EHang Holdings Limited (NASDAQ:EH) announced its quarterly earnings report this week, on August 17th. While the company’s progress so far looks very encouraging and there are reasons to be hopeful in the future, there is still a lot of work to do and the stock continues to be a speculative play at this time.

The company announced non-GAAP earnings of negative 12 cents per share on revenues of $1.4 million which was down about 32% year-over-year and missed analyst estimates of $3.3 million as it delivered 5 AAV units of its EH216 but none of this is as important as the company’s announcement that it finally finished all testing for its product and now ready to submit all paperwork to get approval in China from the Chinese Aviation Administration of China.

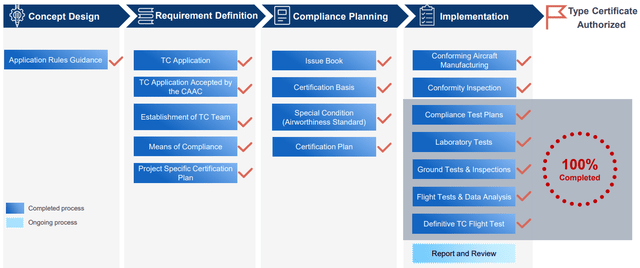

The company which produces AAVs (basically large drones that a human can ride similar to a small helicopter) had been working on this approval process for over 3 years and many investors were wondering if they would ever be done before they run out of money. Since this is a whole new class of product and considered uncharted waters, so many things could have gone wrong in the process that could have completely derailed the company’s efforts. It could have failed any of the many lab tests, ground tests and flight tests it conducted but so far it seems to have passed all tests successfully, proving that its product works safely and as expected.

Testing and approval process (EHang)

After completing more than 9,300 operational trial flights without an incident in 18 cities, the company is now in the final process of Report and Review which involves Chinese authorities reviewing all test results from the last 3 years and giving approval so that EHang can start producing and selling products in large numbers.

The company also announced that it reached an agreement with Bao’an District Government of Shenzhen municipality to form a strategic partnership which involves using the company’s products for a variety of purposes including aerial tourism and sightseeing experience services. This agreement is subject to EHang obtaining final approval from Chinese authorities for its product but chances seem good now or at least better than they ever did.

The company also announced that it is continuing to conduct test flights in several different countries in a variety of partnerships including 7 cities in Japan, Caesarea and Tel Aviv in Israel and in Belgium. The company’s test flight in Belgium included an unmanned flight for delivery of blood for Red Cross which marks the first time ever a medical transportation has been conducted using a delivery drone. This might open new possibilities and new uses for the company’s products moving forward.

The company announced that the total combined number of demo and trial flights across the globe passed 39,000 during the last quarter without any notable incidents. This could tell us that once EHang obtains approval from the Chinese authorities it will likely go for other countries and regions.

EHang now has about $23 million in cash after receiving $23 million in investments during the last quarter from a well-known Korean music producer and investor named Lee Soo Man. It looks like this investment provided the company with lifeline liquidity for the time being so that it can continue its operations. The company has about $45 million in total liquidity. If it gets final approval and starts mass producing its products, the company might need more cash from investors in order to fund this unless it starts out really small and slowly grows its production.

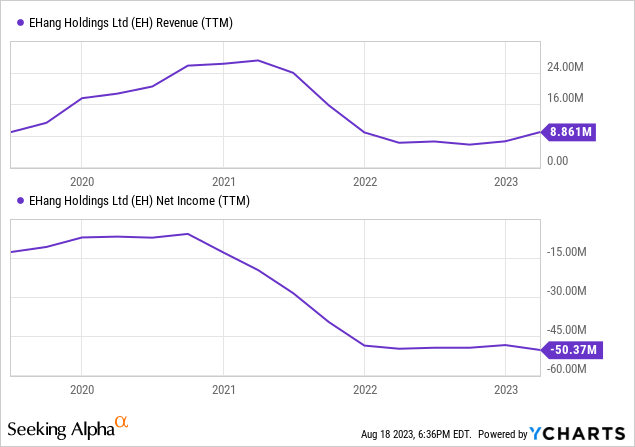

Historically speaking, the company hasn’t generated a lot of revenues in its short history and it typically posted losses but this is to be expected since the company has been in development and testing stage for its main products. Up until now the company had to rely on cash injections from investors in order to stay alive but things could change after it obtains the approval it’s been seeking for the last 3 years and the company could finally start standing on its own feet. Originally the company was expecting to receive its approvals as early as January 2023 but there were delays and things got pushed but now that all testing is complete it’s only a matter of time before the process is completed especially considering that the company was able to complete close to 40k test flights in its history without an incident.

EHang announced that it is receiving a lot of inquiries, questions, demands and orders from potential customers in many different countries for its products. There are many fields where EHang’s manned and unmanned AAVs can be used such as tourism, sightseeing, emergency responding, smart city management and transportation of goods and people. There is also a potential for these drones to be used in e-commerce, medical transports, leisure and other activities. These days with many cities having too much traffic on their roads, deliveries of certain goods can get disrupted and AAVs might offer a solution to this problem. There might be also a potential usage of AAVs as air taxis in the future.

Having said that, there is still a lot of uncertainty out there regarding this company. First, we don’t know for sure that they will get an approval from the Chinese authorities. When it comes to bureaucracy so many things can go wrong, approvals can get held back or delayed significantly. There is also the political side of things, which investors shouldn’t ignore.

Second, the company will have to demonstrate that it can produce and deliver its AAVs at mass scale with the liquidity it has at hand. Currently it enjoys a first mover’s advantage but it’s only a matter of time before one of the larger corporations with deep pockets and massive resources moves in and takes the lion’s share of the market. The company will have to move quickly to keep its first mover’s advantage and it has very little resources to accomplish this.

Third, the demand seems strong for now but it could easily disappear at the first accident or first sign of trouble. The company so far completed tens thousands of flights without a single incident but all it takes is one incident to scare people away from using a new product like this.

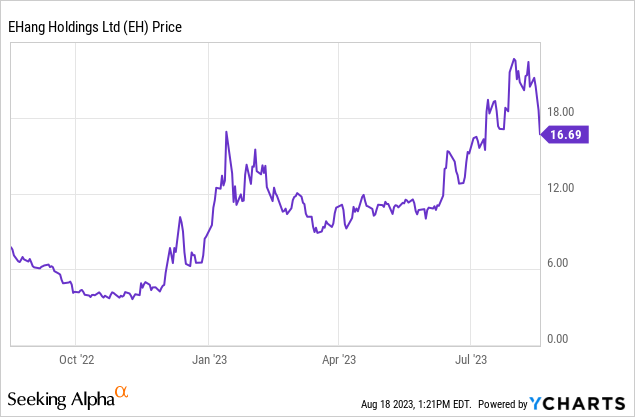

EHang’s stock is down -10% after the company’s announcement. Some of this could be due to profit taking, some of it could be because of the overall weakness we are seeing in Chinese stocks lately and some of it could be due to the uncertainties still surrounding this company and its products.

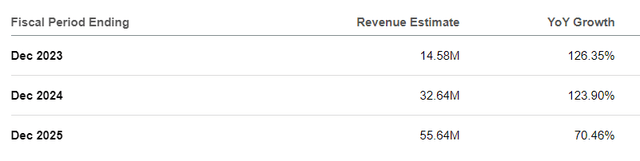

From a valuation standpoint it is difficult to value this stock using traditional metrics because it is still a start-up which is getting ready to deploy its main product after receiving regulatory approval. I’d think of this company like a biotech startup which just received an FDA approval for its main drug. Having said that, analysts expect EHang to generate $32 million in revenues in 2024 followed by $55 million in 2025. Analyst estimates don’t go beyond 2025 but since analysts are expecting this company’s revenues to grow by at least 50% annually for the foreseeable future, we can extrapolate that it could generate $82 million in 2026, $123 million in 2027 and $185 million in 2028.

EHang Revenue Estimates (Seeking Alpha)

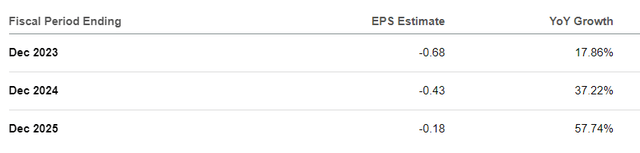

Analysts also expect it to reach about breakeven by 2025 and possibly post a profit after that if the trend continues. Assuming a 20% profit margin on 2028 revenues would give us $37 million in net profits. Since the company’s current market cap is roughly $1 billion, we are looking at forward P/E of 27 even assuming the company meets all these lofty expectations. The stock is definitely not cheap.

EHang EPS Estimates (Seeking Alpha)

If EHang can quickly get government approval, start mass producing its AAVs, deliver them in a timely fashion and take advantage of its first mover’s advantage before “big guys” move in, this can be a good opportunity for investors but there are too many ifs and too many moving parts. I would still consider this as a speculative play and not put too much of my money into it. Try to treat this like a biotech start-up firm and limit your exposure to plays like this to about 1-2% of your portfolio unless your risk tolerance is really high.

Read the full article here