Introduction

SEI Investments Company (NASDAQ:SEIC) has been on a steady growth trajectory as the top and bottom line continues to impress investors. However, the valuation of the business seems a little bit skewed, and getting a good deal right now doesn’t seem very possible. With the P/E approaching 18 I think the premium that investors are left to pay is too high to justify a buy.

We will dive deeper into the quality of the business a bit more below here, but in short, it’s very solid, and the confidence the market has in SEIC is glaringly obvious because of the valuation. With an ROE of over 20% the company is heavily outperforming the sector on this basis and driving further dividend increases I think is likely. Investors that hold shares in the company will likely do well keeping them, but adding to a position or starting one should instead be done when the valuation reaches a level more in line with the sector I think.

Company Structure

As for the business that SEIC engages in it primarily circulates providing wealth management. Included in the asset management and custody banks industry the company has grown very well over the last few years and has a market cap of over $7 billion right now.

Among its many services and offerings are retirement and investment solutions. SEIC also has some services aimed mostly at private banks which include independent financial advisers and investment managers as well.

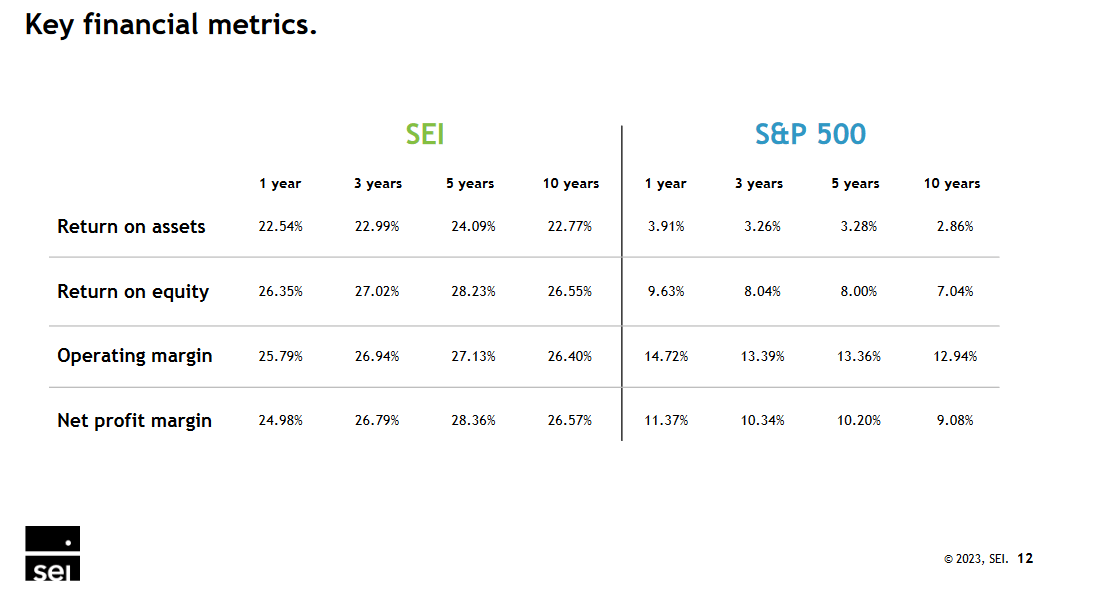

Financial Performance (Investor Presentation)

The company has done very well in growing its asset base and the ROA for the last 10 years has averaged 22.77% which quite frankly is incredible. It’s not often you come across companies able to boast such strong numbers and that seems to be the reason for the higher multiple that SEIC receives.

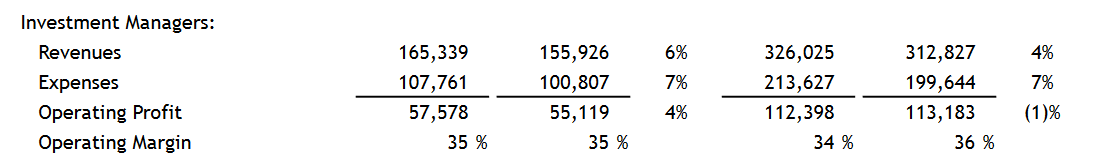

Investment Managers (Earnings Report)

The largest source of revenue for the company continues to be the investment managers which netted the company $165 million in the last quarter alone. This was an increase of 6% YoY and even though operating margins remained the same, it remains a foundational part of the business. Going into the coming quarters I think seeing a continued trend upward will be reassuring to the hold rating but also possibly result in the share price continuing to trend upward still.

Earnings Transcript

On July 26 we got the last earrings results from the company and the market reacted by the share price sliding a few percentage points. However, since it has recovered slightly and I don’t think there were any worrying points made by the management. The CEO Ryan Hickle for example had the following to say.

-

“In the quarter, we repurchased 1.3 million shares of SEI stock at an average price of $58.56 per share. That translates into $75.5 million of stock purchases. We also declared and paid a semiannual dividend of $0.43 per share. The sales momentum we saw earlier in the year continued through the second quarter. Our focus on proactively engaging with current clients, expanding our pipeline and connecting resources across the enterprise to identify and execute against cross-selling opportunities are translating into more wins for our sales teams”.

With higher margins results the company is continuing to benefit shareholders through buybacks and dividends. These practices are what make SEIC such an appealing hold and possibly a buy if the valuation contracts more.

-

“With that, let me turn to our business lines. The Investment Managers segment had another solid quarter. We successfully converted several new clients and funds while growing profits. We also recontracted multiple clients and converted our backlog, implementing a number of large accounts during the quarter. Dennis will provide further detail on this in just a moment”.

As we went over before, the growth in the Investment Managers segment was solid and is a big reason for the continued high ROE that SEIC can maintain right now. Going forward I think the segment will continue to perform very well and further margin improvements I think is likely.

Valuation & Comparison

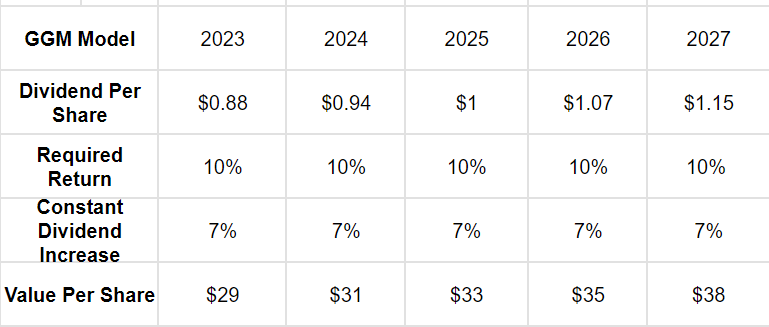

GGM Model (Author)

With the aid of a GGM model, I think we can quite clearly see that investing in SEIC doesn’t necessarily bring enough margin of safety to make it a buy, unfortunately. The share price trades far above my target prices and even with a generous 7% terminal growth rate for the dividends I think we are left without a promising investment opportunity. That isn’t to say holding shares won’t bring any value. The rating of holding shares is something I want to get across here. The business is solid but the price to pay is too high to generate any immediate returns, unfortunately.

Risk Associated

Navigating the intricate landscape of growth and expansion, SEI faces a challenge in the form of inflation. This economic force looms as one of the most formidable hurdles on SEI’s journey toward sustained progress. The dynamic nature of inflation can substantially impact the company’s operating costs, erode purchasing power, and potentially hinder its ability to maintain favorable profit margins. It seems though as inflation cools down activity in the industry will resume and enable SEIC to continue its growth.

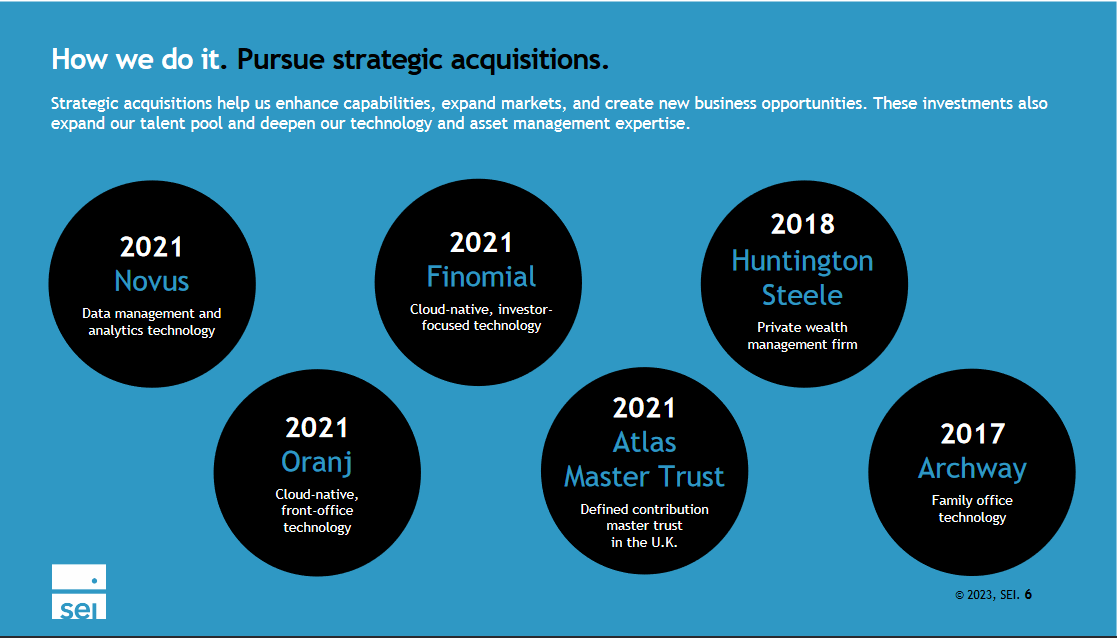

Company Strategy (Investor Presentation)

Moreover, SEI has encountered a degree of vulnerability stemming from its reliance on the earnings generated by its partially owned investment management company. This dynamic creates a significant interdependence between SEI’s financial performance and the fluctuations in the broader market. When market conditions take a downturn, this reliance exposes SEI’s earnings to vulnerability, potentially leading to declines in its financial results.

To bolster its resilience against these challenges, SEI could consider diversification strategies that reduce its overreliance on a single source of revenue. Expanding its portfolio of services and offerings could enable SEI to tap into multiple revenue streams, mitigating the impact of market volatility on its financial performance. Being too reliant on these factors might bring some volatility when conditions no longer are as favorable anymore.

Investor Takeaway

SEIC has proven itself to be a very solid business that can adapt efficiently to trends and grow its asset base accordingly. The company right now though is at a pretty high valuation when compared to the rest of the sector.

Fundamentals are solid and the Investment Managers segment is growing steadily as new clients and customers are taken on. It will be a supporting factor for years to come, but the momentum is sufficient to make it a buy. Investors are better off holding shares and benefiting from the dividend and the solid growth the company has maintained in the last few years.

Read the full article here