The Fed minutes pointed to the strong potential of another rate hike coming later this year and, in some ways, left the door open to potential more hikes if needed. It seems clear that the Fed is watching commodity prices, hoping they remain in check, and, more importantly, credit conditions tightening as banks pull back from lending.

That is a considerable risk because oil and gasoline prices have risen dramatically since the middle of July. Meanwhile, the recent Federal Reserve senior loan officer survey suggests tightening credit is happening slowly, perhaps too slowly.

The bond market is not wasting any time and has been adjusting for a higher rate environment for a few weeks, with the ten (US10Y) and 30-year (US30Y) rates having surpassed their closing highs in October. This is fueling a stronger dollar leading to credit spreads widening again. As a result, the equity market will probably have to pay for its terrible mistake of thinking the Fed would cut rates and rates across the yield curve going lower.

Strong Data

Economic data continues to come in better than expected, and the GDP growth outlook has improved. The Atlanta Fed GDPNow model sees third-quarter real GDP growth at 5.75%, while the Atlanta Fed PCE forecast for the third quarter has risen to 4.8%. That suggests that nominal growth has increased to 10.6% for the third quarter.

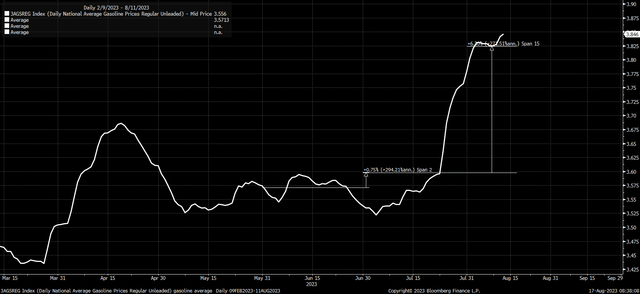

Bloomberg

The faster growth outlook, the drawdown of the strategic oil reserve, and Saudi Arabia’s desire to cut back on oil production have lifted WTI crude oil (CL1:COM) back over $80 per barrel and the national average price of regular gasoline to $3.85 per gallon. For August, gasoline prices have averaged an increase of 6.3%, pushing expectations for headline inflation on an m/m basis sharply higher to a gain of 0.6% m/m increase in the CPI while rising by 3.6% y/y. These values have steadily risen since the middle of July when gasoline prices started to rise.

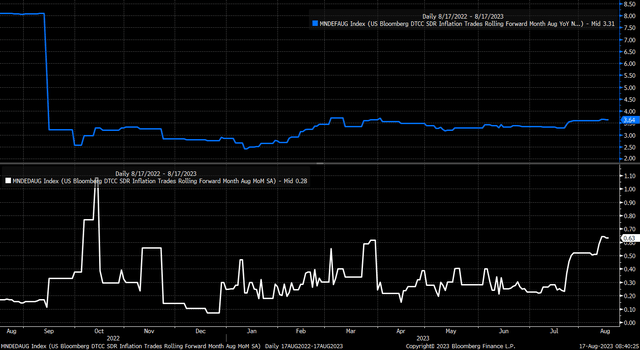

Bloomberg

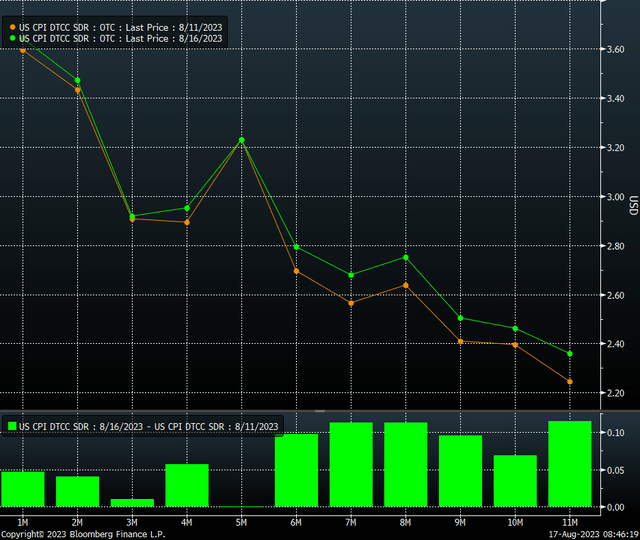

Since the last CPI report, inflation swaps have priced in higher inflation for the balance of 2023 and 2024. This means that the pace of disinflation continues to slow and that region around 3% on headline inflation will likely be very troublesome.

Bloomberg

The Fed is certainly paying attention to commodity prices and that those prices provide upside risks to their inflation mandate. The minutes noted:

Participants cited upside risks to inflation, including those associated with scenarios in which recent supply chain improvements and favorable commodity price trends did not continue or in which aggregate demand failed to slow by an amount sufficient to restore price stability over time, possibly leading to more persistent elevated inflation or an unanchoring of inflation expectations

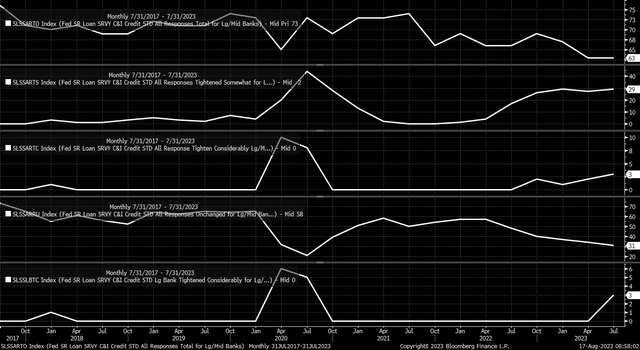

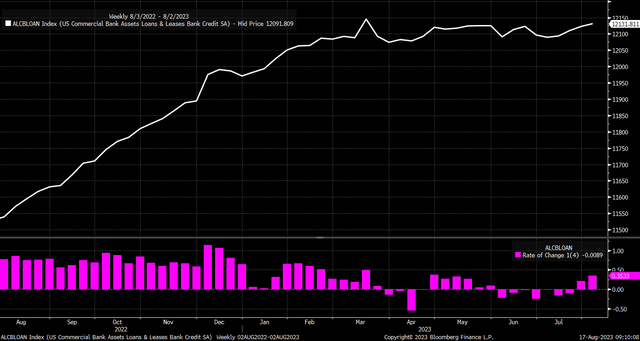

Additionally, based on the latest Survey of Senior Loan Officers, bank lending standards have only tightened minimally over the last quarter. Of 63 participants this quarter, three tighten considerably over the previous quarter versus 2 in April. Twenty-nine firms tightened somewhat versus 27 last quarter, while 31 remained unchanged versus 34 the previous quarter.

Bloomberg

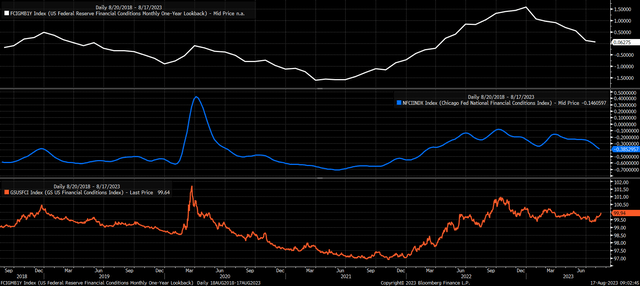

Easing Financial Conditions

But what is clear is that financial conditions as measured by the Federal Reserve financial conditions index, the Chicago Fed financial conditions index, or the Goldman Sachs financial conditions index, more broadly conditions have eased since mid-March. This easing of financial conditions has allowed the economy to reaccelerate and, more important, for risk assets to rally, creating an inflationary force in commodity prices.

Bloomberg

Meanwhile, bank lending for commercial and industrial loans has risen again after contracting some starting in March. As the 4-week rate of change has turned positive, and total values have approached their previous highs.

Bloomberg

The Fed noted that one of its concerns was the continued tightening in lending due to lag effects of monetary. It noted:

In discussing downside risks to economic activity and inflation, participants considered the possibility that the cumulative tightening of monetary policy could lead to a sharper slowdown in the economy than expected, as well as the possibility that the effects of the tightening of bank credit conditions could prove more substantial than anticipated.

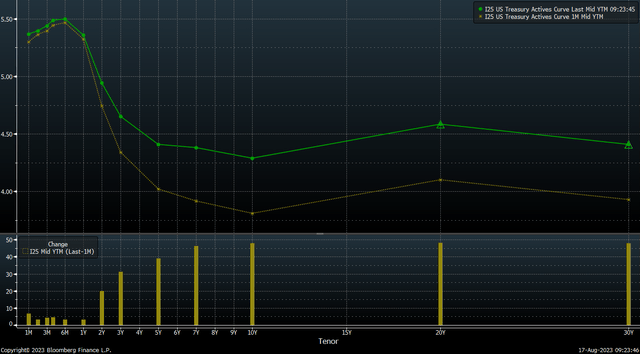

Rates Reach New Heights

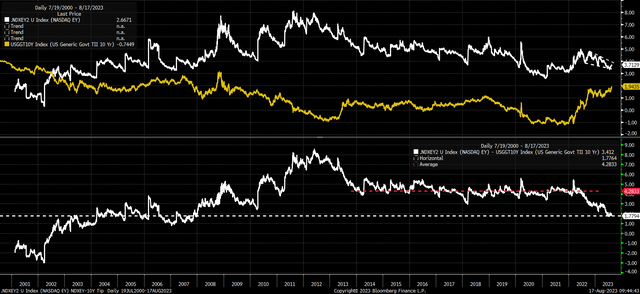

This has pushed rates on the long end of the curve higher as the bond market now accepts that we are in a higher-for-longer interest rate regime. The risk is that the Fed must do more to address the reaccelerating growth. This has nominal rates rising on the long end of the curve by almost 50 bps over the past month, as rates on the ten and 30-year have reached levels on a closing basis not seen in a decade.

Bloomberg

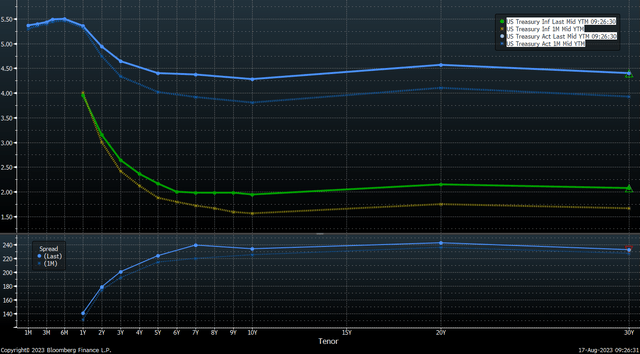

The higher nominal rates have helped to pull real yields up, while breakeven inflation expectations have changed minimally. This is a sign that rates at the long end of the curve aren’t rising due to higher inflation expectations but more so to the resilience of the US economy, which will require rates to stay higher for a more extended period and perhaps permanently higher.

Bloomberg

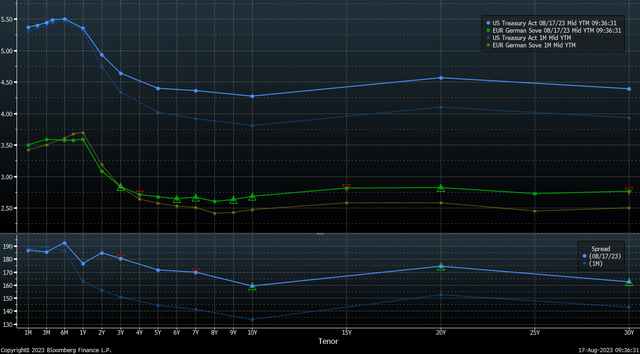

The move to higher rates in the US has strengthened the dollar materially. This will likely continue because spreads between the U.S. rates and international have widened considerably. Additionally, the recent economic weakness in China and the Bank of Japan’s slow reaction to rising inflation should allow the dollar to continue to strengthen versus the yuan and yen. Additionally, spreads between U.S. and German rates are widening, strengthening the dollar over the euro.

Bloomberg

Mispriced Valuations

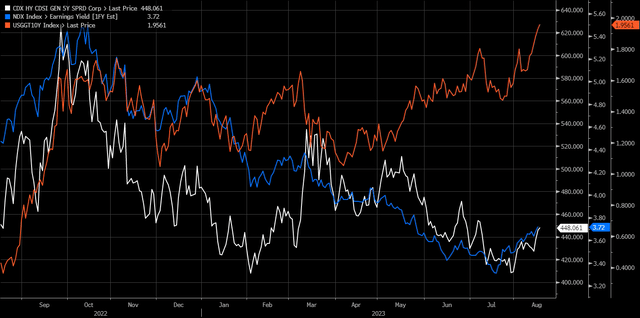

It is also becoming increasingly clear how badly equity markets have mispriced interest rate risk and how overvalued equities are to these higher rates. The spread between the one-year forward earnings yield on the NASDAQ has been hovering around 1.75% for a few months. This spread is the lowest since 2007, well below the 4.28% average over the past decade.

Bloomberg

While it isn’t clear just how much this spread should rise, it seems clear it should move higher from here, and credit spreads may have a large part in saying how much because the NASDAQ earnings yield appears to be trading along with the CDX High Yield index.

Bloomberg

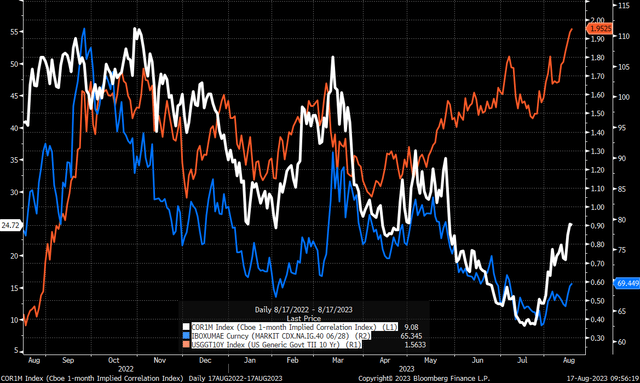

The divergence between real yields, credit spreads, and stocks took place in mid-May, around the time that the short-volatility trade was put into place as measured by the 1-month implied correlation basket, possibly because the equity market thought the Fed was done raising rates in May, and that rate cuts were ahead, which now appears to be a horrible mistake.

Bloomberg

Now that the entire short-volatility trade appears to be in the process of being unwound, and now that systematic flows from CTA appear to be flipping from bullish to bearish, there could be considerable pressure added to the equity market on a re-rating of the equity risk premium.

The bond market is telling us that a higher-for-longer policy path from the Fed will be needed to slow economic growth in the U.S. to bring the economy back into balance, and for that to happen, rates will need to stay high across the curve, the dollar will likely strengthen, and financial conditions will need to tighten. The equity market was wrong betting on Fed cutting rates, and that is now obvious, and the entire trade will need to be unwound.

Read the full article here