Investment briefing

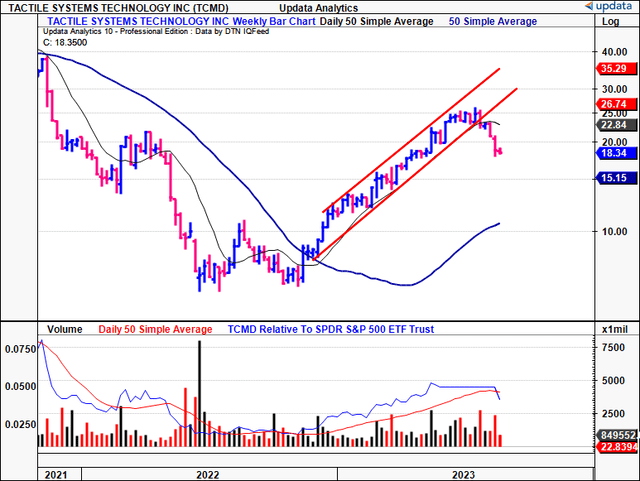

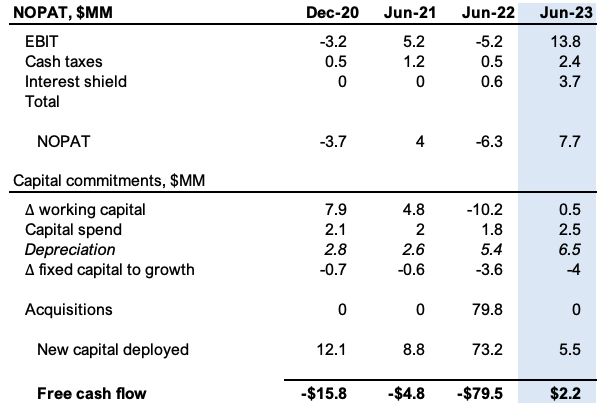

After breaking the line of support in the ascending channel in its 2022—’23 price rally, the equity stock of Tactile Systems Technology, Inc. (NASDAQ:TCMD) has begun to roll over and push to the downside. This re-rating is not unfounded in my view. Thoughtful analysis of the company’s Q2 numbers, its FY’23 outlook, and the owner capital required to produce modest earnings growth corroborate a neutral view by best estimation.

Critically, whilst fixed asset intensity is reasonably low, the firm consumes the bulk of its sales income back as additional working capital requirements to produce more growth. This, despite cash flows backing the revenue clip hit 20% this quarter, all because of a reduction in working capital (“WC”) intensity. Net-net, the firm hasn’t hit the AffloVest numbers I’d be looking for, and it has far softer expectations on the segment going forward. This was a critical feature of the buy thesis, that has now left the party, leaving the rest of us with a hangover to enjoy tomorrow. Revise to hold.

Figure 1. TCMD breaking support at critical level after trending into congestion for 7 weeks, backing and filling along the way. Those in the long account have exited en masse the last 4 weeks to date.

Data: Updata

Critical investment facts to revised thesis

1. Q2 FY’23 earnings insights

I bought TCMD at the start of this year due to its lymphedema markets and its purchase of the AffloVest system, as mentioned earlier. Therefore, it was critical to observe value drivers in each segment from Q2.

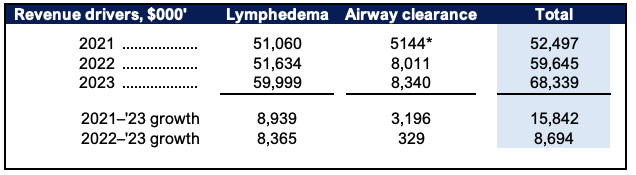

Starting with the financials, top-line sales were up ~15% YoY to $68.3mm on adj. EBITDA of $6.1mm for the quarter. Lymphedema sales were up 16%, underscored by growth in Flexitouch and Entre, clipping $60mm combined for the period (87.8% of turnover). Meanwhile, AffloVest sales exhibited a more moderate 4% YoY growth, settling at $8.3mm—just $329,000 on the last year’s 2nd quarter.

Lymphedema remains the major top line growth driver, as seen below. AffloVest sales haven’t really taken off, up just $3.2mm in Q2 2021–’23. Of the $15.84mm in additional turnover in this time, around 60% is from lymphedema sales, from ’22–’23, it was 96% (note, AffloVest sales in 2021 are recorded as the full year, as it was purchased in September 2021).

The following is relevant about AffloVest going forward:

- Management put the reduction down to purchasing tensions between its durable medical equipment (“DME”) purveyors.

- As a reminder, it sells AffloVest to DME providers, who then sell it to patients. They service patients and bill third-party payers for the product, not TCMD. The DME sales reps do all the heavy lifting in training patients and providing support.

- It claims to employ this model to “[give] access to a larger channel than competitors that market and sell directly”.

But this isn’t as simple as it seems. Just look at the language used on the Q2 call when probed on the marked slowdown in AffloVest sales and outlook:

“[T]o point out to the obvious is when you’re going through a DME and not your own direct sales force, life gets a little bit lumpier…they’re pivoting back to the original [public health emergency] criteria. And I think we expect that we’ll probably see a little bit of slowed placements with them as a result….at the same time to see such strength in our lymphedema business which was more than offsetting and we expect that to continue through the balance of the year as well.”

Hardly inspiring in my view. You’re looking at the classic case of dealing with distributors, which, as pointed out, can get challenging in controlling the sales channel. This is not what the bullish these needed to hear, at all.

Figure 2.

Sources: BIG Insights, Company filings

Moving down the P&L, it saw 70% gross on Q2 sales, down 250bps YoY due to labour and inputs, plus the slack AffloVest contributions. it pulled this down to $6.1mm in operating income on breakeven earnings.

It also finished the quarter with 249 reps in the headcount, down from 280 last year. Around 13 are dedicated to AffloVest, per management. That means:

- Q2 revenue per rep was $274,454 off the $68.4mm, up from $238,580 on a comparable basis. Therefore, the smaller headcount is more productive on aggregate.

- For AffloVest, based on the headcount estimates, average revenue per rep was $641,538.

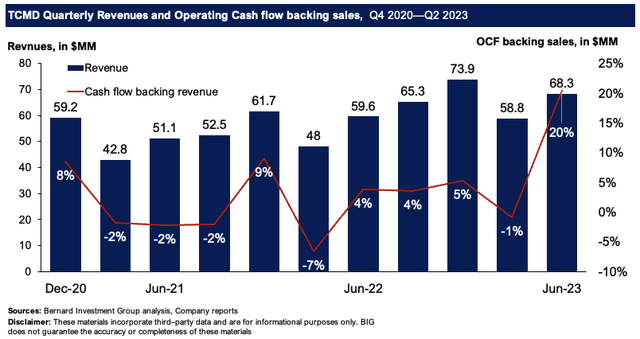

Critically, the firm’s capital budgeting initiatives (discussed later) have begun to pull through at the cash level. You can see the company’s quarterly sales numbers in Figure 3, along with the degree of OCF baking these revenues. You’ve got 20% of sales in cash, up from 8% 2.5 years ago, and more than 4x the average of 2022. The next question is whether this is sustainable, and what it means for creating shareholder value.

My final takeout from the quarter was TCMD expanding the capabilities of its Kylee mobile application. Notably, TCMD registered ~500 unique customer downloads of Kylee during the 2nd quarter, up 37% sequentially from Q1. The tally of patient check-ins on Kylee surged to nearly 63,000 in Q2 FY’23, underscoring the application’s potential to elevate patient engagement in my view.

Figure 3.

BIG Insights

2. Capital employment, capital budgeting

Improvements in cash collections and $7.2mm in additional working capital movements brought in $10mm in cash flows in Q2, up from $1.5mm last year. This is primarily attributed to improved days sales outstanding, which propelled OCF of $13.9mm of the quarter.

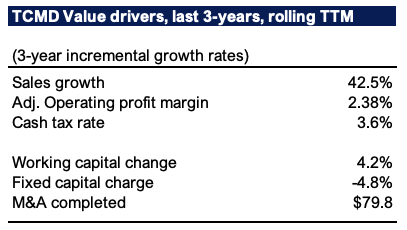

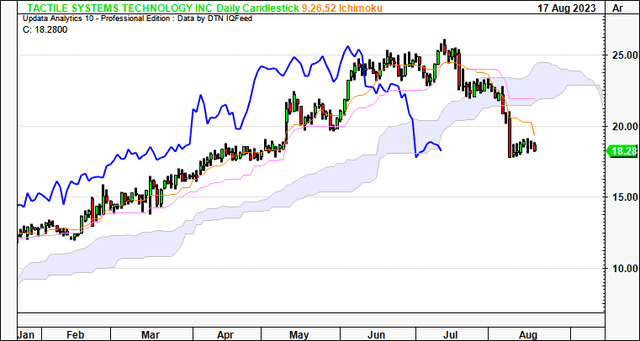

A further breakdown on the company’s value drivers reveals potential tailwinds from capital efficiency over time [Figure 4]. But there’s more to the picture when peeling back the layers.

Here I took the rolling TTM change in revenue, working capital, fixed assets and the contribution from M&A (considering the AffloVest assets purchased in 2021). Most of the upside in the company’s ‘value growth’ has stemmed from sales.

What you’ll note is the 4.8% decrease in fixed capital charge to produce these sales and operating profit. What this tells me is that, for every $1 in sales growth over these past 3 years, TCMD was able to reduce its fixed asset density by ~$0.05. Conversely, with every $1 in sales growth, ~$0.04 of additional working capital was required.

Figure 4.

Sources: BIG Insights, Company filings

The question is, has this created shareholder value? Consider the following, with reference to Figure 5:

- After new capital commitments, it is clear the firm recycled owner earnings (shown here as Free cash flow) back into the business as investments for future growth. FCF’s were in the red over the period of Q4 FY’20–’22 (TTM values). This was understandable, given the company’s growth initiatives.

- Q2 FY’23 saw post-tax earnings shift to $7.7mm in profit, and owner earnings inflect higher to $2.2mm.

- The critical point is that it took $206.5mm in capital employed into the business to earn this $7.7mm, a 3.73% return on investment. In Q2 FY’21, TCMD earned $4mm off $127mm at risk, also ~3% return.

- Therefore, it took 62.5% extra capital deployed into the business ($79.5mm) to produce just $3.7mm in additional earnings, a 4.6% incremental return on investment from Q2 FY’21–Q2 FY’23 (again with TTM values). Over time, the bulk of its capital at risk has been tied up in working capital, 37% of sales on average these past 3 years. Total intensity has been at 76% on average, creeping higher since 2023.

As such, the company is displaying solid earnings growth albeit with much higher capital requirements—despite the working capital changes this period. This decreases the amount of cash it can spin off to shareholders and/or reinvest back into the business over the long term. Therefore, even with the reduction in fixed capital intensity, the economics of TCMD’s business returns haven’t yielded the kind of results I’d projected. As such, my estimation is that growth has not translated to value for TCMD’s shareholders. The market appears to agree, given the recent price action. This adds a neutralizing weight to the risk/reward symmetry, flattening the investment potential in my view.

Figure 5.

Sources: BIG Insights, Company filings

Technical picture

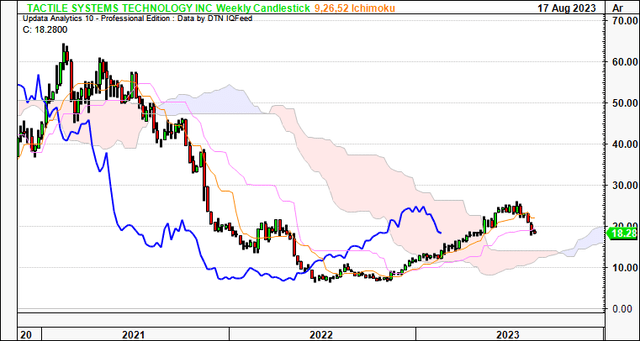

The market’s valuation of TCMD’s investment activity and returns on capital is exemplified in the following series of charts. Figure 6 shows the daily cloud chart and gives a clear picture of the directional trend bias. Critically, the price line and lagging line (in blue) broke into the cloud in July and haven’t recovered since. It now tests the cloud base and thus a break higher from here is absolutely critical in my opinion. Should it trade lower, it risks weak hands who are loosely holding the stock exacerbating the move. Further, the economic headwinds on earnings power outlined earlier aren’t catalytic for large accounts to position against the company in my view.

Figure 6.

Data: Updata

The weekly chart, that looks to the coming months (the daily looks to the coming weeks), is equally as neutral of a setup in my estimation. The lagging line is congesting into the cloud, with the price line rolling over off the 52-week highs. I’d need $21.00 by December to suggest the weekly trend is bullish once again.

Critically, the entire rally from 2022 to ’23—including the double bounce to start the thrust—started in ~July/August last year. Thus, by the point of July ’23, it had extended ~12 months, meaning large accounts and strong hands during the rally could take profits without incurring short-term capital gains tax. With an expansive move from c$6 to $26, 333% investment return on the long account, it is understandable to clip the position and redeploy the capital elsewhere. Especially given 1) AffloVest sales were soft, and 2) the fact it took nearly $80mm to produce just $3.7mm in additional profits, implying a lack of value–add moving forward.

Figure 7.

Data: Updata

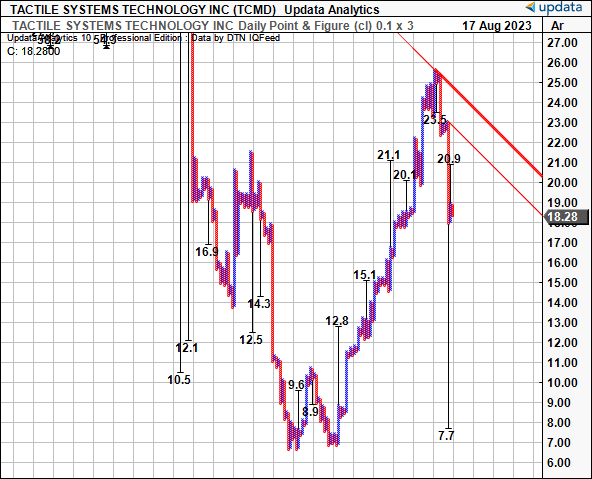

The breadth in price objectives thrown off by my point and figure studies is equally as concerning to the bullish view. I’ve got downsides to $7.70 and upsides to $20. This suggests it could trade within this range going forward. Especially with a break lower, I’d be looking to the $7–$10 range as the next objective, whereas a break higher would get me just ~$1.70/share in upside from the upside target. This also supports a neutral view.

Figure 8.

Data: Updata

Valuation

Given the bulk of value in TCMD’s story the past 3 years is sales–driven (on my analysis), this is where the valuation should be. The stock sells at 1.6x forward sales and this is ~50% discount to the sector. Why the discount though? Is it, 1) a mispricing by the market, or 2) suggestive the market expects negligent sales growth moving forward?

Based on findings here, I’m inclined to the latter. Management expects 10–11.5% top line growth for FY’23. This calls for $278mm at the top, of which, 13–14% is in lymphedema and 0–5% growth in AffloVest. Note–this is down from prior guidance of 18–21%. It also projects $27mm in EBITDA and a 57% tax rate, and I get to $8.6mm in post-tax earnings on this.

Let’s take management’s views at face value for a second. We’ll presume it has good insight to the yearend, and that these projections are reasonably accurate. Taking the average investment percentages outlined earlier (37% in WC, 76% in total capital employed), the $31.2mm YoY projected earnings growth could require an additional $12mm in working capital and a further $23.7mm in capital deployed (ex-WC) to produce $5.7mm growth in earnings, 16% return on incremental investment. This is a reasonable number. But it would take a total $301mm of owner capital deployed into the business to produce this $8.6mm— just 2.08% return on the investments. This is not a reasonable number, and well off the capital cost it requires to produce TCMD’s growth. It makes sense to see an FCF outflow of $22.6mm on these figures ($8.6mm – ($23.7+12) = -$22.6mm). This also supports a neutral view.

In short

In short, despite a number of positive points in the debate, when stripping back the economic layers of corporate value, the facts pattern differs completely from the accounting realities. On earnings power and asset factors alone, I do not believe TCMD is undervalued. Last time, it was said “I am most interested in seeing the progression of AffloVest going forward and believe the market may not be entirely factoring its growth potential in”. Perhaps those long of the stock, including myself, were wrong, and the market was right. With a much softer outlook for AffloVest contributions going forward, TCMD requires a mammoth effort to grow earnings from a projected c.$300mm in capital tied up into the business. Net-net, revise to hold.

Read the full article here