Introduction

Regeneron Pharmaceuticals (NASDAQ:REGN) is a leading biotech firm that invents, develops, manufactures, and sells medicines for serious illnesses, including eye diseases, allergies, cancer, and more. They focus on scientific research and use it as a foundation for their clinical, manufacturing, and commercial efforts. Their products include Eylea, Dupixent, and Libtayo.

In my previous analysis of Regeneron, I discussed their recent setback with the FDA delaying approval for the higher dose Eylea, which was due to a third-party filler concern, not the drug’s efficacy or safety. Despite a 6% decline in Eylea sales, Regeneron showed resilience with a 7% increase in total revenues in Q1 2023, thanks to other drugs like Libtayo and Evkeeza. The company has a solid financial position, substantial cash reserves, and high profitability, even with a concerning valuation and growth score. I recommended a ‘Hold’ position for Regeneron’s stock, as the Eylea delay should be temporary and the company’s potential lies in its ongoing drug development and existing product pipeline. It would be preferable for Regeneron to address the Eylea CRL and diversify its revenue sources while continuing to grow Eylea’s revenue before considering a rating upgrade.

Recent developments: Regeneron reported impressive Q2 2023 financial results, with an 11% YoY revenue surge to $3.2B, surpassing expectations. Despite a ~4% YoY decline, Eylea sales exceeded predictions at $2.4B worldwide. Dupixent, Libtayo, Kevzara, and Praluent enjoyed robust YoY growth. Net income increased by ~14% YoY to $968.4M. Furthermore, on Friday, the US FDA approved Regeneron’s HD Eylea (8 mg), offering less frequent eye condition treatment, comparable to standard Eylea (2 mg).

The following article reviews Regeneron Pharmaceuticals’ recent performance and future prospects. I am highlighting the company’s strong Q2 2023 financial results, the FDA’s approval of high-dose Eylea, and ongoing promising drug developments. Despite some challenges, I upgrade my recommendation on Regeneron’s stock from ‘Hold’ to ‘Buy.’

Q2 2023 Earnings

Looking at Regeneron’s most recent earnings report, the company had total revenues of $3.158B, up 11% from Q2 2022. This increase was attributed to higher collaboration revenue with Sanofi (SNY), which increased to $944M, a 39% increase due to an increase in Dupixent sales. In terms of expenses, R&D expenses increased 37% to $1.085B, while SG&A expenses increased 37% to $652M, mainly due to an increase in commercialization-related expenses for Libtayo outside the U.S. and higher headcount-related costs. Additionally, COCM expenses increased to $213M, up 44% due to the recognition of costs associated with manufacturing commercial supplies of Dupixent. In Q2 2023, the company repurchased shares of its common stock, recording the cost of $723M as Treasury Stock. As of June 30, 2023, there was an aggregate of $2.3B available for share repurchases under the company’s share repurchase program.

Liquidity & Cash Runway

Turning to Regeneron’s balance sheet, the company holds $1.9B in cash and cash equivalents, $6.9B in marketable securities, and an additional $6.3B in non-current marketable securities, totaling $15.1B in highly liquid assets. Given that Regeneron is profitable, as evidenced by a net income of $1.8B for the first half of 2023, it’s added significant cash to its reserves. In terms of liquidity, the company appears to be in a strong position, with a total of $16.9B in current assets against $3.1B in current liabilities. Regeneron’s long-term debt stands at $1.9B, which is manageable given the company’s robust cash and investments. In conclusion, Regeneron appears to be financially healthy, with a strong cash position and profitability. There seems to be no immediate need for additional financing. However, these estimates are my own and may differ from other analyses.

Valuation, Growth, & Momentum

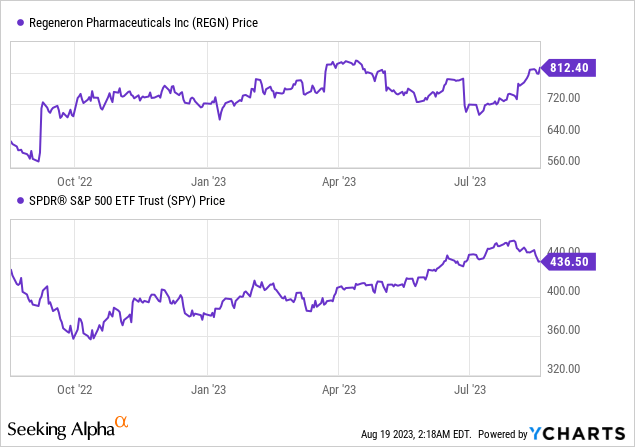

According to Seeking Alpha data: Regeneron’s capital structure is relatively robust with a small debt figure relative to its market capitalization, and a significant cash position. With an enterprise value of $71.87B, the company’s valuation seems reasonable with a forward P/E ratio of 19.11, although its EV/EBITDA and EV/Sales ratios suggest a somewhat high valuation. The company is experiencing slower growth, with declining YoY earnings estimates and a recent decrease in revenue, yet still showcasing a positive 3-year CAGR for both EPS and Sales. The stock’s momentum is positive, outperforming the S&P 500 over the last year with a 1-year return of +25.21%.

Despite the challenges in growth, the profitability metrics are strong, with a high gross profit margin, EBIT margin, and net income margin. Investors should consider the stock’s recent momentum and profitability in the context of its valuation and slower growth prospects.

FDA Approval of High-Dose Eylea Bolsters Regeneron’s Outlook

The FDA’s approval of the high-dose version of Eylea is a significant milestone for Regeneron. This approval addresses the initial setback we discussed earlier related to the third-party filler concerns, providing a clear path forward for the company.

The significance of this approval extends beyond the mere higher dose (8 mg vs. the standard 2 mg). It substantially benefits patients, allowing them to receive treatment less frequently – every 4 weeks for the first 3 months, then every 8-16 weeks, depending on the condition. This could improve patient adherence to the treatment, reduce the burden on healthcare systems, and ultimately lead to better patient outcomes.

Moreover, this approval could boost Eylea’s sales and strengthen Regeneron’s position in the eye disease market. The less frequent dosing might make Eylea more competitive compared to other treatments in the field. However, the company must effectively communicate these benefits to healthcare providers to drive adoption.

This news should also provide a much-needed boost to investor confidence. The approval was based on the positive results from the ULSAR and PHOTON studies, showing that HD Eylea is non-inferior and offers clinically equivalent vision gains compared to the standard dose. With these studies supporting the effectiveness and safety of the higher dose, Regeneron can now expand its offering and potentially capture a larger market share.

Pipeline Updates

During Regeneron’s most recent earnings call, management shared various updates across the company’s pipeline. In the immunology and inflammation pipeline, the company anticipates an FDA decision on Dupixent for chronic spontaneous urticaria by October 22nd, 2023. In the field of oncology, the company presented data on the combination of fianlimab and Libtayo for advanced melanoma, which showed promising response rates. The safety profile of the combination appeared generally consistent with that of Libtayo monotherapy. However, the company did encounter two Grade 5 events (death) with the combination of PSMAxCD28 costimulatory bispecifics with full dose Libtayo, which has led to the discontinuation of enrollment for full dose Libtayo in that trial. Management also touched upon their genetic medicines pipeline, announcing promising first human data for an siRNA that could silence pathological genes in the brain, potentially revolutionizing the treatment of neurodegenerative and CNS diseases.

My Analysis & Recommendation

In conclusion, Regeneron’s strong Q2 2023 earnings report, FDA approval of high-dose Eylea, and promising drug developments solidify its position as a leading biotech firm. The approval of high-dose Eylea, despite initial setbacks, reinforces Regeneron’s resilience and potential to adapt to challenges. Investors should watch for the company’s progress in its diverse pipeline, particularly the FDA decision on Dupixent for chronic spontaneous urticaria and the potential breakthrough in neurodegenerative disease treatment.

While Regeneron has experienced some challenges, such as the halted trial for the combination of PSMAxCD28 costimulatory bispecifics with full dose Libtayo, its broad portfolio and steady profitability make it a compelling option. Based on its solid financial health, positive momentum, and promising prospects, I recommend upgrading Regeneron’s stock from ‘Hold’ to ‘Buy’. The company’s valuation may seem high, but the growth potential in its pipeline and recent successes suggest a favorable long-term outlook. Investors would be wise to capitalize on the promising developments and robust financials of this biotech powerhouse.

Risks to Thesis

When the facts change, I change my mind.

While I’m optimistic about Regeneron’s prospects, there are a few risks to my ‘Buy’ recommendation that should be considered:

- Regulatory Risks: Although the FDA has approved the high-dose version of Eylea, future regulatory setbacks can still occur. For instance, potential delays or rejections in the approval of other drugs in Regeneron’s pipeline could impact their growth prospects.

- Revenue Concentration: The majority of Regeneron’s revenue is derived from one product – Eylea. Any setbacks (e.g. competition, safety concerns, etc.) could significantly alter Regeneron’s outlook.

- Market Adoption: The successful adoption of HD Eylea by healthcare providers and patients is not guaranteed. There might be challenges in convincing healthcare professionals of its benefits, which could limit its market penetration.

- Competition: Regeneron operates in a highly competitive field. Other pharmaceutical and biotech companies are also developing treatments for the same conditions that Regeneron targets. If a competitor releases a superior drug, it could hinder Regeneron’s growth.

- Clinical Trial Results: Regeneron is involved in numerous ongoing clinical trials. Unfavorable results from any of these trials can impact the company’s growth trajectory and my investment thesis.

- Economic Factors: Global economic conditions and regulatory changes can impact the pharmaceutical industry. Price regulations, reimbursement policies, or other government interventions can impact Regeneron’s profitability.

Read the full article here