In an April 25 Seeking Alpha article on the United States Gasoline Fund, LP ETF (NYSEARCA:UGA), I wrote:

As oil and gasoline prices have recovered over the past weeks and months, UGA could continue to move higher, reflecting increasing demand during the peak 2023 driving season as drivers could be paying more at the pump as the odometer clicks rise during spring and the peak summer months.

On April 25, nearby NYMEX gasoline futures were at $2.5630 per gallon wholesale, and the UGA ETF was at the $59.26 per share level. On August 17, September RBOB gasoline futures were 18.8% higher at $2.8406 per gallon. At $71.40 per share, the UGA ETF had rallied over 20%. We are coming up to the end of the peak driving season as students return to school, and the vacation period ends in the fall. Gasoline prices tend to move lower as the demand recedes, and now is a good time to monitor risk levels on long UGA risk positions. However, the ongoing war in Ukraine and rising oil prices could keep fuel prices high during the offseason. Trailing stops could be optimal for long gasoline positions in the current environment.

Gasoline prices approached $3 per gallon wholesale

After reaching a seasonal $2.0204 low in December 2022, gasoline prices rallied throughout 2023, peaking in July during the heart of the 2023 driving season.

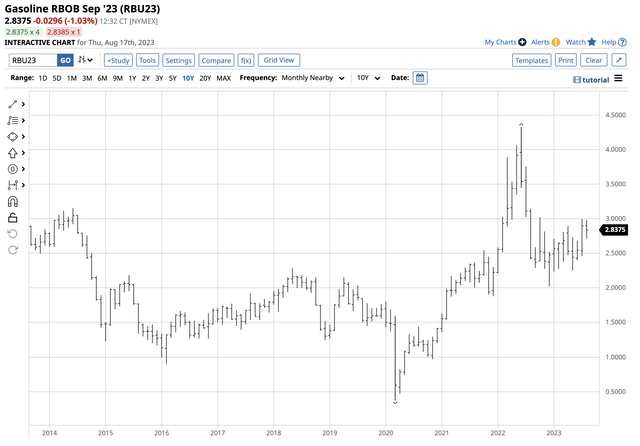

Ten-Year NYMEX RBOB Gasoline Futures Chart (Barchart)

The ten-year chart highlights the 48.3% rise in wholesale gasoline prices on the NYMEX futures market to $2.9960 per gallon in July 2023. While gasoline futures stopped short of the $3 per gallon level, the price at over $2.80 per gallon wholesale remains not far below the July high in mid-August. NYMEX crude oil futures rose to $130.50 per barrel in March 2022, below the 2008 record $147.27 peak. However, gasoline futures soared to $4.3260 per gallon wholesale in June 2022, a record high above the July 2008 $3.6310 high.

The gasoline crack spread has been trending higher

The gasoline crack spread measures the cost of refining a barrel of crude oil into gasoline.

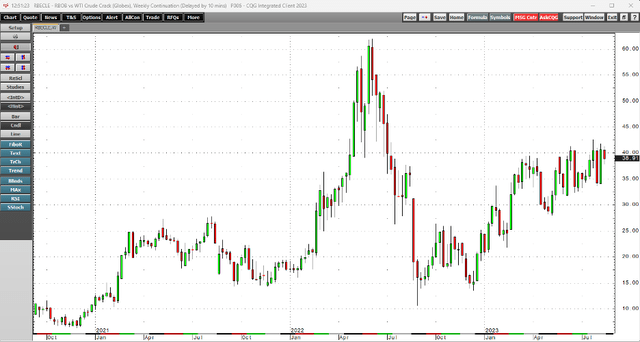

Chart of the NYMEX Gasoline Crack Spread (CQG)

The weekly chart shows the bullish pattern in the gasoline refining spread, making higher lows and higher highs throughout 2023. After reaching a $10.65 per barrel low in August 2022, the crack spread rose to a $42.57 high in July 2023. At $38.66 per barrel on August 17, the gasoline crack is not far below the recent high.

The elevated crack spreads tell us two significant things about the crude oil and oil product markets. First, it indicates that profits at refineries remain robust. Second, it is a bullish sign for crude oil and gasoline as the processing spread is a real-time demand barometer. The crack spread trend remains bullish in August 2023.

Seasonality could be bearish, but geopolitics make 2023 no ordinary year

Gasoline tends to reach highs as the peak of the summer driving season approaches. Significant lows often occur during late fall and winter months. Meanwhile, at least four factors could support gasoline prices during the seasonally weak upcoming months:

- While the U.S. and Europe encourage alternative and renewable fuels, inhibiting the production and consumption of fossil fuels, crude oil, and hydrocarbons continue to power the world. India and China account for over one-third of the world’s population and do not participate in climate change initiatives. Economic growth in China and India will boost crude oil and oil demand over the coming months.

- OPEC and Russia have cooperated on oil production prices since 2016. The cartel aims to achieve the highest oil price that balances supply and demand. Meanwhile, OPEC+ controls and determines supplies. Saudi Arabia requires an $80 per barrel price to balance its domestic budget. Russia needs petroleum revenues to support the ongoing war in Ukraine. Moreover, crude oil has become a Russian economic weapon against countries supporting Ukraine. The cartel will use its pricing power to keep oil and oil product prices as high as possible over the coming months.

- The Biden administration sold an unprecedented amount of the U.S. Strategic Petroleum Reserve in 2022 and 2023 to cap prices. The SPR dropped from over 600 million barrels in late 2021 to 348.4 million barrels as of August 14, the lowest level in over four decades. The administration stated it would buy crude oil to replace the sold SPR barrels at the $67 to $72 level, putting a floor under oil and oil product prices over the coming months. At over $80 per barrel on August 17, the price is above the administration’s target range, keeping the SPR dangerously low with limited ability to address rising oil prices with sales.

- China and other BRICS countries have started pricing crude oil in non-dollar assets. De-dollarization in the oil market could weigh on the U.S. currency’s dominant role as the global reserve foreign exchange instrument and petroleum pricing mechanism, causing dollar-based oil prices to rise.

While seasonality going into the fall is traditionally bearish, geopolitics make the 2023/2024 winter no ordinary period.

UGA is the gasoline ETF product

The United States Gasoline Fund, LP ETF product tracks NYMEX gasoline futures prices. At $71.70 per share on August 17, UGA had $76.12 million in assets under management. UGA trades an average of 30,626 shares daily and charges a 0.96% management fee. UGA does an excellent job of reflecting the price changes in the gasoline futures market.

Since the rally from December 2022 to July 2023 took gasoline futures 48.3% higher.

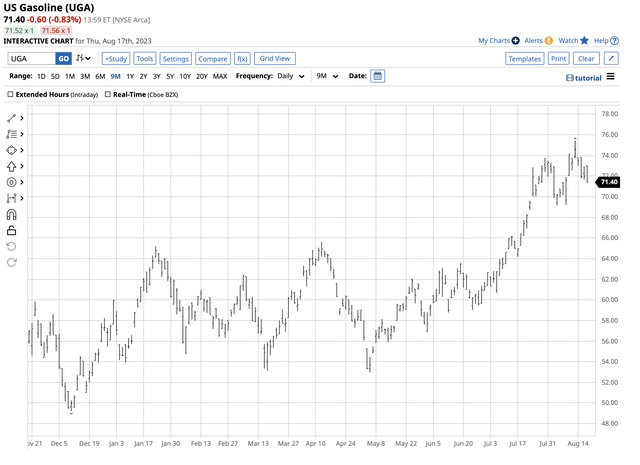

Nine-Month Chart of the UGA ETF Product (Barchart)

Over the same period, UGA rose 53.3% from $49.22 to $75.43 per share. At over $71 per share on August 17, UGA remains closer to the July high than the December low, but it is moving towards the low demand season over the coming months.

Caution on long positions – Trailing stops could be the optimal approach as risk positions are long as the current market price, not the execution price

On April 25, I recommended the UGA ETF, believing seasonality and the geopolitical landscape made the ETF a compelling value at below $60 per share. While I remain bullish on fossil fuel prices for the stated reasons, the seasonality could cause a decline over the coming weeks and months.

For those holding long positions, a trailing stop could be the optimal approach for protecting profits and capital. The most significant factor to remember when trading or investing is that we are not long or short any risk position at the execution price, but at the current market level. Therefore, since risk is always a function of potential rewards, adjusting risk levels and reward horizons is appropriate based on the current market price.

Gasoline is an oil product, and petroleum is the energy commodity in the eye of an ongoing geopolitical storm. As the market approaches a seasonally weak period, extra caution is advisable for the coming weeks and months.

Read the full article here