Introduction: UiPath – Pioneering the Future of Robotic Automation processing with AI Integration

In this article, I will share one of my latest discoveries. I firmly recommend a STRONG BUY rating for UiPath (NYSE:PATH), an RPA company at the forefront of his guild, came to stay and define the new era of AI in the context of Robotic Automation Processing. The company’s product suite is distinct from that of its rising competitors. PATH has a huge market share ahead of it to occupy over the course of the next few years, coupled with prospects of juicy margins and the resulting profits for shareholders. I will diffuse the perhaps high-appearing current valuation of the company and underscore my optimism with my very own valuation models hinting that this company has the potential of becoming a future Ten-Bagger. Stay tuned!

UiPath, a cutting-edge software company that has emerged as a trailblazer in the field of Robotic Process Automation (RPA), revolutionizing how businesses operate and innovate. Founded in 2005 by entrepreneur Daniel Dines along with a partner in a modest Romanian flat, UiPath has rapidly ascended to the forefront of the tech landscape, receiving tons of awards and accreditation from leading institutions as the leader in its endeavor. With a strong commitment to harnessing the power of artificial intelligence (AI), UiPath is further poised to drive efficiency, and foster unprecedented growth for their customers and, as a result, for themselves as well – I believe there is a saying that goes something like that: Building a billion-dollar legacy is not just about amassing wealth for yourself, but in fact about enabling others to rise to millionaire heights on their very own journey – UiPath does that by providing software that creates nothing but pure value for its consumers.

Empowering Enterprises through RPA: UiPath’s Core Product

At the heart of UiPath’s prowess lies its innovative software, designed to automate tasks through Robotic Process Automation (RPA). RPA serves as a bridge between human capabilities and digital systems, enabling software robots to mimic human actions across a wide array of tasks, most of them so-called repetitive tasks. In order to hand these tasks over to robots (software), real human labor can be deployed towards more meaningful tasks such as abstract thinking, creativity, hospitality, and all those other things in which humans are still superior to machines. So RPA basically frees the human genius from being stuck in tiring exercises.

The Advantages of RPA for Businesses at a glance:

Streamlined Workflows: RPA optimizes workflows, enhancing organizations’ profitability, flexibility, and responsiveness.

Elevated Employee Productivity: By relieving workers of mundane tasks, RPA leads to an increase in job satisfaction, engagement, and overall productivity.

Rapid Digital Transformation: RPA accelerates digital transformation, making it feasible to automate legacy systems without the need for extensive APIs or database access.

Unlocking Human Potential: With software robots handling repetitive tasks, human resources are freed to focus on innovation, collaboration, and customer interaction.

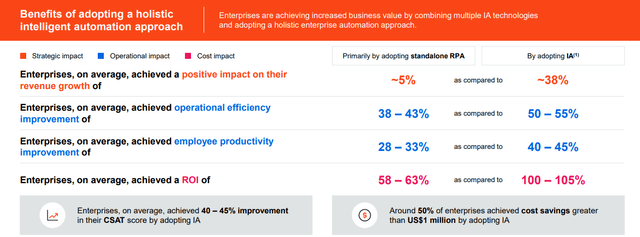

PATH – benefits (PATH -Corporate Presentation)

UiPath’s end-to-end Approach – It’s Value Proposition

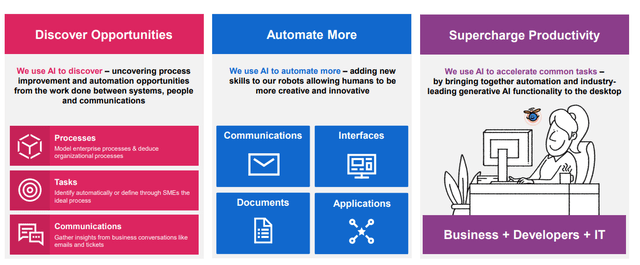

UiPath’s strategic framework revolves around the three pillars of Discover – Automate – Operate. This approach encapsulates the journey that organizations embark on as they adopt UiPath’s technology. It begins with identifying opportunities for automation, followed by the actual automation process, culminating in the seamless operation of the automated processes. Over the past few years, the company has significantly increased its engagement in enhancing its products with the power of AI. RPA is not AI, and AI is not RPA, but those two combined offer a strong value proposition to customers. This comprehensive approach underscores UiPath’s commitment to delivering end-to-end solutions that empower businesses to thrive in the evolving digital landscape and makes UiPath along with its product suite, uniquely positioned against competitors.

AI-powered automation (1Q FY 2024 Earnings Supplemental Slides)

UiPath’s Versatility Across various Industries

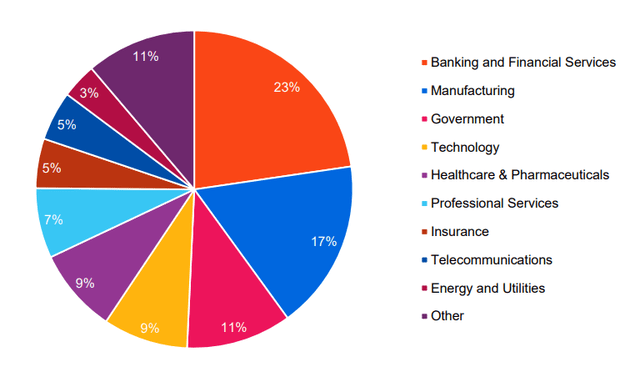

UiPath’s RPA solutions transcend industry boundaries, with applications spanning finance, healthcare, manufacturing, the public sector, and beyond. Organizations such as financial institutions, accounting firms such as Deloitte and EY, tech giants like Spotify and Uber, and numerous others have embraced UiPath’s solutions to enhance their operations and drive growth. RPA’s adaptability to a vast array of processes, both high-volume and cognitive, cements its leadership in the industry. Another pro is that UiPath is relatively easy to implement as a business owner; it doesn’t matter if you are an experienced software engineer or not. UiPath’s products offer the flexibility to be structured by professionals into complex automation systems tailored for your very own unique, complex processes, as well as rather simple automation solutions that someone not gifted with the trait of technology is also able to figure out. Moreover, UiPath is easily able to be integrated with leading ERP systems and other common software used by businesses in their day-to-day operations.

PATH – Industries Overview (Investors Day slides)

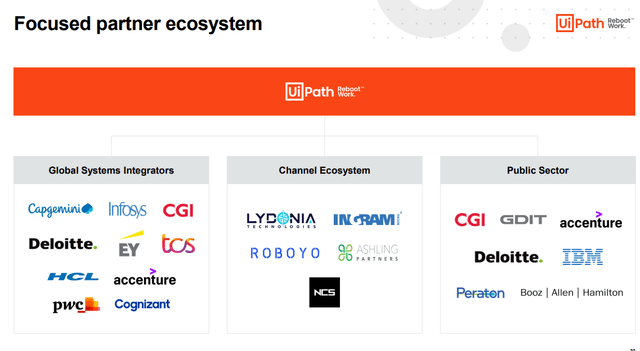

Sales and Partnerships: A Thriving Ecosystem

UiPath’s success extends beyond its technology, encompassing a robust sales strategy and strategic partnerships. The company employs a multifaceted approach to sales, leveraging a direct sales team, pre-sales engineers, and professional services to expedite adoption and deliver value. Collaborating with an extensive network of partners, including system integrators, resellers, and consultants, UiPath extends its market reach and optimizes sales efficiency. Notably, UiPath is evolving its partner ecosystem to prioritize customer adoption, usage, and relationship quality.

PATH – Partner (Investors Day slides)

Valuing UiPath’s Potential

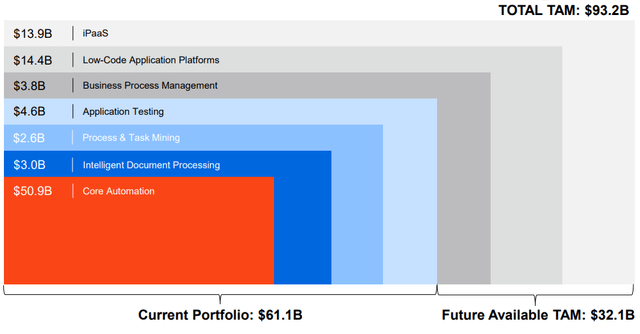

The valuation process initiates by quantifying the immense potential within UiPath’s target market. While current market size projections suggest a valuation exceeding $90 billion, this figure might merely scratches the surface of a potentially more expansive landscape in 10 or 15 years.

PATH – Market Potential (Investors Day slides)

Forecasting Revenues, Projecting Market Share and Guessing the Intrinsic Value of an UiPath Share

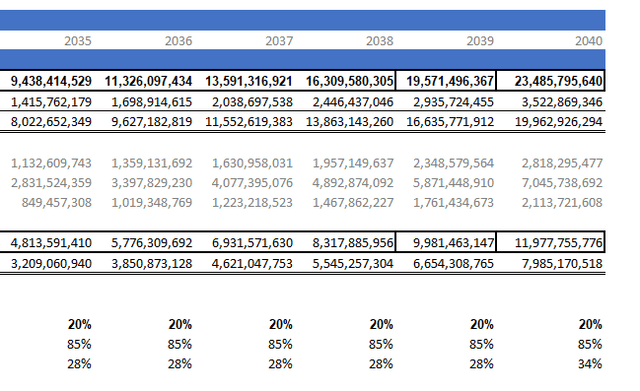

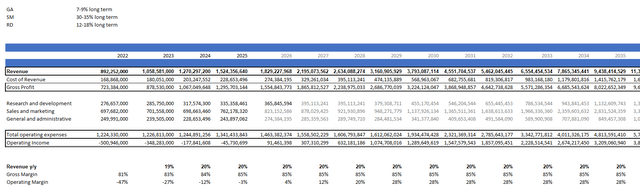

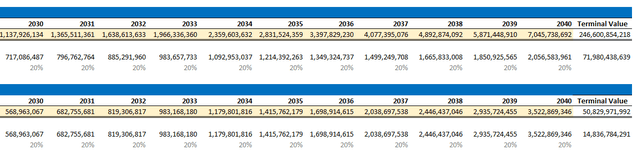

In my model, I basically assume that by FY2040 (16 years ahead), I expect the company to have gained a total annual revenue of about $23.5 billion after successfully continuing its current revenue growth of 20% p.a. average. If that assumption falls in the vicinity of my annual revenue projection for FY2040, UiPath would have acquired a total market share of 25%. I believe that 25% market share and 20% annual growth are even likely to be surpassed by UiPath, but as always, I tend to prefer being rather conservative in my assumptions. In my operating expense assumptions, I used UiPath’s very own projections: 7-9%, 30-35%, 12-18% General administrative expenses, Sales and marketing, Research and development, respectively. Resulting in long-term average margins in line with the company’s own expectations.

PATH – financial metrics – projection 1/2 (Author)

As I believe the company has a bright future possible far beyond what I put in as an assumption thereunder, I nevertheless implied in my model that UiPath will be matured by FY2040 and then significantly slow down in further growth.

PATH – financial metrics – projection 2/2 (Author)

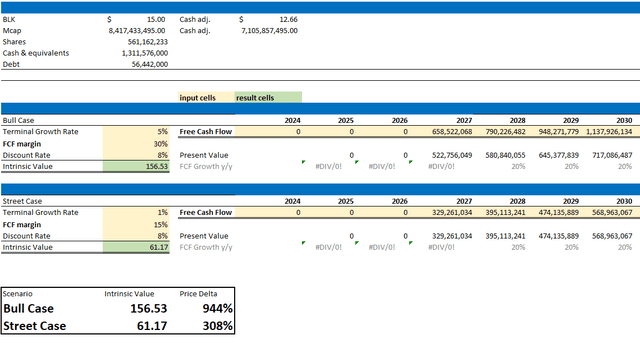

The result of my valuation is the intrinsic value, or fair value per share, derived from the amount of Free Cash Flow produced to be potentially distributed to shareholders. Due to the nature of the company’s business model as a technology company that sells an intangible product, overhead costs are relatively low, which is a great indication for future high cash flow margins.

I provided two scenarios for my Free Cash Flow review: one bullish one and a rather bearish one for the company. While for the bullish case I imply an optimistic but still realistic free cash flow margin of 30% on average, I merely imply half of that amount for the street case. For the street case, I also imply the company will stop growing at all after reaching FY 2040.

PATH – FCF – Model 1/2 (Author) PATH – FCF – Model 2/2 (Author)

As you can see for both scenarios, I put in the expectation for UiPath to become Free Cash Flow positive by FY27. Which might be a little too pessimistic, but I will further delve into my thoughts about Free Cash Flow in the following section, where I am going to review the company’s recent results and financial statements that in fact indicate that UiPath might already generate a positive Free Cash Flow number by FY25. But again, it’s better to be surprised than disappointed. Furthermore, these rather prosaic guesses only further highlight the potential weight of the results I calculated for each of the scenarios. Well, even the pessimistic Street Case points to significant upside potential for UiPath’s share price.

Recent Results Underscore My Optimism

After gaining a comprehensive understanding of UiPath’s future potential and growth trajectory, we now shift our focus to the present moment. It’s essential to examine how the company is performing in the here and now, as we delve into the key takeaways from Q1 2024 and the full year of Fiscal year 2023. This current performance assessment provides a real-time snapshot of UiPath’s progress and its alignment with the forward-looking insights we explored earlier.

Q1 2024 Highlights

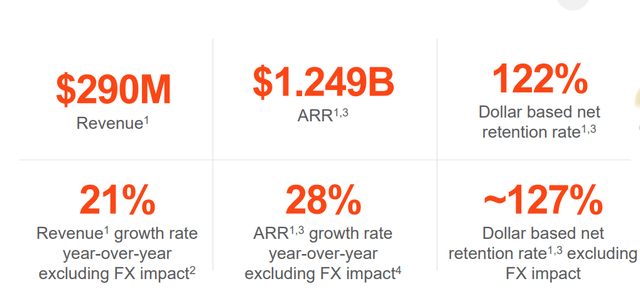

In the first quarter of 2024, UiPath continues to demonstrate its resilience and growth momentum. Notable highlights from this period include:

PATH – Q1 FY24 Financial Highlights (1Q FY 2024 Earnings Supplemental Slides)

Robust Revenue Growth: UiPath’s revenue for Q1 2024 reached $289.6 million, marking an 18% year-over-year increase.

Expanding ARR: The Annual Recurring Revenue (ARMOUR Residential REIT, Inc. (ARR) Stock Price Today, Quote & News) surged to $1,248.9 million, representing an extraordinary 28% increase compared to the previous year. This significant growth signals strong customer adoption and underscores UiPath’s remarkable market position.

Enhanced Gross Margin: UiPath’s commitment to efficiency is evident in its gross margin performance. With a gross margin of 85% for the quarter, the company showcases its ability to maintain a balance between generating future value and managing costs effectively in the present.

Strong Financial Position: UiPath maintains a robust financial position, evident in its cash, cash equivalents, and marketable securities totaling $1,786.4 million as of April 30, 2023. This liquidity strength positions the company well for strategic initiatives and growth investments.

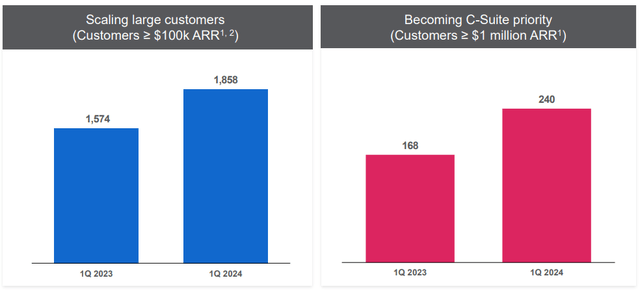

Customer Base Expansion: UiPath’s global footprint is expanding, with approximately 240 customers boasting an ARR above $1 million and around 1,850 customers with an ARR exceeding $100,000. This diverse customer base underscores UiPath’s relevance across industries.

Customer momentum (PATH – 1Q FY 2024 Earnings Supplemental Slides)

Positive Cash Flow Transformation

Earlier, I promised that I wanted to learn a little more about Free Cash Flows and when they can be expected, as it is the crucial factor of my value evaluation approach, which is a Discounted Cash Flow Model. A noteworthy shift in cash flow dynamics occurred as UiPath achieved a positive cash flow from operations of $67.3 million in Q1, 2024. This contrasts starkly with the negative cash flow of $51.9 million during the same period in the previous year. The red marks indicate relevant highlights, in my view. We can see that UiPath basically produced profitable operations, resulting in a positive Cash Flow number from operations for the three months ended April 30, 23. The factor that ultimately dragged it down was a significant allocation of cash, presumably to either money market funds or Treasury bonds or both, which is accounted for as an investment and therefore impacts the overall Cash Flow number. Nevertheless, imaginatively, we are able to adjust that and see that the business might even be profitable already. Nonetheless, I remained a little more cautious about the overall Free Cash Flow level for the whole fiscal year, which is reflected in my valuation model. I am excited about the upcoming release of UiPath’s Q2 FY24 results to find out whether this positive trend on the Cash Flow level continues.

PATH – Cash Flow Statement Q1FY24 (PATH – Form 10-Q)

Risks

UiPath is witnessing rapid growth, a compelling product, and therefore a promising future. While I am significantly bullish on PATH as a prudent investor, we should not neglect reviewing the potential risks that always exist with every thesis.

With the allure of RPA and the massive growth within this field comes increased competition too. UiPath faces competition from various fronts. This is a potential threat and might adversely impact the companies long term performance metrics such as growth, revenue, profits and ultimately its share price. These potential competitors from view mainly include:

Enterprise Platform Vendors: These vendors are either acquiring, building, or investing in automation capabilities. Their existing foothold in enterprise software gives them an advantage in expanding their automation functionalities.

RPA Software Providers: Even though these competitors offering RPA platforms currently lack the comprehensive end-to-end automation capabilities that UiPath offers.

Adjacent Automation and Integration Platform Companies:

Companies specializing in low-code, process mining, integration, and other automation-related fields pose competition by providing features that can be integrated into the automation process.

Future developments pertaining to competition must be carefully monitored.

Uncertainties in Assumptions and Model Reflection:

An inherent challenge in projecting the future lies in the nature of assumptions. While my model on UiPath is designed to be reflective of its growth trajectory, uncertainties and unforeseen changes could impact the accuracy of these assumptions. It’s important to note that no projection is immune to uncertainties, and while the model provides valuable insights, it remains a simplified representation for clarity.

Currency Risks:

UiPath operates in a global market, which exposes it to currency risks. Pricing its products in local currencies can lead to fluctuations in revenue and profitability due to currency exchange rate fluctuations. These risks necessitate careful monitoring and strategic mitigation strategies to maintain stability and predictability in financial performance.

Customer Concentration:

Moreover, UiPath’s financials reveal a concentration of revenue and ARR among a limited number of customers. While such customer relationships are valuable, any failure to retain these key clients could lead to significant declines in revenue and ARR. The company’s ability to manage customer relationships and provide exceptional value is pivotal in mitigating this risk.

Dual-Class Structure and Voting Control:

A distinct aspect of UiPath’s corporate structure is its dual-class stock arrangement, where Class B common stock carries significantly more voting power than Class A common stock. The concentrated voting control, predominantly held by Daniel Dines, Co-CEO, Co-Founder, and Chairman, limits the influence of other shareholders on crucial decisions. While this structure can expedite decision-making, it does raise concerns about the diversity of perspectives and influence over key strategic choices.

Conclusion/Opinion

In conclusion, UiPath stands as a remarkable testament to the power of innovation and strategic foresight in reshaping industries and driving transformative change by offering true value to customers.

The different aspects we’ve embarked upon through this article underscore the profound impact of UiPath’s technology and its potential to revolutionize businesses across diverse sectors.

However, as with any investment, there are risks and uncertainties to consider. The competitive landscape, uncertainties in assumptions, and currency risks pose challenges that demand continuous vigilance. Yet, the risks are not without remedy.

When we consider the valuation, the promising trajectory of revenue growth, the transformative potential of RPA, and the company’s ability to address challenges, the bullish investment thesis remains compelling. The comprehensive valuation model, which accounted for various scenarios and potential growth paths, supports my optimism for UiPath’s future, resulting in a STRONG BUY rating for the stock.

In light of recent results that underscore the company’s resilience and growth, such as the substantial increase in revenue, expansion of ARR, enhanced gross margin, and positive cash flow transformation, UiPath is on a trajectory that resonates with this optimistic outlook I have.

With the increasing incorporation of AI in its RPA solutions, UiPath’s end-to-end approach will define the future of this innovative era.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best AI Ideas investment competition, which runs through August 15. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here