Summary

European Wax Center (NASDAQ:EWCZ) is a franchisor and operator of out-of-home [OOH] waxing services. Readers may find my previous coverage via this link. My previous rating was a buy, as I believed EWCZ would generate decent returns for existing shareholders at the previous valuation. I am revising my rating from a hold to a sell as I see near-term risk in growth. In addition, the stock return profile is no longer attractive at this current valuation when compared against lower-risk assets like S&P and US 10-year bonds on a risk-adjusted basis.

Financials/Valuation

EWCZ reported 2Q23 revenue growth of 11% to $59 million, in line with the consensus estimate of $58.5 million. EWCZ also reported 2Q23 adj. EBITDA of $21.2 million, modestly ahead of consensus of $20.6 million. From a margin perspective, 2Q adj. EBITDA margin increased by 100 basis points to 35.9%. EWCZ also opened 25 net new centers in 2Q23, finishing the quarter with 1,003 centers, a growth of 12%.

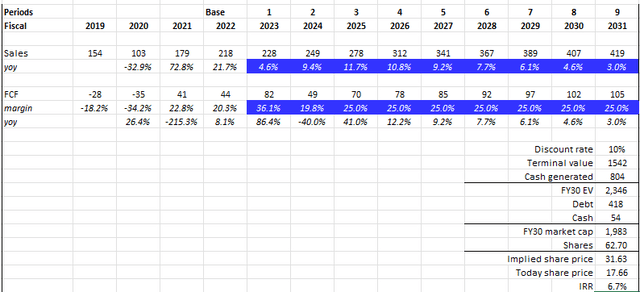

Based on author’s own math

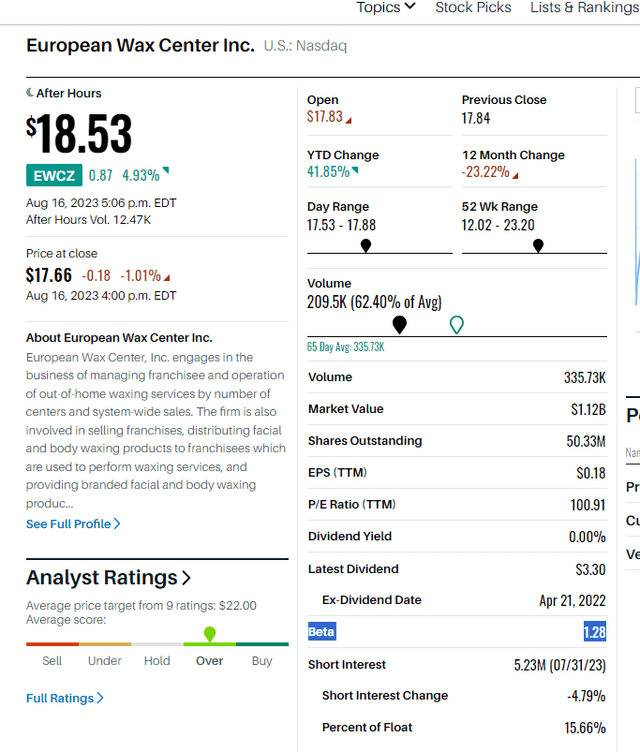

Since my initiation in October 2022, the stock has risen by 30% and as high as 50% at one point. With the increase in share price, valuation, and near-term risk (cited below), I believe there are risks to the short-term return profile. Using my DCF model, which is based on consensus estimates in the first few years followed by a deceleration to a 3% terminal growth rate, the stock’s 10-year IRR is 8%, which is below what S&P has historically delivered. Given the relative risk profile between S&P and EWCZ, I believe the risk-adjusted expected return for EWCZ is much lower at the current valuation. According to Barrons, EWCZ has a beta of 1.28x, which means the risk-adjusted return (7.6% x 1.28x) is 6%. This is less than 200 basis points above the US 10-year yield. All in all, this suggests to me that EWCZ is quite expensive. If the businesses miss estimates or print nasty results (due to the bad macroeconomic backdrop), we could see a sharp derating from here.

Barrons

Comments

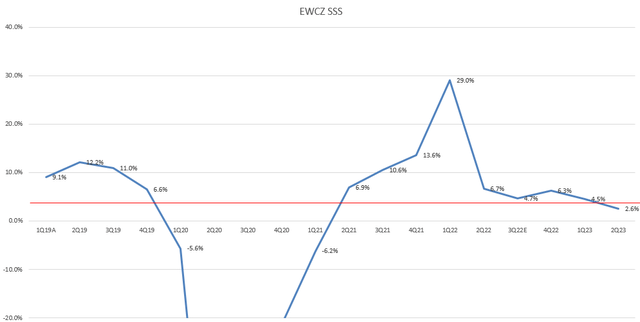

Looking at the past few results, I think there are already signs of cracks. 2Q23 results included 10% system-wide sales growth with a 2.6% comp and 25 new units. While this level of demand is respectable given the macro backdrop, I think the euphoria from 1Q23 is dying, and 2H23 is going to be hard given the tough 2H22 comps and possible recession. If we plot the EWCZ SSS chart over the past few quarters, it is clear that the historical trend is broken. It used to be from mid- to low teens but is now printing low single digits. While this is near the high end of the management-guided range, at the current pace, there is a risk of 4Q23 turning negative as it laps the tough 4Q22 comps of 6.7%. The stock sentiment might turn really bearish at this point.

EWCZ

The fact that new store openings (25 this quarter) accounted for a sizable portion of 2Q23 revenue growth is another cause for concern. In the event of a recession, I’m afraid this leg of growth will be muted as franchisees become less willing to open new stores in the face of weakening consumer discretionary spending power. If we look at FY19 (pre-COVID normalized level), EWCZ opened on average around 10 centers, which is a lot lower than the 25 today. My concern is that the current 20+ run rate might be elevated as franchisees and EWCZ feel confident that the US will not dip into a recession. Suppose it did, and net new center openings reverted to 10 in the near term, coupled with muted SSS (this should be negative in a recession, but I assume flat), EWCZ would be growing top-line at a much slower rate (half of what it is growing today).

Conclusion

My revised outlook on EWCZ prompts a rating downgrade from hold to sell due to heightened near-term risks. Despite reporting good 2Q23 financials, with revenue and adj. EBITDA growth in line with estimates and an increased center count, the stock’s recent price surge and current valuation diminish its attractiveness, especially when compared to lower-risk investment options like S&P and US 10-year bonds. Signs of weakening demand, a potential economic downturn, and the possibility of reduced new store openings all contribute to my reservations about EWCZ’s short-term prospects. Considering these factors, I perceive the risk-adjusted return at its current valuation to be unfavorable, raising concerns about potential sharp declines in the event of disappointing results or unfavorable macroeconomic conditions.

Read the full article here