Overview

My recommendation for Cadre Holdings (NYSE:CDRE) is a hold rating, as I view the valuation as fairly valued. That said, I am bullish on the business due to its highly visible reoccurring revenue stream, cash flow-generative business, neat balance sheet (that can be used to drive growth via M&A), and consistent pricing power. I would be on the lookout to buy the stock if the valuation goes down in the future.

Business

CDRE manufactures and distributes safety and survivability equipment for first responders. The business reports on two key segments: Product and Distribution. Product represents the bulk of the business’s revenue and gross profit at 80% and 88%, respectively, for FY22. The remainder is from Distribution. CDRE is a primary US-focused business, with 75% of revenue coming from domestic sales and 25% from international.

Recent results & updates

Sales for CDRE increased by 2.4% in 2Q23, with product sales up 3.7% buy dragged down by distribution sales decline of 4.8%. Increases in duty gear and armor mix, as well as a decrease in EOD volume, contributed to a 330bps y/y and 220bp q/q increase in adjusted EBITDA margins in Q2. At the bottom line, EPS saw $0.29, which beat consensus estimates if $0.18 (60% beat). It’s important to remember that demand from 2H23 was pulled forward into the 2Q23, which is why 2Q23 performed so well. Hence, 3Q23 is likely to be a weak quarter. Nonetheless, I think it is better to focus on a full year basis (FY23) as 4Q will likely be the largest volume quarter of the year given timing of large domestic and international projects, according to management.

Regarding the growth outlook, I am confident that CDRE is poised for significant growth due to the mission critical nature of its offerings. The products from CDRE provide crucial safety benefits to both direct users and those in close proximity. Adhering to stringent safety protocols and traditional warranty provisions ensures optimal performance in all scenarios, resulting in regular update cycles for over 80% of their product range. This established pattern generates consistent and predictable recurring revenue, as demand is closely linked to these scheduled updates. Simultaneously, the sales of related consumable products maintain a recurring revenue stream by addressing replenishment requirements.

Since our products provide protection in users as well as those around them with limited or no room for error, drivers such as wear and tear, technological advancements stringent safety standards, the exploration of warranties, and new accessories create refresh cycles for over 80% of our products. from: 2Q2023 earnings call

This mission critical nature and recurring demand also consistent pricing power. Since going public in 2021, every quarter has seen CDRE’s prices rise by more than the target of 1% above material inflation. Given that pricing-led growth has high margins, I expect CDRE to maintain growth in the mid-single digits (at the top line) and increase margin.

Once again, we exceeded our 1% price growth target above material inflation in the fourth quarter. Customers recognize and appreciate the superior quality and performance of Cadre’s products, enabling us to maintain our premium position. from: 2Q2023 earnings call

Organic growth aside, M&A should also help support mid-single-digit growth. CDRE has a rather strong balance sheet as of 2Q23, with net debt of $90 million, or 1x net debt to EBITDA. If we assume a consensus FY24 EBITDA estimate of $84.4 million and apply a 3x leverage ratio to it, CDRE would be able to draw an additional $107 million. This $107 million, along with the expected $67 million in FCF generated over the next 6 quarters (3Q23 to 4Q24), gives a total of $170 million in dry powder to acquire assets. CDRE is trading at 12x forward EBITDA today; if the $170 million is allocated to purchase assets at 12x EBITDA, it implies incremental EBITDA of $14 million, or 20% from LTM levels.

Valuation and risk

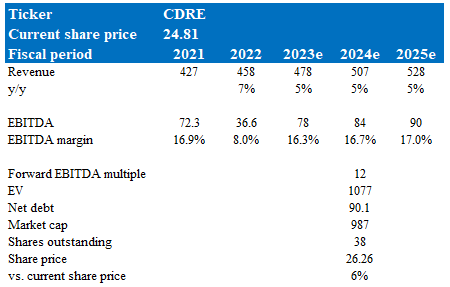

Author’s valuation model

According to my model, CDRE was valued at $26 in FY24, representing a 6% increase. This target price is based on my growth forecast of mid-single digit growth over the near term. This is the historical growth rate that CDRE has demonstrated and is also in line with management’s FY23 guidance.

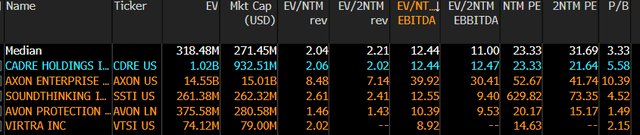

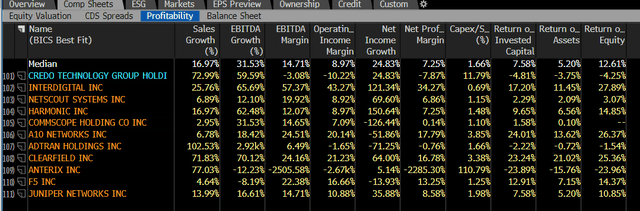

CDRE is now trading at 12x forward EBITDA, which I believe will stay at this level as it is where it has historically traded (its average) and at a discount to peers. When compared to its larger peers, CDRE is expected to grow much slower (20+% vs. CDRE’s mid-single digit). CDRE profitability is also relatively weak when compared to the group.

Bloomberg

Bloomberg

The upside risk here is that management manages to drive EBITDA growth much higher than I expected through acquiring cheap assets. The accelerated growth in EBITDA is likely to drive positive earnings momentum, driving multiples up in the near term.

Summary

To sum up, my assessment of CDRE leads me to recommend a hold rating, primarily due to the current valuation being deemed fair. However, I maintain a positive outlook on the company’s prospects, driven by its consistent reoccurring revenue, cash flow generation, strong balance sheet for potential M&A, and steady pricing power. Should the valuation decrease in the future, I would consider a buy position. Notably, the ability to maintain price increases and the potential for organic and M&A-driven growth further support the mid-single-digit growth projection.

Read the full article here