The last and only time I wrote about PayPal Holdings, Inc (NASDAQ:PYPL) was after its Q1 FY2023 report in May, after which PYPL stock fell nearly 13% in one day and then continued to fall, losing another 10% or so after that heavy dip.

In my May article, I argued that PYPL was not that undervalued even after such a massive correction. My valuation analysis at the time led me to conclude that PYPL should only yield about 20% over the next 5 years, meaning the stock should only grow by 3.72% annually. That was too low for a “Buy” recommendation.

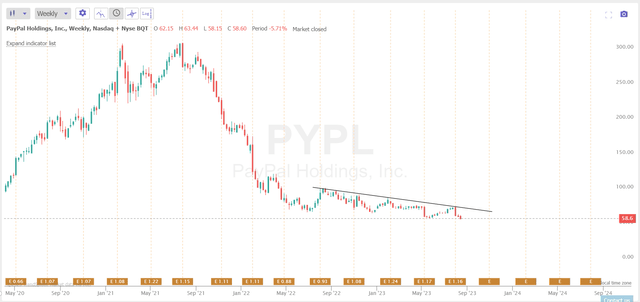

A few days ago, the company reported on Q2 FY2023 results, and some of my predictions came true. In any case, the downtrend is not over yet:

TrendSpider Software, author’s notes

Today, I would like to update my coverage and reassess my past projections based on what we saw in PYPL’s Q2 financials.

Q2 Results And What They Caused

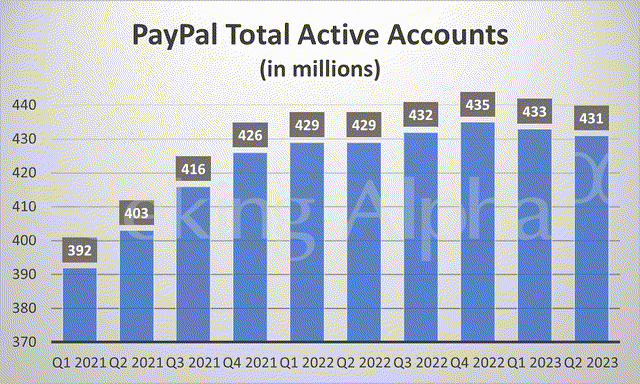

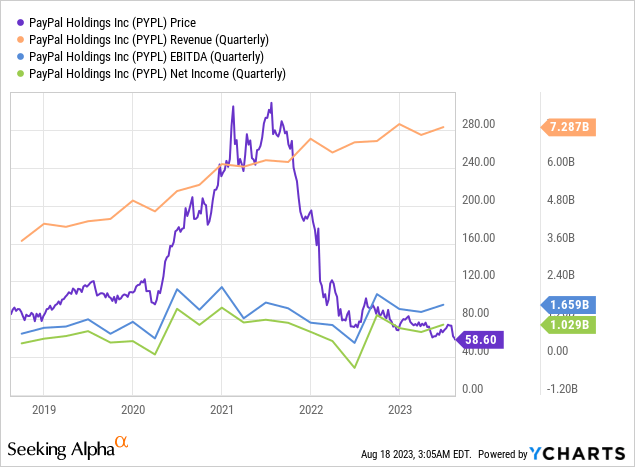

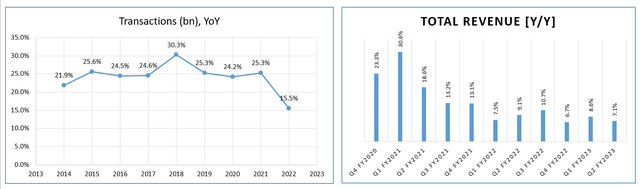

PayPal’s Q2 results, published on August 3, 2023, showed Non-GAAP EPS of $1.16 in line with expectations, and revenue of $7.3 billion beating estimates by $30 million [7.4% YoY growth]. Total payment volume hit $376.5 billion, up 11%, and transactions grew by 10%. Active accounts reached 431 million. The management provided FY2023 guidance with GAAP EPS of ~$3.49 (+67% up from $2.09 in FY2022) and Non-GAAP EPS growth of ~20% to ~$4.95 (+19.8% up from $4.13 in FY2022).

You would think that the results should make investors happy – just look at the forwarding increase in EPS [according to the guidance]. But on the day the PYPL report was released, the stock plummeted >12% and has continued to edge lower ever since:

TrendSpider Software, author’s notes

Why is it happening?

The decline can be mainly attributed to a continued decrease in active accounts for the second consecutive quarter:

Seeking Alpha data

Investors fear that PYPL will continue to lose market share as a result of this inexorable decline. So far, no clear consequences can be derived from the factual financial results.

As Argus Research analyst, Stephen Biggar, wrote in his note [August 3, 2023 – proprietary source], the company has altered its marketing strategy to focus less on new users and more on greater utilization by existing users. Over the past few years, the firm expanded its “Buy Now Pay Later” [“BNPL”] offering by introducing short-term installment products in the U.S. and UK. It also launched a new service enabling customers to trade cryptocurrencies using their PayPal accounts.

In my opinion, the problem with PYPL lies in its poor unit-economics metrics, as well as in the excessively high valuation that investors initially gave in the hope of quickly conquering the market in new segments.

Let’s first update my model with the Q2 numbers – they will help me explain what exactly I mean by poor unit economics.

Excel, author’s work Excel, author’s work

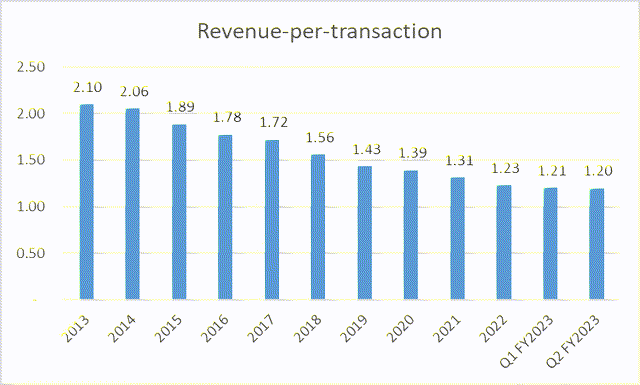

As you can see, although in absolute terms PYPL’s revenue has grown at a CAGR of 15.1% since 2013, the revenue-per-transaction ratio has been falling by ~5.2% annually.

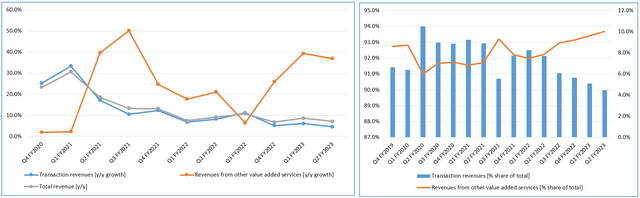

Still, the growth in the “Revenues from other value-added services” that you could see in the infographic below doesn’t add any tangible incremental growth or diversification, as the share of this segment in the revenue structure has only grown to just 10% of consolidated revenue figure:

Excel, author’s work

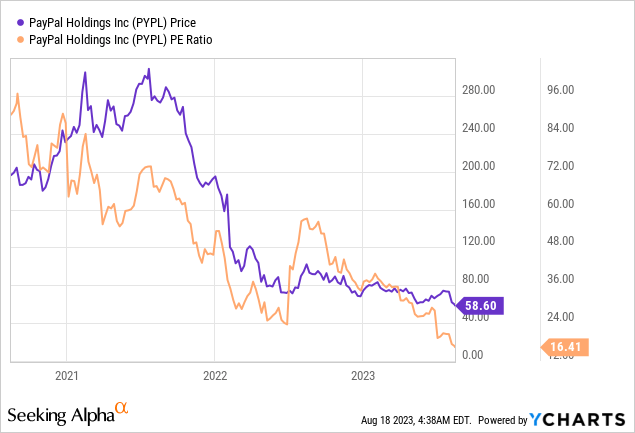

So we notice that the company’s new projects don’t really bring strong overall top-line growth. PYPL’s revenues continue to decline as the addressable market becomes more and more saturated. Here is where the disappointing picture of falling valuation metrics comes from. The P/E ratio, for example, has fallen from ~40-40x in FY2022 to just ~16x as investors discount PYPL’s ability to grow as strongly as it was expected previously:

As last time, let’s assume the PYPL will be able to grow its user base by only 2% YoY over the next 5 years [which is already better than the decline in Q1 and Q2]. Then my earlier predictions on PYPL’s key unit economic metrics should still hold:

| Year | Users [M] | Transactions [B] | Sales [$M] | Revenue-per-transaction |

| 2023 | 441.66 | 24.98 | $29.22 | 1.17 * |

| 2024 | 450.49 | 27.97 | $32.07 | 1.15 |

| 2025 | 459.50 | 31.33 | $35.2 | 1.12 |

| 2026 | 468.69 | 35.09 | $38.64 | 1.10 |

| 2027 | 478.07 | 39.3 | $42.41 | 1.08 |

| Assumptions [YoY] | +2% | +12% | -2% |

Source: Author’s work [* – the ratio will decline by 5.2% in FY2023]

Even though last time my prediction of an exit multiple P/E of 12x was criticized by SA readers, I believe this number is the most reasonable to calculate the fair value of PYPL. Why? First, we apply the necessary principle of conservatism because there is always the temptation to intentionally arrive at the conclusion that suits our biased brain. Second, no one has canceled the business cycle. The older the company gets, the more difficult it becomes to grow, and accordingly, the larger the discount to valuation should be. It is very important to add here that another assumption is sewn into this assumption: PYPL will not grow as fast as it did before 2022.

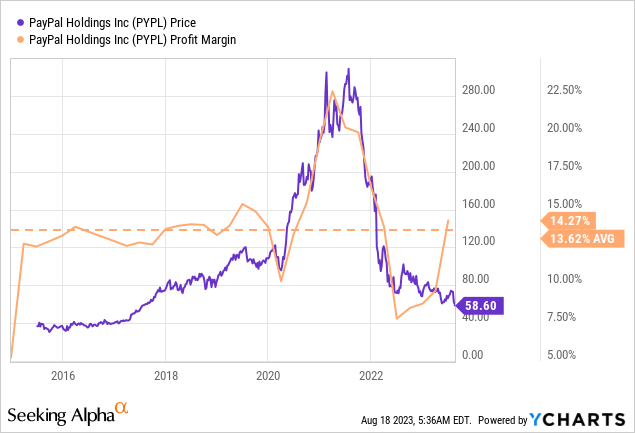

Let’s assume that the net margin is raised above the long-term average against the background of the maturity of the business cycle. Let’s say from the current 14% to 17%, 200 basis points higher than I assumed previously.

Then, my updated valuation model yields an upside of 36% by the end of FY2027, which corresponds to a CAGR of ~6.3% since today:

Excel, author’s work

In general, under conservative assumptions, PYPL stock is currently undervalued. But if we think in a probability-like context, then with such an upside potential, PYPL currently has no margin of safety, based on the above calculations. Roughly similar returns can be found in the debt market today. So why would an investor overpay for the equity risk in this particular case is not entirely clear to me.

The Verdict

I am prepared internally that many of the readers will disagree with my opinion. Stocks that are falling rapidly but still have solid TTM financials always attract value seekers. The key point here, however, is that the TTM numbers tell us nothing about the future. The reality is that despite its best efforts, PYPL is losing market share and its growth continues to stagnate quarter-on-quarter, resulting in ever-lowering valuation multiples.

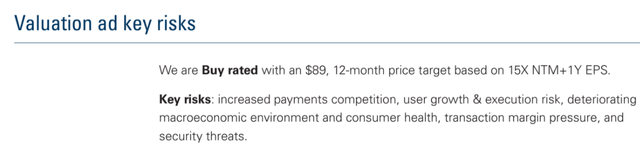

Perhaps the new CEO can turn things around. Goldman Sachs equity research analysts recently issued a note (August 14, 2023 – proprietary source) welcoming the appointment of Alex Chris – a former executive of Intuit (INTU) – to this position. They believe that Chris’ extensive experience in product development, small and medium business (SMB) solutions, and payments will benefit PayPal. Chris’ choice is attributed to his track record of delivering results, developing product strategies, understanding customers, and building talented teams.

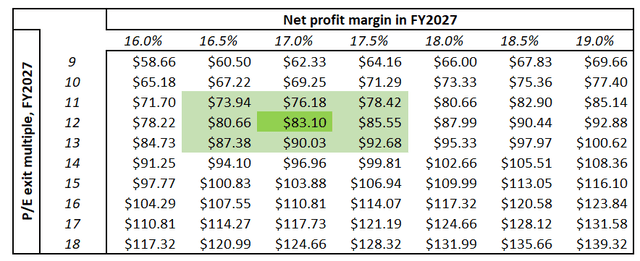

By the way, the bank has a way brighter forecast for PYPL’s valuation:

Goldman Sachs (August 14, 2023 – proprietary source)

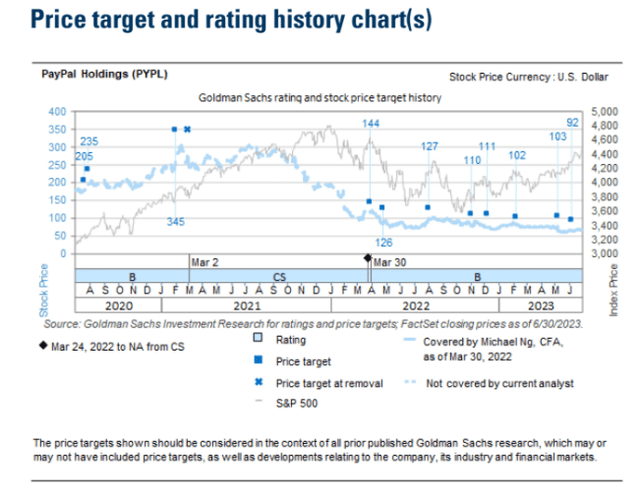

So maybe I’m wrong. But so far they have been wrong:

Goldman Sachs (August 14, 2023 – proprietary source)

It will be very exciting to see what new steps the new management will take and how the company will be realigned into a new phase of growth. Many large companies once succeeded in doing this, but there is a risk that PayPal will not succeed. If you’re willing to take that risk now, I wish you the best of luck. But I stay on the sidelines.

Thank you for reading!

Read the full article here