likely to extend into the second half, as the company’s debt investment portfolio has yet to fully realize the impact of a 0.50% rate hike in the June quarter and a 0.25% increase in July. Improved portfolio credit ratings and new investments would also boost earnings growth potential. Horizon’s full-year net investment income expectations of around $1.84 per share for the full year compared to an annual distribution of $1.32 indicate a payout ratio of 72%, which is down significantly from the legally required payout ratio of 90%. Moreover, the company already had a spillover income of around $1.02 per share as of the end of the June quarter. Therefore, I anticipate a healthy special dividend along with a base dividend for shareholders. Although an interest rate cut in 2024 could have a negative impact on its floating rate portfolio, improved fundamentals in the VC market due to economic stabilization and investment in new opportunities would help the company offset the impact of a rate cut.

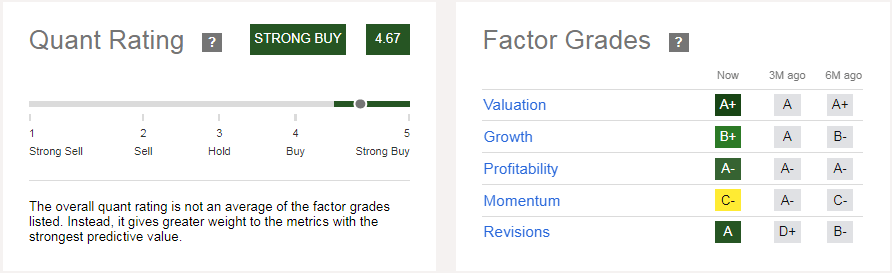

Horizon’s Quant Rating (Seeking Alpha)

Despite the recent selloff, Horizon’s stock is currently trading slightly above its net asset value. I anticipate a limited downside for its shares in the near future, with the expectation that strong forward earnings growth potential, combined with healthy dividends, will help it trade at a premium to net asset value. Seeking Alpha’s quantitative analysis ranks Horizon as a strong buy, with a quant score of 4.67. A strong quant buy rating is attributed to the company’s growth rates, profitability, and positive earnings revisions, all of which I discussed in depth above. It also received an A+ for valuation, owing to its trailing and forward price-to-earnings ratios. According to SA quant ratings, Horizon is the tenth-best stock to buy in the industry.

TriplePoint Lags Slightly Behind Horizon

TriplePoint also specializes in investments in early-stage venture capital-backed companies. It has a large portfolio value than Horizon, which stood at around $941 million at the end of the June quarter. Furthermore, the company offers a wide range of debt financing options, including growth capital loans, customized loans, equipment financing, direct equity investments, and revolving loans. Despite diversification and size, TriplePoint trails Horizon on key metrics.

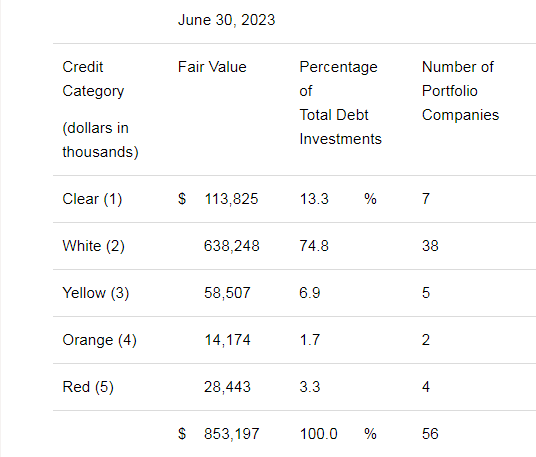

TriplePoint Portfolio Credit Rating (Earnings Release)

The company has been suffering significant losses on its debt positions, creating a sharp decline in NAV. Its net asset value fell by 24% to $10.70 per share in the June quarter, compared to $11.88 at the end of 2022. Furthermore, there is a risk of further NAV decline because $28 million of its debt investments, accounting for 3.3% of the portfolio, are at high risk of default. Its two debt investments, accounting for 1.7% of the portfolio, received an orange credit rating, the second-lowest internal credit rating score. The weighted average investment ranking of the company’s debt investment portfolio as of June 30 was 2.07, compared to 2.12 at the end of the previous quarter.

Aside from credit ratings, TriplePoint’s June quarter net investment income growth rate of 28% is lower than Horizon’s 50%. Its portfolio yield of 14.1% is also significantly lower than Horizon’s 16.7%. Wall Street currently expects its NII per share to be around $2 per share for the full 2023, representing a low to mid-single-digit percentage increase over the previous year. Although there is no risk to dividends in 2023 because earnings are expected to exceed its annual distribution of $1.60 per share, a dividend cut risk could emerge in 2024 due to expectations for a 13% year-over-year earnings decline. It also received a lower quant score than Horizon, owing to slower growth rates. Overall, it is ranked 21st out of 95 industry peers based on the SA quant score.

In Conclusion

Horizon and TriplePoint may experience some volatility due to concerns over the risk of credit losses. The risk, however, is not significant enough to prompt a major selloff or dividend cut in the near future. Horizon, in particular, appears well positioned to sustain the investment income growth momentum, owing to higher portfolio yield and lower risk of credit losses. Its dividend is not only secure, but there is also a good chance of a healthy special dividend. Meanwhile, TriplePoint appears riskier than Horizon due to a lower credit rating for its investment portfolio and sluggish earnings growth prospects in the second half of 2023.

Read the full article here