Normally, I’m quite supportive of Simplify as an organization, as I have reviewed several of their exchange-traded funds (“ETFs”) like the Simplify Volatility Premium ETF (SVOL) and the Simplify Interest Rate Hedge ETF (PFIX). I found both to be solid, innovative funds. However, Simplify also has duds like the Simplify Tail Risk Strategy ETF (CYA).

In this article, I will provide my thoughts on the Simplify Aggregate Bond PLUS Credit Hedge ETF (NYSEARCA:AGGH).

Fund Overview

The Simplify Aggregate Bond PLUS Credit Hedge ETF aims to maximize total returns by primarily investing in investment grade (“IG”) bonds while mitigating credit risk.

The AGGH ETF is actively managed to enhance yield by “enhancing duration exposure via structurally efficient curve positioning and to generate additional income by selling interest rate and credit volatility.” The AGGH ETF will opportunistically invest in CDX calls, Quality-Junk- factor-based hedges, and equity puts.

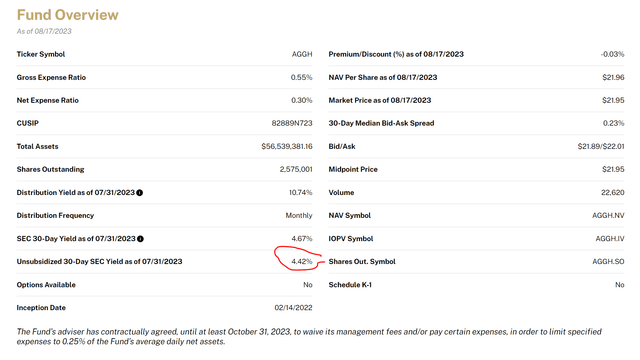

The AGGH ETF has $56 million in assets and charges a 0.30% net expense ratio (0.55% gross expense ratio, but some fees are waived until October 2023.

Based on the fund description above, I am expecting the AGGH ETF to be invested primarily in IG bonds, similar to the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD), with credit hedges such as call options on credit default swaps (“CDS”) based on the CDX Index, funded by writing calls and put options on fixed income securities.

Portfolio Holdings Does Not Match Fund Description

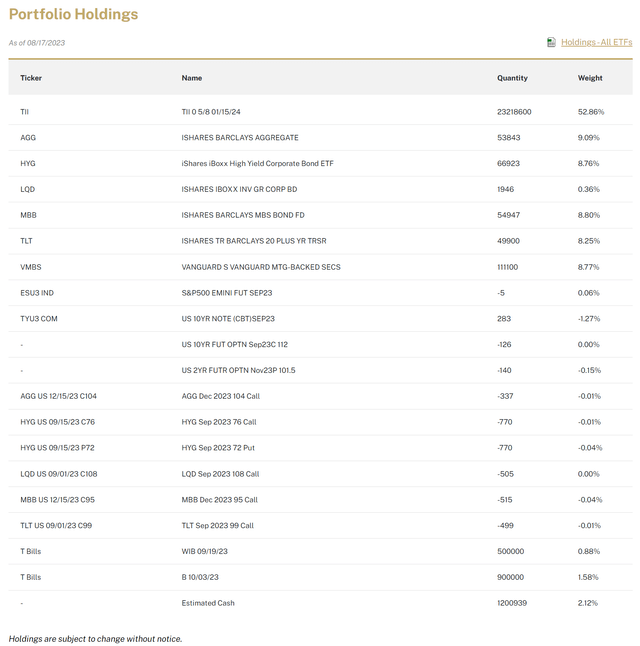

However, a quick look at the portfolio holdings shows I am way off in my expectations (Figure 1).

Figure 1 – AGGH holdings (Simplify.us)

The AGGH ETF’s largest holding is TII 0 5/8 01/15/24, with a 52.9% weighting. I believe this security refers to treasury inflation indexed bonds with a January 2024 maturity. The AGGH ETF also holds positions in other ETFs like a 9.1% weight in the iShares Core U.S. Aggregate Bond ETF (AGG), an 8.8% in the iShares iBOXX $ High Yield Corporate Bond ETF (HYG), and an 8.8% weight in the iShares MBS ETF (MBB).

While operating a fund of funds structure is totally fine and acceptable, it is starkly different from the fund description above which leads one to believe AGGH was investing in investment grade corporate bonds with credit hedges similar to the iShares Interest Rate Hedged Corporate Bond ETF (LQDH) that hedges interest rate risk.

In fact, if we look through the fund holdings, the allocation to IG bonds is only through a minuscule 0.4% weight in the LQD ETF, while there is an 8.8% allocation to non-investment grade corporate bonds via the HYG ETF.

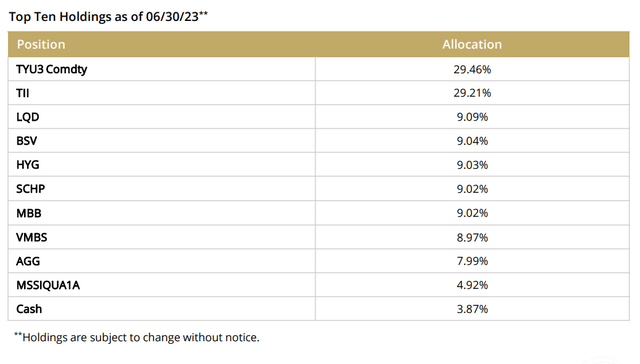

Furthermore, AGGH’s portfolio also shifts around quite a lot. For example, as of June 30, 2023, the fund’s largest position was in 10Yr treasury notes (“TYU3 Comdty” listed below at 29.5%) and it had a much higher weighting in the LQD ETF at 9.1% (Figure 3).

Figure 3 – AGGH holdings as of June 30, 2023 (AGGH factsheet)

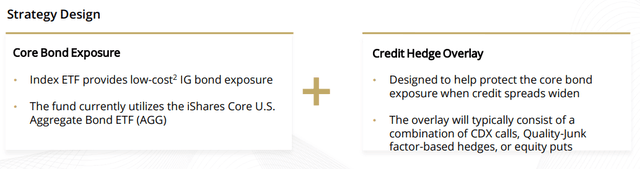

So essentially, the AGGH is an opportunistic fixed income hedge fund being marketed as an aggregate bond fund providing core bond exposures with a credit hedge overlay (Figure 4).

Figure 4 – AGGH’s marketed strategy design (Simplify.us)

My worry is that investors may only look at the marketing documents and allocate ‘core bond’ weights to the AGGH ETF, when it should only garner “alternative fixed income” weights.

Returns

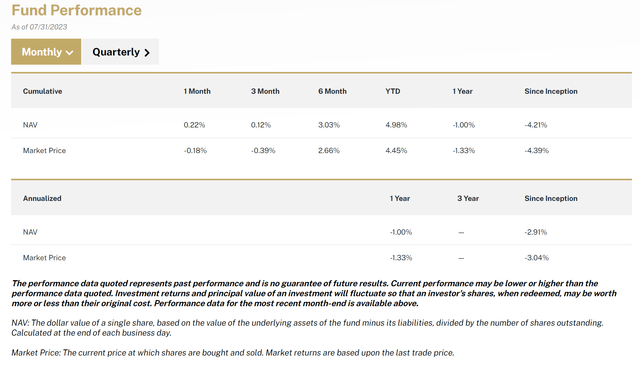

Returns-wise, the AGGH ETF has delivered modest returns, with YTD and 1Yr total returns of 5.0% and -1.0%, respectively, to July 31, 2023 (Figure 5).

Figure 5 – AGGH has delivered modest returns (Simplify.us)

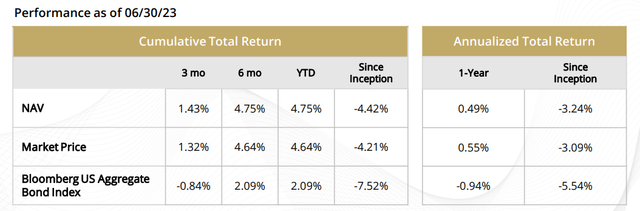

On the surface, the AGGH ETF has outperformed its benchmark, the Bloomberg US Aggregate Bond Index. AGGH has returned -3.2% since inception compared to the benchmark’s -5.5%,as of June 30, 2023 (Figure 6).

Figure 6 – AGGH has outperformed benchmark (Simplify.us)

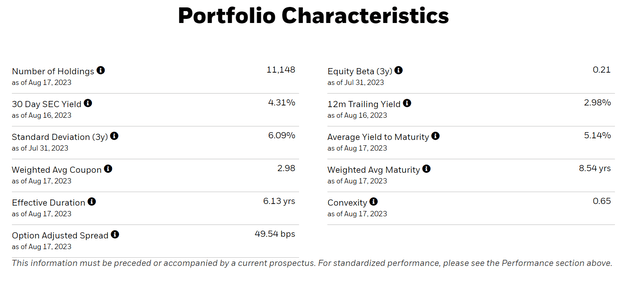

However, this comparison may be a bit misleading because the benchmark index, as modeled by the iShares Core U.S. Aggregate Bond ETF, has a 6.1 year effective duration that is relatively stable (Figure 7).

Figure 7 – AGG has a 6.1 year duration (ishares.com)

However, AGGH, with its high portfolio turnover, does not have a stable duration profile. For example, for the AGGH ETF, the largest portfolio weight currently is the TII bond with a January 2024 maturity which has a 5-month duration. However, back in June, the AGGH ETF has much longer duration with its largest weight being 10yr treasury notes. So comparing AGGH to AGG may be comparing apples to oranges.

Distribution & Yield

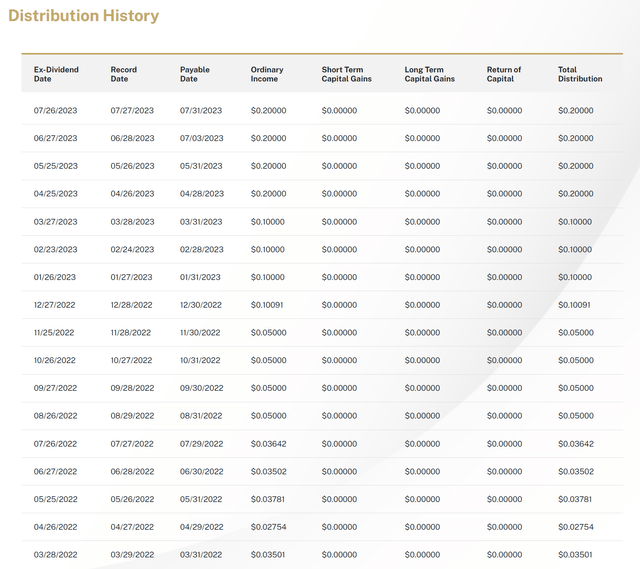

The AGGH ETF is currently paying a $0.20/month distribution that annualizes to a 10.9% forward yield (Figure 8).

Figure 8 – AGGH historical distributions (Simplify.us)

However, it is unclear whether this distribution is sustainable or if it is just funded from liquidating the fund’s NAV. According to the fund’s data, it has a 30-Day unsubsidized SEC yield of only 4.4% (Figure 9).

Figure 9 – AGGH has a 4.4% unsubsidized SEC yield (Simplify.us)

With 1Yr total returns of -1.0% on NAV, it is clearly not earning its distribution based on historical returns.

Furthermore, it is interesting to note the AGGH ETF’s distribution has increased quite dramatically in the past few months, from $0.05/month in November (2.7% forward yield on current NAV of $21.96) to $0.10/month in December (5.5% forward yield on current NAV) and $0.20/month in April.

While the increase in distribution could be a sign of improved net interest income (“NII”) on the underlying investments as interest rates have risen since 2022, it could also be a conscious effort by AGGH to appeal to yield-hungry investors by paying a large upfront distribution that is not supported by income and earnings.

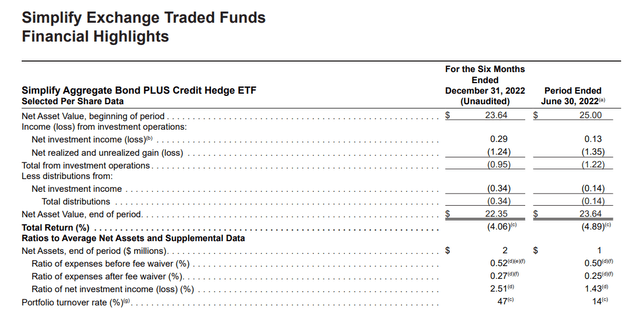

The AGGH’s most recent semi-annual report suggests it could be the latter, as we can see the fund earned only $0.34/share in NII in the six months ended December 31, 2022 (or $0.057/month) and paid $0.34/share in distributions (Figure 10).

Figure 10 – AGGH earned $0.34 in NII and paid $0.34 in distributions in H2/2022 (AGGH semi-annual report)

Unless the AGGH ETF’s strategy has suddenly been able to quadruple NII to over $0.20/month since the turn of the year, the most logical explanation is that the fund is just paying back investor’s capital through the distribution. We will soon find out the truth as the fund is due to release its annual report for the year ended June 30, 2023.

Conclusion

The AGGH ETF is marketed as a core bond fund with a credit hedge overlay. However, my analysis of the fund’s holdings and trading suggest it is an unconstrained fixed income hedge fund that trades in and out of positions depending on the manager’s views on duration and credit.

Hedge funds are fine, as long as it is marketed that way. In fact, the AGGH ETF has delivered decent 1 year total returns of -1.0%, commendable since fixed income securities have faced headwinds from rising interest rates.

My main issue is that the AGGH ETF appears to be positioning itself as a “core bond fund with credit hedges” that pay a 10%+ distribution yield. However, its holdings are mostly not IG corporate bonds, and the fund does not appear to earn its distribution.

The AGGH ETF joins CYA as another Simplify ETF that I would avoid.

Read the full article here