Being with no one is better than being with the wrong one. Sometimes those who fly solo have the strongest wings.”― Nitya Prakash.

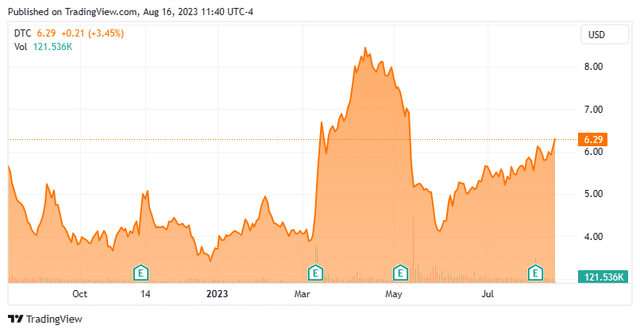

Today, we put Solo Brands, Inc. (NYSE:DTC) back in the spotlight, as it seems an appropriate time to revisit this small cap name after it recently posted second quarter results. The stock has also stabilized after a big drop in the spring, when a couple of beneficial owners of the shares dumped a large amount of their stock on the market. The equity quickly got over that event and has slowly moved higher since. Can the rally continue? An analysis follows below.

Seeking Alpha

Company Overview:

Solo Brands, Inc. is located just outside Dallas in Grapevine, TX. This direct-to-consumer outdoor and lifestyle products company offers several key product lines. Its biggest seller is camp stoves under the Solo Stove Lite brand name. The company has a variety of price points for this product line starting at under $100 and consistently generates positive reviews. Historically, over 80% of the company’s revenues comes from its direct-to-consumer digital marketing channel and the rest from its retail partners. Over 80% of overall revenues come from its Solo Stove business line. The company is focused on expanding its retail or wholesale business with its retail partners.

The company also distributes fire pits under the Solo Stove brand name; kayaks under the Oru brand name; paddle boards under the ISLE brand name and numerous other outdoor products. The stock currently trades just over six bucks a share and sports an approximate market capitalization of just under $575 million.

Second Quarter Results:

Solo Brands, Inc. reported its second quarter numbers on August 3rd. Revenues fell just under four percent on a year-over-year basis to slightly under $131 million. Non-GAAP earnings per share came in at 22 cents, a penny above the consensus. Net income for the quarter was $11.5 million, a huge improvement from the net loss of $19.9 million from 2Q2022. It should be noted that most of this improved comparison is due to a non-recurring $30.6 impairment charge Solo Brands took in the second quarter of last year.

Management maintained their previous full year revenue guidance of between $530 million and $540 million. However, leadership did bump up their FY2022 adjusted EBITDA margin projections 50 basis points to between 17% and 18%. During the quarter, the company’s wholesale business saw sales surge 57% from the same quarter last year to $31.3 million. Direct-to-consumer sales dropped just over 14% to $99.7 million as the company cut back on marketing spend. This change in marketing mix resulted in SG&A expenses falling to $63.5 million for the quarter compared to 2Q2022. Inventory also dropped to $113.7 million by the end of the quarter, compared to $133 million at the start of FY2023.

Analyst Commentary & Balance Sheet:

Since second quarter results hit, Bank of America ($9 price target) and Piper Sandler ($12 price target) have reissued Buy ratings. William Blair also reassumed coverage on Solo Brands, Inc. on June 14th with an Outperform rating.

Approximately four percent of the outstanding float in the shares is currently held short. Two beneficial owners disposed of nearly 17 million shares in the stock in May of this year. This came within a just over 11 million share secondary offering. Around the same time, the company acquired a company called Terraflame that offers indoor flame products. A director did buy $100,000 worth of shares in March. That has been the only insider activity in the stock so far in 2023.

The company ended the second quarter with just over $60 million in cash and marketable securities on its balance sheet after producing an impressive $48.3 million worth of free cash flow during the second quarter. The company had negative free cash flow of $16.5 million in the second quarter of 2022. Solo Brands has approximately $143 million in total debt and $300 million of availability left on an existing revolving credit facility.

Verdict:

The company made $1.07 a share in profits in FY2022 on just over $517 million of sales. The analyst firm consensus is that profits will drop to 91 cents a share in FY2023 as revenues rise three percent. They also see earnings rebounding to $1.12 a share in FY2024 as sales growth in the low teens.

Solo Brands, Inc. seems a good value in what I view as an overvalued market. The stock trades at six times trailing earnings and is producing impressive free cash flow. Earnings will drop approximately 15% this year but are projected to pop back next year. The company’s balance sheet also appears in good steed, with net leverage of less than 1.5X. Solo Brands, Inc. shares should be valued at least nine bucks a share, which would be 10 times this year’s projected profits and half the overall market’s current earnings multiple.

The beauty of traveling solo is that you wonder unexpectedly, but almost certainly into the direction you were meant to go.”― Shannon Ables.

Read the full article here