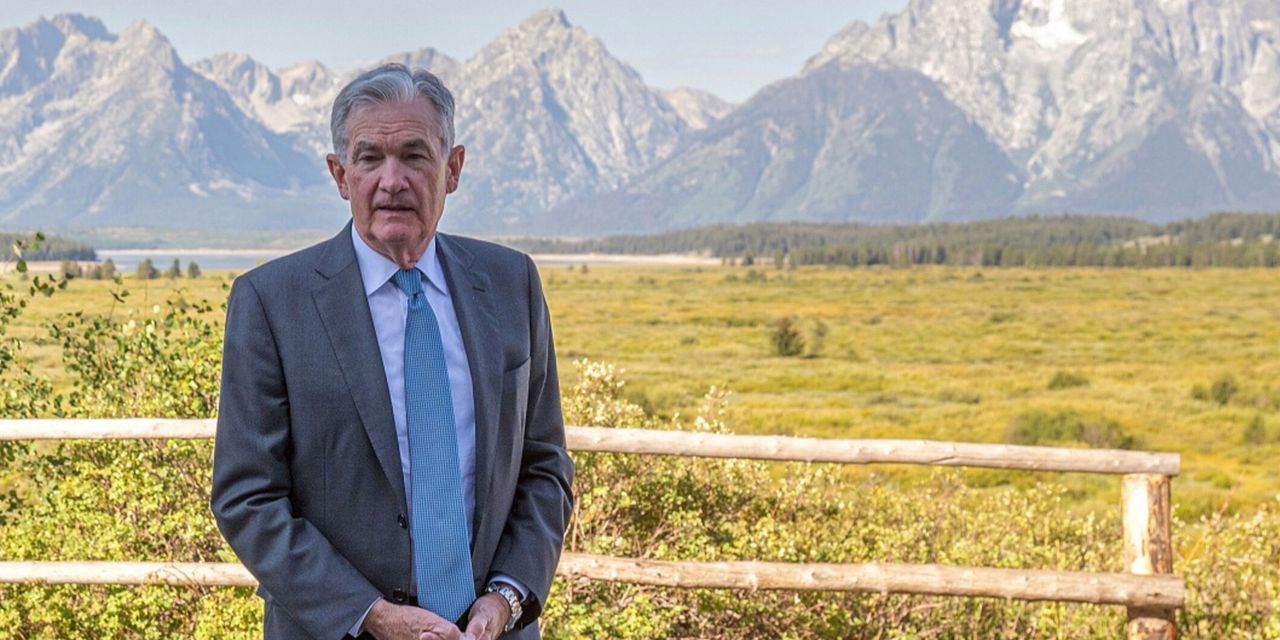

A year ago, Federal Reserve Chairman Jerome Powell sent financial markets reeling when he vowed, in a brief but dramatic speech in Jackson Hole, Wyo., that the U.S. central bank would tame inflation, notwithstanding the economic pain.

Twelve months later, inflation has been slashed by two-thirds while the economy continues to expand and the unemployment rate holds steady near a record low. The Fed, it seems, is well on its way to getting price growth back to its 2% annual target through a mix of higher interest rates and balance-sheet reduction, while avoiding the “unfortunate costs” about which Powell warned.

But as central bank officials and top academic economists gather again on Aug. 24-26 in the Grand Tetons for the Fed’s annual end-of-summer confab, the celebration is muted, given that the path forward is both hazy and fraught with significant risk.

Economic headwinds are growing as higher rates start to bite, while inflation may be leveling out well above the Fed’s desired target. The Fed has abandoned explicit forward guidance and declared its dependence on data, even as the economic data are becoming more difficult to parse.

In speeches this summer, bank officials have offered differing views on whether they believe that interest rates have peaked. Once again, economists and investors will look to the Jackson Hole economic policy symposium for clues as to what comes next.

“When you’re closer to optimal policy, the decisions become tougher,” says Adam Posen, president of the Peterson Institute for International Economics and a regular attendee of the late-August conference. “Do you adjust? Which way do you adjust? What risks do you worry about?”

Those questions and dozens of others will be hanging over the 2023 symposium, which formally kicks off next Thursday evening and features a speech by Powell on Friday morning. Hosted by the Kansas City Fed, the gathering has brought together an exclusive and influential group of the economic elite—central bankers from around the globe, federal policy officials, and leading economists—every summer since 1982, when Paul Volcker was Fed chairman and the economy was mired in a deep recession.

Every Fed chair since has made a speech from Jackson Hole, often using the opportunity to define a new message or lay out a new policy framework. That rich history has lent outsize importance to the remarks, which have become the centerpiece of an event otherwise filled with presentations of academic research papers focused on the annual theme—this year, it’s “Structural Shifts in the Global Economy.” On the sidelines, the informal hallway conversations will all but certainly focus on what the Fed will do at its next policy meeting, in September.

For Powell, the speech will afford a platform this year to clarify his views on future Fed policy, without revealing the exact moves he expects the central bank to make in coming months, say former Fed staff members and close Fed watchers. It will offer him a chance to dive more deeply into what Fed officials will consider in deliberating whether to stop raising interest rates, and later, when to cut them.

Don’t expect a specific preview of the Sept. 19-20 meeting. The Fed will have another month’s worth of labor and inflation data to study before then. But Powell could acknowledge that both price growth and the labor market appear to be moving in the right direction, while cautioning that the Fed will keep rates restrictive for some time—and take them higher, if needed.

“It won’t be a ‘hallelujah’ speech,” says Diane Swonk, chief economist at KPMG, who will be attending the conference. “The question is, how cautious does he take it? Guarded optimism is warranted—but he will not use the word ‘optimism.’”

A repeat of last year’s nine-minute “rifle shot” speech, as Posen puts it, is unlikely largely because the outlook now is more muddled than it was a year ago. The key for Powell will be to strike a balanced-enough tone so that even a nod to the progress made so far isn’t misinterpreted by market participants as a signal that rate cuts are coming soon.

A too-rosy view could lead to a stock market rally and a drop in Treasury yields, which would risk a premature easing of financial conditions, running counter to the Fed’s own goals. “If he wants to reorient investors, he will do it at Jackson Hole,” says Gina Bolvin, president of the Bolvin Wealth Management Group.

By the same token, words of caution won’t be empty talk, or merely a means of tamping down a premature market celebration. The challenges the Fed faces in the months ahead are immense. It is clear that the push to bring the core personal-consumption expenditures price index, the Fed’s preferred inflation measure, back down to the 2% target range will be far more difficult than was reducing core PCE to a recent 4.1% from a February 2022 peak of 5.4%.

Indeed, “most participants” on the Fed’s policy-making committee continue to see significant inflation risks to the upside, minutes from the July meeting, released on Wednesday, showed.

One reason is because the labor market remains exceedingly tight by almost any measure, with job growth running at an average monthly pace of roughly 217,000 positions for the three months ended in July. That’s more than double the roughly 100,000 jobs a month the Fed estimates are needed to keep pace with population growth.

Robust job growth has helped keep the unemployment rate near a half-century low of 3.5%, which has kept consumers spending. But it can also lead to too-fast wage growth as employers compete for workers. In a surprising bit of good news for the Fed, compensation gains began to slow in the past couple of months, even without an increase in unemployment. But economists are skeptical that the trend can hold.

“I think we are one meaningful shock away from having wages start rising again, in a nonsustainable way,” Posen says.

The housing market is also far stronger than anticipated, having recovered surprisingly quickly from the brief downturn it entered as interest rates climbed last summer. That has sparked worries among some Fed officials, who fear that a long-awaited slowdown in rent growth—which has yet to show up in the government’s official data—could be shorter-lived than economists had previously thought.

A number of quirks in the way inflation data are calculated are also complicating the inflation outlook and the Fed’s decisions. Headline inflation figures reflect comparisons with year-ago levels. Because price growth accelerated through the spring and summer of 2022, this year’s inflation data suggested a sharp deceleration. But now that the anniversary of July 2022’s peak inflation reading is past, year-ago comparisons no longer will look as favorable. That could mean inflation rates will move sideways, more or less, for the next few months.

At the same time, some categories, such as gasoline and car insurance, are poised to keep rising. And health-insurance costs—a major drag on headline inflation in July, with prices down 30% year over year—are all but guaranteed to reverse course this fall, when the Bureau of Labor Statistics readjusts how it calculates the sector’s prices. That recalibration will erase the impact of a Covid-era anomaly, which had been making health-insurance inflation appear artificially low, and push overall price growth up.

“To think that the path won’t have some bumps in it is to not look at the data, because we know the data alone are set up to have some bumps right now,” Swonk says.

Fed officials are also beginning to contemplate the economic outlook after the current inflationary cycle ends. The fear is that it might be more inflation-prone than in the past, due to systemic post-Covid changes in the global economy that could linger for years to come. The push to reshore domestic supply chains and decouple global economies is likely to have a lasting inflationary impact, for example, and declining immigration, coupled with an aging population, could exert a permanent drag on the domestic labor supply. Given these and other political and economic developments, the concern is that it might be increasingly difficult for the Fed to bring interest rates back to prepandemic levels.

“There’s a real debate over whether we’re going back to an economy that we had prepandemic, or whether we’re going to have a new baseline,” says Bill English, a former senior Fed staff member who is now a finance professor at Yale University.

The global theme of this year’s Jackson Hole conference suggests that much of the discussion—and perhaps even Powell’s speech—will focus on the idea of higher inflation over the long term. It is likely to be just the start of a conversation that central bankers will have for years.

Write to Megan Cassella at [email protected]

Read the full article here