Introduction

Shares of Delta Apparel (NYSE:DLA) have fallen 30% YTD. Despite the fact that the company’s share price has dropped a lot, I believe that it is still not the best time to go long because the company’s operating and financial performance may be under pressure in the coming quarters.

Investment thesis

Although the company’s shares are relatively cheaply priced by multiples, I don’t currently see growth drivers/catalysts that could push the stock higher. First, I don’t think we’ll see a quick recovery in consumer clothing spending, even if inflation eases in the coming quarters, as consumers continue to face higher everyday spending. Secondly, I do not expect that we may see support from higher prices for the company’s products, as this may put additional pressure on traffic in the chain’s stores, which is still in the negative zone. In addition, based on the company’s guidance for 2024 (fiscal), I do not expect that increasing economies of scale can support the operating margin of the business.

Company overview

Delta Apparel designs, manufactures and sells outdoor clothing for men and women. The main brands are Delta Group and Salt Life Group. The company operates in the US market.

3Q 2023 (fiscal) Earnings Review

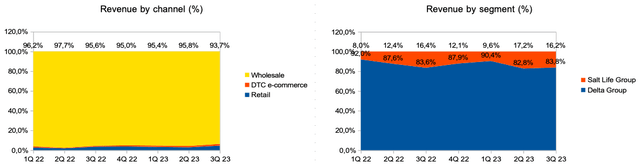

The company’s revenue decreased by 16.2% YoY. From the point of view of sales channels, the wholesale channel (94% of revenue) made the largest contribution to the decline in revenue, where revenue decreased by 17.9% YoY. In terms of revenue segments, Delta Group segment revenue decreased by 15.9% YoY, while Salt Life Group segment revenue decreased by 17.5% YoY.

Revenue mix (Company’s information)

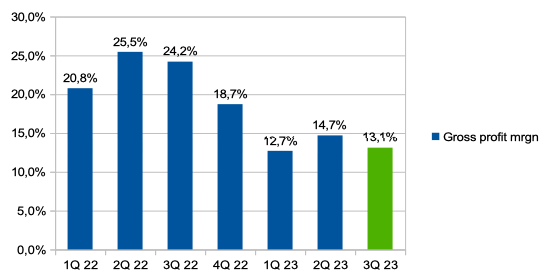

Gross profit margin decreased from 24.2% in Q3 2022 (fiscal) to 13.1% in Q3 2023 (fiscal) due to higher cotton prices and higher overhead fixed costs due to lower output (severance pay) ). You can see the details in the chart below.

Gross profit margin (Company’s information)

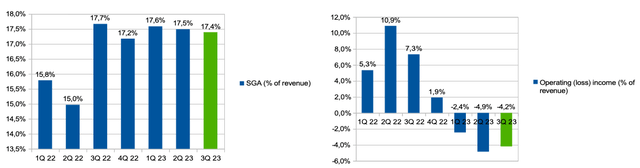

SGA spending (% of revenue) decreased slightly from 17.7% in Q3 2022 (fiscal) to 17.4% in Q3 2023 (fiscal). Thus, the operating loss (% of revenue) reached 4.2%. You can see the details in the chart below.

SGA expenses (% of revenue) & op. loss (% of revenue) (Company’s information)

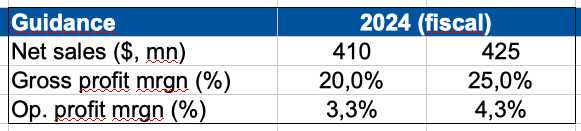

In addition, the company’s management provided guidance for 2024 (fiscal). On the one hand, I like the fact that the company expects a positive operating income, however, on the other hand, the company’s guidance on revenue suggests a decrease in revenue in the range of 12% to 15% relative to 2022 (fiscal) year. Thus, I believe that the company does not expect a significant recovery in sales next year relative to 2023 (fiscal).

Guidance 2024 (fiscal) (Company’s information)

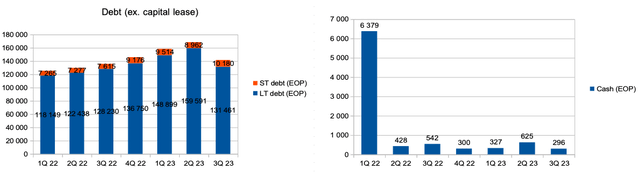

Separately, I would like to note the structure of the company’s debt. The level of leverage is still at a fairly high level, although the company managed to demonstrate a decrease in debt by about 16% compared to the previous quarter. Cash balance decreased to approximately $0.3 million.

Debt & Cash (Personal calculations)

Long term debt is at $131.5 million, which is about 93% of the company’s total debt (ex. capital lease). I propose to delve into the structure of long-term debt in more detail for a more accurate understanding. Currently, about $126.4 million (94% of long term debt) is owed to a loan agreement with Wells Fargo.

Under the loan agreement, the company has the option to increase its debt level to $170 million. Thus, in accordance with the loan agreement, the company’s management has the opportunity to raise an additional $44 million to finance operating activities. On the one hand, I like that the company has the ability to raise additional funding if the recovery of financial results takes longer than expected.

In addition, based on the current level of operating loss and free cash flow, I believe that the additional financing of $44 million that the company can raise will allow it to finance operations in the next 4-6 quarters, while the company expects operating margin to recover in 2 -4 blocks.

On the other hand, according to the loan agreement, the company may lose the opportunity to raise additional financing if such indicators as receivables, inventory levels and EBITDA are below the minimum values. The company’s management does not disclose the exact figures for the minimum values, but says that at the moment all indicators exceed the required minimum values.

My expectations

Despite the fact that the company’s management says it sees signs of a normalization in consumer demand in the sportswear market, I expect the company’s top line growth and operating margin to continue to be under pressure in the coming quarters. First, as I wrote above, if inflation slows in the second half of 2023, I think that the recovery in consumer spending will lag behind the slowdown in inflation.

Secondly, the company’s current guidance for the next year suggests a 12%-15% decrease in revenue compared to 2022, so I do not expect that the return of economies of scale will reduce operating costs (% of revenue) and support profitability.

I believe that the company has already passed the main stage of declining demand in view of macro headwinds, however, the recovery of consumer demand and financial performance may take a longer period of time.

In addition, according to management’s comments during the Earnings Call after the release of financial results, the company expects the gross profit margin to recover starting from Q2 2024 (fiscal), while operating margin may start to recover from the second half of 2024 (fiscal). Thus, I do not see catalysts for growth in the stock in the next 2-4 quarters.

With gross margins sequentially increasing into the low to mid-20% range and improving operating margin profits beginning in the second quarter as well as revenue growth in the back half of the year.

Risks

Margin: rising prices for raw materials (cotton), increased marketing costs due to increased competition, and reduced economies of scale can lead to a decrease in the operating profitability of the business.

Cash burn: low cash on the balance sheet, when the company’s operating income continues to be in the negative zone, may lead to the need to increase debt, therefore, increased interest expenses can have a negative impact on net income.

If financial performance deteriorates, the company may lose the ability to raise additional financing under the credit line, which could lead to severe pressure on revenue growth and margins as the company is unable to invest in working capital and CAPEX.

Macro (general risk): a decrease in real consumer incomes may lead to a decrease in consumer spending in the discretionary (clothing) segment, which may have a negative impact on the company’s business growth due to lower traffic and pressure on the average check.

Valuation

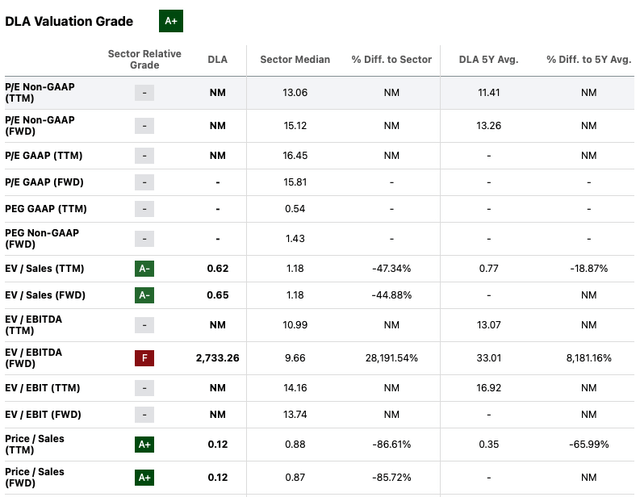

Current Valuation Grade A+. Now it’s not easy to value a company according to multiples, as we can’t look at the P/E multiple since the company’s net income is negative. Under the EV/Sales (FWD) multiple, the company is trading at 0.7x, implying a discount of about 45% to the sector median, however, this looks fair given the downward trend in revenue, operating loss and company size. Based on the reasons above, although I believe that the current level of discount is fair, I don’t think investors should decide to buy shares based on relatively low valuations according to EV/Sales or P/Sales multiples.

Multiples (SA)

Conclusion

Thus, I believe that now is not the best time to go long. I don’t expect to see a catalyst for stock growth in the coming quarters that could drive prices higher, as I think both revenue and operating margins will continue to be under pressure. My recommendation is Hold.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here