Big Lots (NYSE:BIG) has faced numerous challenges in the last decade and the stock has appropriately reflected that. Since inception, it is down by 28% and the last bull run was also followed by close to 90% drawdown. Some of its strategies boosted its short-term outlook but never addressed a long-term vision for the company. So where do we stand now? We have a company that is potentially on its last legs, with declining metrics, and in my opinion no visible plan for its future.

Deja Vu

The story of Big Lots is following a trajectory that we have seen plenty of times before and this industry can be quite a graveyard of retail businesses. Big Lots is a retail company that operates as a discount retailer. It offers a wide range of products, including furniture, home goods, electronics, toys, food, and clothing, at discounted prices. Some of the most common causes of failure for companies in this industry are struggling physical storefronts, massive debt, lack of adaptability, and inefficient operations.

Starting in 2015 there have been 154 recent bankruptcies. In 2020, there were 52 instances of retail bankruptcy, which significantly reduced to 21 in 2021 — indicating a 60% year-over-year decrease. In the subsequent year, 2022, only a few companies faced bankruptcy. Retailers are now contending with newly emergent issues like escalating prices and a decline in consumer spending. Some reports are suggesting that retail bankruptcies could resurge in 2023 due to these factors. I believe its stock performance says we could potentially see another victim here but where do things actually stand?

Deteriorating Financials

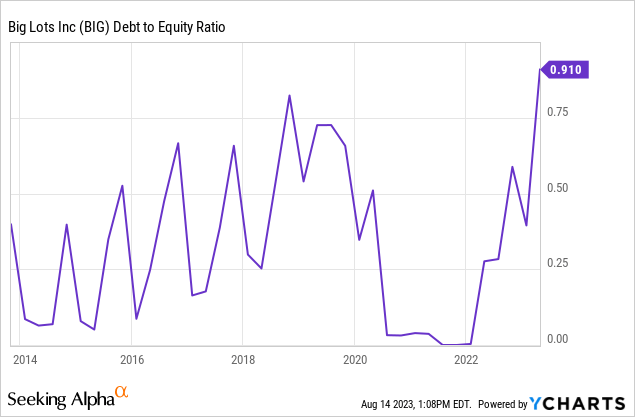

BIG’s current assets ($1.2B) exceed its current liabilities ($836.0M) but do not cover its long-term liabilities ($2.3B). Its debt to equity is close to its highest levels and is at the highest level in the last ten years.

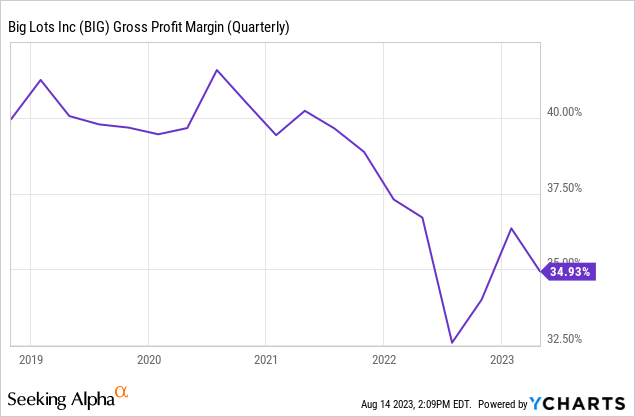

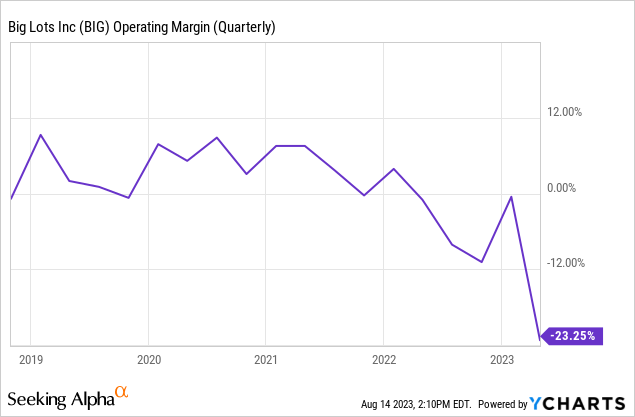

None of this is helped by their cash flow. LTM saw OCF at -$117M and unlevered FCF at -$131M which means that unless this situation improves, in my opinion, we may not see a reduction in debt levels anytime soon. But how did it get here? I believe the company instead of formulating a strategic plan, arguably engaged in tactical moves designed to boost the stock price over the short term. They engaged in sale and lease-back transactions and used the proceeds of this to buy back their own stock. And I believe now the management is left with little cash and declining margins with few options to move the needle for the company.

Valuation that reflects the current situation

The good news is that the market seems to realize the situation the company got itself in. The company trades at a big discount to its book value at 0.45x. EV/Sales is also close by at 0.47x. When compared to the peers in the industry the valuation fully reflects the current position of the company in my opinion.

| Company | EV/Sales |

| Wayfair (W) | 0.96x |

| Ollie’s Bargain Outlet Holdings (OLLI) | 2.53x |

| Haverty Furniture (HVT) | 0.65x |

| Leon’s Furniture Limited (OTCPK:LEFUF) | 0.65x |

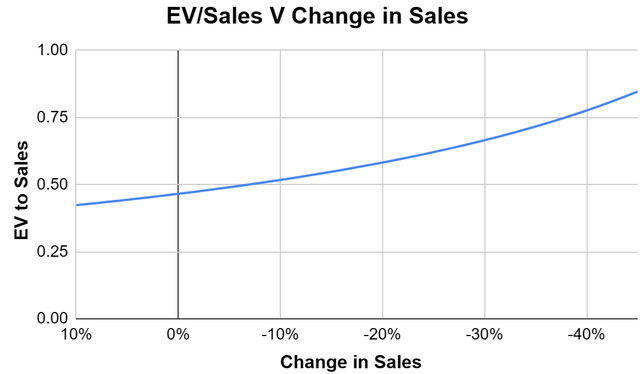

Due to the uncertainty exhibited by the current environment, it would also be helpful to see how this would change based on a wide range of scenarios.

Author Generated

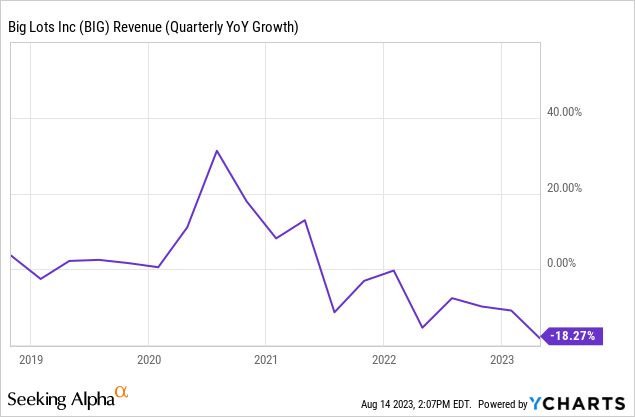

LTM we saw close to a 12% decline in sales. If there is a turnaround and the business drastically improves, we can see this going deeper into the value territory (although we would also have to consider earnings for truly saying a stock is in value territory). On the flip side, if we see a further decline in sales we may see the ratios start to inflate a bit but it would still not go over the sector median of 1.2x

What can change the situation for the company?

This thesis could be invalidated if the company can turn around its business through several strategies. Many of these strategies have worked and saved the company in the past and it remains to be seen if it moves in this direction this time as well. The company could try another shot at rebranding. There are multiple value-focused chains and it could differentiate itself in a market with offerings exclusive to Big Lots and bring additional value to price-conscious customers. At the same time, it can also enhance its e-commerce offerings and appeal to a younger audience. On the bottom line, I believe it can continue to close underperforming stores and optimize its footprint to better focus on stores with stronger sales. Improving customer loyalty could also help the company go a long way when customers are differentiating mostly by price. It also did another lease and sale back agreement recently and expects to use these proceeds to pay down some of its debt which is a good move in my opinion and will help position the company better. All in all, the company needs to fire on multiple cylinders and management is key to the execution.

Closing Commentary

I think what scares me the most is the lack of a long-term executable strategic direction. I understand many retail businesses are struggling in a tough environment but only the strongest could survive. We have had just whispers of a recession in the future but Big Lots is already in a tough patch with declining top and bottom line numbers. Raising capital through stock sales means undoing all the buyback that were done previously. The company could take on more debt but it’s hard to see the financing being done on favorable terms. The road looks tough and if this business sees a turnaround it would make for an interesting case study.

Read the full article here