In the dynamic world of pharmaceuticals, Merck & Co., Inc. (NYSE:MRK) has consistently emerged as a formidable player, showcasing resilience and innovation. While recent stock market trends show a slight decline in stock price, a more comprehensive view reveals Merck’s impressive performance compared to major equity indexes. At the heart of this achievement is Merck’s focus on oncology, particularly the cancer medication Keytruda. This drug has notably enhanced the company’s income and stands to rise among the top-selling global medications because of its adaptability in addressing multiple types of cancers. Expanding on the discussion from the previous article, this piece provides a technical analysis of Merck’s stock price, to predict its future trajectory and pinpoint investment opportunities. Present observations suggest that the stock price is consolidating, and short-term trends hint at a potential upward movement. However, further consolidations are expected before a significant rally emerges, crossing the $118.86 mark.

A Glimpse into Pharma’s Leading Giant

The pharmaceutical landscape is vast and ever-changing, with Merck being one of the dominant entities in this realm. In the second quarter of 2023, Merck showcased a resilient financial performance. The company’s sales signified consistent underlying growth, especially pronounced in the Oncology and Vaccines segments. Worldwide sales reached $15.0 billion, marking a 3% hike from the same quarter the previous year. When the declining LAGEVRIO sales (which plummeted by 83% to $203 million) are set aside, growth peaked at 11%. However, after adjusting for LAGEVRIO and the impacts of foreign currency fluctuations, the growth ascends to 14%. Two noteworthy contributors to this surge were KEYTRUDA and GARDASIL/GARDASIL 9, whose sales burgeoned by 19% (to $6.3 billion) and 47% (to $2.5 billion) respectively.

In the backdrop of these figures, the company reported a GAAP loss per share of $2.35 and a Non-GAAP loss per share of $2.06, both incorporating a charge of $4.02 per share stemming from the Prometheus acquisition. In the realm of research and development, Merck unveiled promising data at the 2023 ASCO Annual Meeting, spotlighting positive results from the KEYNOTE-671 trial and intriguing outcomes from the KEYNOTE-942/mRNA-4157-P201 trial, a joint endeavor with Moderna (MRNA). Furthermore, Merck announced encouraging findings from two Phase 3 trials assessing V116 and initiated a Biologics License Application with the U.S. FDA for Sotatercept. Rounding out the report, Merck updated its full-year 2023 financial projection, elevating and narrowing its anticipated worldwide sales to fall between $58.6 billion and $59.6 billion, inclusive of a predicted 2% detriment from foreign exchange. LAGEVRIO sales are estimated to contribute around $1.0 billion to this forecast. Adjusted Non-GAAP EPS expectations are set between $2.95 and $3.05, taking into account a 5% negative influence from foreign exchange and a significant one-time charge associated with the Prometheus purchase.

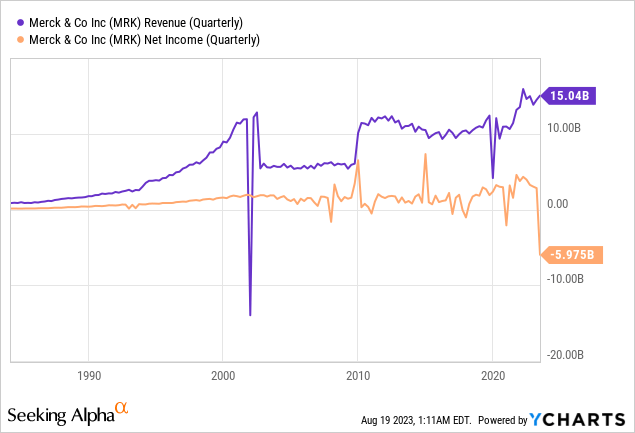

The chart below presents the revenue and net income for Merck, and it is observed that the company has been generating substantial revenue after the Covid-19 recession. Despite a temporary drop in net income, Merck’s positive quarterly revenue, combined with strategic investments and a diverse portfolio, underscores a long-term bullish outlook for the company.

Bullish Long-Term View with Expected Consolidations Ahead

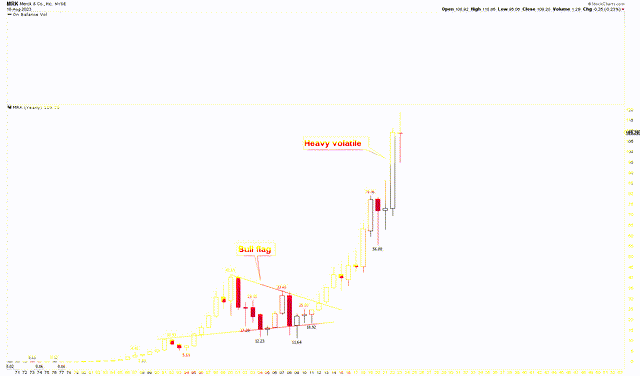

The yearly chart below depicts a robust bullish trajectory for Merck’s long-term outlook. This bullish trend is evident in the bull flag formed between 2000 highs of $41.69 and 2009 lows of $11.64. This flag’s breakout led to a significant upward movement, signaling substantial momentum over an extended period. From the trough of $11.64, the price surged by 921%, reaching a peak of $118.86. Such a significant price leap suggests potential market pullbacks at elevated levels. The volatility marked by the 2022 candle suggests a potential correction if the rally fails to surpass the record high of $118.86. While 2023 has commenced with some corrections, the overall market strength remains oriented toward the upside. Previous discussions on Fibonacci levels also hint at potential market exhaustion and subsequent correction. However, any breach above the $118.86 mark might trigger a new surge to higher levels.

Merck Yearly Chart (stockcharts.com)

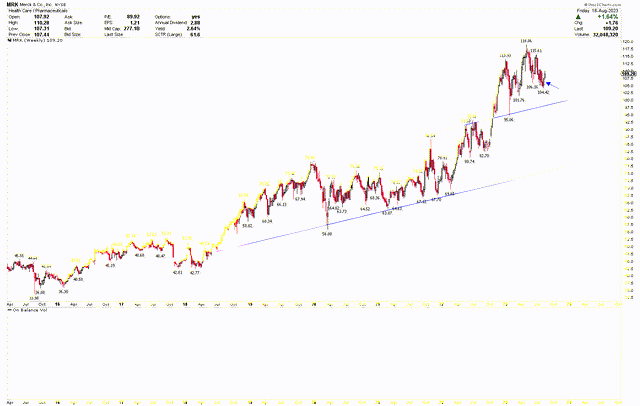

Furthermore, the weekly chart below complements this long-term bullish sentiment. Offering a snapshot of the short-term market dynamics, the chart shows that the recent two weekly candles point skyward, hinting at a possible rally in the ensuing days. The blue trend lines delineate the market’s trajectory. Yet, for a fresh rally to gain traction, the market must first surpass its all-time high, given the volatility shown by the 2022 yearly candle and the recent short-term peak at $118.86.

Merck Weekly Chart (stockcharts.com)

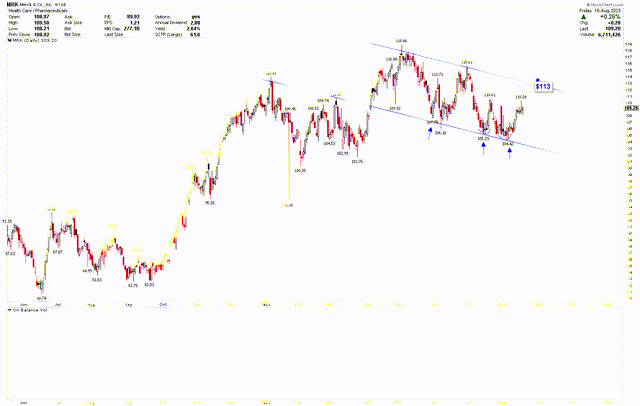

The daily chart below underscores Merck’s short-term robustness, signified by a double bottom at $105.29 and $104.42 along the blue channel line. Currently, the price is ascending from this foundation, targeting the channel line resistance near $113. Yet, for additional upward progression, Merck’s stock price must still surpass the $118.86 mark. Investors might consider observing the stock’s price behavior at the $113 resistance level before making investment decisions.

Merck Daily Chart (stockcharts.com)

Market Risk

Keytruda, a significant revenue driver for Merck, faces potential challenges as its patent expiration in 2028 might pave the way for biosimilars, potentially diminishing Merck’s market dominance. This, combined with potential declines in sales from other products like Lagevrio and unforeseen adverse events tied to major offerings, could strain the company’s financial health. On the other hand, acquiring entities like Prometheus Biosciences, while strategic, demands substantial financial commitments and poses integration complexities. If not adeptly handled, these could further burden the company’s financial reserves. Technically, while Merck exhibits a promising upward as seen by the yearly chart, it isn’t without its setbacks. Previous substantial price rallies hint at possible future market retractions, and barriers, such as the $118.86 resistance level, might impede further growth.

Bottom Line

Merck’s journey through the pharmaceutical landscape illuminates its robust adaptability and the challenges faced in this rapidly evolving industry. Its essential oncology product, Keytruda, has positioned the company favorably, but looming patent expirations and competitive pressures emphasize the need for strategic foresight. The company’s diversification efforts, such as acquiring Prometheus Biosciences and ventures into the animal health sector, manifest its vision for sustainable growth. While its stock charts suggest potential market corrections, the long-term outlook remains optimistic. Such a fusion of business acumen, diversification, and strategic acquisitions showcases Merck’s commitment to maintaining its pharmaceutical leadership.

From a technical standpoint, the stock price remains consolidated until it surpasses the $118.86 threshold. In the short term, the price target is set at $113. Investors should observe price momentum and consider entering a long position following a significant market correction or a breakout above $118.86.

Read the full article here