Written by Nick Ackerman.

For some background, here is my view on dividend growth stocks:

Dividend growth stocks aren’t always the most exciting investments out there. They often aren’t grabbing the headlines, and they aren’t the stocks running up hundreds of percentages in a year. In fact, they are often some of the least exciting stocks. And that is precisely their strongest selling point. With such a vast world of dividend growth stocks available out there, it is important to screen through to see if there are any worthwhile investments to explore.

They are stocks that provide growing wealth over time to income investors. Dividend growers are often larger (not always), more financially stable companies that can pay out reliable cash flows to investors. Some are slower growers than others. Some are going to be cyclical that require a strong economy. Some are going to be secular, which doesn’t generally rely on a more robust economy.

Dividend growth can promote share price appreciation. Of course, that is if these companies are growing their earnings to support such dividend growth in the first place. Trust me. There are yield traps out there – I’ve owned a few that I’m not particularly proud of.

I like to think of investing in dividend stocks as a perpetual loan of sorts. Essentially, every dividend is a repayment of your original capital. Eventually, holding long enough, you have the position “paid off.” It is all returned back into your pocket from that point forward.

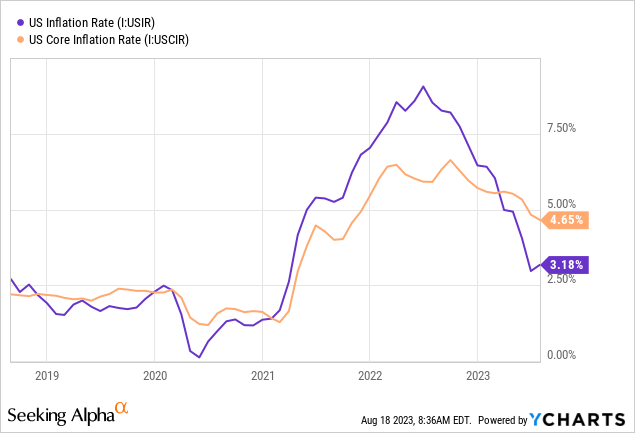

The Fed gave another 25 basis point hike in order to continue to tame inflation bringing rates to the highest level in 22 years. Inflation continues its downward trend. Most are expecting this to be one of the last hikes, with potentially one more later this year, but it all depends on the data as it comes in. The latest CPI report shows a slight uptick from last month.

The Fed themselves project for interest rates to be cut next year and in 2025 from current levels. Again, it depends on how data comes in and what sorts of events happen during this time.

All of this being said, it is important to understand my approach to dividend stocks and why screening dividend stocks can be important for income investors. These are August’s five dividend growth stocks that might be worthwhile for a deeper exploration. As with any initial screening, this is just an initial dive – more due diligence would be necessary before pulling the trigger.

The Parameters For Screening

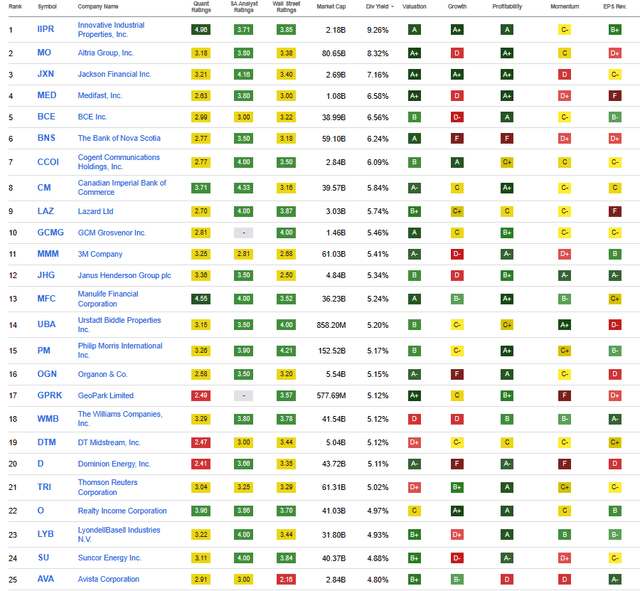

I’ll be using some handy features that Seeking Alpha provides right here on their website for this screen. In particular, I will be screening utilizing their quant grades in dividend safety, dividend growth and dividend consistency.

Dividend Safety is relatively self-explanatory. These will be stocks that SA quants show reasonable safety compared to the rest of their various sectors. The grade considers many different factors, but earnings payout ratios, debt and free cash flow are among these. This category will be stocks with A+ to B- ratings.

For the dividend growth category, we have factors such as the CAGR of various periods relative to other stocks in the same sector. Additionally, the quants also look at earnings, revenue and EBITDA growth. As we will see, this doesn’t mean that every stock with a higher grade has the growth we are looking for. This just factors in that the dividend has grown or earnings are growing to support dividend growth possibly. For these, the grades will also be A+ through B- grades.

Finally, for dividend consistency, we want stocks that will be paying reliable dividends for us for a very long time. In particular, hopefully, they are raising yearly, though that isn’t an explicit requirement. We will also include stocks with a general uptrend in dividend payments, which means there could have been periods where they paused increases for a year or two.

After looking at those factors alone, we are left with 527 stocks at this time from the 525 listed last month. I’ll link the screen here, though it is a dynamic list that constantly updates regularly. When viewing this article, there could be more or less when going to the link.

From there, I wanted to narrow down the list a lot more. I then sorted the list by forward dividend yield, from highest to lowest. Since these will be safer dividend stocks in the first place, screening for those among the higher payers shouldn’t hurt.

I will share the top 25 that showed up as of 08/02/2023.

Top 25 Screening (Seeking Alpha)

As usual, we will skip over the names at the top of the list that we recently covered in the prior couple of months. That includes Innovative Industrial Properties (IIPR), BCE (BCE), The Bank of Nova Scotia (BNS) and Cogent Communications Holdings (CCOI).

That leaves us with giving Altria (MO), Jackson Financial (JXN), Medifast (MED), Canadian Imperial Bank of Commerce (CM) and Lazard (LAZ) a look for this month. JXN is a new name, but the rest we are revisiting.

Altria 8.32% Yield

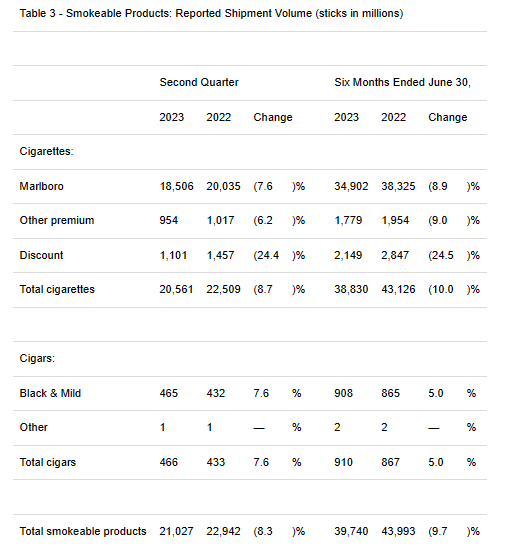

As usual, MO needs very little introduction. This is a favorite of income investors. This sin stock recently posted its results, and it was mostly in line with analysts’ expectations. While they’ve made several missteps over the years in trying to replace the shrinking cigarette shipping volumes, they are on a new quest after acquiring NJOY. Cigar shipments have grown, but their bread and butter Marlboro brand continues to see shrinking volumes year after year.

MO Cigarette Volume (Altria)

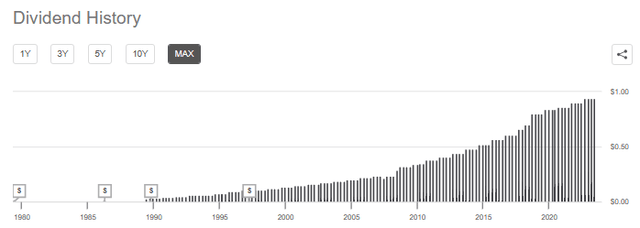

Despite that, revenue grew year-over-year at around 1.3%. Certainly, nothing to brag about, but considering your core business showed a 10% decline in shipment volume for total cigarettes, it certainly shows the pricing power they have. Of course, the real claim to fame for MO here is the growing dividend which has been growing for 53 years, according to Seeking Alpha.

The pace of growth in recent years may have slowed down on the back of slower earnings growth, but they are widely expected to keep on raising the dividend. If history repeats, the raise should be announced sometime later this month.

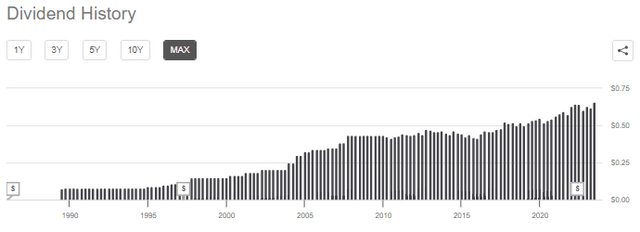

MO Dividend History (Seeking Alpha)

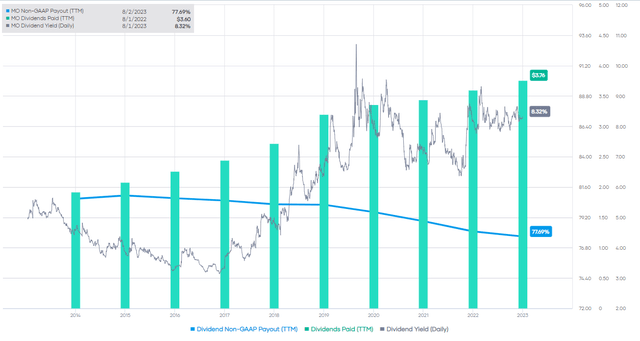

This is backed by a well-covered dividend with a payout ratio of around 77% based on forward estimates. That’s certainly high, but only really where it’s been for the last decade. In fact, over the last decade, it would appear that the payout ratio has actually come down during this time slightly. Besides growth in the dividend, the actual yield itself is a monster at the stock’s current share price.

MO Dividend History and Earnings (Portfolio Insight)

Jackson Financial 7.16% Yield

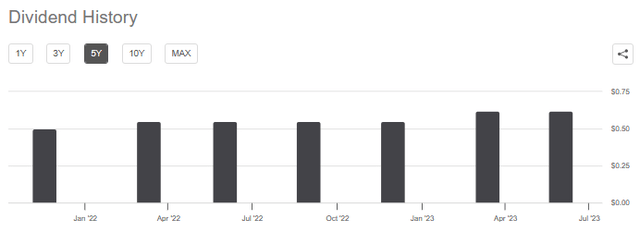

This is a new name to the list and one I debated adding. This is simply because the history isn’t that long, but they appear committed to growing their dividend nonetheless. Initially, the company paid a $0.50 quarterly payout that was raised to $0.55; then, the last increase bumped it up to $0.62. So fairly healthy increases as well.

JXN Dividend History (Seeking Alpha)

JXN was spun off from Prudential (PRU); this was completed in late 2021, thus, is why the company would have a short history. However, operations go back to its founding in 1961.

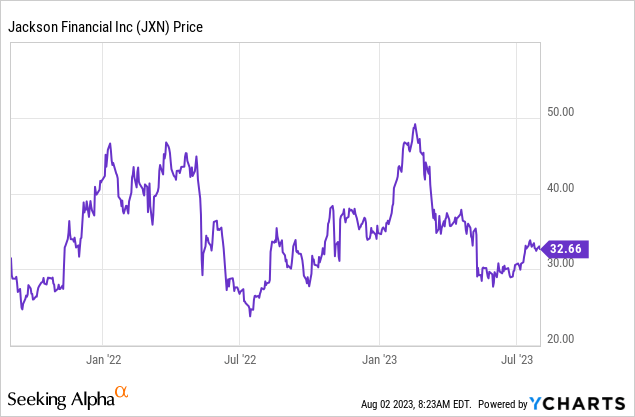

Besides growing its dividend to push the yield up, the company has seen a struggling share price over the last several years, with a particularly deep drop more recently.

YCharts

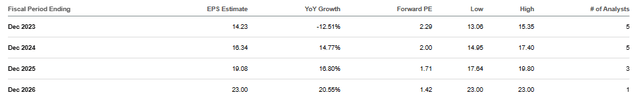

One of the causes for being under pressure could be the expectation for earnings to drop quite significantly this year before increasing again over the next several years. Of course, that’s only estimates of the increases, and it will depend on what happens in the overall economy going forward.

JXN Earnings Estimates (Seeking Alpha)

Annuity sales hit a new record in 2022, and that showed bode well for JXN, especially as the record-high sales continued in the first quarter of 2023 as well. The dividend is easily covered with a payout ratio of 17.4% based on forward EPS estimates, even considering the dip in earnings that are expected before anticipating growth returning. This should lead to a bright dividend growth future for JXN, and it makes it most definitely an interesting name to consider.

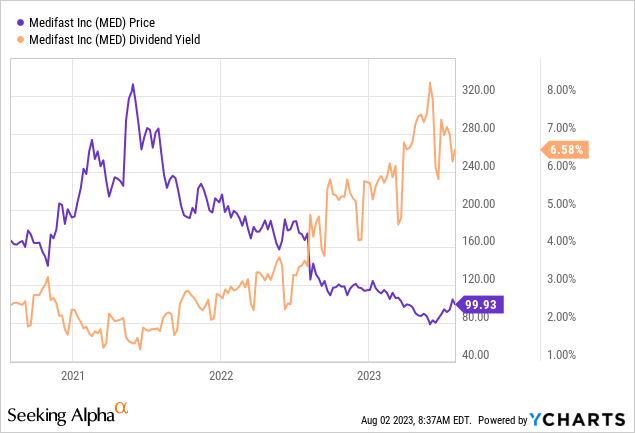

Medifast 6.6% Yield

This is a name we’ve come across several times, the last being in May 2023. The yield here is primarily the result of the stock plunging over 43% in the last year. This was a pandemic darling that’s seeing its fortunes reverse as so many of the Covid plays are facing similar fates.

YCharts

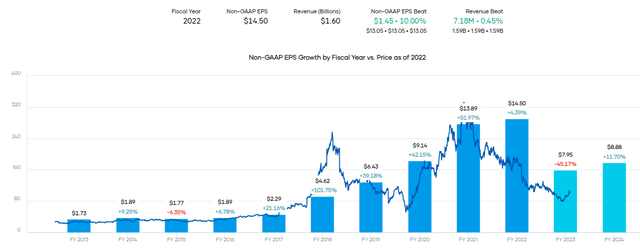

Earnings were booming during this time as health became front and center when people were at home with nothing better to do. The company focuses on “weight loss, weight management, healthy living products, and other consumable health and nutritional products” around the globe. However, consumers seem to have reversed these healthy habits back to pre-pandemic levels.

MED Earnings (Portfolio Insight)

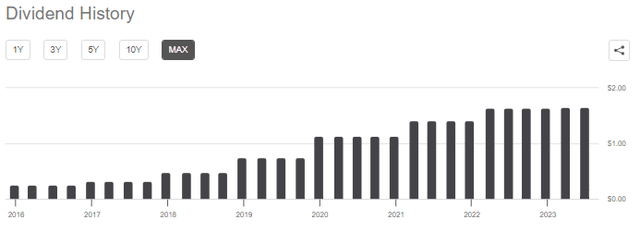

The company did reward shareholders quite impressively while earnings were booming. And it must be said that they are trying to hold onto their dividend streak by raising 0.6% with their last raise.

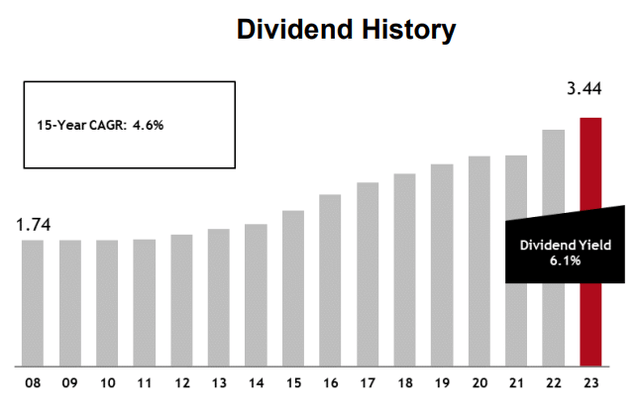

MED Dividend History (Seeking Alpha)

However, the pressure of earnings coming down so dramatically pushes the payout ratio to 83%. That leaves them with some room, but as a company that wants to grow, that also limits cash that could go to their growth. This is only around a $1 billion market cap company, but they do have big ambitions for growth.

Overall, we’re targeting 200 to 300 basis points of sustainable gross margin savings by 2025, enabling us to utilize these savings to fuel the actions we are taking to grow in the years ahead We believe that funding our growth this way can help mitigate negative impacts on our margins and will allow us to make future progress towards our 15×25 goals.

I’d like to talk a little bit more about the growth initiatives that we are currently undertaking. We have already established share leadership in the weight loss market, but with more than 2,200 million people in the United States alone looking at weight management as part of their broader effort to achieve their health and wellness goals, it’s clear that we have only just scratched the surface of what is possible.

While our business growth rhythm has been disrupted, our core business remains strong, and we continue to be highly confident in our coaches’ ability to expand their reach and engagement with our current offerings. At the same time, our model gives us the ability to explore other revenue-generating opportunities as we continue to nurture that core business.

“15×25” is a reference to returning to 15% annualized revenue growth and 15% operating margins by 2025.

Their Q2 results came in at $2.77, which smashed the anticipated $1.32 to $1.44 range they guided for in Q1. That’s certainly some bright news, but for Q3, they are guiding for EPS of $0.71 to $1.32.

This is one company that I’d still look to avoid unless you have a strong opinion that they can return to growth once again if consumers continue a healthier lifestyle.

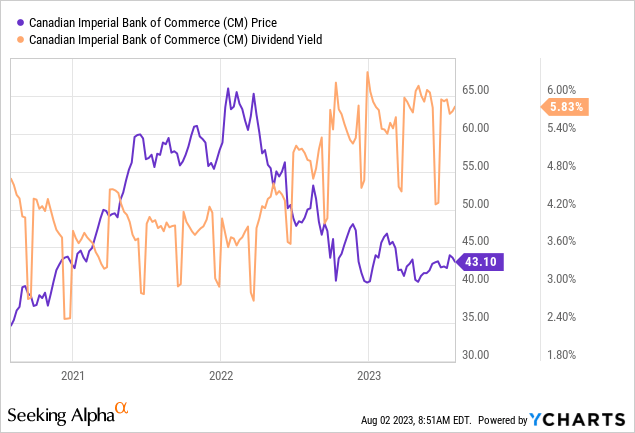

Canadian Imperial Bank of Commerce 5.84% Yield

The last and first time that CM showed up on our monthly screening article was back in February 2023. This came about as their share price has come under pressure – which is pretty much a key theme on how many of these names make their way onto this screening piece. That’s kind of the point, though, finding higher yielders that have shown fairly consistent dividend growth at a cheaper valuation on what could be temporary dips.

YCharts

CM is one of Canada’s “big 5” banks, so clearly, it plays an important role in Canada. Of course, not only are they important in Canada but important around the world with their global operations despite not being Canada’s biggest bank.

An important bank means it should be offered some protections in terms of government support when things get shaky. That doesn’t always mean losses can be avoided for investors, but it should mean some added scrutiny from regulators that keep a closer eye on these entities.

The dividend gets paid in CAD and is converted to USD, so in looking at the dividend history, it could look a bit unusual when looking at the USD amounts.

CM Dividend History CAD to USD (Seeking Alpha)

Instead, looking at their latest fact sheet shows us a better representation of the dividends paid annually.

CM Dividend History (Canadian Imperial Bank of Commerce)

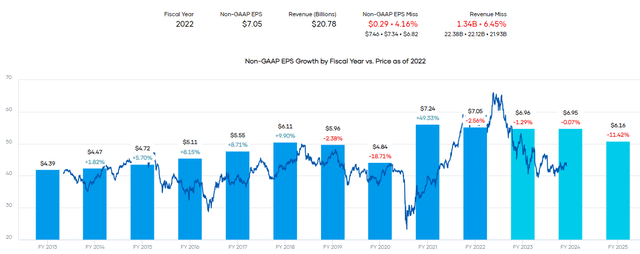

The dividend history is attractive, and it could be a relatively attractive bank based on valuation. However, its earnings growth has been pretty minimal or nonexistent. Revenues have been slowly moving higher over the years but are mostly expected to flatline going forward in the next couple of years. Earnings are anticipated to be under pressure, and they haven’t necessarily been the most consistent earners in the last several years, either.

CM Earnings (Portfolio Insight)

Of course, that was having to deal with the pandemic as well, and financial institutions are naturally sensitive to economic conditions anyway. With all that being said, it’s certainly an interesting name to consider going forward, but it would be great to see earnings start trending higher.

Lazard 5.74% Yield

LAZ last appeared for us in April 2023, so relatively recently. This name also popped up on a couple of occasions last year too. LAZ is a financial company that focuses on financial advisory and asset management. In terms of asset managers, this is a small company with a market cap of around $3 billion and an AUM of around $240 billion. The last reported AUM shows an increase from the prior month, which is encouraging. This is a partnership that issues a K-1 tax form.

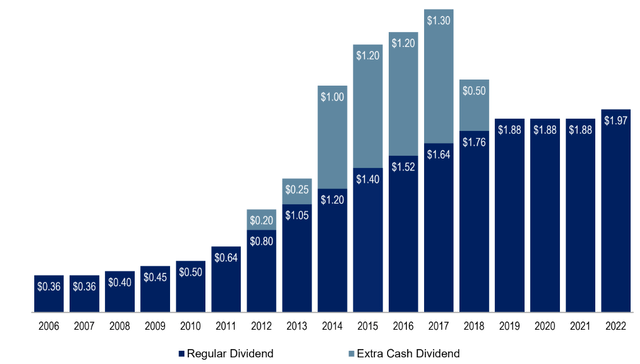

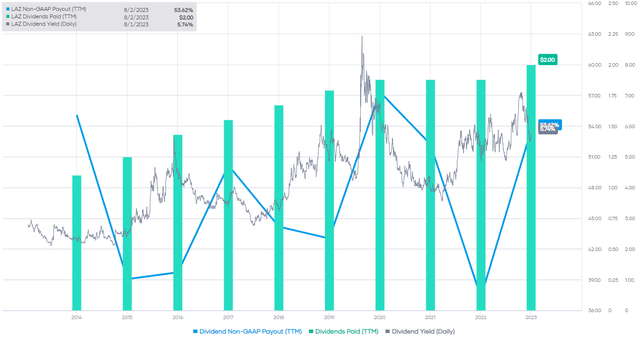

The company has been able to deliver a trend of solid dividend growth and, when times were good, pretty sizeable special dividends as well.

LAZ Annual Dividend History (Lazard)

They don’t always raise every year consecutively; as an example, the last dividend amount has now been for five quarters in a row. The $0.47 before that was held steady for 13 quarters straight, which includes the pandemic period. This isn’t necessarily a bad thing either, as the company pays more when it can and then conserves cash in more tough economic times.

The non-GAAP dividend payout ratio has been fine in the prior years.

LAZ Dividends and Earnings (Portfolio Insight)

However, earnings in the last quarter showed non-GAAP EPS of $0.24, about half of what the company is currently paying quarterly. On a GAAP basis, it was a net loss of $1.41 per share. The difference here was related to cost-saving initiatives:

Second-quarter and first-half 2023 adjusted results1 exclude pre-tax charges of $146.7 million and $167.4 million, respectively, relating to expenses associated with cost-saving initiatives; first-half pre-tax charges of $10.7 million relating to expenses associated with senior management transition, a benefit pursuant to tax receivable agreement obligation (“TRA”) of $40.4 million, and $19.1 million relating to certain asset impairment charges. On a U.S. GAAP basis, these resulted in a net charge of $146.7 million, or $1.65, per share, diluted, for the second quarter, and a net charge of $145.9 million, or $1.66, per share, diluted, for the first half of 2023.

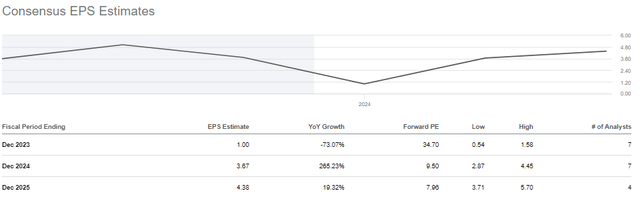

Based on forward estimated earnings, it doesn’t look great, as analysts anticipated $1 in earnings for fiscal 2023 before recovering significantly.

LAZ Earnings Estimates (Seeking Alpha)

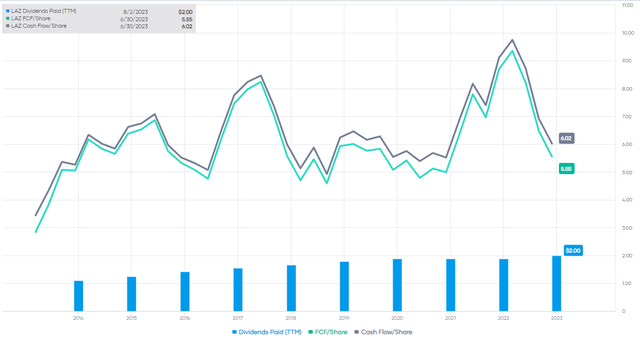

That said, cash flow and FCF have looked better than their EPS.

LAX Dividends and Cash Flows (Portfolio Insight)

The company looks to be in a tough situation but is another example of a company reliant on the overall economic and market conditions. The company’s CEO sees the M&A market stabilizing, “and conditions are set for the beginning of a rebound.” Should that occur, it’s likely that LAZ can begin to recover its earnings and cash flows and start putting those back in the right direction once again.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here