Over the past several months, this blog has emphasized that the war on inflation has been won. In measurement terms, the “go to” index for the public and the Fed is the CPI (Consumer Price Index), and the crucial monthly number is the 12-month look-back, i.e., the rate of inflation as measured over the past year (+3.3% as of July). The three-month and six-month trends aren’t ever discussed (the three-month trend is +1.9% annual rate; the six-month is 2.6%). In addition, as we have emphasized in these blogs, BLS’s imputation of shelter costs (30% weight in the CPI) uses data that is lagged 8-12 months. If current data were used, CPI would already be significantly under the Fed’s CPI 2% target.

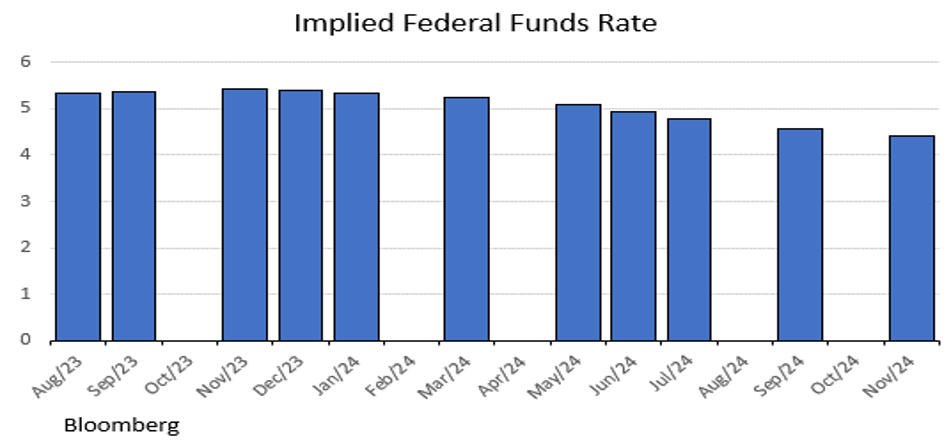

Markets are finally coming around to this viewpoint. The graph at the top shows that the Fed’s rhetoric has the market believing that the current Fed Funds rate (5.25%-5.50%) will be with us for the rest of the calendar year, but you can see that there is some relief in 2024. This is from the point of view of a market sold on a “soft-landing.” If Recession were the base case, the downtrend in rates would be much faster.

Recession!

Our view is, and has been, that a Recession is coming, if not already here. And, we are not alone. Despite the fact that the official forecast of the Fed is that there will be “No Recession” (Powell planted a question in his last press conference to make sure he was asked about the change in the Fed’s GDP forecast), the economists at three of the Regional Federal Reserve Banks (NY, Cleveland, St. Louis) think otherwise. The chart above shows that the probability of Recession for each of the Banks is actually higher than those same models showed for the last two actual Recessions (the Pandemic Recession and the Great Recession). In fact, a Recession has never failed to appear when the models were at today’s levels.

In addition, for the 16th month in row, the Conference Board’s Leading Economic Indicators (LEI) have been negative. The last positive reading was way back in February 2022! At this many negative months in a row, LEI has a 100% track record in forecasting Recession.

Two more indicators screaming Recession are shown in the chart below. The freight industry is clearly in Recession, with the Cass Freight Index down -2.2% in July alone and -8.9% over the year. One of the major freight haulers, Yellow, recently closed its doors and declared bankruptcy. If goods aren’t moving, commerce must be on the wane!

Housing is another sector in the doldrums. Mortgage loan applications continue to fall every week and are now at 30-year lows (-29.4% year over year). Both new and existing home sales show significant year over year declines, and building permits are off -13% from year earlier levels (not a good omen for the immediate future).

But, you say, retail sales for July were +0.7%, a huge upside surprise. Doesn’t that show economic expansion? Not so fast. Like some of the other suspicious seasonally adjusted (SA) data, a look beneath the cover tells a different story. As pointed out by Rosenberg Research, the actual raw (Not Seasonally Adjusted (NSA)) data for retail sales fell -0.4% from June to July; this on top of June’s -2.7% monthly decline. Rosenberg says that this was the weakest set of June and July data in five years. Over that time period, he says, the NSA data have averaged +0.8%, so this -0.4% is a very weak reading. Backing up that view, the Johnson Redbook Same Store Sales for July showed 0% growth.

Once again, as we have found in other recent reports, it appears that the magic of seasonal adjustment has turned a sow’s ear into a silk purse! While markets accept seasonally adjusted numbers as gospel, we are clearly skeptical.

Other Data

- Home Depot (HD), Target

TGT

WMT

- The chart shows the year over year trend in U.S. retail sales using a 3-month moving average – not a pretty picture!

- Industrial Production (IP) did rise 1.0% in July, spurred by utility output and auto production. June’s IP data was revised down to -0.8% from -0.5%. So, at best, this makes the June-July months nearly flat. Utility output was spurred by record-breaking heat in parts of the U.S. As for auto production, once again the seasonal adjustment is questionable as fewer auto plants shut down for the traditional summer retooling.

Inflation – the Good News Continues!

The chart shows that, except for Australia, the July annualized rate of inflation was just above 2% in the developed world, and even lower than that in Canada. And that doesn’t include the clear deflation occurring in China (see below).

Inflation expectations are quite important in the inflation war (even the Fed thinks so!). That’s because if consumers expect inflation, they won’t hesitate to purchase now (lest the price be higher tomorrow). But, if they don’t expect inflation, they are more likely to hesitate to purchase if the price appears too high. That reduces aggregate demand and ultimately results in disinflation or even deflation. The chart from the NY Fed shows rapidly falling (1 year ahead) inflation expectations. This is yet another positive inflation sign.

A look at one more chart is also encouraging. The light blue line on the chart below shows the ISM Manufacturing Prices Paid Index. Note how closely CPI follows (four-month lag). The implication is for continued rapidly falling inflation.

China

The second largest economy in the world is clearly faltering. In July, China’s Industrial Production fell -0.8% from the previous month, and retail sales slowed by -1.7%, negative now in three of the last four months.

Q2’s real GDP growth, at a 3.2% annual rate, is anemic when compared to the high single digit rates of the recent past. The chart above shows the downtrend in China’s growth rate since 2000. The sluggish Q2 GDP growth rate appears to have weakened even more in Q3. July’s overall data shows stagnation.

The crisis in its real estate sector looks to be getting worse. Last week, Country Garden, once considered one of China’s strongest developers, defaulted on debt payments. This continues the string of collapses in the residential real estate that has recently plagued China’s economy. Officials now fear that collapse will spill over to the sensitive financial sector, especially since Zhongrong Trust, an asset manager and shadow bank, closed its doors. If this doesn’t cascade into other closures, the best that can be hoped for is tighter credit standards which will negatively impact consumers and businesses and further devastate the housing market.

Like it or not, China plays a significant role in the world’s economy. Its economic struggles bode ill for the rest of the world’s economies, especially for its major trading partners.

Final Thoughts

- The markets think the Fed is done raising and will move to lower rates in 2024. We agree, both because the war against inflation has already been won, and because we still see a Recession ahead. So do several of the Regional Federal Reserve Bank models.

- The yield curve remains inverted, now for more than a year. That, along with 16 months in a row of negative readings from the Conference Board’s LEI have predicted Recession with a 100% track record.

- The freight industry is clearly in Recession, and a close look at the U.S consumer via retail sales and from Q2 retailer reports (HD, TGT, WMT) shows emerging weakness.

- The rise in Industrial Production looks to be a function of seasonal factors, including weather and changing practices at auto plants. The Regional Federal Reserve Bank monthly surveys continue to show manufacturing contraction.

- China’s economy is already in Recession, putting downward pressure on world trade, a bad thing, but also on inflation (perhaps some saving grace).

- The war on inflation has already been won. We see year over year CPI inflation below 3% by year’s end and at or below 2% a year from now – even with BLS’s questionable methodology.

- Buy Bonds!

(Joshua Barone and Eugene Hoover contributed to this blog)

Read the full article here