Thesis

ChargePoint’s (NYSE:CHPT) unique business model of selling, rather than owning networked charging solutions has allowed it to rise as a leader in the EV charging industry. While I believe they will be able to maintain their dominant position in the level 2 charging market, I have concerns about their short-term profitability and valuation for investors. Through potential partnerships and expansion of their innovative SaaS services, I am looking for more tangible results, particularly in resolving their main issue of operating margins while simultaneously continuing sales growth. However, given that their stock price has already fallen immensely due to diminishing investor sentiment, I would recommend a HOLD until I see ChargePoint make a stronger recovery in their financial metrics.

Company Overview

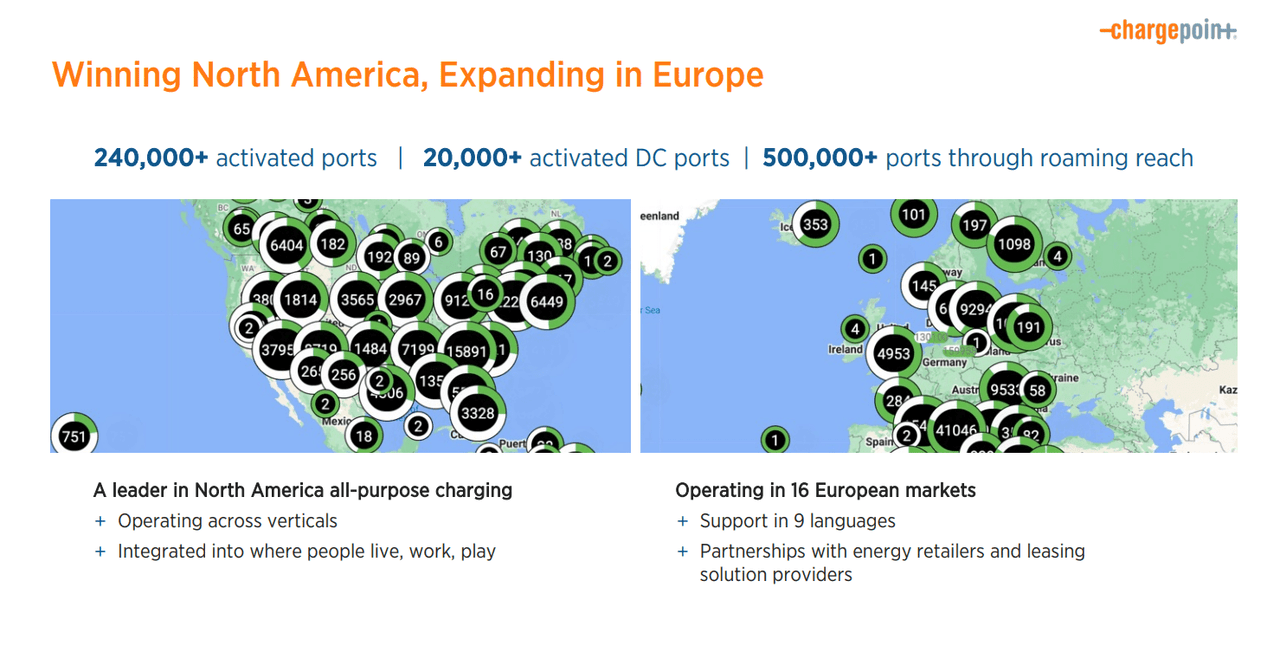

ChargePoint is the leading distributor of electric vehicle (EV) charging solutions. With one of the largest presences of any other EV charging company in North America, ChargePoint’s unique business model of selling networked hardware for EV charging stations that are connected through its cloud-based subscriptions gives it an edge in both cost efficiency and scalability. Without needing to bear the costs of expenses such as land or maintenance, ChargePoint can focus on investing in its services, products, and future. ChargePoint’s revenue stream and business model is broken into 2 main segments – networked charging capital and subscriptions. Networked charging capital is comprised of both level 2 AC chargers and level 3 DC chargers. While ChargePoint’s core offering is in its extensive network of cheaper, slower-charging level 2 AC chargers, it began to increase its investments into level 3 DC chargers to provide service for long-distance travelers or those in a hurry. ChargePoint mainly sells solutions to fleet operators and commercial enterprises such as retailers, workplaces, and shopping venues, but also offers home solutions for their residential customers, allowing them to cover all verticals. Their dominance in level 2 AC chargers is evident by their lead position with over 30,000 charging stations in the US and 240,000+ global activated charging ports. As the market leader in the US, they have begun to expand globally, and have continued to strengthen their reach in Europe.

ChargePoint Investor Presentation March 2023

In regards to their cloud based solutions, their software allows for a more streamlined experience for charging station hosts and EV drivers. For station hosts, a ChargePoint’s subscription of “ChargePoint as a service” allows them to easily manage to charge infrastructure, and payment processing, and even allows them to analyze data on charging station usage, charging patterns, and EV driver behavior. In addition to a SaaS subscription, ChargePoint also offers warranty solutions through “Assure” to provide maintenance and support. On the other hand, EV drivers also benefit through ChargePoint’s free app and other Cloud services, which allow them to easily locate nearby charging stations, manage payment methods, and optimize charging preferences.

Industry and Competitive Overview

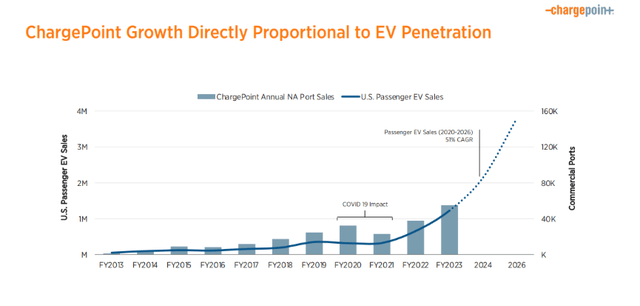

ChargePoint Investor Presentation March 2023

In the coming year, ChargePoint has high expectations for growth correlated with US passenger EV sales at an incredible 51% CAGR. Grand View Research backs up this number, valuing the global EV charging infrastructure market at USD 19.67 billion in 2022 and projected to grow at 29.1% CAGR. With the addition of the Alternative Fuel Vehicle Refueling Property Credit set by the Inflation Reduction Act this year, demand for EV charging stations will no doubt increase as businesses can be eligible for a 30% credit with a $100,000 limit for each new piece of charging property ($1,000 limit for homeowners). With a renewed expiration date of Dec. 31, 2032, I have high hopes that there will be a sustained increase in demand from ChargePoint’s key demographic. From a competitive standpoint, I strongly believe that ChargePoint will be able to maintain its position as a global leader in its specific niche. While the EV charging station market is overall dictated by the derived demand from EV vehicles, ChargePoint’s business model of selling to operators rather than actual vehicle users presents them with an entirely different market. As ChargePoint has mentioned in their 2023 10-K filings, its competitors such as ABB Ltd (OTCPK:ABBNY), Tritium (DCFC), and Tesla (TSLA) are not in direct competition as they mainly focus on nonnetworked goods and level 3 DC charging. With ChargePoint’s offering of networked hardware, specifically for level 2 chargers, I believe that it will be able to grow in conjunction with the growth provided by the developments of such companies, rather than being hurt by them. My main concern for this company, however, lies in its short-term profitability concerns and outlook.

Financial Analysis

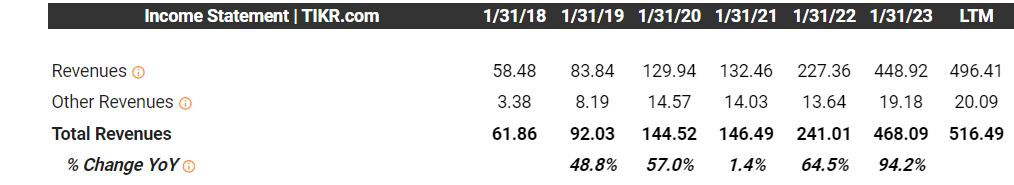

Taking a look at ChargePoint’s financial metrics, we see that it has no issue with growing its business. Revenue has grown at a considerable 50.5% CAGR in the past 5 years (Tikr Values) and has continued this growth this past quarter with reported revenue of $130.0 million, up 59% QOQ.

Tikr Terminal

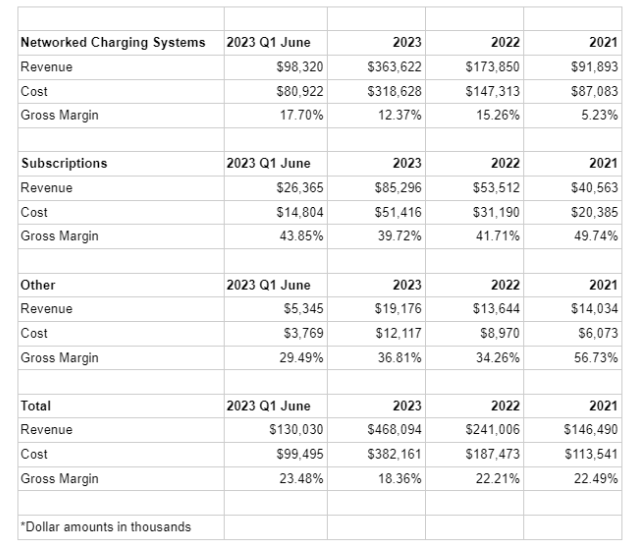

Due to their unique business model which is a combination of selling networked hardware and selling subscriptions, their overall gross margins are fairly good compared to its competitors such as Tritium and EVgo at a comfortable 20.2% LTM.

Author’s Material

Looking at their segment-by-segment gross margin, we see that the recent quarter displayed overall recovering gross margins. While recurring revenue from subscriptions is always good when compared to the average SaaS gross margin of around 75%, ChargePoint’s margins are lacking. While they are still in a somewhat growth phase with increasing headcount and need for customer service/Assure maintenance, I still believe they have ways to go in improving their gross margin.

The main issue with ChargePoint’s financials comes from its huge operating costs, largely in the form of R&D and marketing. Increases in headcount and large share-based compensation have been reported to be leading to higher figures in overall operating costs, resulting in a net income loss of $345mm and an EPS of -$1.01 as of 2022. In the recent quarter, they have shown some improvement with a higher EPS of -$0.23. Still, concerns remain about if this company will continue being able to balance its strong revenue growth with positive earnings.

Y Charts

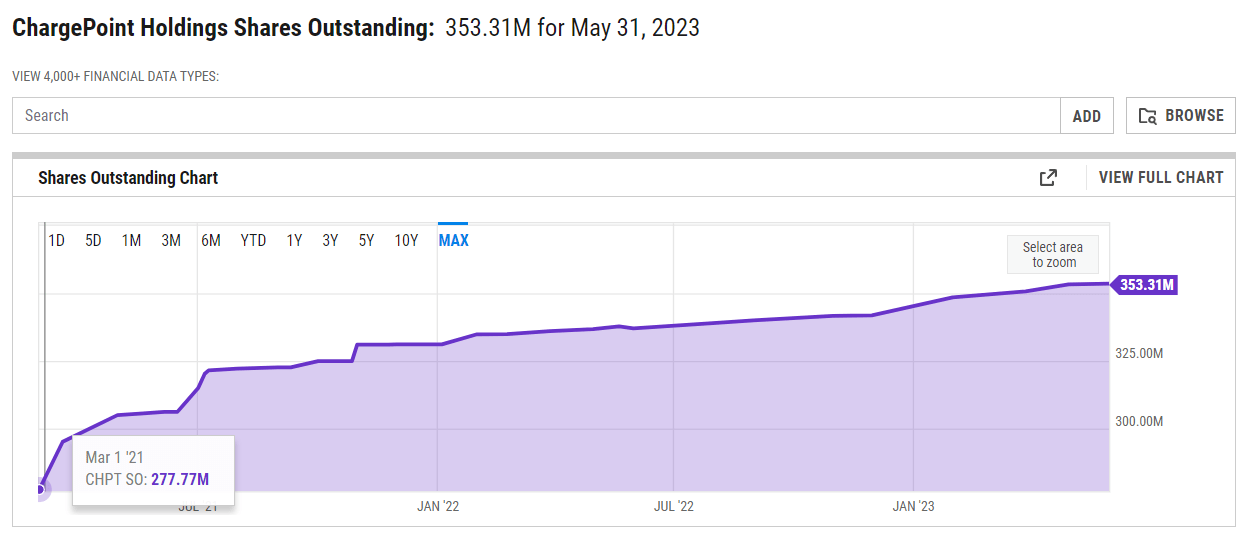

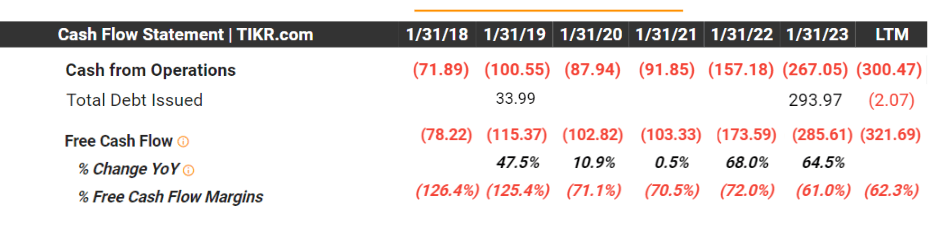

Looking at their balance, sheet we see that ChargePoint has recently taken on more to raise capital, and has continued to dilute shares with share-based compensation. While the debt and dilution are not at an alarming point just yet, It does bring up concerns about ChargePoint’s ability to keep up with operating costs amidst its rapidly growing business. Key considerations looking forward in the next quarter are ChargePoint’s efforts to reduce operating costs and a way to improve its gross margin to reach profitability. While their revenue growth has been in line with analysts’ estimates still, I would like to see share-based dilution slow down and operating margins improve to cover their debt and negative cash flow before considering an investment into ChargePoint.

Rows moved for better viewing (Tikr Terminal)

Potential Catalyst and Growth Drivers

1. Partnerships to Capitalize on Level 2 Market

Before I continue, I do want to address something I have been seeing in many other articles discussing ChargePoint. Oftentimes, I see authors talking about large competition from DC-focused charging companies such as Tesla, failing to recognize the main demographic that ChargePoint is selling to. For better understanding, we look at regular gas stations as references. Over 85% of gas stations are attached to convenience stores and serve only to drive traffic to the store, where overpriced drinks and snacks compensate for their ridiculously high-profit margins. The cost of gas usually only contributes to around 2% of the profit margin of the convenience store, with it making an average of 5%-10%, largely due to the traffic the store brings. Similarly, EV stations are no different. Already, an estimated 30% of ChargePoint’s EV charging stations are free due to the operator’s choice or through subsidies. While some operators may use this in order to promote their initiatives in ESG, there is no doubt that it helps keep drive traffic for commercial operators such as those who want to keep customers in their facilities (eg. casinos and malls).

Even for fleet operators, most cars are charged overnight or during operation breaks, with estimates reporting that cars are being parked 95% of the time. The level 2 network niche that ChargePoint is targeting seeks to capitalize on an entirely different demographic than many companies focused on level 3 DC chargers. With their unique approach, my focus of this first catalyst is ChargePoint’s potential to partner with companies that complement their business model. Partnerships with large malls, stores, and convenience store chains, could pair well with their business strategy of providing cheap, available charging to new waves of EVs. With most cars being parked for longer than an hour and 1 hour, DC charging isn’t always necessary (and even has some harmful effects on battery life) for most cars, and potential partnerships could arise to capitalize on this data. If management is able to handle operations correctly, deliver on their guidance of positive FCF by the end of FY2024 (slight skepticism), and more effectively tap into their market, ChargePoint will no doubt be a strong pick-and-shovel long-term play in the EV revolution.

2. SaaS Expansion

With a large portion of operating costs going into R&D, I would like to see the SaaS side of ChargePoint deliver in the future with more innovation and cost efficiency. Competitors such as EVgo have already begun developing their own network and mobile app to help both EV drivers and operators. In my opinion, expansion into its SaaS by being able to operate similarly to Uber’s (UBER) business model would allow it to competitive edge. Uber has been able to use its services to scale effectively and provide efficient solutions to find the fastest drivers for each customer. If ChargePoint can leverage its own networked hardware to the level of Uber, I believe it will be able to cut down on the cost of revenue and provide a niche in which the most efficient routes and charging stations are mapped out. Based on how much traffic each station has, this app may develop into something that facilitates large-scale EV adoption. ChargePoint’s extensive roaming reach is a testament to this, but I would like it to be able to develop well in Europe and be able to reach a stage where it can be able to cut costs and provide a solution for customers not seen yet by other EV charging companies.

Valuation

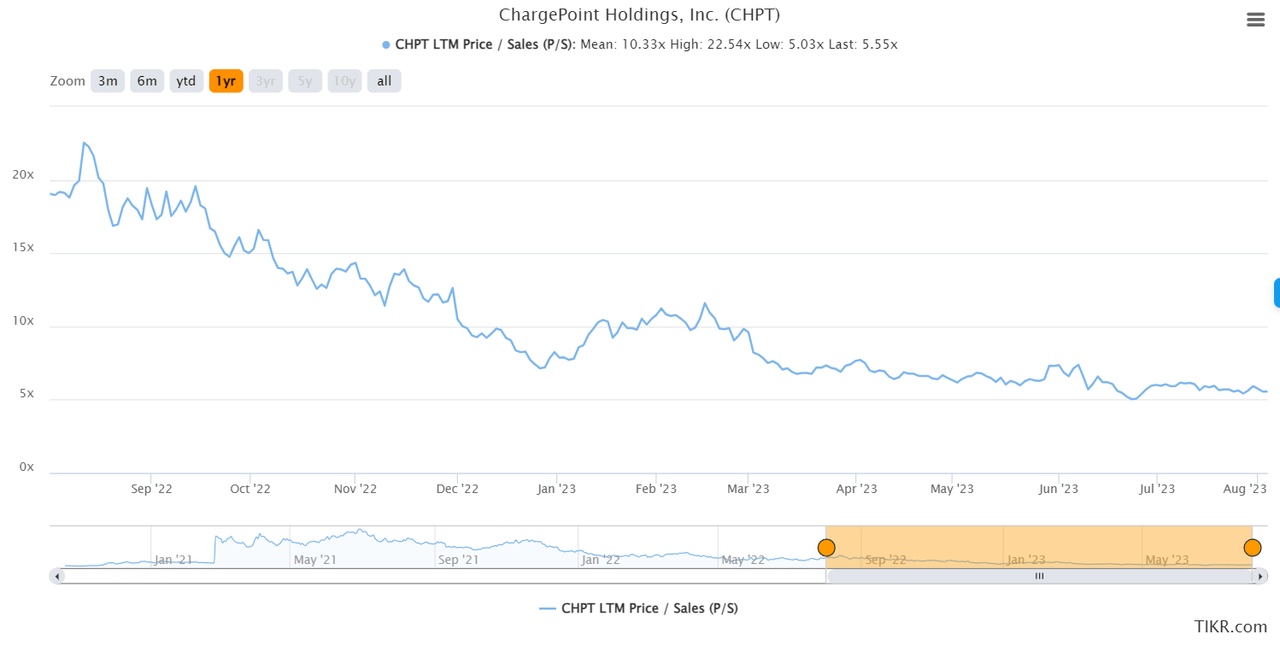

With continual negative cash flow, it’s truly difficult to value this company and project future earnings in a DCF. Given that ChargePoint is a relatively new public company still focused on revenue growth rather than profitability, I found that it was best to compare it against its recent history and peers. Given that it was rapidly increasing revenues with poor earnings, I chose to use the P/S ratio rather than the P/E ratio. We see that ChargePoint has around a 4.12x P/S ratio TTM, compared to its industry median of 1.43x. As the industrials sector may not be completely reflective of EV charging companies, I looked at ChargePoint’s close competitors, EVgo (EVGO) and Blink (BLNK). Their P/S ratios are 3.2x and 4.27x respectively, giving us a better idea of where ChargePoint sits.

Comparing it to its peers, we see that ChargePoint is relatively well priced compared to its peers, but when looking at its historically decreasing P/S multiple, it may signal that investors have begun to lower expectations for ChargePoint. I would largely attribute the decreasing P/S despite its consistently strong revenue to decreasing investor demand, largely due to the poor stock price performance and profitability issues. While I have looked at the P/S ratio, it’s important not to ignore that their P/E ratio has been continuously negative due to negative net earnings. Whether or not ChargePoint will be able to fix this issue warrants more time and maturity in its financials.

Tikr Terminal

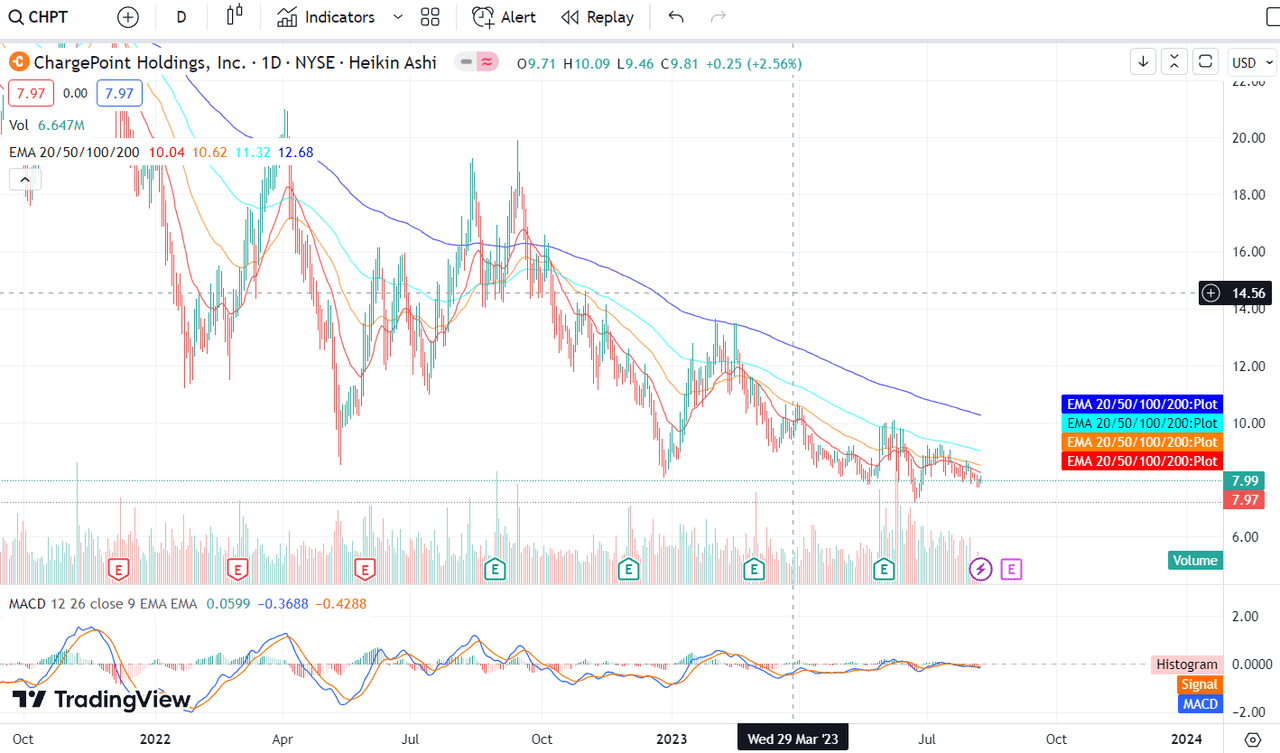

With its overall down-trending stock price, it’s truly hard to value this stock. When looking from a more technical stance, we see that the company has been following a rough downtrend, staying below large resistance points of the 200 EMA and 100 EMA recently. With lower lows being created and a short-term inflection point not yet clear, I would highly recommend investors to stay cautious with this company. I would look for this coming year’s guidance for earnings in order to satisfy investors first. Until I see the profit maturation of ChargePoint’s business model, it’s hard to recommend this as a buy as of right now. However, given its strong potential for future growth and continued dominance in the market, watching here to average cost basis may be good for investors, given that ChargePoint breaks out of its long downtrend.

Daily Chart, Heiken Aishi Candle Sticks with 200ema, 100ema, 50ema, 20ema, MACD, and Volume bars (TradingView)

Risks

Although much of the risks and concerns of this company are in its short-term financial metrics, there are some other headwinds to consider. Overall, despite the EV adoption rate slowly picking up momentum, it still faces issues with a negative feedback loop. Due to concerns about high EV prices, limited station infrastructure, and limited range, many customers are hesitant to adopt EVs. This hesitation results in many charging stations being underutilized and unprofitable. While the main purpose of these EV stations is not to gain money, subscription costs for network and maintenance may result in less demand for ChargePoint’s products. The one mitigant that I have for this negative feedback loop is the fact that new tax credits and government regulations may make it easier for operators to continue having stations. Continual efforts from the Biden administration to push sustainable energy including EV charging subsidizes positions ChargePoint to benefit as many operators prepare for potential higher EV demand. However, my main concern always goes back to management’s ability to handle profitability and its rapidly growing business. The share-based dilution and horrible stock price performance, coupled with overall weak financial metrics don’t spell out any short-term investment in my opinion. While some may say this is a time to buy at the bottom, I would still caution other investors to wait for stronger financial metrics and valuation

Conclusion

Overall, I am highly supportive of ChargePoint’s unique business model and believe that its approach to selling networked hardware with networked SaaS will help it maintain its competitive edge. However, given that it is still early in development, there are still many challenges it needs to tackle. The hardware component is facing issues with underutilization and the gross margins of its SaaS offerings are not yet comparable to other SaaS companies. While I do think ChargePoint may be able to dominate the level 2 market in the future, I believe it’s crucial to see like to see tangible financial results and management’s delivery of profitability in FY2024 before gaining confidence in its ability to reverse its current downward trend. I advise investors to watch out for the next earnings report to see if management guidance is following through, and recommend a HOLD for now.

Read the full article here