Quick-Recap On Q2 Results

I believe the bullish case remains intact for Frontdoor (NASDAQ:FTDR) despite some challenges over softening consumer spending and paid user conversion on the new FTDR apps. FTDR reported exciting 2Q results, achieving its fourth consecutive beat on EPS by $0.32 and surpassing revenue expectations by $9.74 million. The company also raised guidance for revenue, adjusted EBITDA, and share repurchases for FY23. Starting with top-line revenue, FTDR witnessed a 25% decrease in RE channel and a 11% decrease in DTC channel due to volume decline, while renewal channel increased by 15% thanks to rise in retention rate. Additionally, FTDR is experiencing positive momentum from its new apps and on-demand services, which are projected to contribute $60 million for the year – aligning with my forecast. Factors such as easing inflation and improved weather patterns alleviated FTDR’s margins, resulting in an increase in gross margin by 840 basis points, reaching 52%. For a more comprehensive analysis of FTDR, please consult my prior post titled Frontdoor: Improving Renewal Base With Upside From The New Frontdoor Brand.

Key Updates Discussion

Significant Improvements Over Margins

In my earlier assessment, I had predicted that FTDR would benefit from easing inflation and well-planned price increases, contributing to margin expansion, a projection that materialized successfully during the quarter and was evident in the stock price. In Q2, inflation concerning HVAC and major home appliances reached a plateau, moving from the peak observed in FY22 to low-single digits. Moreover, FTDR has continuously demonstrated its adeptness in pricing strategies. In this quarter, it achieved a notable 9% price increase, effectively offsetting the approximately 2% decline in volume. Based on these developments, it seems reasonable to conclude that the inflationary headwind is gradually diminishing. This assessment is supported by the stability observed in the PPI and FTDR’s capability to transfer costs to end consumers.

Continuing forward, I’m observing that FTDR is effectively capitalizing on its “reinforcing cycle of growth” strategy. This strategy involves consistently transitioning customers to the preferred network, which not only offers superior service but also operates at lower costs due to volume discounts. The implementation of preferred contractors reached a peak in Q2, standing at 84% compared to 82% a year ago. This uptick underscores the company’s dedication to enhancing efficiency and strengthening its value proposition. I believe the preferred contractor model remains to be a key competitive advantage to FTDR and a source of growth.

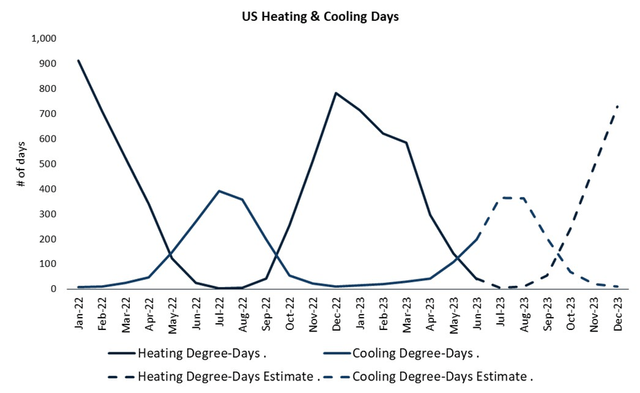

I found it interesting that cooler-than-normal weather brought $17 million benefits to FTDR through lower incidents and claims, which exhibited the seasonality of business. It’s worth noting that this quarter experienced fewer cooling days compared to the previous year, as substantiated by historical data from the EIA. However, there’s a forecast for the advent of El Niño, which often results in abnormal heat and heightened extreme weather events in the coming months. Therefore, I believe it’s plausible to anticipate that the gains from the current weather conditions might be counterbalanced by higher claims and repairs in Q3, thereby potentially mitigating the current weather-related gains.

Heating and Cooling days in the US (EIA Short-Term Energy Outlook, by Author)

Improving Renewals But Declining Real Estate And DTC

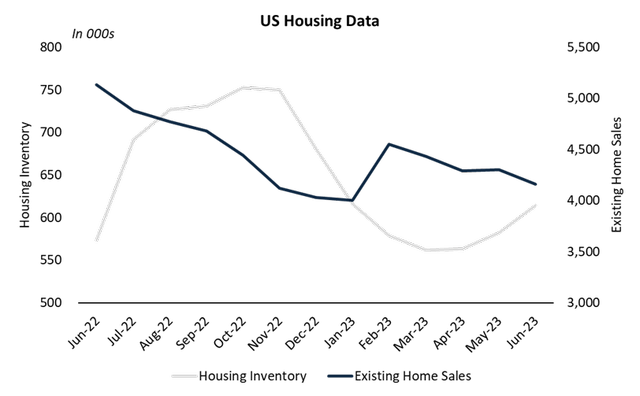

During Q2, the RE channel experienced a decline of 25% yoy, a trend that closely aligns with the projection I outlined in my previous report. Management cited this decline to a tight housing market where sellers hold the upper hand, as home service plans are usually offered by seller to juice up the deal in a buyer-oriented market. Personally, I’ve always held reservations regarding the RE channel, as it appears to require meticulous mechanisms to function optimally. This includes factors such as a robust buyer’s market, strong connections with real estate agents, and comprehensive education and services to incentivize customer renewals. It’s conceivable that management has recognized suboptimal input and reward dynamics in the RE channel. This is potentially supported by the allocation of more resources towards DTC and the new Frontdoor brand. Nonetheless, it’s important to note that existing home sales are on the decline, leading to an accumulation of inventories. This scenario points toward early indications of a more balanced buyer/seller market that could potentially favor FTDR’s RE channel.

US Housing Data (by Author, the Realtor, Fred Data)

The DTC channel dropped by 11% yoy due to economic uncertainties, more price-sensitive consumers, and reduced ad spending. While this outcome might be somewhat disappointing, it’s worth noting that the decline was consistent with management’s guidance. On a positive note, management has taken proactive steps to counteract the volume loss. They are refining the discount strategy and reallocating $20 million from app marketing to bolster the DTC channel, including notable initiatives like the recent collaboration with Amazon on delivery packaging. Looking ahead, given the abatement of inflation and the overall robustness of economic indicators, I anticipate a more favorable performance for the DTC channel in Q3.

In the midst of the macro headwinds affecting the RE and DTC channels, the renewal channel demonstrated remarkable resilience. The retention rate surged by 190 basis points yoy, reaching an impressive 76.3% – the highest recorded in the past five years. This news is incredibly positive as customer retention serves as the bedrock and growth catalyst for FTDR. Equally exciting is that FTDR accomplished this feat while implementing an 11% price increase during the period. This underscores the customer loyalty and perceived value associated with FTDR’s offerings. I believe the retention rate can still improve in the coming quarters with heavy marketing efforts and the new Frontdoor campaign.

FTDR Brand Gaining Momentum With One Caveat

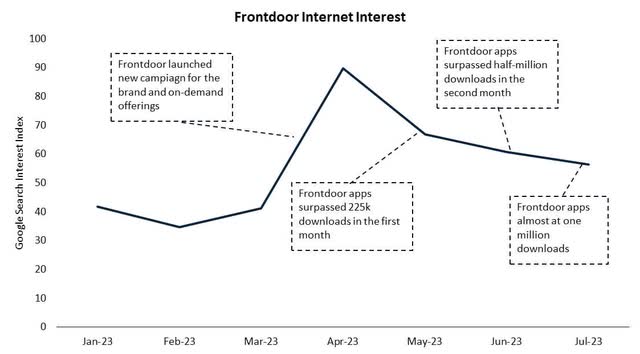

Since the launch of the new Frontdoor brand in May, along with the introduction of the apps, FTDR has been making notable strides, amassing 950k downloads within a span of four months. FTDR has executed its advertising campaign effectively, evidenced by a discernible spike in the Google search index. Notably, “Frontdoor app” has emerged as the top-related query. I also thought FTDR is smart on directing the crowd to the Frontdoor Pro through the appealing HVAC upgrade sales, which was the primary driver for the other revenue in Q2.

Upon delving into the realm of on-demand services, it’s clear that customers are enthusiastically embracing the free expert calls and offering positive feedback about the user-friendly app design. However, one caveat remains, as management cited that they are experiencing low conversion rate to paid services and early on monetization. It’s advisable for investors to remain attentive to the monetization aspect, exercising patience given that the apps are still in their nascent stage. I believe investors should keep an eye on the monetization, but also need some patience as the apps are still in the early stage. At present, my emphasis leans more toward the volume of downloads rather than immediate hard revenue, with prevailing objective being to kindle customer interest through expert calls and educate them about the brand. I hold the conviction that if FTDR sustains its momentum in terms of downloads, it will significantly bolster its brand image and value proposition in comparison to its less technologically advanced competitors.

Google Search Index (Google, by Author)

Valuation Update

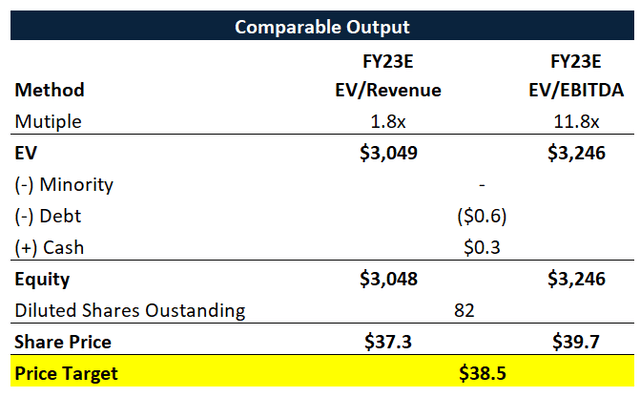

Though I previously included a DCF model in my prior publication, I think the current valuation for FTDR should be based on public comps, specifically using EV/EBITDA and EV/Revenue multiples. DCF is not appropriate in this case due to the housing market’s instability and the early stage of the new Frontdoor brand, which could distort the valuation and fail to reflect current market dynamics. The EBITDA and Revenue multiples are preferable as they are unaffected by capital structure and can be easily compared to industry peers, considering the varying structures of core comps like First American and Old Republic.

I am upgrading the target price from $36.6 to $38.5 based on 1.75x F23E EV/Revenue and 12.75x F23E EV/EBITDA multiple due its strong 2Q result, improved retention rate, and traction on Frontdoor apps. Adding to this, the positive macroeconomic tailwinds and the gradual improvement in the real estate market are poised to contribute to FTDR’s ongoing growth trajectory.

Comps (by Author)

Risks

Strategic Risk

The new Frontdoor App is gaining traction, but management is concerned about the low conversion rate to paid customers. I think the app is still in its early stages and should focus on growing the user base. However, if the conversion rate doesn’t improve in the coming quarters, it will have significant impacts as FTDR has invested heavily in the app and it is a key driver for future growth.

Macro Risk

In recent quarters, FTDR saw declines in RE and DTC, which mostly contributed to the shaky housing market and fading consumer spending. The broader economy also remained resilient, which help to further lighten up the macro side for FTDR. Although these risks are not currently critical to FTDR’s bullish thesis, investors should nevertheless keep an eye on them.

Conclusion

Since my initiation on FTDR, the stock had an almost 20% run partially due to broader market up-beats but more on its pure alpha. While I see the slowdowns in RE and DTC, I am not unduly concerned as these declines have already been factored into the stock’s valuation and management have communicated these declines clearly. Looking forward, I am encouraged by the continued emphasis from management on digital capabilities and a DTC-focused approach. This strategic direction not only positions FTDR at the vanguard of innovation but also sets it apart from its competitors. As the industry undergoes transformative shifts, FTDR’s commitment to modernization and DTC-centric strategies demonstrates a keen understanding of evolving customer preferences. With these strategic moves in mind, I am reiterating my buy rating for FTDR, now accompanied by an updated price target of $38.5.

Read the full article here