Dear Fellow Shareholders,

FPA New Income Fund (MUTF:FPNIX, the “Fund”) returned 0.21% in the second quarter of 2023 and 2.24% year-to- date through June 30, 2023.

|

Sector |

As of 6/30/2023 |

|

Yield-to-worst1 |

6.64% |

|

Effective Duration |

1.99 years |

|

High Quality Exposure2 |

89.8% |

|

Credit Exposure3 |

10.2% |

As inflation abated during the quarter, the Federal Reserve raised the Fed Funds rate by 25 basis points in May before pausing its tightening and leaving the Fed Funds rate unchanged in June.4 However, the Fed’s commentary and guidance for additional Fed Funds rate increases, coupled with uneven macroeconomic data, drove risk-free rates higher during the quarter. Yields on Treasury bonds with one-to-five- year maturities increased by approximately 60-80 basis points during the quarter, while yields on longer-maturity Treasury bonds increased by approximately 20-50 basis points. Notwithstanding generally lower spreads across investment-grade and high-yield bond markets, bond yields generally increased during the quarter.5 On an absolute basis, we continue to see an attractive opportunity to buy longer-duration, high-quality bonds rated single-A or higher (“High Quality”). We believe such investments will enhance the Fund’s long- term returns and the Fund’s short-term upside-versus-downside return profile. We do not generally view “Credit“ (investments rated BBB or lower) as attractively priced, but we continue to search for, and will seek to opportunistically invest in, Credit when we believe prices adequately compensate us for the risk of permanent capital impairment and near-term mark-to-market risk. The Fund’s Credit exposure increased slightly to 10.2% at June 30, 2023 from 9.9% at March 31, 2023. Cash and equivalents represented 4.0% of the portfolio at June 30, 2023 versus 4.2% at March 31, 2023.

Portfolio Attribution6

Collateralized loan obligations (CLOs) backed by corporate loans were the Fund’s largest contributors to performance during the quarter, mostly due to coupon payments. These bonds also benefited from higher prices resulting from lower spreads. The second-largest contributors to performance were CLOs backed by commercial real estate loans. The returns on these AAA-rated commercial real estate CLOs were driven by coupon payments, partially offset by lower prices caused by higher spreads. The vast majority of these corporate and commercial real estate CLOs are floating rate and have benefited from increases in their coupons as rates have risen. Asset-backed securities (ABS) backed by auto loans or leases were the third- largest contributors to performance due mostly to coupon payments but partially offset by lower prices as a result of higher risk-free rates.

Although corporate bonds and loans also positively contributed to performance, the Fund’s corporate common stock holdings were the largest detractors from performance during the quarter because of lower prices. Agency-guaranteed commercial mortgage-backed securities (CMBS) and Treasury bonds were the second- and third-largest detractors from performance, respectively, driven by lower prices resulting from higher risk-free rates.

Portfolio Activity7

The table below shows the portfolio’s sector-level exposures at June 30, 2023 compared to March 31, 2023:

|

Sector |

% Portfolio 6/30/2023 |

% Portfolio 3/31/2023 |

|

ABS |

60.4 |

63.5 |

|

Mortgage Backed (CMO)8 |

5.4 |

5.5 |

|

Stripped Mortgage-backed |

0.4 |

0.4 |

|

Corporate |

6.7 |

6.2 |

|

CMBS9 |

15.4 |

12.5 |

|

Mortgage Pass-through |

1.9 |

2.0 |

|

U.S. Treasury |

5.8 |

5.7 |

|

Cash and equivalents |

4.0 |

4.2 |

|

Total |

100.0% |

100.0% |

|

Yield-to-worst1 |

6.64% |

6.04% |

|

Effective Duration (years) |

1.99 |

1.81 |

|

Average Life (years) |

2.67 |

2.41 |

We continue to take advantage of higher yields by actively buying longer-duration, High Quality bonds. The duration of these investments is guided by our duration test, which seeks to identify the longest-duration bonds that we expect will produce at least a breakeven return over a 12-month period – assuming a bond’s yield will increase by 100 bps during that period. Consistent with this test, during the second quarter of 2023, we bought High Quality fixed-rate bonds including Treasuries, ABS backed by equipment, agency- guaranteed CMBS, ABS backed by prime quality auto loans, utility cost-recovery bonds, ABS backed by prime-quality credit card receivables, and ABS backed by cellular towers. On average, these fixed rate investments had a duration of 4.2 years. In addition, we bought floating rate, AAA-rated CLOs backed by middle-market loans.

Within Credit, we bought a BBB-rated corporate bond, which we partially paid for by selling an existing shorter-duration and lower-yielding investment from the same company. In addition, we also traded an existing leveraged loan investment for a pari passu high-yield bond from the same issuer, the latter investment possessing, we believe, a more attractive return profile.

In addition to the Credit sales described above, to fund this quarter’s investments we sold existing short- duration holdings, including High Quality ABS with an average duration of less than one year and corporate loan CLOs. Finally, we sold Treasuries to buy other similar- or longer-duration bonds.

Market Commentary

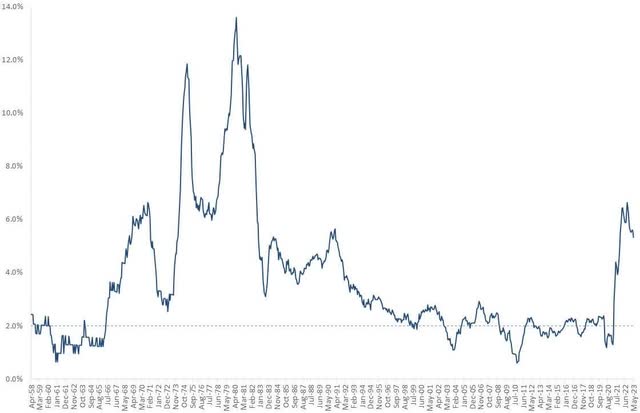

By many measures, such as the index shown below, inflation is declining, although it still remains meaningfully above the Federal Reserve’s target of 2%:

CPI Urban Consumers less Food and Energy year/year change

| Source: US Department of Labor. As of May 31, 2023. The Consumer Price Index, or CPI, reflects the average change over time in prices paid by urban consumers for a market basket of consumer goods and services. The Federal Reserve seeks to achieve an average of 2% inflation rate (https://www.federalreserve.gov/newsevents/pressreleases/monetary20221102a.htm). Dotted line represents the Federal Reserve target. |

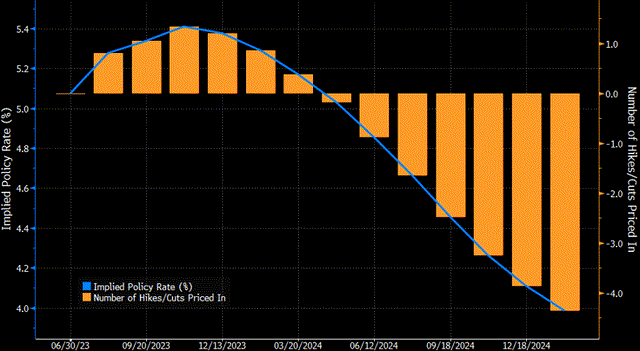

After raising interest rates since March 2022 (while simultaneously implementing quantitative tightening, or a reduction in the size of the Federal Reserve’s balance sheet) and having made some progress in reducing inflation, the Federal Reserve raised the Fed Funds rate by 25 bps in May before opting to “pause” and leave that key monetary policy rate unchanged in June. The rationale for this pause was to provide time to see how Fed policy implemented thus far is affecting the economy. At the same time, however, most Federal Reserve policymakers believe higher interest rates will be necessary to push inflation closer to its 2% target. Therefore, the Fed’s most recent projections showed a higher terminal Fed Funds rate, which was also reflected in the Fed Funds futures market. The bottom line is that, as of June 30, the market expected the Fed Funds rate to peak at approximately 5.4% in November 2023 before the Fed begins cutting rates:

Implied Overnight Rate & Number of Hikes/Cuts

Source: Bloomberg; As of 6/30/2023.

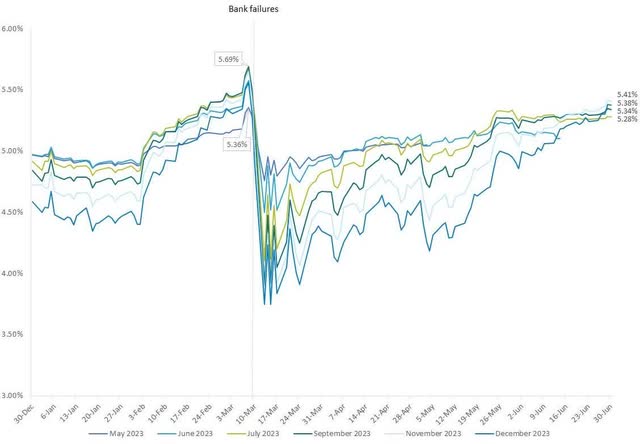

Fed Funds Rate Expectations

Source: Bloomberg; As of 6/30/2023.

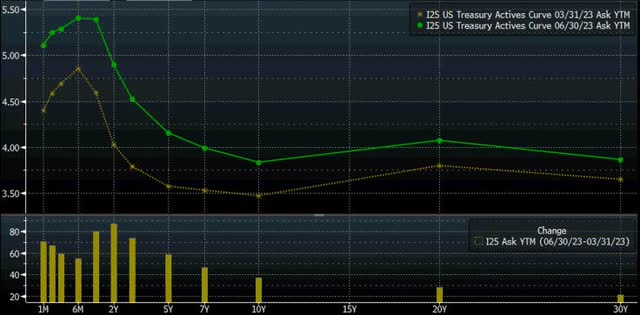

Note, however, and as shown above, the path of rates is not set in stone. For example, following the March 2023 bank failures, the market expected the Fed to begin cutting rates in June. But since March, the macroeconomic data has not painted a clear picture of the economy’s trajectory: while inflation has declined slightly, the job market and economic growth have remained resilient. Consequently, the Fed did not cut rates in June, the expected future Fed Funds rate nearly recovered to its pre-March level, and Treasury yields have risen since March, as shown below.

U.S. Treasury Yield Curve

Source: Bloomberg; June 30, 2023

|

Maturity |

||||||||

|

1Y |

2Y |

3Y |

5Y |

7Y |

10Y |

20Y |

30Y |

|

|

Change in yields (bps) during Q2 2023 |

80 |

87 |

74 |

58 |

46 |

37 |

28 |

21 |

|

Change in yields (bps) year-to-date |

71 |

47 |

30 |

15 |

3 |

-4 |

-7 |

-10 |

Lack of clarity in the macroeconomic picture is why we do not pretend to know either what the Fed will do over time or how interest rates will change. We place interest rate forecasting in the “too hard” pile. There are too many variables to predict. Further, it’s difficult to have conviction in any of those variables, because macroeconomic data are extremely challenging to measure in real-time and are subject to revision. Imagine investing in a company and believing it had huge earnings growth only to find out later that its earnings had significantly declined. Such a revision would likely affect your investment thesis and the returns on the investment you’d already made. Such is the challenge we face with macro-driven investing and, specifically, trying to predict the direction and magnitude of interest rate moves. To borrow an analogy from our colleagues: with macro investing we are driving with not only a windshield that’s cracked, dusty, and hard to see through, but also a dusty rear window.

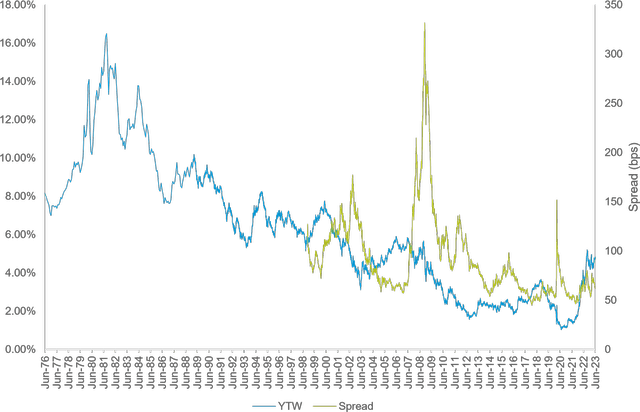

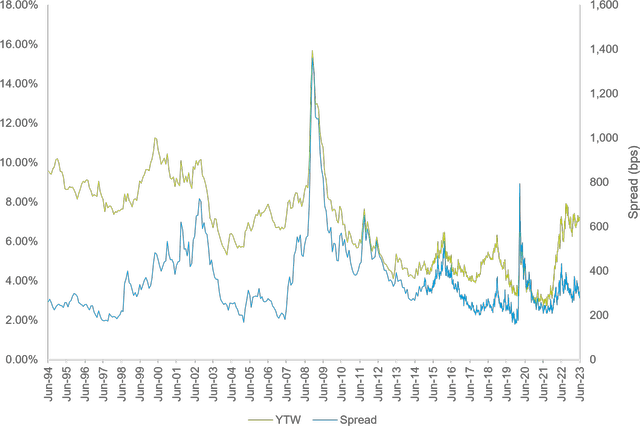

What we can see clearly, though, is that yields are still near decade-plus highs, as shown by the following charts. The first chart shows the Aggregate Bond Index; the second chart shows the BB component of the high-yield index, excluding energy, an index we believe is a better indicator of high-yield bond pricing because it excludes both “noise” related to the more volatile energy sector and changes in ratings composition in the overall high-yield index over time.

Bloomberg U.S. Aggregate Bond Index

|

Source: Bloomberg. As of 6/30/2023. YTW is yield-to-worst. Spread reflects the quoted spread of a bond that is relative to the security off which it is priced, typically an on the-run treasury. Past performance is no guarantee, nor is it indicative, of future results. Please refer to the end of the presentation for Important Disclosures and Index definitions. |

Bloomberg U.S. Corporate High Yield BB excl. Energy

| Source: Bloomberg. As of 6/30/2023. YTW is yield-to-worst. Spread reflects the quoted spread of a bond that is relative to the security off which it is priced, typically an on the-run treasury. Past performance is no guarantee, nor is it indicative, of future results. Please refer to the end of the presentation for Important Disclosures and Index definitions. |

While the market vacillates about the direction of the economy, yields remain higher than they have been in over a decade. On an absolute basis, we find longer-duration, High Quality bonds attractive for two reasons:

First, we believe that over the long term, investors will benefit from growing their capital at today’s yields for multiple years. One might wonder whether it makes more sense to hold cash or very short-duration bonds instead of longer-duration bonds. If we knew rates will rise further and the timing and magnitude of that increase, then certainly holding onto cash or very short-duration bonds would make a lot of sense. However, we don’t believe we can know such things with a high level of conviction. Therefore, we believe it makes sense to take advantage of yields available today. Thinking about the opportunity cost of this decision helps elucidate the rationale: if yields were to decline by 25 basis points (or 50 basis points, or some other large amount) we believe investors would regret not buying bonds at today’s yields when they had the chance.

Second, we believe longer-duration High Quality bonds offer a more attractive short-term return profile. Bond prices can, of course, move between today and a bond’s maturity so we want to be mindful of duration risk and short-term returns. Employing the duration test described earlier, if yields in the short term were to increase by 100 bps over the next 12 months, we believe these longer-duration investments would produce at least a breakeven return, limit short-term drawdowns, and preserve capital we could then seek to redeploy into higher-yielding investments. Alternatively, if yields were to decline for any reason, longer- duration investments would meaningfully improve the Fund’s short-term total return. For example, at June 30, the Fund held a Treasury bond that matures in June 2028. As of June 30, that bond had a maturity of five years, a duration of 4.5 years, and a yield-to-worst and yield-to-maturity of 4.12%. If that bond’s yield increases by 100 bps over the next twelve months, one would expect a positive total return of 0.54% for that period. On the other hand, if that bond’s yield were to decline by 100 bps over the next twelve months, one would expect a total return of 7.72% for that period. 18 months ago, when yields were close to zero, one could only buy a Treasury that was slightly longer than one year in maturity and still expect to make money in a rising rate environment (assuming that rates rise by 100 bps over twelve months). Of course, such a short Treasury bond has very little upside over the course of a year if yields decline, because that bond will be close to maturity and be worth near par. In comparison to shorter-duration bonds in a low-yield environment, we believe longer-duration bonds at today’s yields have a more attractive asymmetry in their short-term upside versus downside return while also locking in an attractive yield (on an absolute basis) for the long term.

As yields increased over the past 18 months, we purposely extended the duration of the bonds we bought – guided by the 100 bps duration test described above – and, in the process, extended the Fund’s duration. Since the end of 2021, we have increased the duration of the Fund by 0.6 years. For context, when rates were extremely low in 2021, the Fund had a duration that was much shorter than the 1-3 year Aggregate Bond Index. Now that market yields are higher, duration is less expensive, and we believe we are compensated to own longer duration bonds. Consequently, the Fund now has a duration longer than the 1- 3 year Aggregate Bond Index. Such a portfolio adjustment is what we believe active management is supposed to do: position defensively and preserve capital when the market is expensive and then go on offense when the market gets cheaper. With respect to duration risk, our strategy results in the Fund buying shorter-duration bonds when yields are low and then adding duration when yields are higher. In comparison, while we have meaningfully increased the Fund’s duration over the past 18 months, the duration of the Short-term Bond Fund Category has not meaningfully changed during that time.

In contrast to the market for High Quality debt which we think is attractive, we are aware that the absolute yield available in lower-rated debt is also higher than it has been in many years but we do not generally view this type of debt as attractive for the Fund, particularly as spreads have recently decreased. We continue to search for attractive opportunities in Credit but often find the potential absolute returns insufficient compared to the risk of permanent impairment of capital. We also often find that the extra return over highly rated debt that lower rated debt offers is insufficient in comparison to the incremental risk of permanent impairment of capital borne by lower rated debt.

In summary, broadly speaking, we find today’s bond market attractively priced and among the most attractive we have seen in at least a decade. We are excited about the opportunities we see to enhance our investors’ long-term returns while continuing to limit their short-term drawdowns.

Thank you for your confidence and continued support.

Abhijeet Patwardhan

Portfolio Manager

Footnotes1 Yield-to-worst (“YTW”) is presented gross of fees and reflects the lowest potential yield that can be received on a debt investment without the issuer defaulting. YTW considers the impact of expected prepayments, calls and/or sinking funds, among other things. Average YTW is based on the weighted average YTW of the investments held in the Fund’s portfolio. YTW may not represent the yield an investor should expect to receive. As of June 30, 2023, the Fund’s subsidized/unsubsidized 30-day SEC standardized yield (“SEC Yield”) was 4.43%/4.30% respectively. The SEC Yield calculation is an annualized measure of the Fund’s dividend and interest payments for the last 30 days, less the Fund expenses. Subsidized yield reflects fee waivers and/or expense reimbursements during the period. Without waivers and/or reimbursements, yields would be reduced. Unsubsidized yield does not adjust for any fee waivers and/or expense reimbursements in effect. The SEC Yield calculation shows investors what they would earn in yield over the course of a 12-month period if the fund continued earning the same rate for the rest of the year. 2 High Quality is defined as investments rated A or higher, Treasuries, and cash and equivalents. 3 Credit is defined as investments rated BBB or lower, including non-rated investments. 4 Source: Bloomberg. Federal Reserve; https://www.federalreserve.gov/newsevents/pressreleases/monetary20230503a1.htm, Implementation Note issued June 14, 2023 5 Source: Bloomberg. 6 This information is not a recommendation for a specific security or sector and these securities/sectors may not be in the Fund at the time you receive this report. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. The portfolio holdings as of the most recent quarter-end may be obtained at www.fpa.com. 7 Portfolio composition will change due to ongoing management of the Fund. 8 Collateralized mortgage obligations (“CMO”) are mortgage-backed bonds that separate mortgage pools into different maturity classes. 9 Commercial mortgage-backed securities (“CMBS”) are securities backed by commercial mortgages rather than residential mortgages. Past performance is no guarantee, nor is it indicative, of future results. |

Read the full article here