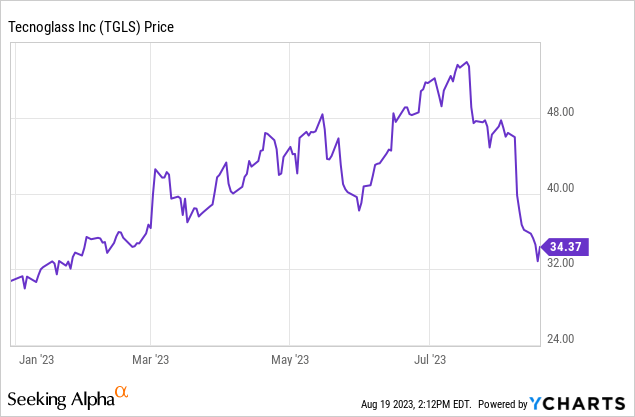

It’s amazing how quickly things can change in the financial markets. Just a month ago, I cautioned that shares of Colombian glass and window manufacturer Tecnoglass (NYSE:TGLS) appeared to be fully valued ahead of a potential slowdown in the construction industry. Shares have since gotten walloped, with the stock dropping a quick 35%. Indeed, the company has now given up almost all of its 2023 year-to-date gains:

While I think the market was too optimistic when the stock was in the $50s, this may be turning into an overreaction in the other direction. Here’s why I’m moving back to a buy rating for Tecnoglass stock.

Q2 Earnings Were Strong

On August 8th, Tecnoglass reported its Q2 earnings. These came in better than expected. Non-GAAP EPS of $1.12 beat by 5 cents. Revenues of $225 million were way ahead of the expectation for $209 million of revenues; the $225 million figure also represented 33% year-over-year growth.

That said, we should take these results with a grain of salt. There was never all that much doubt that Tecnoglass would have strong results in 2023, as there is already a large backlog of orders in place. The question is more around where 2024 and 2025 results will end up as higher interest rates and a potentially flagging South Florida economy start to hit new construction demand.

Regardless, the Q2 numbers were well ahead of expectations and showed that the business still has strong momentum behind it. So, why did the stock sell off double digits on the seemingly favorable earnings results?

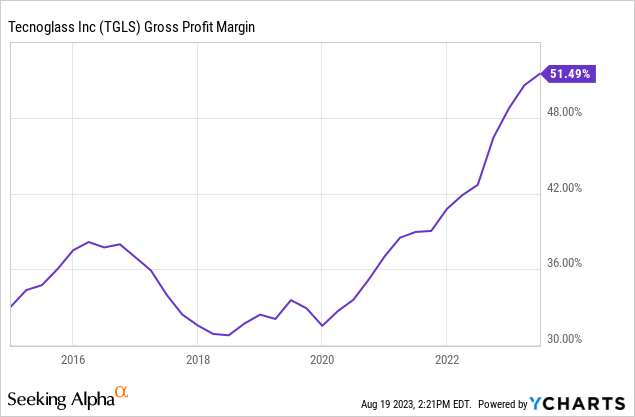

I believe the answer has to do with gross margins. Here is Tecnoglass’ gross margin evolution since being a publicly-traded company (note that this is annual not quarterly figures):

As you can see, the firm has enjoyed a tremendous surge in margins since 2020, with a nearly 2,000 basis point improvement in results. This is the fundamental reason why Tecnoglass went from being a single-digit to $50 stock. It’s great selling more products — people always like top-line growth — but where you really get the exponential earnings growth comes from selling more products at higher margins.

However, I don’t believe this gross profit margin expansion will be a permanent feature. Tecnoglass does have some proprietary technology and patents which insulate it from commodity pricing effects. Still, for many customers, buying decisions will be made primarily on price. A huge move up in margins potentially opens the door for more production at rival firms to try to steal back some of that margin.

In addition, the roaring hot housing market of the past few years and shortages of inputs, including windows, gave firms like Tecnoglass a great deal of pricing power. I suspect in a more normal economy, let alone a recession, gross margins settle back toward 40% instead of the recent 50%+ figures Tecnoglass was producing.

To that point, we saw the first signs of this in the Q2 earnings release. Tecnoglass’ gross margin was 48.7% This was up from 43.5% in the same quarter of 2022. Note, however, that it was down sharply from Q1 of 2023, where Tecnoglass earned a record high profit margin of 53.2%.

Here is quarterly gross margin data for Tecnoglass:

- Q1 2022: 44.8%

- Q2 2022: 43.5%

- Q3 2022: 52.2%

- Q4 2022: 52.2%

- Q1 2023: 53.2%

- Q2 2023: 48.7%

This quarter’s 48.7% gross margin is still tremendous, and far above what Tecnoglass was earning prior to the pandemic. However, it is a sharp break from the past nine months of results, suggesting that Tecnoglass is starting to see the pricing picture turn a bit less favorable. That’s entirely to be expected as interest rates continue to push higher and the Miami economy’s strength continues to taper off.

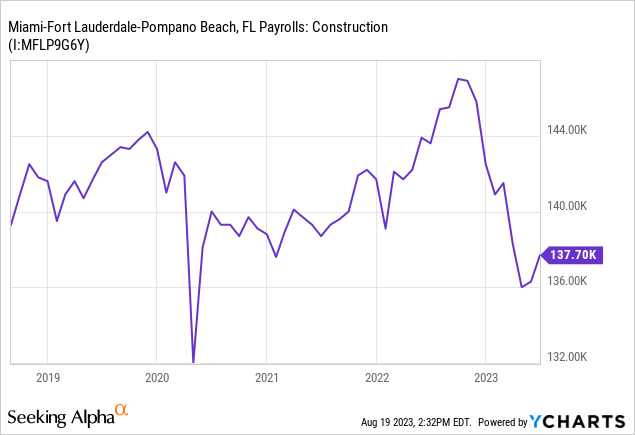

There was some pushback on my prior article around whether Miami — a key Tecnoglass market — is actually slowing down or not. I’d point to things such as construction employment as showing that the momentum is waning:

I’d point out that there have been media reports that construction loans are becoming more difficult to obtain in the market as well. As a Financial Times article notes:

“[T]he torrid growth in Miami property prices has slowed. Prices are still inching up, although the volume of sales has fallen and brokers say it is now taking longer to close deals.”

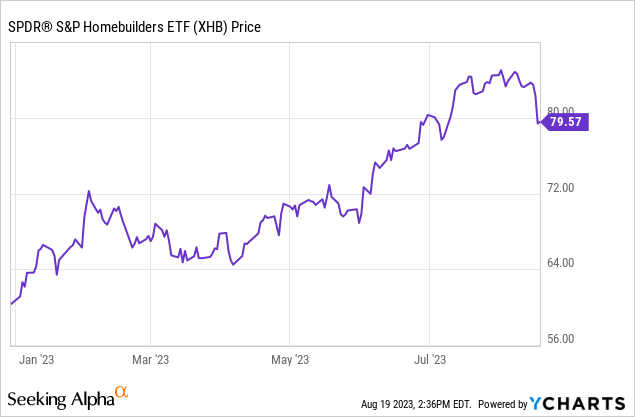

All this to say that I believe Tecnoglass stock was priced at peak cyclical bullishness a month ago, and shares have sold off in August as investors digest the slowing market and the renewed rise in interest rates. Further to that point, after rallying all year, homebuilding stocks moved significantly lower last week as mortgage rates rattled sentiment:

What’s Tecnoglass Worth In A Slowing Market?

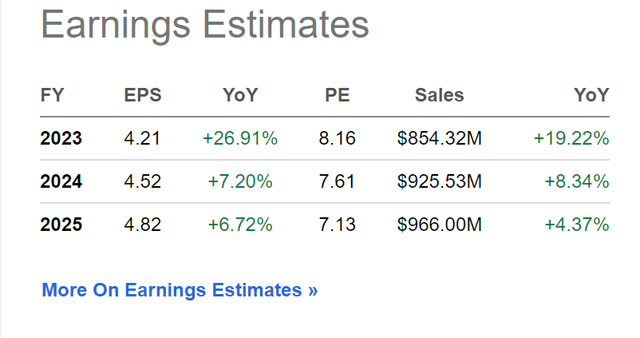

Here are the current analyst earnings projections for TGLS stock:

TGLS earnings estimates (Seeking Alpha)

I personally would assume slightly lower revenue growth in 2024 — backlog is still strong but I expect it to rapidly lose steam given higher interest rates and the softening South Florida economy. So, let’s say $900 million of revenue in 2024, up a bit from this year but well off the recent growth rate. And I assume a gross margin of 44%, which is still far above where it was prior to 2020 but reflects a more mid-cycle rather than boom period sort of pricing environment.

As per my calculations, this would result in Tecnoglass generating about $170 million of net income next year, which would be a modest dip from the $202 million earned over the past 12 months, though still ahead of the $156 million it earned in fiscal year 2022. This would result in a 2024 earnings per share figure of approximately $3.54.

With the stock at $34 as of this writing, this would put Tecnoglass at just under 10x my estimate of 2024 earnings. And I believe my estimate bakes in a much more prudent and conservative economic outlook than what the consensus is currently modeling.

There is risk to the downside; perhaps gross margins go plunging back into the 30s in a full-on recession scenario. And top-line revenues might fail to grow at all next year if a bigger credit crunch emerges. That said, using fairly cautious numbers on my part — well below current street estimates — still gets Tecnoglass to being a touch under 10x forward earnings.

I think that’s a reasonable price to pay for a company that has shown strong historical growth and whose management team has earned increasing respect in the marketplace albeit in a cyclical industry and with a potential Colombian political risk discount. Tecnoglass has a durable competitive advantage from its favorable location, shipping rates, and low-cost manufacturing capabilities. I expect the company to be significantly larger in five and ten years than it is today, and that should give adequate room for significant share price appreciation from here.

That said, the firm’s big dip in gross margin this quarter was a stark reminder that the company had previously been benefitting from a construction boom, and that boom period now appears to be ending. Investors will need to prepare for more normal economic conditions and perhaps even a bust depending on where interest rates end up. Expect Tecnoglass shares to remain volatile in coming months as investors digest the changing economic cycle. But for investors with a multiple year time horizon, I now see TGLS stock as offering an attractive risk/reward profile once again.

Read the full article here