Dear readers/followers,

When it comes to overvalued companies (or what I view as one) with a potential upside, but only if you base it off 20x+ P/E, I don’t believe the market has yet accounted for the full impact of the risk-free rate and normalization with regards to this in terms of what companies should be valued at. Yum! Brands (NYSE:YUM) is a very good example of this.

I’ve reviewed Yum! Brands before and stayed a “HOLD” on the company, which proved this time around to be the correct choice to make. The company has underperformed.

Here we go through the current valuation thesis and the estimate for Yum! Brands – where it might go, and where valuation expects it to go. More importantly, what we might make in such a case or in such a scenario. That’s the important thing, after all.

Let’s see, therefore, what we have here.

Yum! Brands – The upside is theoretical. It might materialize, but results imply some issues

This company is one of those businesses that’s great on the surface – but also comes with a low yield, and potential headwinds in this sort of inflationary scenario. It’s a consumer staples business – which I love, and it owns some businesses which I often frequented in the US, and still do visit from time to time both inside and outside of the US.

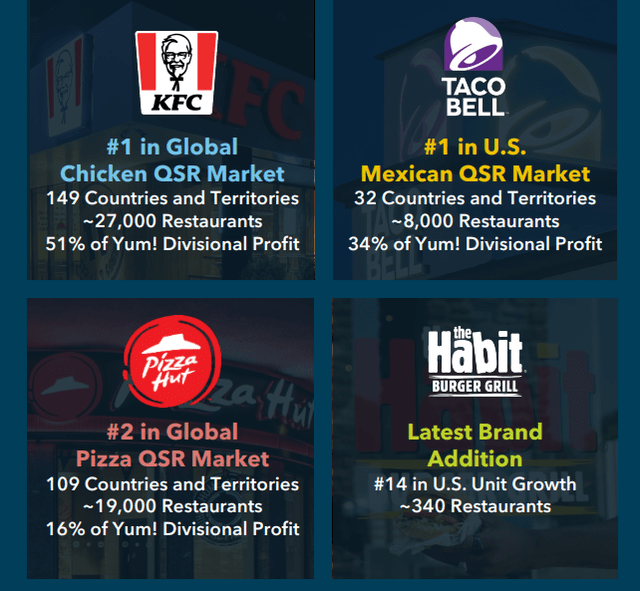

YUM IR (YUM IR)

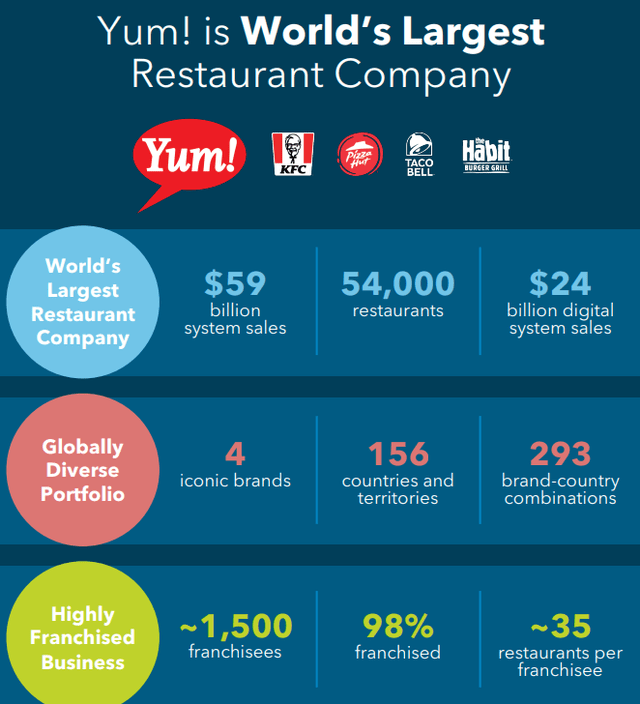

For those of you that don’t know, the company’s prime names are KFC, Taco Bell, and Pizza Hut. They also include smaller brands that frankly, I have never heard of, let alone tried the food of.

The company is a holding company with a franchise model. With over 52,000 units franchised to date and working, it’s proof of the concept. over 30% of the units are under a master franchising agreement – predominantly in China, while others are single-level or store agreements. More of information of how the company exactly works can be read here.

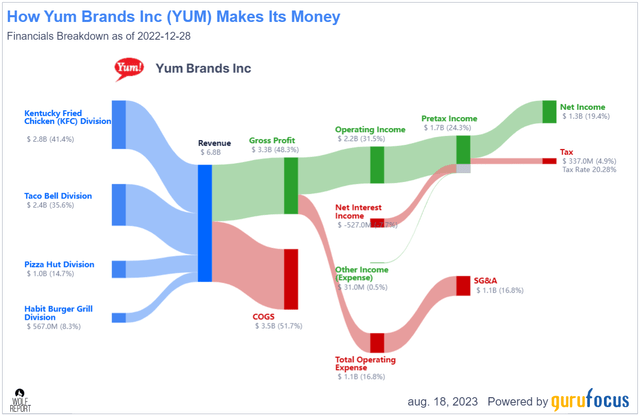

A quick glance at the top-line to bottom line shows us just how well the company works.

Yum Revenue/Net (GuruFocus)

This picture doesn’t share though, how those 31%+ operating margins are actually among the market-leading in the entire sector. Same with 20%+ net margins, which is what the company made – around 19-21% – for the past few years. The company has superb profitability, owing to its operating model, which lets franchisees take most of the operating-level risks.

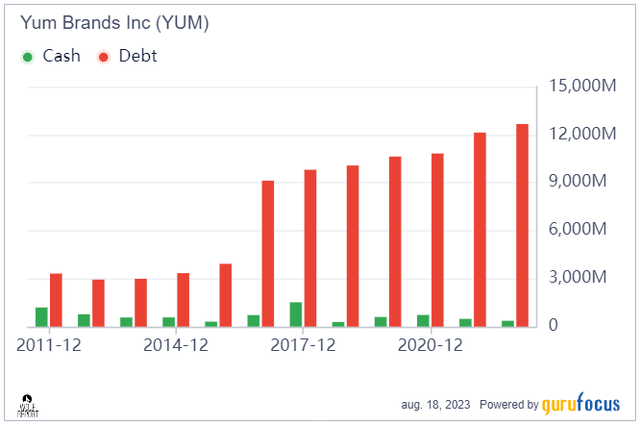

It’s worth mentioning despite these numbers, that the company has taken on a meaningful amount of debt over the past few years…

Yum! Brands Cash/Debt (GuruFocus)

…but that this debt has also resulted in significant increases in profitability, namely ROIC net of WACC, and that debt, while ratcheted up, is not what I see as the main issue for this company. Based on the current BB+ credit rating, it’s clear however, that the 308% LT debt-to-capital ratio is not something that the credit rating agencies are too keen on premiumizing. So this company, with very high leverage, is trading at close to 26.5x P/E, which is massive.

Yield also doesn’t excuse it. At the current share price of nearly $130/share, the company is yielding no more than 1.86% – which isn’t all that great, considering you can get 4-5% from a savings account on a money market fund.

The latest set of results we have are the 2Q23, which reported a sales growth of 13%, 9% same-store sales growth, and 6% unit growth. Top-line numbers were excellent and without worry. GAAP profit grew less – around 4%, but core EPS was up 12%.

The company reported momentum continuing. KFC was the largest contributor here, growing almost 20% on the top-line level, with unit growth of 1,025 new locations and 30% digital sales growth contributing to this truly massive increase. The company also continues to remain convinced of its ability to drive sales growth as well as momentum, and it expects to deliver FY23 significantly above its long-term growth target.

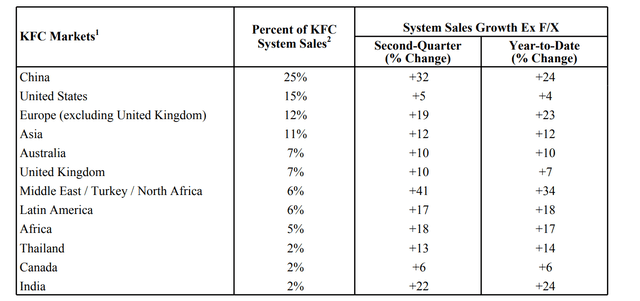

China has taken over first place as KFC’s market leader in terms of systems sales. The USA only accounts for 15% here, with KFC has become a truly worldwide brand with a very impressive sales mix.

Yum! Brands IR (Yum! Brands IR)

The other brands are much more US-centric. As a comparison, Pizza Hut is nearly 42% of sales in the USA. Its smaller brand, Habit Burger, opened a few new locations, and sales grew here as well, but as I’ve said before, it’s really the major three brands that should be of interest to you here.

With regards to Russia – because this was a significant market, like with McDonald’s (MCD) for the company, YUM exited Russia completely when it sold its KFC businesses in the nation. This included all of the KFC restaurants, the operating system, the master franchise rights, and the trademarks for the relevant brands. The company is now out of Russia as of 2Q23.

YUM IR (YUM IR)

On the whole of it, this impacted the company negatively to the tune of around 1-2% for the KFC unit, excluding FX.

The company expects low double-digit growth for the year. This is, according to management, derived from basically a continuation of the very strong trends for the first half of the year. The company, due to its pricing and customer demographics, doesn’t expect much of an impact from a potential decline in overall spending either. It’s also related to savings on the SG&A side of the company, as well as improving margins in certain countries. Some colors can be found in the call here.

We were also pleased to have improving margins in our company-operated store base. You saw a 200-basis-point improvement there in our biggest — driven by improvements in our biggest store bases, and we’re going to continue to manage that. I don’t think there’s anything else to call out in terms of color on that part of the year.

(Source: Cristopher Turner, 2Q23, Yum! Brands)

I’m prepared to confirm at this point that Yum is showing some true blue-chip sort of resiliency. While I expected this could happen, the degree of stability, especially in the face of Russia and other inflation and cost challenges, has been very impressive. In this article, I’m starting to believe more than before, that the company may actually sustain this trajectory.

This means that targets that might have been considered lofty before, might be able to be confirmed at this point, or at least be considered somewhat more realistic than before.

Unfortunately, I did not “BUY” Yum when it was in a position that in retrospect could have been considered cheap. But one of the biggest mistakes we could make here is raising the bar just because the company has grown somewhat in valuation.

The reason I’m more positive this time around is that I’m starting to see proof of the company’s potential – and if this is considered realistic, what we have here is the actual potential for a market-beating RoR, within my demand range for an investment.

Let me show you what I mean.

Yum! Brands – It could actually deliver 20% annualized growth rate.

My problem with Yum! Brands has never been the business model or the brands. Who wouldn’t want to own the company that owns KFC, Taco Bell, and Pizza Hut at a good price? There’s a lot to like, even love about this company and its business model.

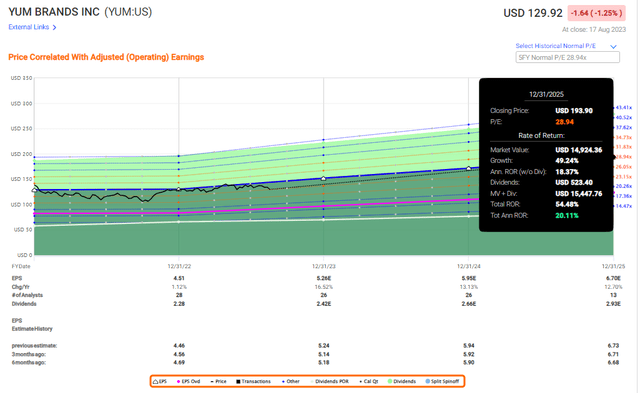

My problem has been expecting this company to be worth upwards of 30x P/E – which is what the market is asking in order to deliver a 20% annualized RoR.

This is the upside I could see in that set of circumstances.

F.A.S.T graphs Yum Upside (F.A.S:T graphs)

However, this demands almost 29x P/E on the part of the valuation. If the company manages to maintain its growth rate, this is far from impossible. And the reason I’m more positive here is that the company has managed to sustain its growth rate despite significant global headwinds. The company is also not, relative to its valuation, as expensive as when I last reviewed it.

With over 25 years on the market since its IPO, it’s also now one of the most impressive brands in its segment. Since 1997, it’s grown more than double its size, growing from 30,000 to 54,000 restaurants. I see little reason, given the international scale, why there would not be a repeat of such a performance going forward. The reason for the change in my outlook is based on how little the company seems affected by headwinds, such as cost increases, and how it’s actually able to navigate these. I also believe that, unlike before, the company’s pricing power relative to its size and to competition, is stronger than I initially expected. Companies in this segment and their customers seem to have accepted the near-double-digit price increases, and their strategies seem very similar here. (Source)

It cannot have escaped anyone who frequents fast-food chains, including myself while traveling at times, that we’ve seen 9-14% price hikes across many key items and menus.

There is something to be said for Yum! Brands and its over 30% (but below 40%) miss ratio even with a 20% Margin of error when it comes to the company’s EPS forecasts (Source: FactSet).

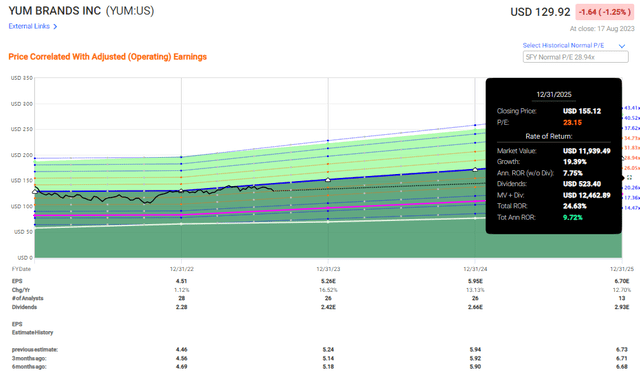

However, at this valuation and future outlook, even a reversal to 23x P/E, which would be cheap for a company that’s managed to average a growth rate of almost 9% in this sector and with these brands, you’re still making almost double digit in terms of annualized RoR for this business.

Yum! Brands Upside (F.A.S.T graphs)

So while I will certainly never call Yum! brands cheap when trading at this multiple, I can see the upside here. And if we consider it likely that the company actually archives these targets, and that this premium holds, then the 15% conservative upside is actually visible at close to 26-28x P/E, as opposed to the 21-23x P/E that I’ve previously communicated.

That means that the time has come for a rating upgrade and a PT upgrade – a big one. I’m raising the bar for Yum! Brands here, bumping it to $130/share which means we have a slim upside and a “BUY” here as of the 2Q23 results.

I plan to go into the company with a small stake, and grow it into a long-term holding, or until it goes too high, on the basis of continued outperformance, the almost no impact from Russia, and its international expansion potential.

Here is my thesis for the company.

Thesis

- Yum! Brands is a very attractive business, holding four very attractive franchises/restaurant brands, three of which have undoubted international fame. The company has decent fundamental (below-IG credit rating), and superb historical trends, making it a theoretically attractive investment at a decent price – even a premium.

- As of this article, I’m okay with a premium of around 26-28x P/E, which means that I am changing my rating and my PT for the company.

- I go with a “BUY” at a PT of $130/share. It’s an extremely slim “BUY”, but it’s a “BUY”.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I now view the company as a “BUY” with an upside at this particular time.

Read the full article here