Since Medical Properties Trust, Inc. (NYSE:MPW) circulated its Q2 2023 results, there have been quite a few articles published about it by Seeking Alpha analysts. They have mostly focused on the sustainability of MPW’s dividend.

The concerns about MPW’s ability to maintain $0.29 of quarterly dividend are totally justified given the trajectory of the recent financial performance and more conservative argumentation of MPW’s management in the Q2 earnings call.

The Street has also assumed a more pessimistic stance against the Stock:

- RBC Capital lowering its estimate and assigning a Speculative Risk category.

- Raymond James slashing the rating to Underperform from Strong Buy.

- BofA cutting the rating to Underperform from Neutral.

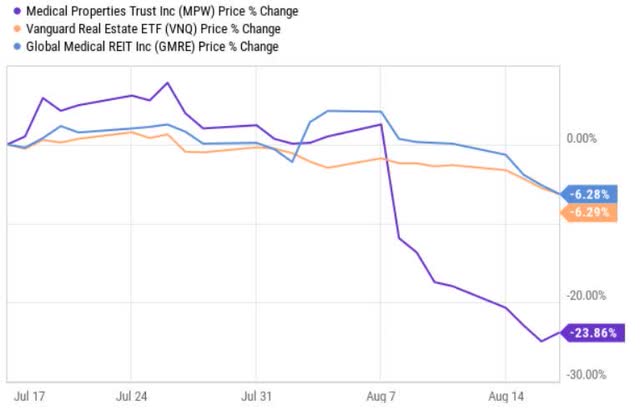

After MPW released its Q2 results, the stock price dropped significantly.

YCharts

Granted, there have been several systematic drivers which have put a downward pressure on the overall real estate investment trust, or REIT, sector. In general, the medical office segment / hospital (and small-cap REIT space) has not necessarily enjoyed great tailwinds that could provide support for the underlying valuations.

Yet, after Q2, the delta between MPW’s stock price and the overall REIT index has been very considerable (~17%).

A drop in market cap at a such magnitude creates an interesting situation from the valuation perspective. As of now, MPW trades at a P/FFO of 6.6x based on an annualized Q3 funds from operations (“FFO”) estimate of $0.28 (which itself is already adjusted for non-cash items). If we factor in FFO estimate for 2024, the P/FFO multiple drops to ~5x.

This is clearly very low both in absolute and relative terms (considering the sector average P/FFO of 12.5x). Due to a heavy discount, the current dividend yield has increased to 15.7%.

Now, my idea is to assess MPW’s financials, cash flows and recent earnings to make a justified judgment as to whether the Company has the potential to survive the crisis without diluting the shareholder base.

In the context of so low multiples, the thing that matters the most is achieving an optimal structure of debt maturities to avoid major refinancings until the situation normalizes. This way, MPW can win some time under which it can divest or monetize some of its assets and accumulate cash to gradually redeem portions of debt thereby bringing down the leverage to a more sustainable level.

If MPW succeeds with its balance sheet and in the process avoids massive share issuances or unfavorable divestitures, the Share price will follow.

Synthesis of Q2 results and MPW’s financial position

First, if we look at the key financial figures, the performance does not look that bad. The YTD FFO landed at $0.85 per share, which is ~9% below the 2022 comparable. On a quarter-on-quarter basis, the normalized FFO has, in turn, increased by ~5%. On a same store NOI level, the results are also stable due to a solid rental collection levels and embedded rent escalators.

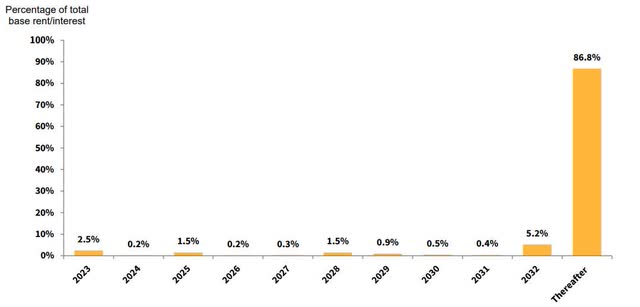

MPW Investor relations

Moreover, the structure of MPW’s leases is very solid with immaterial expiries until 2032. This, coupled with the fact that at June 30, 2023, 99% of MPW’s properties were occupied, leaving only 5 properties as vacant (or 0.2% of total asset size), allows the Management to be more flexible and focused on the balance sheet side.

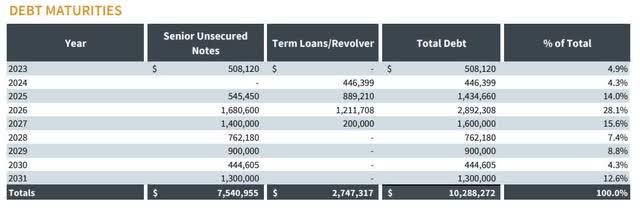

The leverage of MPW remains relatively high with net debt to EBITDA of 6.9x. The adjusted interest rate coverage ratio stood is somewhat healthy – 3.4x.

MPW Investor relations

However, if we peel back the onion a bit, we can see that the underlying structure of the debt maturities is rather favorable as less than 10% of the total outstanding debt falls due in 2023 and 2024. In addition, 86% of the total debt is priced on a fixed interest rate, which in the context of the current weighted average cost of financing of 3.9% puts MPW in a solid position to not make overly aggressive moves in the refinancing front.

An additional aspect, which de-risks the whole story of over-indebtedness is almost no exposure to secured (encumbered) financing. Hence, there is a room for MPW to attract secured financing in case lending markets become overly conservative and reluctant to channel financing to the Company.

Finally, the recent disposal activity sends comforting signals for a gradual optimization of the balance sheet in the near term.

On March 30, 2023, MPW sold 11 facilities located in Australia – as a results receiving $1.2 billion. The deal was structured in two phases:

- The first phase closed on May 18, 2023, in which MPW received $730 million. These proceeds are already taken into account in the aforementioned financials (i.e., Q2 results and current debt structure).

- The second phase is expected to be complete by early Q4 of 2023. In this phase, MPW is set to capture the remaining part of the deal amount – i.e., ~ $400 million.

On top of the additional $400 million, there are two more streams of cash stemming from M&A activity.

First comes from the notice from the Prime Healthcare Services, Inc., where it is stated that the operator will exercise its right to repurchase from MPW a property for $100 million. This will likely be factored into the Q3 financials.

Second comes from MPW’s asset monetization step, where just recently it sold $105M of its interest in Steward Health Care System’s new syndicated asset-backed credit facility to a global asset manager.

If we sum the aforementioned proceeds together and consider the structure of MPW’s debt maturities, there is very little refinancing risk involved until 2025. This provides MPW with a solid opportunity to further optimize its balance sheet and prepare for first notable debt refinancings, which really start taking place only in 2026.

Now, once MPW made Q2 results public, the stock price decreased significantly. One of the main drivers for this was the additional funding of up to $140 million channeled towards one of its largest operators – i.e., Steward Health Care. This was interpreted as a major sign of weakens for Steward and caused significant uncertainty around future rent collections.

Nevertheless, a couple of days after Q2 results, MPW announced that it has successfully sold $105 million of its interest in Steward.

What this indicates or confirms is the fact that MPW acted as a middleman in the entire refinancing process for Steward until the new syndicated facility was landed.

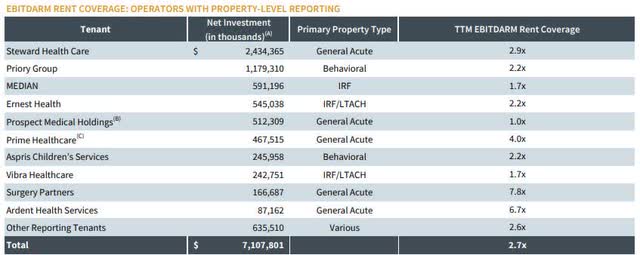

MPW Investor relations

The total portfolio TTM EBITDARM rent coverage exclusive of all Care Act grants of the main operators is relatively sound at a 2.7x level. Especially Steward Health Care, which is one of the main concerns carries a solid 2.9x coverage. An additional positive sign about Steward was that during Q2, it had refinanced the credit facility 5 months ahead of the maturity of its previous loan agreement.

The bottom line

All in all, I think that MPW’s valuation in combination with resilient fundamentals creates an interesting opportunity to consider going long the Stock.

The balance sheet, while quite indebted, is in a good position to become gradually optimized via the forthcoming proceeds stemming from several divestitures. Then, if we consider the back-end loaded debt maturities, MPW has a lot of breathing room until 2026 to accumulate liquidity for successful refinancing. Until then, I do not see a major uptick in the interest cost because nearly 90% of the debt is already fixed.

The only issue is the financial situation of key MPW’s operators. Over the past couple of quarters, MPW has provided capital for Steward and Prospect Medical Holdings to maintain the necessary liquidity. Together, these operators account for ~30% of the total leases.

Now, there are several dynamics which bode well for a healthy normalization in this area. For example, improving EBITDARM rent coverage, access to external financing and successful refinancings, continued rent payments etc.

Based on the information we have now and what is made public, the probabilities are definitely skewed towards a positive outcome (i.e., continued rent coverage).

However, it seems that the market is pricing in a scenario of a dividend cut because of the high leverage, estimated FFO barely covering the dividend and no remaining cash flows from which to optimize balance sheet or provide ad-hoc financing for its operators if necessary.

Honestly, I do not mind MPW cutting the dividend even though the structure of debt maturities, positive news on the operator front, and only a temporarily drop in the quarterly cash FFO may warrant a sustainable dividend coverage.

Even if MPW cut its divided by half, investors would still enjoy ~8% of yield due to considerably depressed valuations.

In a nutshell, it seems that Medical Properties Trust offers an interesting opportunity into which allocate a small portion of capital. At the same time, due to some outstanding uncertainties around MPW’s operators and the well-known corporate governance issues, I would not open too high of an exposure towards Medical Properties Trust, Inc. stock.

Read the full article here