Investment action

Based on my outlook and analysis of AppLovin Corp. (NASDAQ:APP) 2Q23 results, I recommend a hold rating. I would like to mention here that I take a more conservative approach to the US macroeconomic environment and mobile gaming industry; hence, my focus is on the possible downside for APP in the near term. While I am bullish on APP developments (especially the AXON 2.0 launch), I am worried about the technical aspect of the stock. Given the strong rally so far into the year, I believe expectations are running high, and any weakness (which could be perceived weakness) would send the stock diving as investors sell to take profits. Weakness could easily stem from a steep recession, weaker than expected mobile gaming recovery growth, or even missing consensus estimates.

Basic info

APP offers an end-to-end software that optimizes monetization, and uses machine learning to make data-driven marketing decisions for profitable growth. The business generates majority of revenue domestically (61% as of FY22) with the remaining group under Rest of the world.

Review

Revenue dropped 3% to $750 million in 2Q23 as 28% growth in Software platform revenue was offset by a 25% decrease in app revenue. Although sales have decreased, they are still above the midpoint of management’s $720 forecast. Software platform EBITDA margin increased 500 bps sequentially to 67%, and app margin increased 300 bps sequentially to 18%, for a total of $334 million in EBITDA. As I view it, the key takeaway is the success of AXON 2.0, which I deemed the key driver for APP beating its own guidance, and also the medium-term growth driver.

Briefly, AXON 2.0 is an AI algorithm that drives the marketing efforts on the AppDiscovery demand side of the Software Platform. In other words, it enhances the efficacy and efficiency of advertisers marketing efforts. While the cost per install is higher, advertisers are willing to pay because of the better ROAS (return on ad spend). As a result of the improved ROAS, advertisers will see increased revenue, and APP will share in this growth as part of the revenue sharing agreement (hence, APP is indirectlly levered to the growth of advertisers as well). This last point was made abundantly clear in the financials, as AppDiscovery saw a 38% increase in revenue per install despite an 8% decrease in total installations. Although AXON 2.0’s installs are down overall, I am positive that, over the medium term, revenue should continue to grow as the installs are now much more valuable to app marketers thanks to the platform’s enhanced targeting. Keep in mind that AXON 2.0 didn’t have much of an impact on 2Q23 because it was released in the middle of the quarter. A full quarter of AXON 2.0’s availability should aid growth in 3Q23 compared to 3Q22.

While AXON 1.0 was designed almost exclusively for the mobile gaming industry, I believe that AXON 2.0 will serve as a gateway for APP to expand into new markets. This is huge because diversifying away from the speculative and competitive mobile gaming vertical would significantly reduce the risk of APP’s long-term growth profile. Management’s long-term goal is to steadily expand its non-gaming business by gradually expanding into more and more market niches. This makes sense, as the AXON 2.0 AI algo will need to consume more data specific to the market before it can assist with improved targeting.

And then you’ve got the more interesting long-term dynamic that, if this technology is so good that we’re one of the largest channels, if not the largest for all of our gaming partners. And it’s now working within gaming and outside of gaming, it opens up the door to the possibility of a lot of advertiser expansion, which will create more density in our auction, create more scale to the business. (2Q23 call)

Near-term stock performance

Since management has indicated that they do not anticipate any significant changes within the next six to twelve months that could have an impact on their execution, I believe that the business fundamentals will remain positive. However, from a technical perspective, I am less positive given the huge rally from $9 at the start of the year to $39 today (4x increase). Valuation from a forward PE perspective has also risen from 19x to 32x today. This indicates a lot of expectation by the market for APP’s upcoming performances. Given the unclear recovery for the broader mobile market and macroclimate, I would not downplay the risk of APP missing guidance on consensus estimates in 2H23. If that happens, I think there is a high chance for the stock to face sharp near-term pressure as investors take profits.

Valuation

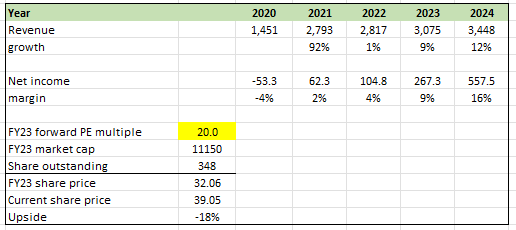

Author’s work

My model aims to showcase the potential downside in case APP’s 2H23 performance comes in weaker than expected and investors take profits after observing any potential weakness. Using APP’s recent valuation history, the lowest it touched was 20x forward PE (just 6 months ago). Using that as a benchmark and consensus FY24 estimates, my downside price target is $32. Note that this is where APP was trading right before its earnings. Hence, I am recommending that you hold off on any investments for now and wait for the share price to dip below that level before investing. At that level, we have a much higher margin of safety.

Risk and final thoughts

The way I could be wrong here is that I am too conservative. The US recession might not come, and the broader mobile gaming industry could recover more than I expect. In this scenario, APP should continue to perform and print good results, thereby supporting its high valuation in the near term. In conclusion, my recommendation for APP is a hold rating, driven by my concerns over the stock’s recent strong rally and elevated market expectations. While I acknowledge positive developments like the AXON 2.0 launch and the company’s revenue growth, my cautious approach to the US macroeconomic landscape and the mobile gaming industry underscores my focus on potential near-term downside risks. Despite my bullish outlook on APP’s advancements and prospects, technical aspects are worrisome, given the substantial YTD stock surge and high valuation.

Read the full article here